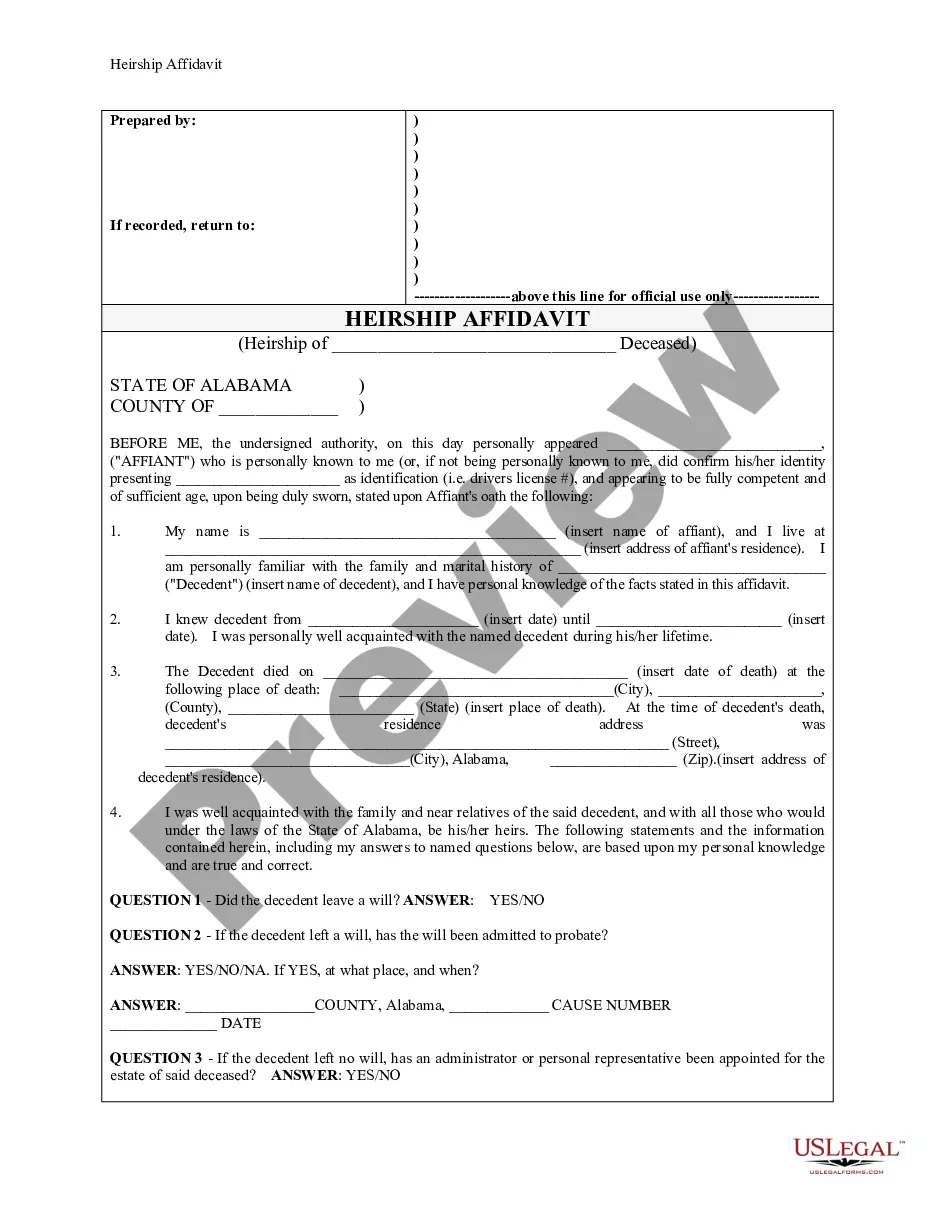

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is also an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Hawaii Transfer On Death Deed Form For Trust

