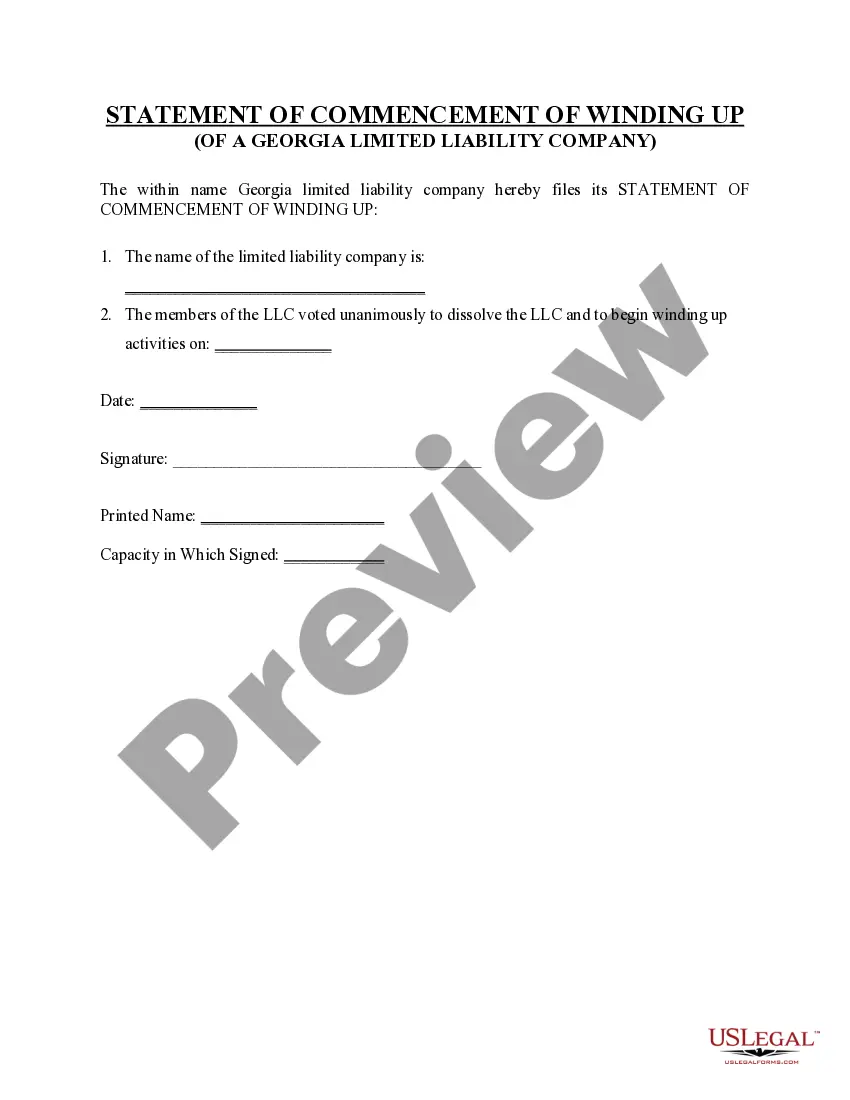

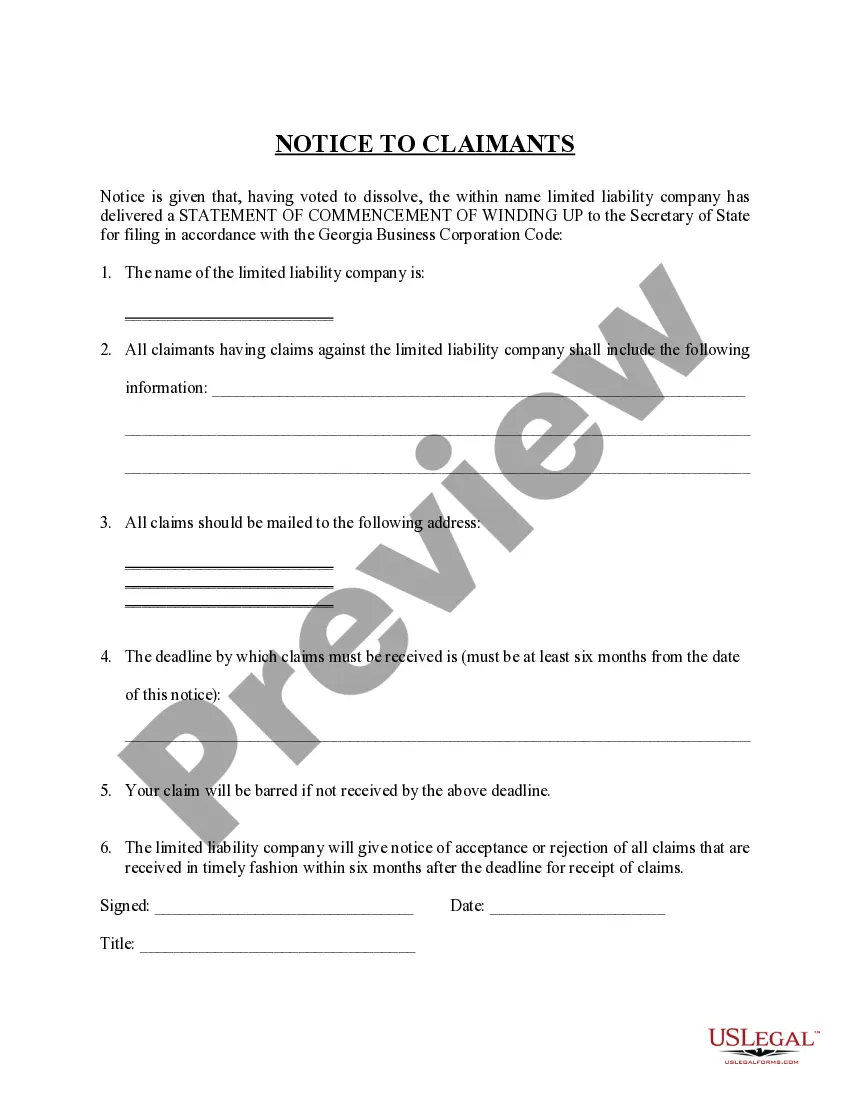

The dissolution package contains all forms to dissolve a LLC or PLLC in Georgia, step by step instructions, addresses, transmittal letters, and other information.

Dissolve Company In Texas

Description

How to fill out Georgia Dissolution Package To Dissolve Limited Liability Company LLC?

Identifying a reliable location to obtain the most up-to-date and pertinent legal forms is part of the challenge of navigating bureaucracy.

Selecting suitable legal documents requires precision and careful consideration, which underscores the necessity of acquiring samples for Dissolve Company In Texas exclusively from trustworthy sources, such as US Legal Forms.

Eliminate the complexities associated with your legal documentation. Discover the extensive US Legal Forms repository to locate legal templates, assess their applicability to your situation, and download them instantly.

- Utilize the library navigation or search option to locate your template.

- Review the form’s description to verify if it meets the criteria for your state and county.

- Access the form preview, if available, to confirm that the template is indeed the one you are looking for.

- Return to the search to find the appropriate document if the Dissolve Company In Texas does not satisfy your needs.

- Once you are certain about the form’s significance, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Select the subscription plan that aligns with your needs.

- Proceed to the registration to complete your transaction.

- Conclude your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading the Dissolve Company In Texas.

