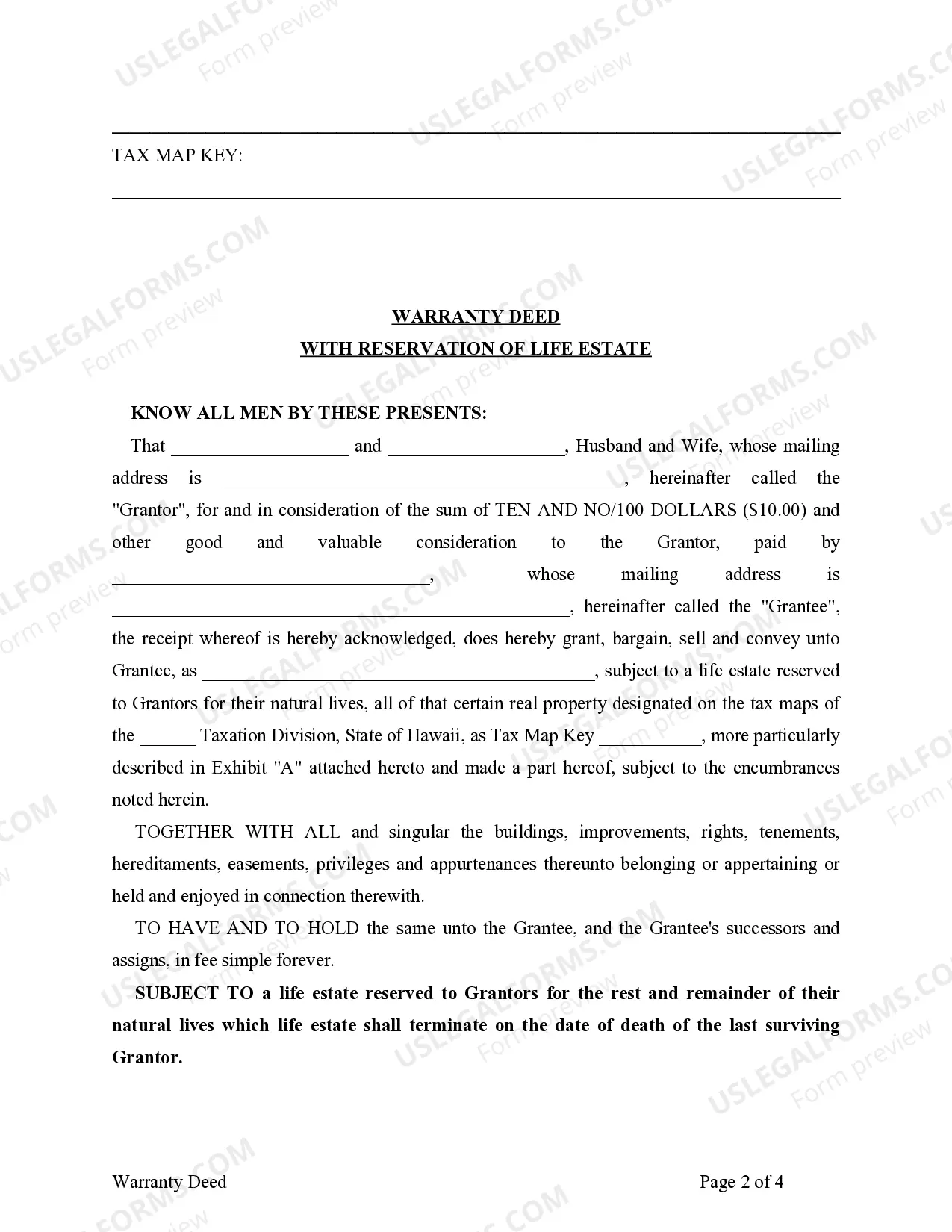

Hawaii Life Estate Deed Without Powers

Description

How to fill out Hawaii Warranty Deed To Child Reserving A Life Estate In The Parents?

It’s well known that you cannot become a legal authority instantly, nor can you understand how to quickly construct Hawaii Life Estate Deed Without Powers without possessing a specialized background.

Assembling legal paperwork is a lengthy process requiring specific education and expertise. So why not entrust the formulation of the Hawaii Life Estate Deed Without Powers to the experts.

With US Legal Forms, one of the most comprehensive legal document repositories, you can acquire everything from court filings to templates for internal business correspondence. We recognize how vital compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are region-specific and current.

You can regain access to your documents from the My documents section at any time. If you’re an existing client, you can simply Log In, and find and download the template from the same section.

