A Home Equity Line of Credit (HELOT) note is a legal document that outlines the terms and conditions of borrowing against the equity in a property. It serves as a binding agreement between the borrower and the lender, ensuring both parties are aware of their rights and responsibilities. This article provides a detailed description of what a HELOT note example for mortgage entails, shedding light on different types of HELOT notes commonly used in the industry. 1. Traditional HELOT Note Example: The traditional HELOT note example is the most commonly used document. It specifies the maximum loan amount that can be borrowed, the draw period during which the borrower can access funds, the repayment terms, and the interest rate. This type of HELOT note is often secured by the borrower's property and subject to the lender's approval. 2. Fixed-Rate HELOT Note Example: A fixed-rate HELOT note example is less common but provides added stability to borrowers. Unlike a traditional HELOT with a variable interest rate, this type of note specifies a fixed interest rate for the entire term of the loan. This gives borrowers the advantage of predictable monthly payments, making it easier to budget their finances accordingly. 3. Interest-Only HELOT Note Example: An interest-only HELOT note example allows borrowers to pay only the interest on the borrowed amount during the draw period. This type of note offers flexibility in the initial years of the loan, as borrowers have the choice to make interest-only payments or pay additional amounts towards the principal debt. However, it's important to note that after the draw period ends, borrowers are required to repay both the principal and the interest. 4. HELOT Conversion Note Example: A HELOT conversion note example is relevant for borrowers who wish to convert their HELOT into a fixed-rate mortgage or another type of loan in the future. This type of note outlines the specific terms and conditions related to the conversion process, including any associated fees or costs. 5. Adjustable-Rate HELOT Note Example: An adjustable-rate HELOT note example is similar to the traditional HELOT note. However, it stipulates that the interest rate may fluctuate during the draw period based on specific market conditions, such as changes in the prime rate. Borrowers should carefully consider this type of note, as it can lead to varying monthly payments. When dealing with a HELOT note for mortgage, it's crucial for both lenders and borrowers to carefully review the terms and conditions, seek legal advice if necessary, and ensure full comprehension of the obligations involved. The examples mentioned above highlight some common types of HELOT notes, but it is essential to consult with relevant professionals to understand the specific terms and conditions of any given loan agreement.

Heloc Note Example For Mortgage

Description

How to fill out Heloc Note Example For Mortgage?

Using legal templates that comply with federal and regional regulations is a matter of necessity, and the internet offers many options to pick from. But what’s the point in wasting time searching for the correctly drafted Heloc Note Example For Mortgage sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are simple to browse with all files organized by state and purpose of use. Our specialists stay up with legislative changes, so you can always be confident your form is up to date and compliant when obtaining a Heloc Note Example For Mortgage from our website.

Obtaining a Heloc Note Example For Mortgage is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the steps below:

- Take a look at the template using the Preview feature or through the text description to make certain it meets your requirements.

- Browse for a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and select a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Heloc Note Example For Mortgage and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

A home equity line of credit (HELOC) is a loan that allows you to borrow, spend, and repay as you go, using your home as collateral.

Loan payment example: on a $50,000 loan for 120 months at 8.25% interest rate, monthly payments would be $613.26. Payment example does not include amounts for taxes and insurance premiums.

What do I need to bring for a HELOC loan? In addition to a qualifying credit score and sufficient equity, you'll need to provide documentation to verify your income and financial history. This can include recent pay stubs, two years of tax returns, bank statements and a current mortgage statement.

A home equity line of credit (HELOC) is a loan that allows you to borrow, spend, and repay as you go, using your home as collateral. Typically, you can borrow up to a specified percentage of your equity. Equity is the value of your home minus the amount you owe on your mortgage.

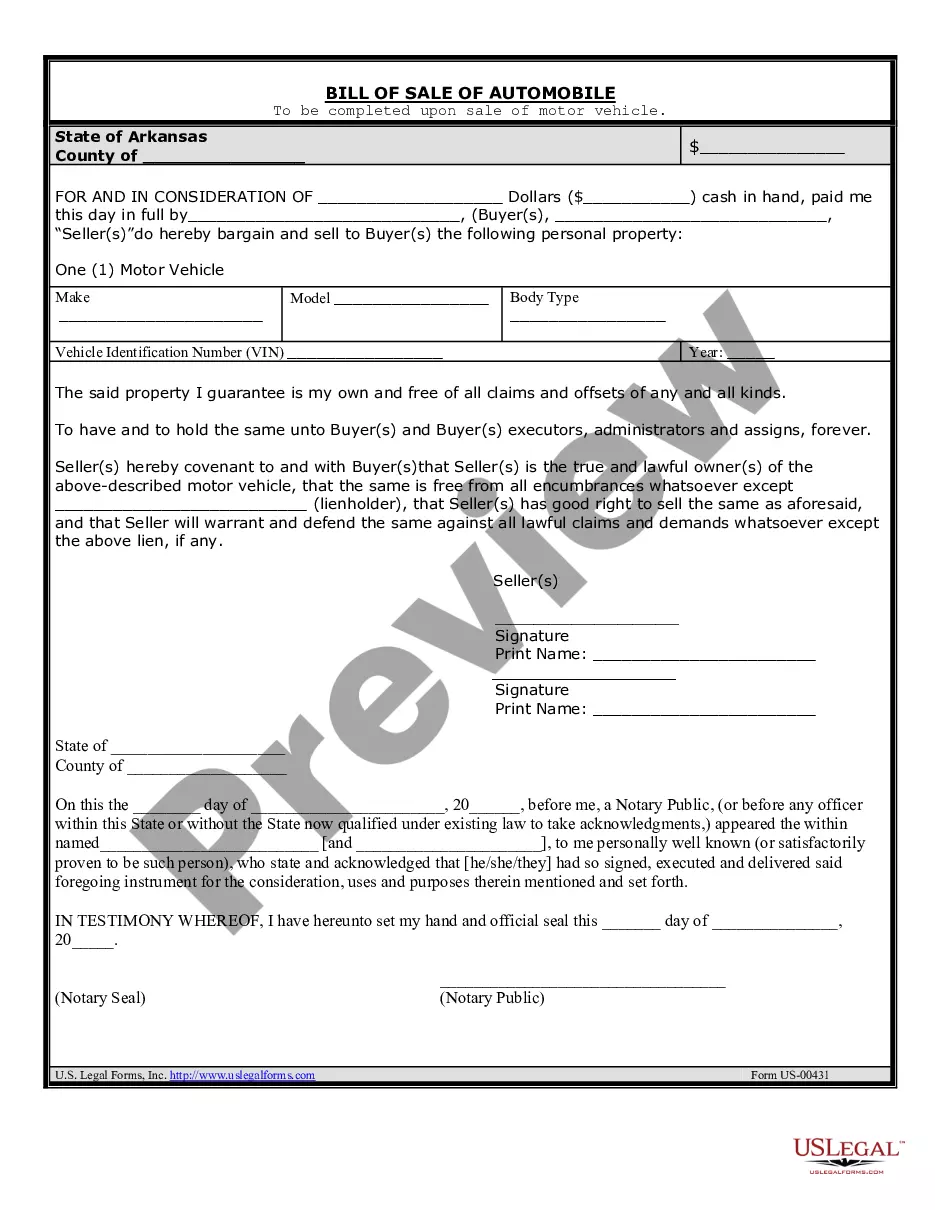

Yes, there is a promissory note for a HELOC. The HELOC note outlines the terms and conditions of the loan agreement between the homeowner and the lender.