Power Of Attorney Irs

Description

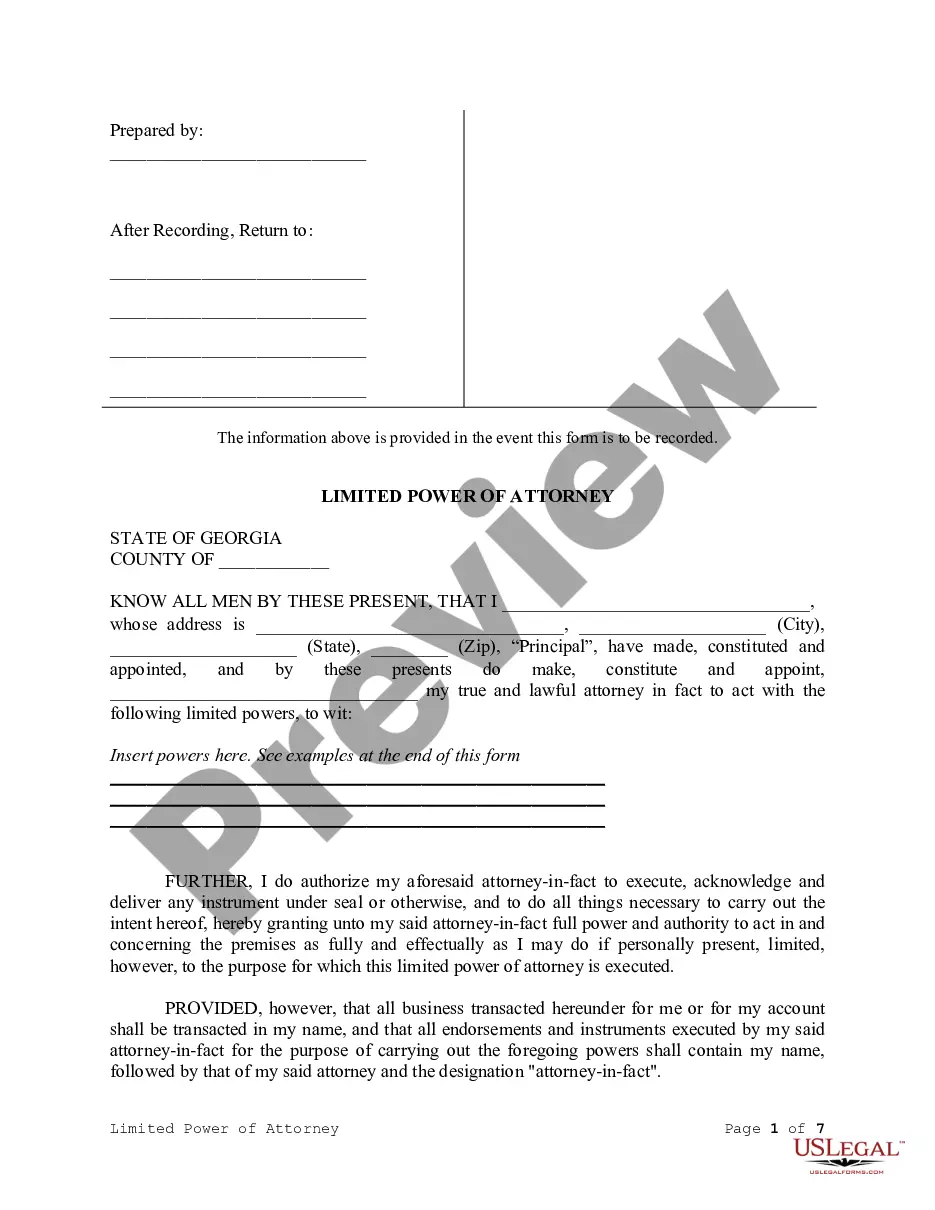

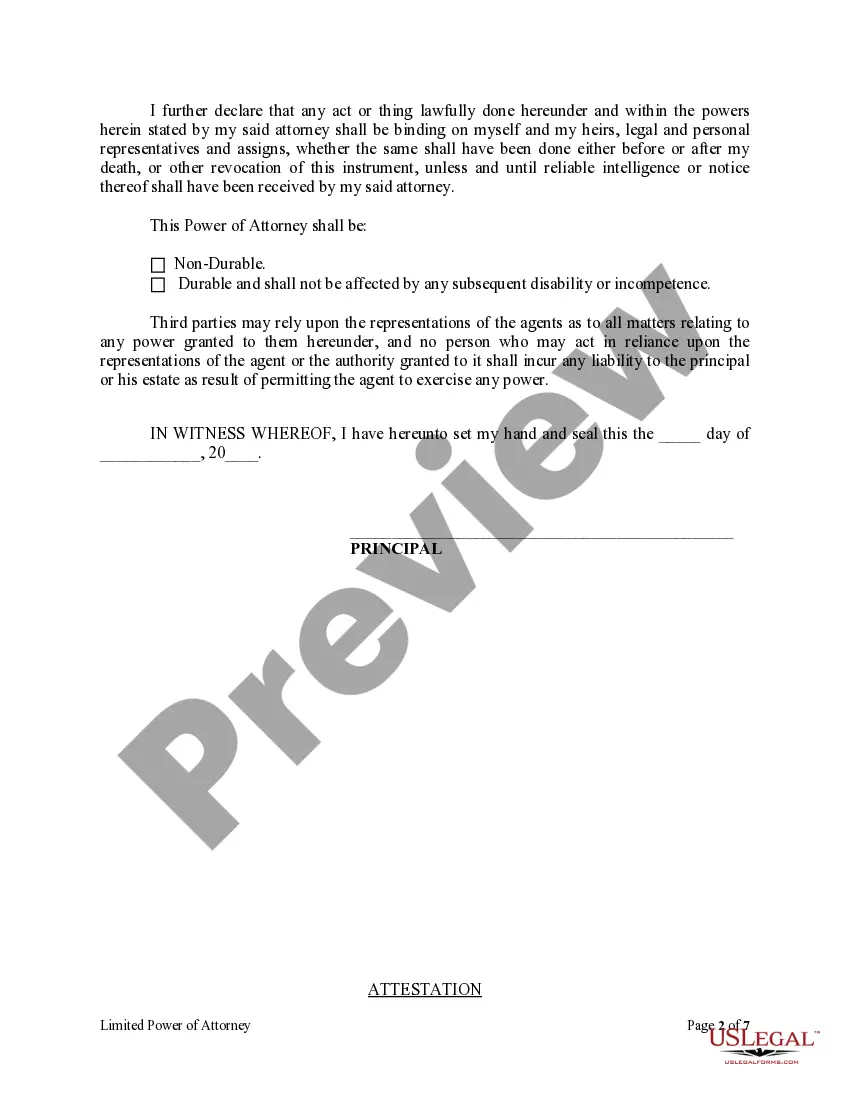

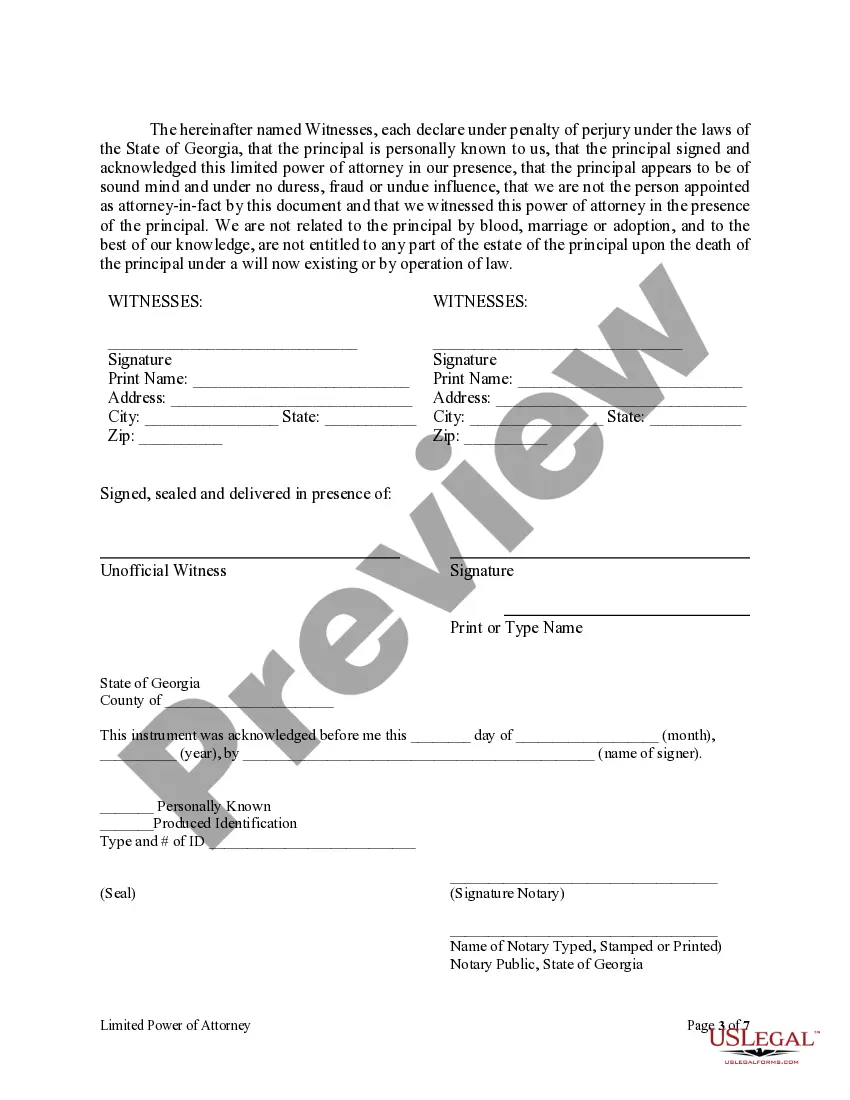

