Sale Bill

Description

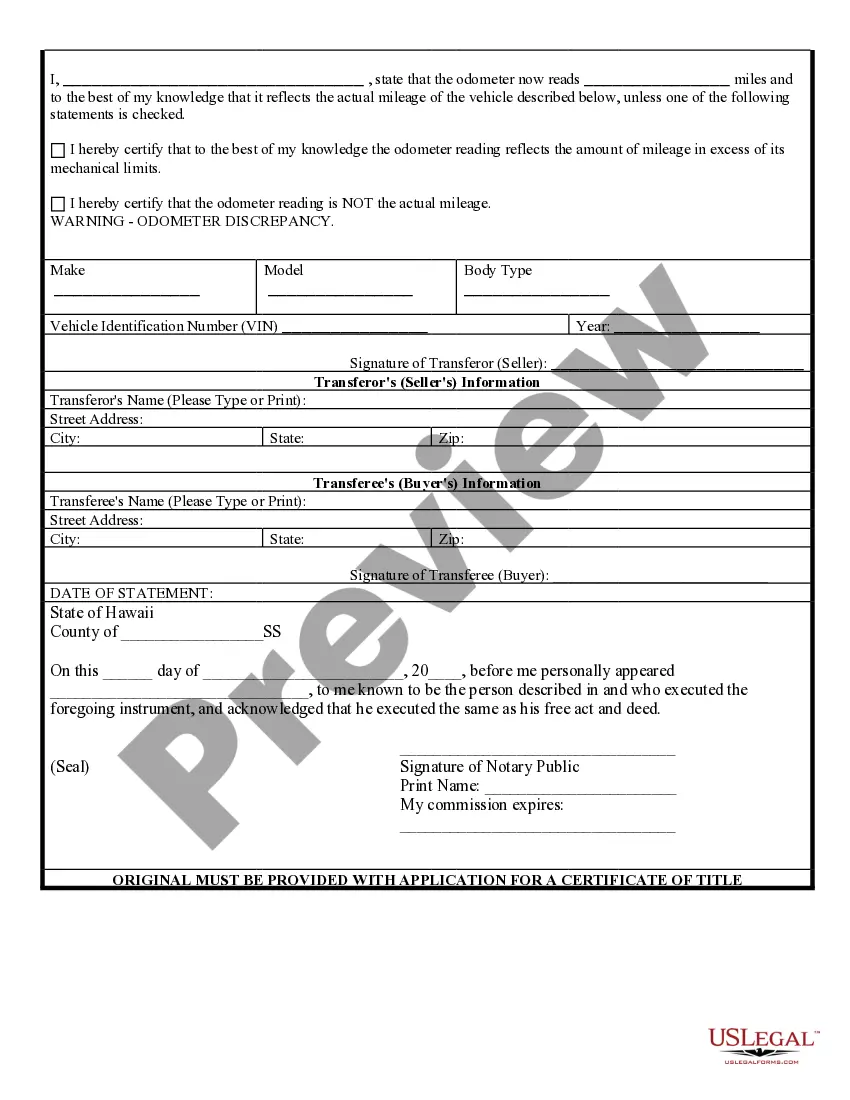

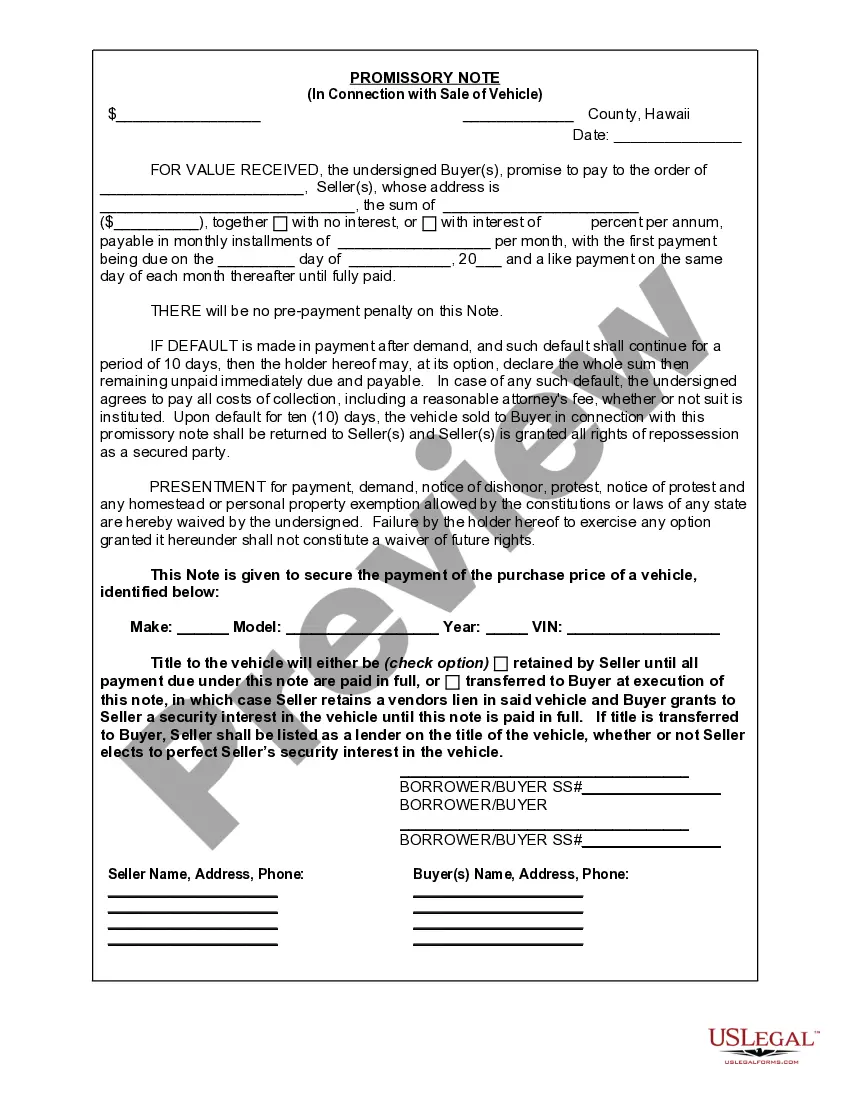

How to fill out Hawaii Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

- If you already have a US Legal Forms account, log in and download the sale bill template by clicking the Download button. Ensure your subscription is current; renew it if necessary.

- For first-time users, start by browsing the form descriptions in Preview mode. Verify that you've selected the correct sale bill that aligns with your needs and complies with your local regulations.

- If you encounter any discrepancies, utilize the Search feature to find the appropriate sale bill template that fits your requirements.

- Proceed to purchase your document by clicking the Buy Now button and selecting your desired subscription plan. You'll need to create an account for full access to our library.

- Complete your purchase by entering your credit card information or using PayPal. Your subscription will grant you access to essential legal forms.

- Finally, download your sale bill and save it on your device. You can always find it later under the My Forms section of your profile.

By harnessing the power of US Legal Forms, you can ensure that your sale bill is expertly crafted and legally valid. With a robust collection of over 85,000 legal forms and expert assistance, we make legal documentation accessible for everyone.

Start your journey today and experience the convenience of efficient legal form management!

Form popularity

FAQ

Yes, a handwritten bill of sale is perfectly acceptable. Ensure it captures all relevant details, such as buyer and seller names, item description, and signatures. A clear and concise handwritten document can serve as a valid proof of the sale.

Yes, a handwritten bill of sale is considered legitimate as long as it includes the necessary details. Make sure to include the buyer's and seller's information, a description of the item, and signatures from both parties. This document serves as proof of the transaction, which can protect both you and the buyer.

To create a sales bill in Excel, open a new spreadsheet and format it to include all pertinent details such as seller information, buyer information, and an itemized list of products or services. You can use simple formulas to calculate totals and taxes. For added convenience, templates are available on platforms like USLegalForms that can guide you in creating a professional sales bill in Excel.

