Promissory Note Template Georgia For Personal Loan

Description

How to fill out Georgia Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Individuals generally link legal documentation with complexities that require the expertise of a specialist. In some respects, this is accurate, as creating a Promissory Note Template Georgia For Personal Loan demands considerable understanding of subject requirements, including state and county laws. However, with US Legal Forms, the process has become more straightforward: a comprehensive online collection of ready-to-use legal templates tailored for specific state regulations is accessible to all.

US Legal Forms provides over 85,000 current forms categorized by state and purpose, making it quick and easy to search for a Promissory Note Template Georgia For Personal Loan or any other specific document. Existing users with an active subscription must Log In to their account and click Download to acquire the form. New users will need to create an account and subscribe before they can store any documentation.

Here is a detailed guideline on how to obtain the Promissory Note Template Georgia For Personal Loan.

All templates in our library are reusable: once purchased, they remain stored in your profile. You can access them anytime through the My documents tab. Discover all the benefits of using the US Legal Forms platform. Sign up today!

- Review the page content carefully to ensure it meets your requirements.

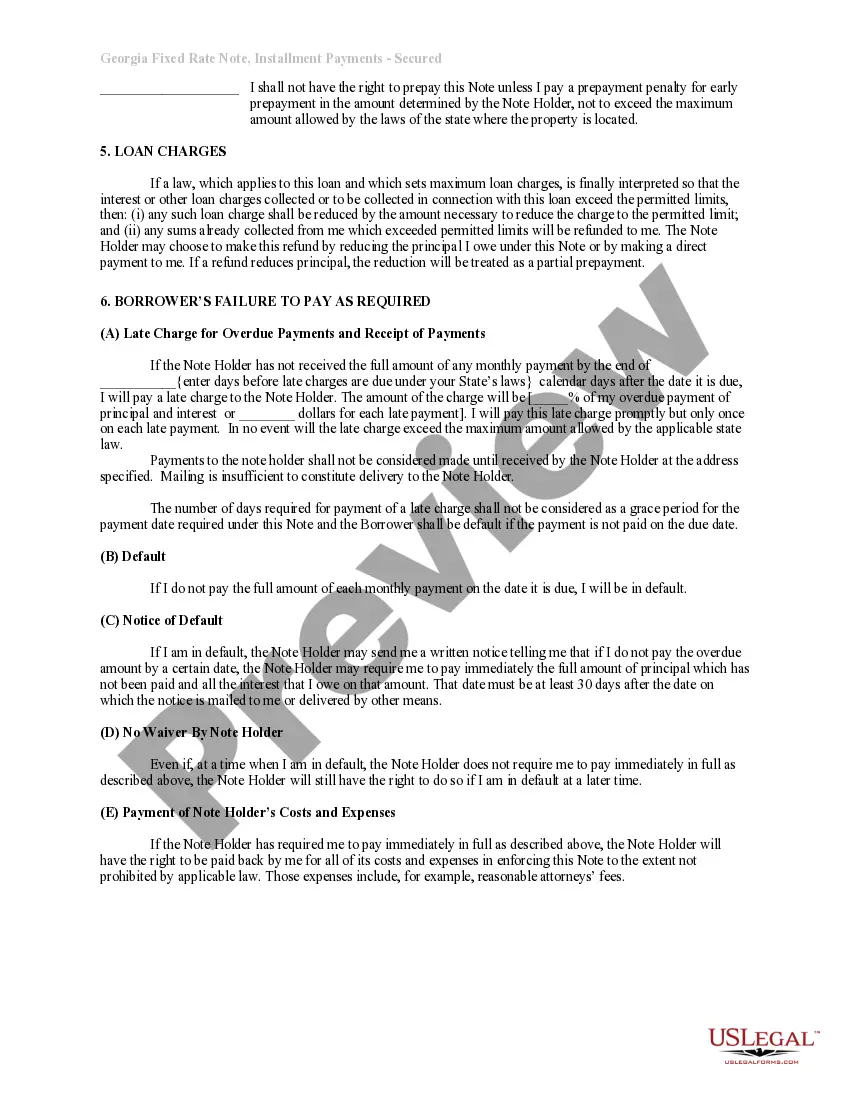

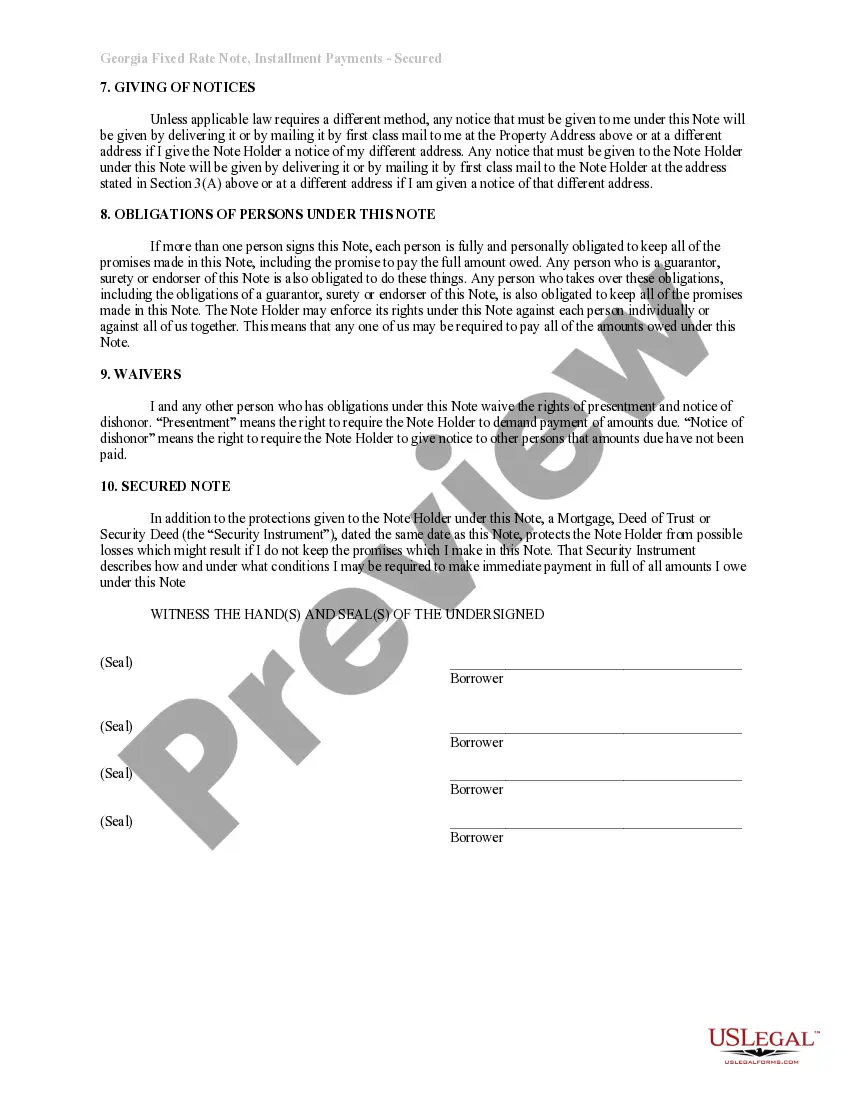

- Examine the form description or confirm it using the Preview feature.

- Find another example using the Search bar above if the current one doesn't meet your needs.

- Click Buy Now when you discover the correct Promissory Note Template Georgia For Personal Loan.

- Choose a pricing plan that aligns with your requirements and budget.

- Create an account or Log In to proceed to the payment screen.

- Complete your payment via PayPal or with your credit card.

- Select the format for your document and click Download.

- Print your document or upload it to an online editor for faster completion.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money.

A Georgia promissory note must be signed and dated by the borrower and a witness. It should also be notarized.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.