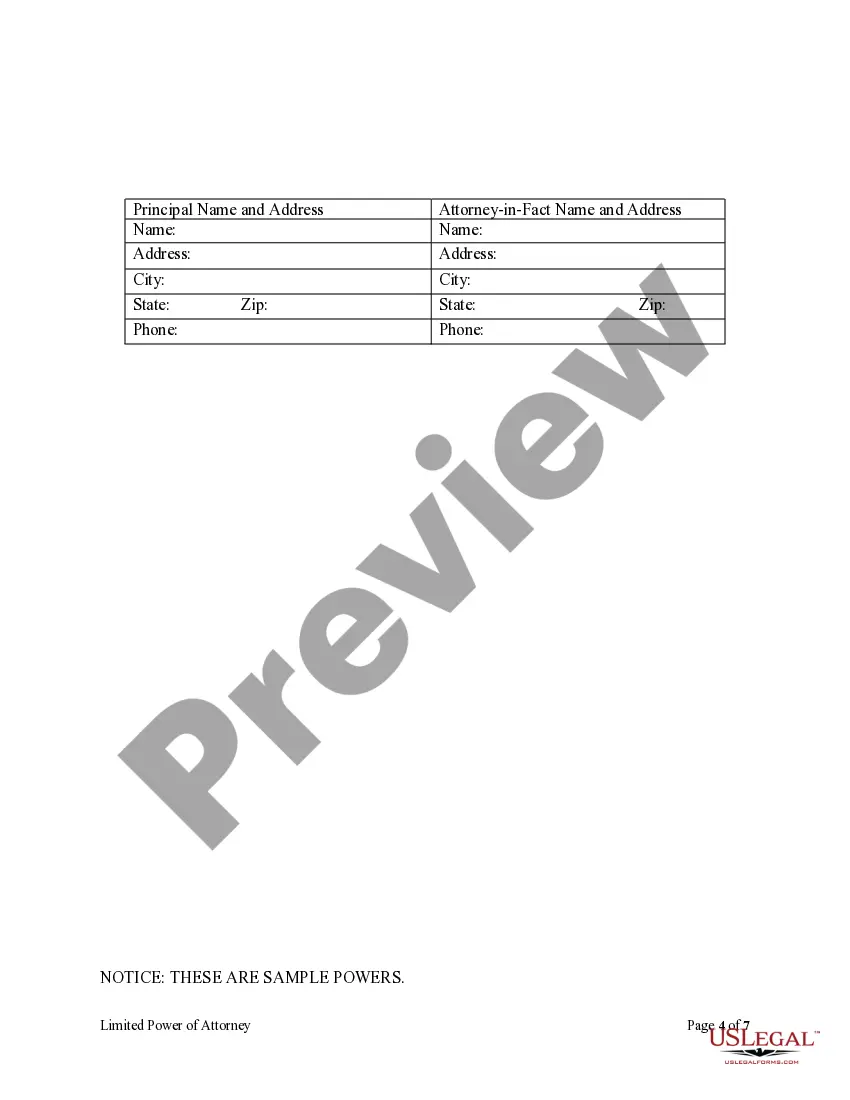

How to fill out Georgia Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log in to your US Legal Forms account to access previously downloaded documents, ensuring you have an active subscription. If needed, you can renew it per your payment plan.