- Once the form is on your device, you can modify it using the editor or print it out and fill it out by hand.

Form popularity

FAQ

To remove yourself from an LLC in Texas, you usually must submit a notice of resignation to the other members. Depending on your LLC's operating agreement, there may be additional steps involved. If you are considering dissolving the company as well, it is prudent to explore options for dissolving a company in Texas. Consider utilizing US Legal Forms to facilitate the process.

How to Dissolve a Texas LLC. To dissolve your LLC in Texas, you submit the completed Certificate of Termination of a Domestic Entity (Form 651) in duplicate to the Secretary of State by mail, fax, in person or at SOSDirect Online.

To dissolve your LLC in Texas, you submit the completed Certificate of Termination of a Domestic Entity (Form 651) in duplicate to the Secretary of State by mail, fax, in person or at SOSDirect Online.

The first step is to ensure that all the partners have agreed to dissolve the partnership. Once all partners agree to dissolve, a Certificate of Termination must be filed with the Texas Secretary of State. This certificate must include the LLP's name, the filing date, and the signature of at least one partner.

Step 1: Get Proper Approval. ... Step 2: Stop Doing Business. ... Step 3: Notify Creditors and Claimants. ... Step 4: Sell and Distribute Business Assets. ... Step 5: Pay All Outstanding Business Taxes. ... Step 6: Handle Any Other Outstanding Matters. ... Step 7: File a Certificate of Termination.

The entity must: Take the necessary internal steps to wind up its affairs. ... Submit two signed copies of the certificate of termination. ... Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller. ... Pay the appropriate filing fee.