Limited Liability Company For Dummies

Description

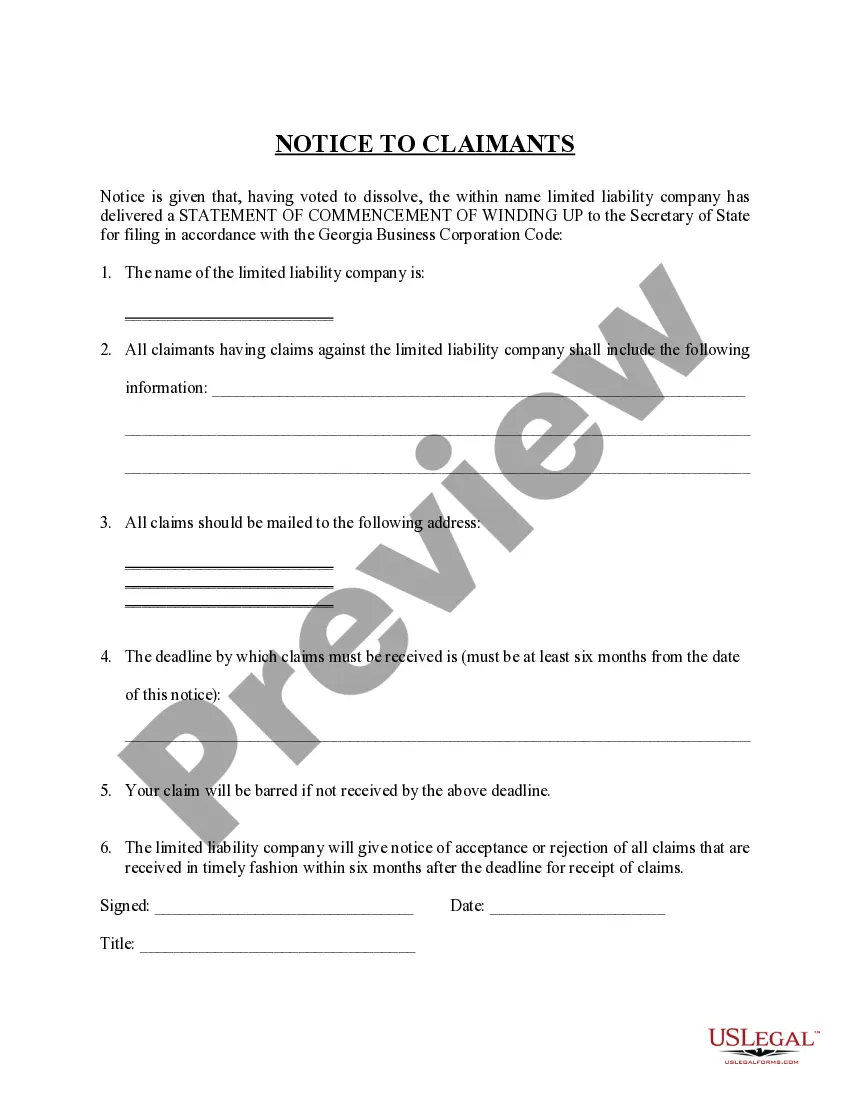

How to fill out Georgia Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your US Legal Forms account if you're a returning user to access download options. Ensure your subscription is current, or renew it as necessary.

- For first-time users, explore the comprehensive online library. Preview the available templates and select one that aligns with your state’s requirements.

- Use the search feature to find alternative templates if the initial choice doesn't meet your needs.

- Proceed to purchase your selected document by clicking the 'Buy Now' button and selecting an appropriate subscription plan.

- Complete your transaction by entering your payment details, either through credit card or PayPal.

- Download the completed template to your device and access it anytime from the 'My Forms' section of your account for future reference.

US Legal Forms empowers you with a hassle-free approach to legal documentation, making it a convenient choice for individuals and attorneys alike.

Start your journey to forming a limited liability company today and unlock the full potential of US Legal Forms!

Form popularity

FAQ

Writing 'LLC' correctly requires you to use the proper abbreviation for Limited Liability Company consistently. Ensure you follow the naming conventions and include 'LLC' at the end of your business name. This clarity is vital, especially for those learning about the structure, like Limited Liability Company for dummies.

To write an LLC example, think of a straightforward business scenario. Begin with the LLC name, such as 'Johnson's Bakery LLC,' and outline its services, like baking and selling goods. It helps to see how a Limited Liability Company functions in real life, especially for those new to business concepts.

Writing an LLC example involves drafting a fictitious business to illustrate how it operates. For instance, you might describe a company named 'Smith's Landscaping LLC' that offers gardening services. Including such relatable examples can help you grasp the concept of a Limited Liability Company for dummies.

To fill for an LLC, start by choosing a unique name and checking its availability in your state. Next, gather the required information to complete the application, including member details and your LLC's purpose. You can simplify this process by using US Legal Forms, which provides structured guidance on forming your Limited Liability Company.

Yes, you can file your Limited Liability Company (LLC) by yourself. This process includes completing the necessary forms and submitting them to your state's business filing office. However, consider using platforms like US Legal Forms for step-by-step guidance. This option simplifies the filing process and ensures you meet all requirements.

The best filing status for a limited liability company depends on the number of members and specific business goals. A single-member LLC is typically treated as a sole proprietorship for tax purposes, whereas a multi-member LLC defaults to a partnership. You can also choose to have your LLC taxed as an S corporation for tax advantages. Understanding these options is vital for maximizing your tax benefits.

The best program to start a limited liability company includes reputable online services that specialize in business formation. US Legal Forms offers comprehensive resources and templates, guiding you in the LLC formation process. These programs often provide additional services like operating agreements and compliance help, ensuring you start your business on the right foot while staying organized.

The biggest disadvantage of a limited liability company is the potential for self-employment taxes. While LLCs protect your personal assets, they can also lead to higher tax obligations for self-employed individuals. Additionally, some states impose additional fees or franchise taxes on LLCs, which can further complicate financial matters. It's essential to consider these factors before forming an LLC.

To file for a limited liability company correctly, start by checking your state’s requirements. You can complete the process online for convenience, or opt to do it through the mail. Using resources like US Legal Forms can help simplify the paperwork involved, ensuring you don’t miss any critical details. This way, you can focus on getting your business up and running.

The best way to file for a limited liability company is to use an online service, which streamlines the process. You must choose a suitable name, prepare your articles of organization, and file them with your state. Platforms like US Legal Forms can guide you through the steps, making it easier for beginners. This approach ensures that you comply with state regulations properly.