Trust Deed With A Mortgage

Description

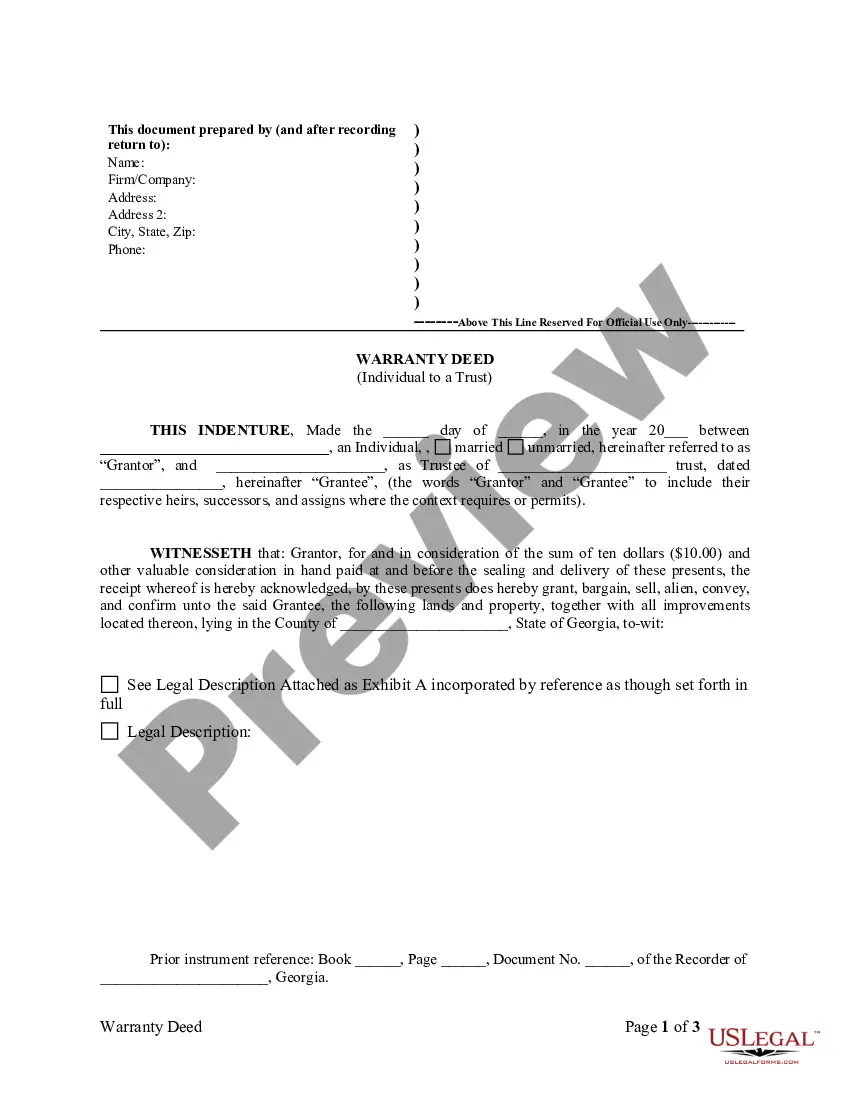

How to fill out Georgia Warranty Deed From Individual To A Trust?

- If you are a returning user, log in to your account and ensure your subscription is active. Download the required form template by clicking the Download button.

- For first-time users, start by browsing the available forms. Utilize the Preview mode to read descriptions and confirm the selected document aligns with your local jurisdiction requirements.

- If you encounter any discrepancies, use the Search tab to find alternative templates that better suit your needs.

- Once you find the right form, click on the Buy Now button to select your preferred subscription plan. You will need to create an account to gain full access to the library.

- Enter your payment details, either through credit card or PayPal, to finalize your subscription and purchase.

- After completing your purchase, download your trust deed with a mortgage form and save it on your device. You can also access it anytime through the My Forms section of your profile.

Conclusion: US Legal Forms is committed to empowering users by offering a comprehensive library of over 85,000 fillable and editable legal forms. With expert assistance available, you can ensure that your legal documents are accurate and compliant.

Get started today and simplify your legal document process with US Legal Forms!