Description

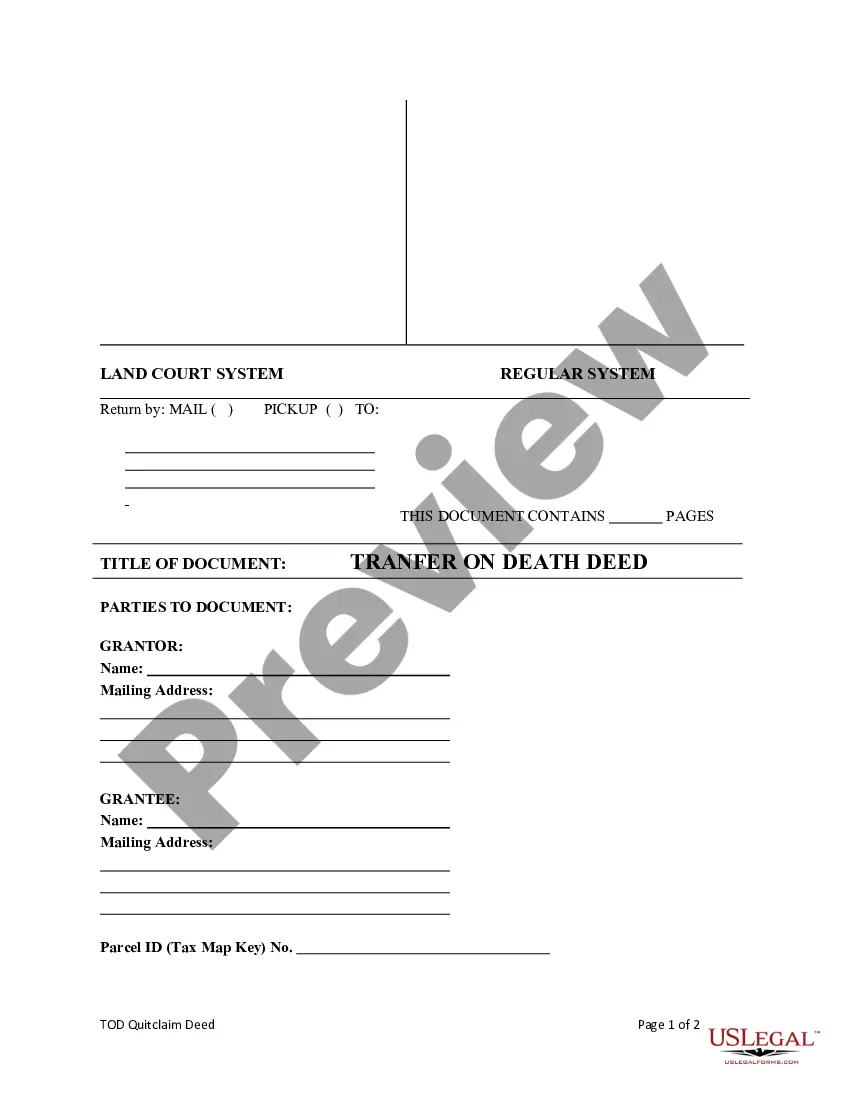

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

The Hawaii Transfer On Death Deed Template For Trust presented on this site is a versatile official document designed by experienced attorneys in accordance with national and regional laws.

For over 25 years, US Legal Forms has served individuals, entities, and legal experts with more than 85,000 authenticated, state-oriented forms for various business and personal scenarios. It is the fastest, simplest, and most dependable method to obtain the documentation you require, as the service ensures bank-level data security and anti-virus safeguards.

Re-download the document whenever necessary. Access the My documents tab in your profile to retrieve any previously saved forms.

- Search for the document you need and examine it.

- Browse through the file you searched and view it or review the form description to verify it meets your requirements. If it does not, utilize the search bar to find the correct one. Click Buy Now once you have identified the template you require.

- Select a pricing plan that fits your needs and create an account. Make a quick payment using PayPal or a credit card. If you already possess an account, Log In and check your subscription to continue.

- Choose the format you prefer for your Hawaii Transfer On Death Deed Template For Trust (PDF, DOCX, RTF) and download the sample onto your device.

- Print the template to complete it manually. Alternatively, utilize an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with an electronic signature.

Form popularity

FAQ

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

The most important benefit of a TOD account is simplicity. Estate planning can help minimize the legal mess left after you die. Without it, the probate system can take over the distribution of your assets. It can also name an executor of your estate and pay off your remaining debts with your assets.

The way it differs from a TOD deed is that a living trust can be used for any type of asset, not just real estate. So if you have stocks, savings accounts, valuable belongings, or other assets that you want to transfer to someone after your death, a living trust is a way to do it.

