Third Party Guarantor Service For Lease

Description

How to fill out Georgia Guaranty Attachment To Lease For Guarantor Or Cosigner?

Legal document management might be frustrating, even for experienced professionals. When you are looking for a Third Party Guarantor Service For Lease and do not get the time to devote trying to find the right and updated version, the procedures can be nerve-racking. A strong web form catalogue could be a gamechanger for everyone who wants to handle these situations successfully. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you may:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any demands you could have, from individual to organization papers, in one place.

- Employ innovative tools to finish and deal with your Third Party Guarantor Service For Lease

- Access a useful resource base of articles, guides and handbooks and resources relevant to your situation and requirements

Save time and effort trying to find the papers you will need, and use US Legal Forms’ advanced search and Review feature to discover Third Party Guarantor Service For Lease and get it. If you have a subscription, log in in your US Legal Forms account, look for the form, and get it. Take a look at My Forms tab to find out the papers you previously downloaded and to deal with your folders as you can see fit.

If it is your first time with US Legal Forms, register a free account and obtain unlimited use of all benefits of the platform. Here are the steps to take after downloading the form you need:

- Verify this is the correct form by previewing it and reading its information.

- Ensure that the sample is acknowledged in your state or county.

- Select Buy Now once you are all set.

- Select a monthly subscription plan.

- Pick the format you need, and Download, complete, sign, print out and send out your document.

Benefit from the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Change your everyday document management into a smooth and user-friendly process today.

Form popularity

FAQ

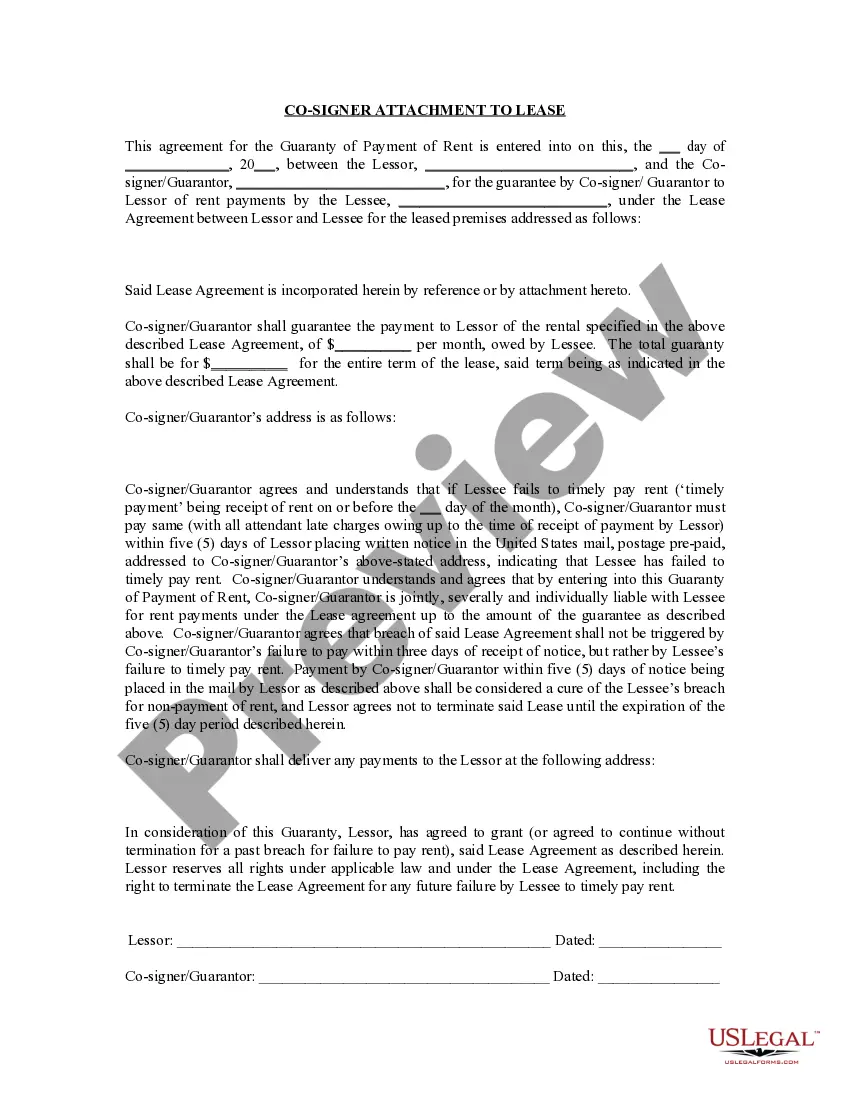

Your guarantor will have to sign a contract with the letting agent or landlord. This will set out the terms of the guarantor and their responsibilities to the property. Most contracts will state that a guarantor is liable to cover any unpaid rent for the length of the tenancy.

Landlord details ? the name and contact information of the landlord. Tenant details ? the name of the tenant or tenants for whom the guarantor is providing the guarantee. Property ? the address of the property that is being rented. Tenancy term ? the start and end date of the fixed terms of the tenancy.

What does a guarantor need to provide? Guarantors will need to provide information to a landlord or letting agency to ensure they can take on the responsibility of being a guarantor: Proof of identity, like a passport or UK driving licence. There will be credit checks that they need to pass.

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

Lenders run a series of checks before approving a guarantor loan to assess whether the borrower or guarantor will be able to repay the loan. Credit checks review your credit history and reveal your credit score, giving the lender insight on how well you've repaid other types of credit and loans in the past.