Georgia State Withholding Login

Description

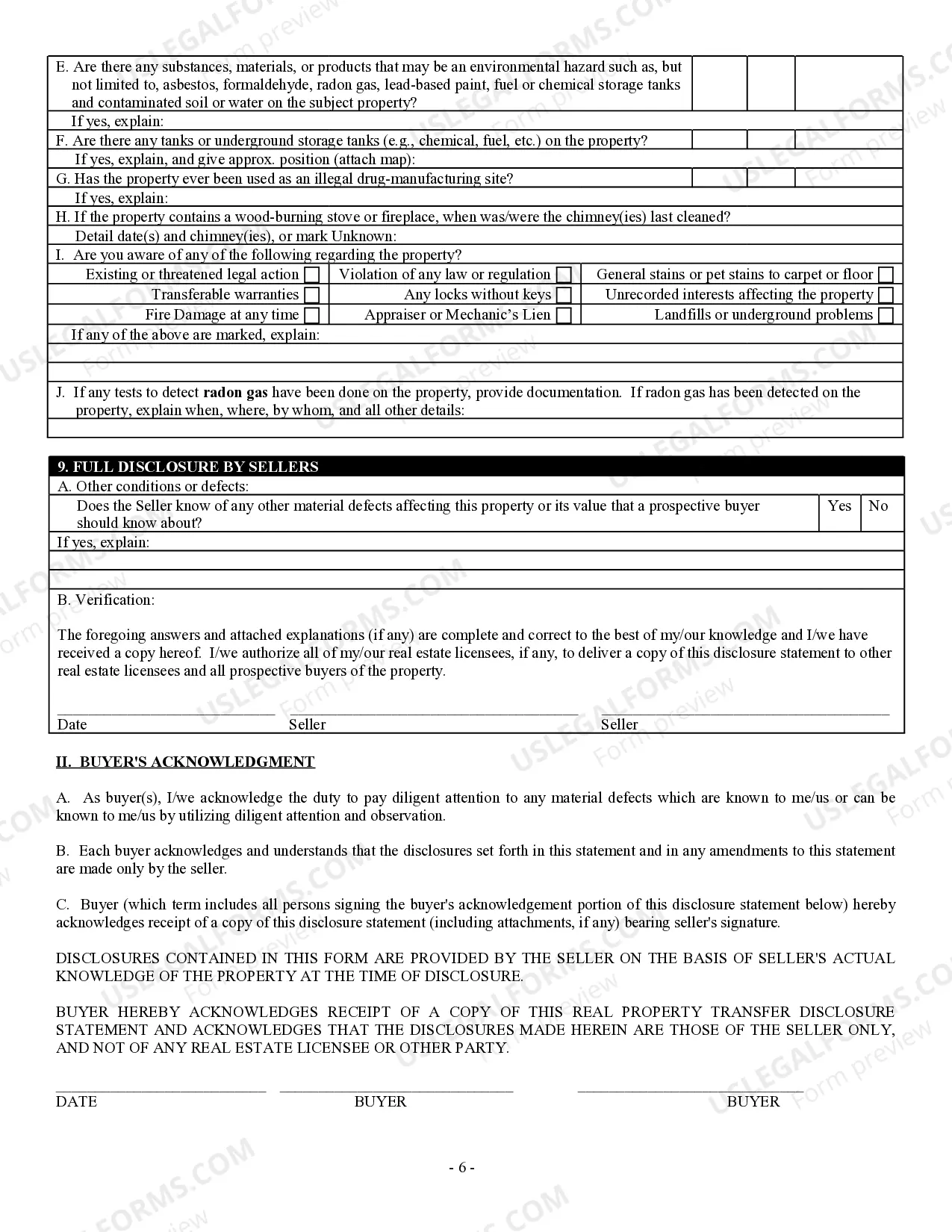

How to fill out Georgia Residential Real Estate Sales Disclosure Statement?

Locating a reliable resource for the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it is essential to obtain samples of Georgia State Withholding Log In solely from trustworthy sources like US Legal Forms. An incorrect template can consume your time and prolong your current situation.

Once you have the document on your device, you can edit it using the editor or print it out and fill it in by hand. Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms collection to uncover legal samples, evaluate their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search box to locate your template.

- Examine the description of the form to ensure it meets the requirements of your state and locality.

- Check the form preview, if available, to confirm it is indeed the one you seek.

- Return to your search to find the appropriate template if the Georgia State Withholding Log In does not meet your needs.

- Once you are confident about the form's relevance, download it.

- If you are a registered user, click Log in to verify your identity and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Choose the pricing plan that aligns with your needs.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Georgia State Withholding Log In.

Form popularity

FAQ

Bylaws serve a couple of important purposes: They provide a road map for running your business. This map includes how many people will be on your board, how to handle board and shareholder meetings, and the duties of each of your officers.

Some examples of S-Corporation By-Laws which may appear on a company's records are: Annual meetings are to be held for the purpose of electing a governing board of directors for the upcoming year. A quorum of six directors is needed in order to proceed with voting or other transactional business.

Articles of incorporation are the primary law of an association used to establish the general organization and governing of the association to achieve corporate existence. Bylaws are the secondary law of an association best used to detail how the society is formed and run.

Unless otherwise provided in the Bylaws, the record date for determining shareholders entitled to notice of and to vote at any meeting is the close of business on the day before the first notice is mailed or otherwise sent to the shareholders, provided that in no event may a record date be more than 70 days before the ...

An S Corporation is required by state law to adopt bylaws that govern the corporation's internal management and the rights of the shareholders.

Corporate bylaws function as a legal contract between the officers, directors, and shareholders of your Texas corporation, outlining the rules and procedures your corporation will follow. Bylaws cover a range of topics, including finances, voting, appointing officers and directors, and much more.

Do bylaws need to be signed? Technically, it's possible for a board of directors to adopt bylaws without signing them. However, signing your bylaws demonstrates that everyone is on the same page about how your corporation will function.

A corporation's bylaws, also called company bylaws or just bylaws, are a legal document setting forth key rules and regulations governing the corporation's day-to-day operations. By articulating the procedures management must follow, these rules help ensure a corporation runs smoothly, efficiently, and consistently.