Form popularity

FAQ

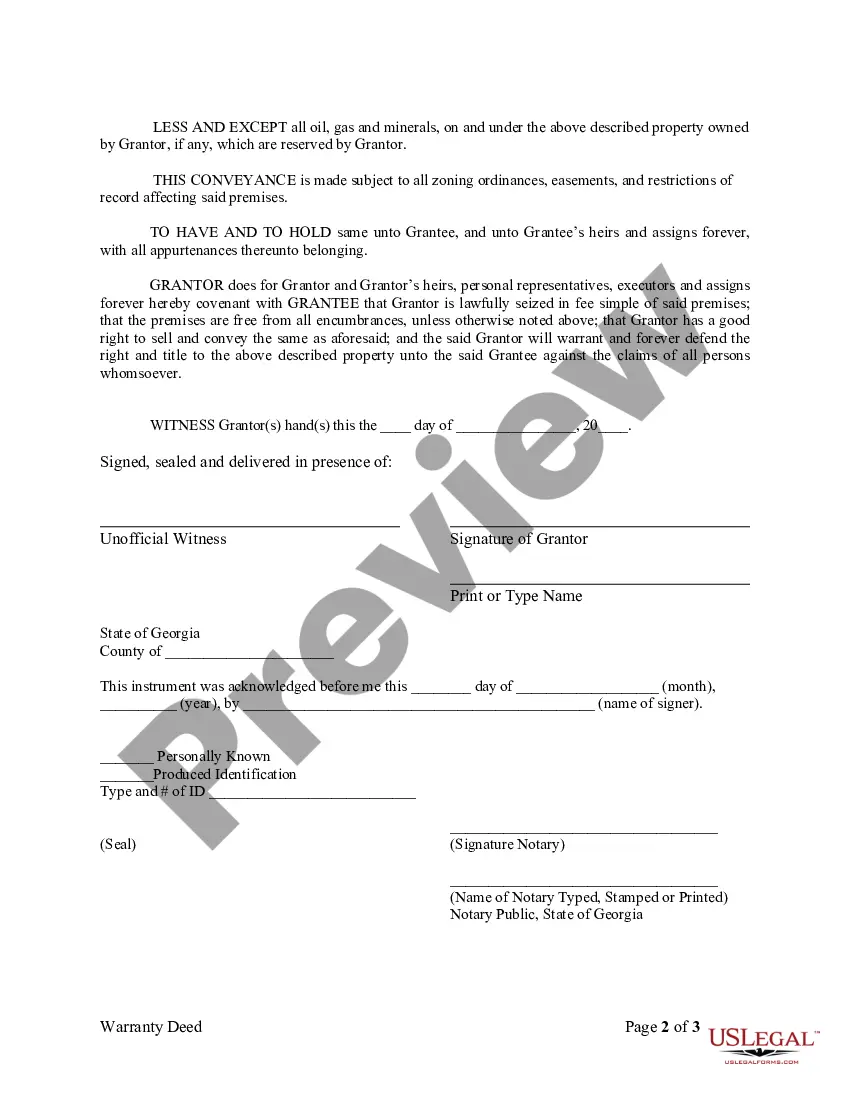

Yes, you typically need to declare a trust deed to ensure its validity and enforceability. This includes filing it with appropriate local or state authorities. Not declaring a trust deed may complicate your legal standing, especially if you have a mortgage involved. USLegalForms can assist you in navigating these declarations and ensuring everything is in order.

A deed of trust offers specific advantages over a traditional mortgage, primarily concerning foreclosure processes. In some states, a deed of trust can streamline the process for lenders. Additionally, it may provide a more favorable structure for managing a relationship with your lender, particularly when using a trust deed with a mortgage.

Yes, you can place a house that has a mortgage into a trust. However, it's important to consider how this may affect the mortgage lender's rights. Typically, the mortgage will remain intact, and you will still owe payments. At USLegalForms, we provide the resources you need to understand how to properly set up a trust deed with a mortgage.

To obtain a trust deed, start by consulting with a legal professional who specializes in estate planning. You will need to define the terms of your trust, including the assets to be included and the beneficiaries. Once your trust is established, the legal professional will draft the trust deed with a mortgage tailored to meet your needs. Utilizing platforms like US Legal Forms can simplify this process by providing necessary documents and guidance.

While putting your house in trust offers benefits, there are disadvantages as well. One drawback includes the potential exposure to certain taxes or fees associated with the trust. Additionally, transferring a property might complicate your mortgage obligations, especially with the trust deed with a mortgage. It's wise to consider these factors and seek legal advice before making any decisions.

Inheriting a house with a mortgage means you assume responsibility for the debt. You will need to continue making mortgage payments, or you could explore options like refinancing or selling the property. Assessing the trust deed with a mortgage is crucial for understanding your rights as a new owner. Consult with a legal advisor to make informed decisions regarding your inheritance.

Indeed, a house with a mortgage can be placed in a trust. You must ensure that the trust is structured correctly to satisfy the mortgage terms. When placing a property in a trust, remember to review the trust deed with a mortgage to confirm all conditions are met. This allows for continued management of your property while adhering to mortgage requirements.

Yes, you can transfer a home with a mortgage to a trust. This process requires careful planning to ensure the lender is notified. Often, you will need to inform your mortgage lender of the trust's existence. Properly handling this transfer can also maintain your rights and obligations under the trust deed with a mortgage.

Someone might choose to use a deed of trust for several reasons, primarily flexibility and security. A deed of trust can allow for a quicker foreclosure process, which benefits lenders and borrowers looking for certainty. Additionally, using a trust deed with a mortgage can simplify the property transfer process during estate planning. If you need solutions or templates, consider exploring USLegalForms for more tailored guidance.

Lenders often prefer a deed of trust because it offers a faster foreclosure process. Unlike a typical mortgage, a trust deed allows lenders to bypass court proceedings, which can save time and resources. This streamlined process provides more security for the lender, making a trust deed with a mortgage a favored choice in many financial agreements. Additionally, borrowers face less risk in a well-structured deed of trust scenario.