- Preview the available templates for the Power of Attorney and ensure it aligns with your jurisdiction’s requirements. Double-check descriptions for clarity.

- If you don’t find the ideal template, use the search feature to find additional forms that may better suit your needs.

- Select the desired form and click the Buy Now button. Choose a suitable subscription plan and create an account securely to access resources.

- Complete your purchase by entering your credit card or PayPal information. Ensure payment processing is confirmed before proceeding.

- Download the form to your device, allowing for easy completion. You can also access it later through the My Forms section of your account.

In conclusion, US Legal Forms simplifies the process of acquiring vital legal documents, empowering individuals and attorneys alike. The extensive form library ensures users can find exactly what they need for effective legal compliance.

Start your journey to efficient legal document management with US Legal Forms today!

Form popularity

FAQ

To obtain power of attorney for the IRS, you must complete Form 2848, which authorizes someone to represent you before the IRS. You can download this form from the IRS website or access it through platforms like US Legal Forms for convenience. After filling it out, submit the form to the IRS to grant your chosen representative the power to act on your behalf regarding tax matters. Managing your IRS representation through a power of attorney simplifies your communication and helps ensure that your tax issues are handled professionally.

Yes, the IRS does recognize a power of attorney (POA) for tax matters. This legal document allows your appointed representative to act on your behalf in dealing with tax-related issues, ensuring that your interests are properly represented. It is important to complete the form accurately and ensure it meets IRS requirements for it to be effective. For assistance, you can rely on US Legal Forms, which offers resources and templates to help you navigate IRS power of attorney requirements.

Yes, an IRS power of attorney form can be signed electronically as long as the method of signing complies with IRS e-signature regulations. The IRS accepts electronic signatures on forms submitted through authorized methods. However, it's crucial to ensure that both you and your representative follow any specific guidelines set forth by the IRS. Platforms like US Legal Forms can help streamline this process while ensuring you meet the required standards.

Filling out a power of attorney form involves several straightforward steps. First, you need to select the right form for IRS purposes, which allows you to grant authority to someone else to handle your tax matters. Next, you'll fill in your details, the representative’s information, and specify the powers you are granting. Utilizing US Legal Forms can simplify this process, as it provides templates and guidance tailored for IRS power of attorney situations.

Typically, the IRS does not require the power of attorney to be notarized. However, some states might have their own rules that do mandate notarization. It is essential to check the specific requirements in your state to ensure compliance. Using a platform like US Legal Forms can guide you through the process and help you understand any necessary steps.

Submitting a power of attorney to the IRS involves filling out IRS Form 2848 and sending it through appropriate methods, such as mail or fax. If you're working with a tax professional, they can assist in this submission to ensure accurate processing. Make sure that all sections are completed correctly to prevent delays. Platforms like USLegalForms can guide you in preparing and submitting the necessary paperwork.

The IRS does accept digital signatures under specific conditions. Ensure your digital signature complies with IRS guidelines for authenticity and legality. Utilizing electronic forms can simplify compliance and ensure that your documents are filed correctly. Digital signatures can streamline the process, making it easier for you to manage your tax matters efficiently.

Yes, the IRS allows an IRS power of attorney to be signed electronically in some instances, depending on state laws. Check the guidelines for your specific state and the requirements outlined by the IRS. If you're unsure about the process, you can use platforms like USLegalForms to create and manage your electronic power of attorney securely.

To submit a power of attorney to the IRS, you need to complete IRS Form 2848. Once completed, you should mail, fax, or submit the form online if applicable, based on your circumstances. If you are using a tax professional, they may handle this submission on your behalf. This step is essential for your appointed agent to access your tax records and discuss your tax matters with the IRS.

Yes, a power of attorney can typically be signed virtually, subject to state laws and the requirements set by the IRS. Many states allow electronic signatures on documents, including tax-related forms. Be sure to verify that the virtual signature method you choose meets legal standards for your power of attorney. Utilizing platforms that specialize in legal documents can help streamline this process.