Regardless of the purpose of your documents—be it for financial and legal matters, or personal use—our website has you covered. Experience US Legal Forms today!

- Locate the document you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if Hawaii Life Estate Deed Without Powers is what you’re seeking.

- Restart your search if you need a different template.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the transaction is complete, you can obtain the Hawaii Life Estate Deed Without Powers, complete it, print it, and send or mail it to the necessary individuals or organizations.

Form popularity

FAQ

After considering who you can legally disinherit and deciding that disinheritance is the correct decision, you can ensure that someone is removed as a beneficiary by updating or creating your Last Will and Testament. You may wish to include a reason in your Will.

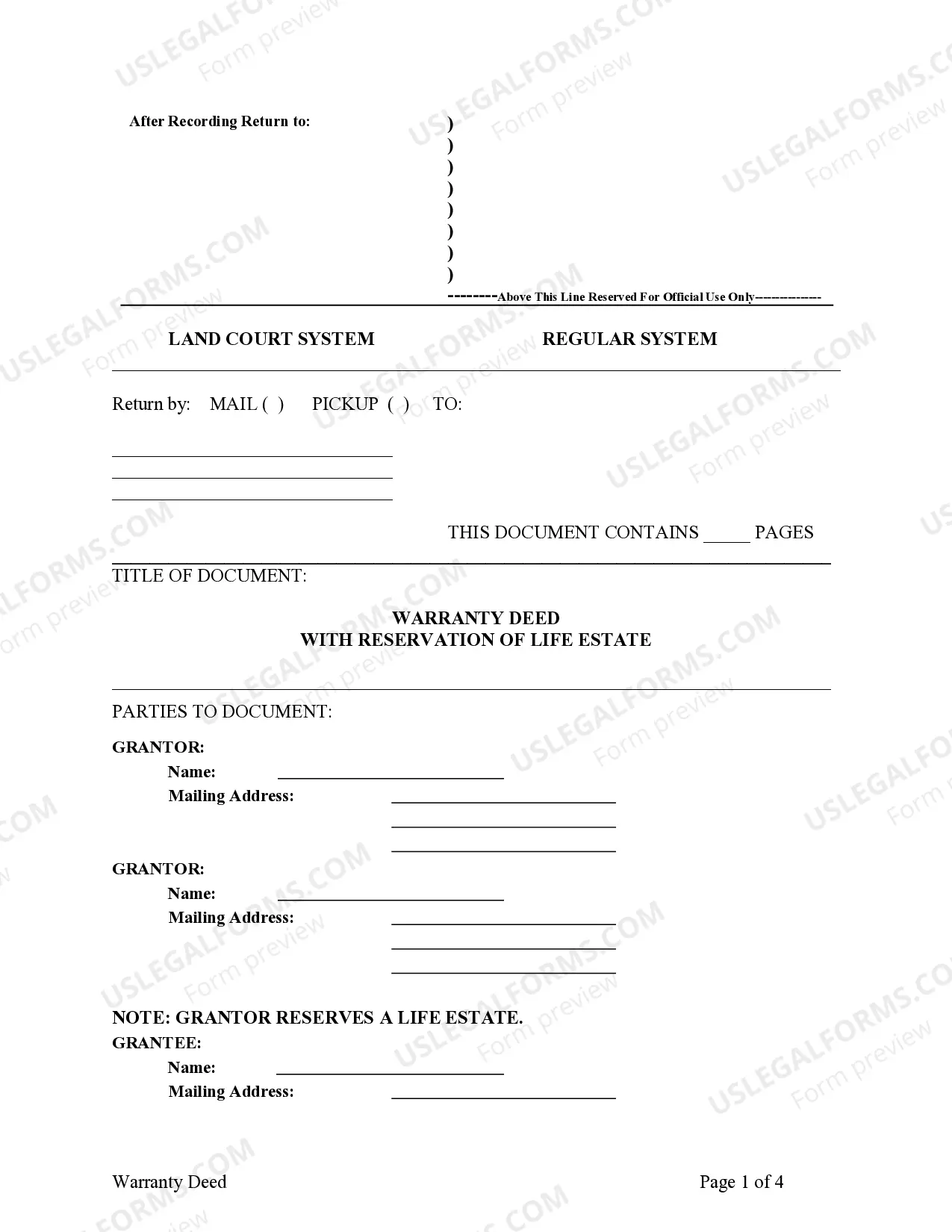

All life estates are for the life of the tenant. All contracts for a life estate have to be in writing to be enforceable. A life estate can be a freehold estate. The life tenant is responsible to pay taxes on the property.

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.