Making a sales bill involves gathering key information about the transaction. Include your business name, customer details, item descriptions, prices, and any necessary tax information. You can easily create a sales bill by using available templates or software that simplifies invoicing, such as those provided by USLegalForms.

Filing sales and use tax in Texas requires you to register for a state sales tax permit. Once registered, collect all sale bill records and complete the Texas sales tax form. Submit your return online through the Texas Comptroller’s website, or use third-party services like USLegalForms to facilitate the process with guidance and templates.

Yes, you can generate an invoice by yourself. Using a simple document creation tool or specialized invoicing software, you can format an invoice with all key components such as descriptions of goods or services, costs, and payment instructions. USLegalForms offers various templates that you can customize to create a professional sales bill efficiently.

To create a sales bill, start by outlining the essential information, such as seller and buyer details, date of sale, and items sold. Include the total sale amount and specify any applicable taxes. You can draft a sales bill manually or utilize software that can generate one for you, like tools offered by USLegalForms.

Certainly, you can create your own sales invoice. Begin by including your business information, customer details, and a breakdown of the products or services sold. Make sure to list the sale bill amount and payment terms clearly. Consider using templates from USLegalForms to simplify the process and ensure you include all necessary information.

Yes, you can file sales tax yourself. To do this, gather all necessary documents related to your sales, including receipts and sales records. After compiling your information, you can complete your sales tax return through your state’s online portal or by using relevant forms. If you prefer, platforms like USLegalForms can help streamline the process of filing your sales tax.

Yes, a sale bill is required for many types of transactions in West Virginia, especially for vehicle transfers. This document serves as evidence of the sale and is pivotal for both the buyer and seller. When you provide a sale bill to the DMV, it streamlines the process of registering the vehicle in the new owner's name. It is advisable to always have this document prepared when buying or selling a vehicle.