Guarantor Service For Bad Credit

Description

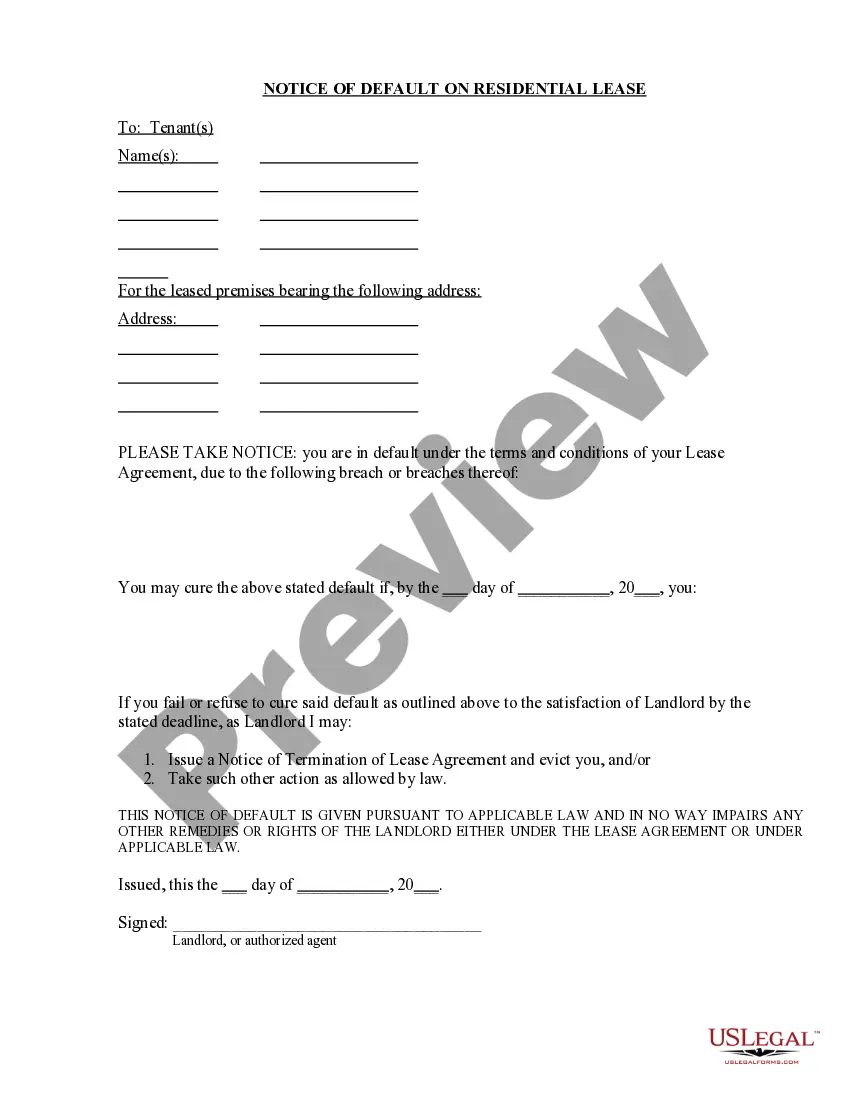

How to fill out Georgia Guaranty Attachment To Lease For Guarantor Or Cosigner?

It’s clear that you can’t transform into a legal expert instantly, nor can you swiftly master how to prepare Guarantor Service For Bad Credit without possessing a specialized skill set.

Drafting legal documents is an extensive process that demands specific training and expertise. So why not entrust the preparation of the Guarantor Service For Bad Credit to the specialists.

With US Legal Forms, one of the most extensive legal document collections, you can find everything from court filings to templates for internal communication.

If you require a different template, restart your search.

Create a free account and select a subscription plan to purchase the template. Click Buy now. After the transaction is complete, you can download the Guarantor Service For Bad Credit, fill it out, print it, and send it or mail it to the required individuals or organizations.

- We recognize how crucial compliance and adherence to federal and state laws and regulations are.

- That’s why, on our site, all forms are location-specific and up to date.

- Begin with our website and acquire the document you need in just a few minutes.

- Discover the form you're looking for using the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if Guarantor Service For Bad Credit is what you need.

Form popularity

FAQ

Explain why your credit score may be low, whether you're dealing with medical bills, divorce, or other financial situations, and your landlord may be more lenient. Show Proof of Payments- If your credit score is low, but you've always paid rent on time, show your potential landlord proof of your on-time rent payments.

There are insurance companies that offer rent guarantee and legal expense insurance to landlords. If your landlord has this insurance they will be protected if you don't pay your rent. You could offer to pay the premium for this type of insurance in return for your landlord waiving their requirement for a guarantor.

Guarantors with a bad credit history are not likely to be accepted by lenders so it's unlikely you'll be able to act as a guarantor if you have a low credit score. There's no magic credit score number that will guarantee you'll be accepted as a guarantor. Each lender will have their own lending requirements.

One example of a guarantor could occur when someone who is under 21 applies for a credit card but is unable to provide proof that they are capable of making minimum payments on the card. The card company may require a guarantor, who becomes liable for repaying any charges on the credit card.

Explain Your Situation- Be extremely honest with your landlord or property manager about your credit history. Explain why your credit score may be low, whether you're dealing with medical bills, divorce, or other financial situations, and your landlord may be more lenient.