Deed To Secure Debt With Power Of Sale

Description

How to fill out Georgia Deed To Secure Debt With Power Of Sale?

Individuals typically link legal documentation with something complex that only an expert can manage.

In some respects, this is accurate, as formulating a Deed To Secure Debt With Power Of Sale necessitates a thorough understanding of subject matter requirements, including state and municipal laws.

Nonetheless, with US Legal Forms, the process has turned more straightforward: pre-constructed legal templates for any personal and business circumstance complying with state regulations are compiled into a single online directory and are now accessible to all.

Print your document or transfer it to an online editor for quicker completion. All templates in our catalog are reusable: once obtained, they remain saved in your profile. You can access them whenever necessary via the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current forms categorized by state and area of application, so searching for a Deed To Secure Debt With Power Of Sale or another specific template takes merely minutes.

- Previous users with an active subscription need to Log In to their account and click Download to acquire the form.

- New users must first register for an account and subscribe before they can download any materials.

- Here is the detailed guidance on how to access the Deed To Secure Debt With Power Of Sale.

- Carefully examine the page content to confirm it fulfills your requirements.

- Read the form description or check it through the Preview option.

- If the former does not meet your needs, find another example using the Search bar above.

- When you discover the correct Deed To Secure Debt With Power Of Sale, click Buy Now.

- Choose a pricing plan that aligns with your needs and financial situation.

- Create an account or Log In to proceed to the payment section.

- Complete your subscription payment via PayPal or with your credit card.

- Select the file format and click Download.

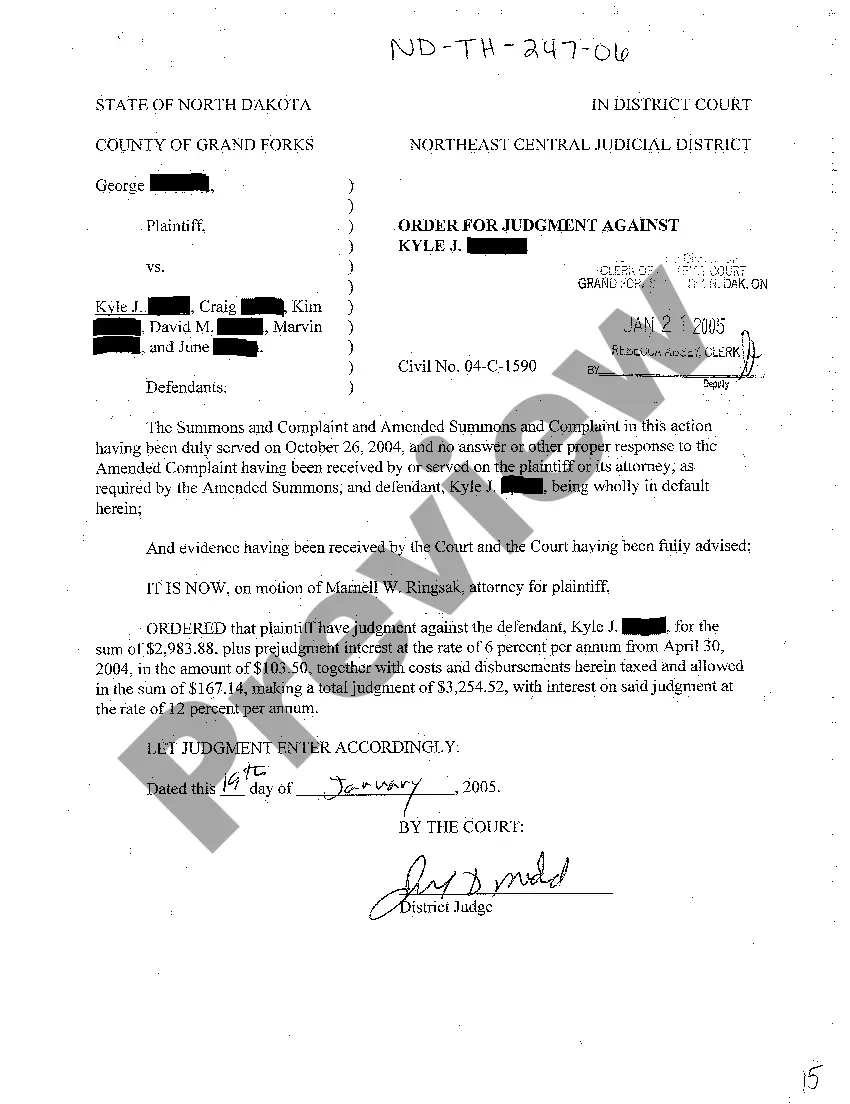

Form popularity

FAQ

A "power of sale provision" is a clause in the deed of trust or mortgage in which the borrower pre-authorizes the sale of property by way of a nonjudicial foreclosure to pay off the balance of the loan in the event of a default.

The power of sale clause in a mortgage note states that the lender has the power to sell the property in the case of a homeowner's default. In other words, it gives your lender the right to sell your home and use the proceeds to pay your outstanding balance if you fail to pay your mortgage.

The three players involved in a deed of trust are: The trustor, also known as the borrower. The trustee, typically a title company with the power of sale, legal title to the real property, and the ability to hold a nonjudicial foreclosure.

The most popular form currently in use is the mortgage to secure optional future advances which is a combination of two security arrangements whereby the borrower makes an irrevocable offer of his property as security for a subse- quent loan which may later be accepted at the option of the mortgagee.

Most deed of trust mortgages include a power-of-sale clause. This clause allows the trustees in deed of trust mortgages to do non-judicial foreclosures on delinquent borrowers - that is, foreclose without going to court.