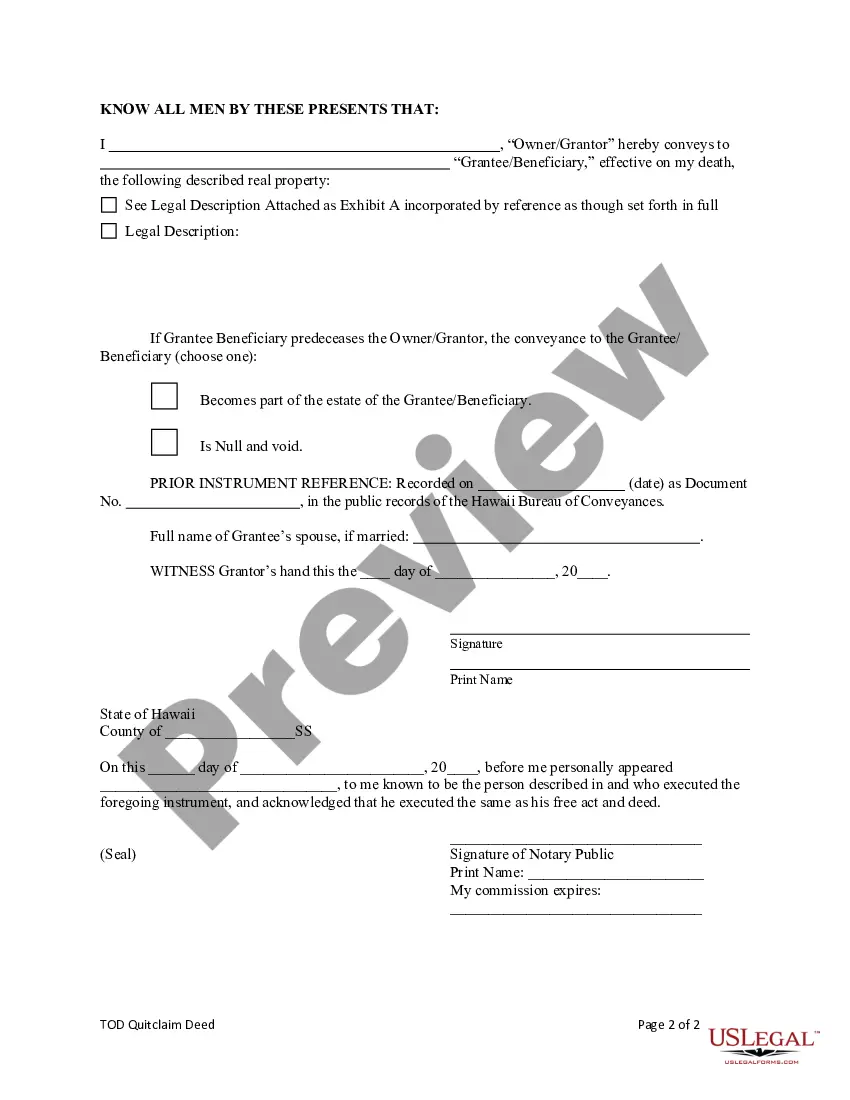

Transfer-on-Death deeds also do not allow for naming a contingent beneficiary on the deed like a trust document that owns the property does. Secondly, if the intended beneficiary is a minor, the minor would not be able to manage or transfer the property until they reach the age of 18.

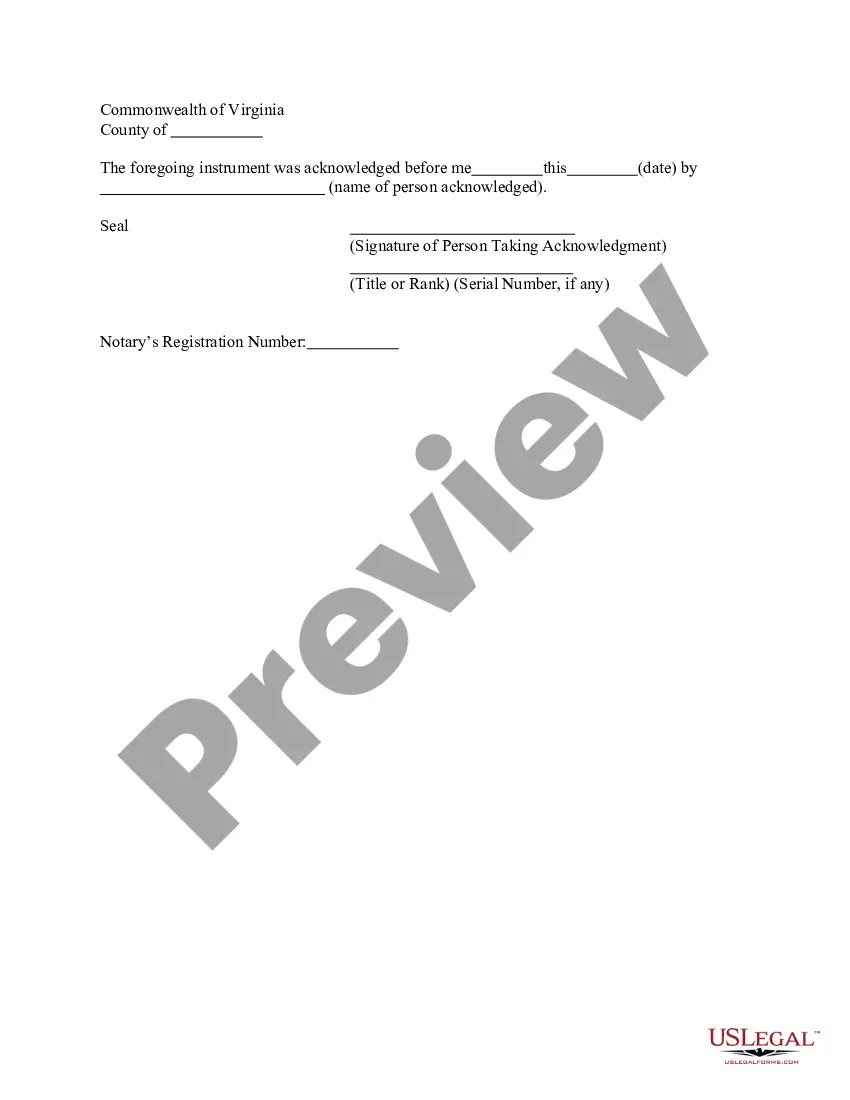

Hawaii Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with either the Bureau of Conveyances or the Office of the Assistant Registrar of the Land Court (see "Recording Your Deed" below to determine which) before your death. ... The beneficiary's rights.