Trust Deed For Shares

Description

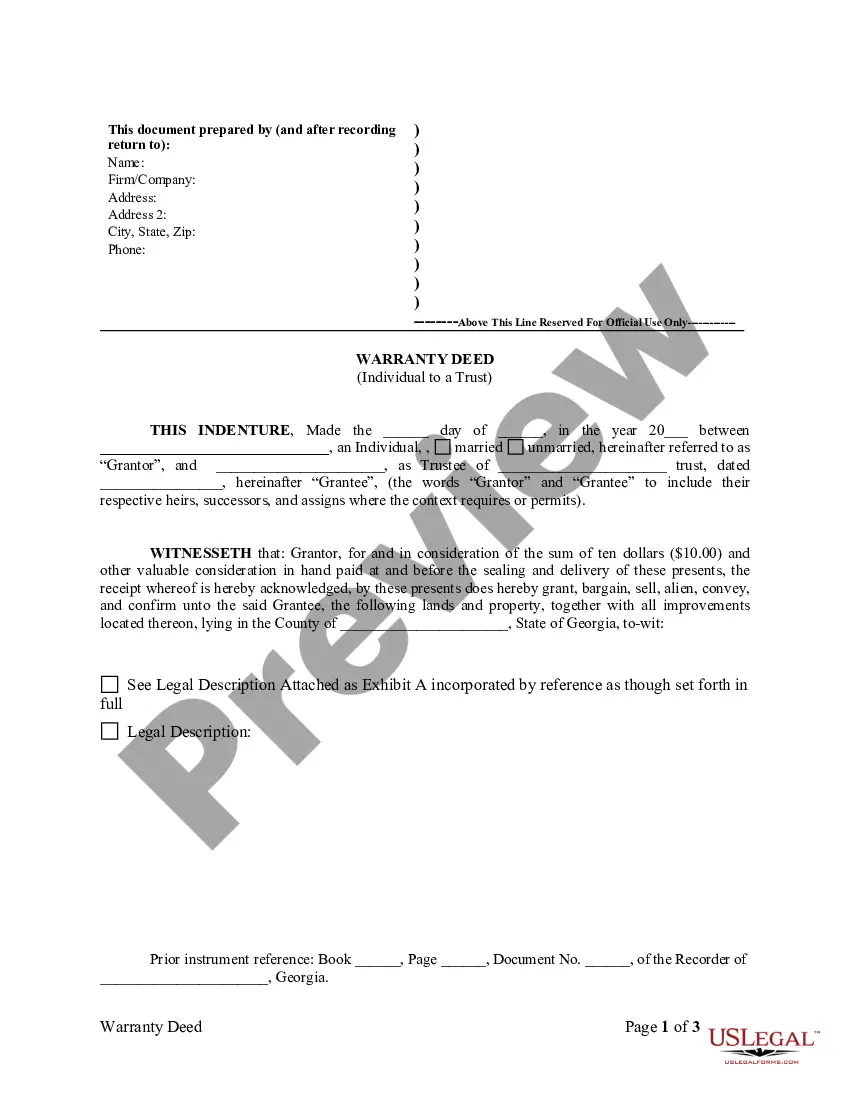

How to fill out Georgia Warranty Deed From Individual To A Trust?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; if it's expired, renew it as per your payment plan.

- If you're a first-time user, start by exploring the Preview section and form descriptions. Make sure you select the trust deed that aligns with your needs and complies with local jurisdiction requirements.

- If necessary, utilize the Search feature to find an alternative template that fits your criteria better, and proceed only if you're satisfied.

- Purchase the document by clicking the Buy Now button. Choose the subscription plan that works best for you and create an account to access the full library.

- Complete your purchase by entering your credit card information or opting for PayPal to pay for the subscription.

- Download the trust deed for shares and save it on your device. You can revisit and access it later in the My Forms section of your account.

In conclusion, US Legal Forms provides an efficient solution for obtaining necessary legal documents, like a trust deed for shares. With a robust collection and expert assistance, you will ensure your documents are handled with care and precision.

Start your journey today and explore the extensive library offered by US Legal Forms!

Form popularity

FAQ

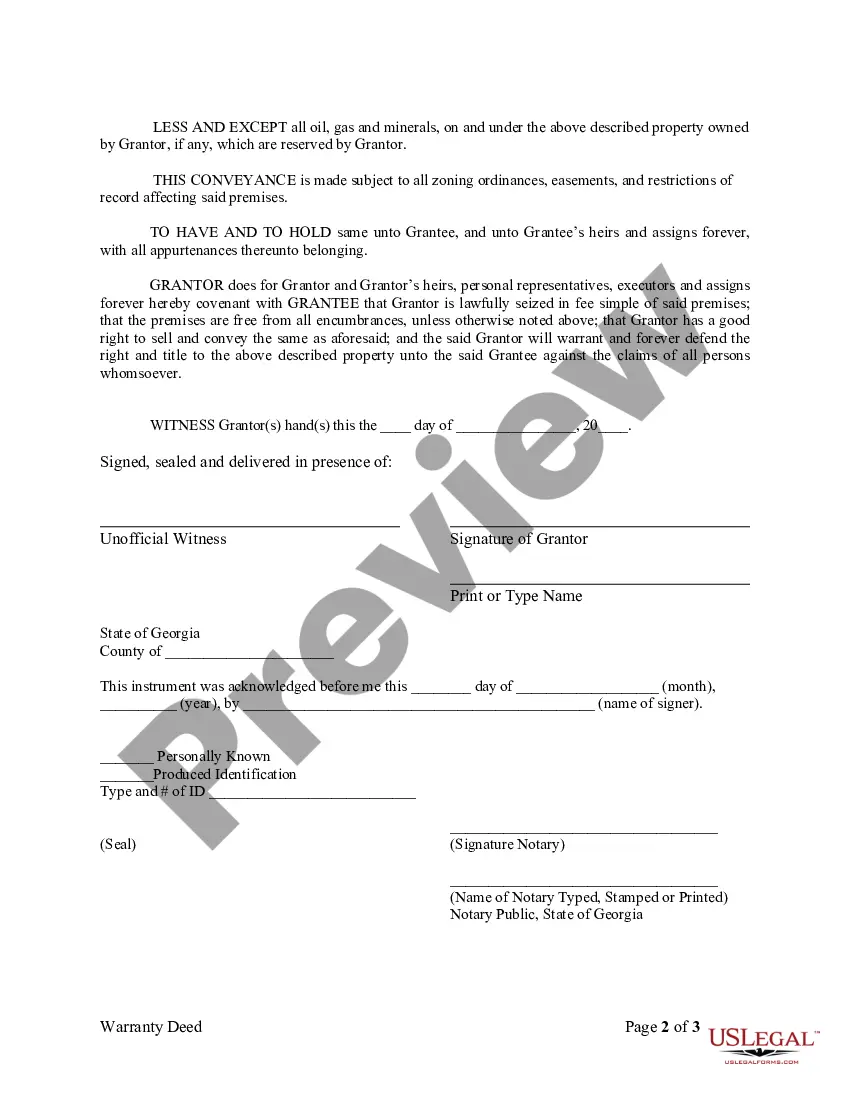

Drafting a trust deed requires outlining the trust's terms, including details about the assets, beneficiaries, and trustee responsibilities. It's essential to be clear and specific to avoid any confusion in the future. A trust deed for shares should address how the shares are to be handled by the trustee. For a smooth drafting process, consider using the resources available through US Legal Forms to ensure compliance and accuracy.

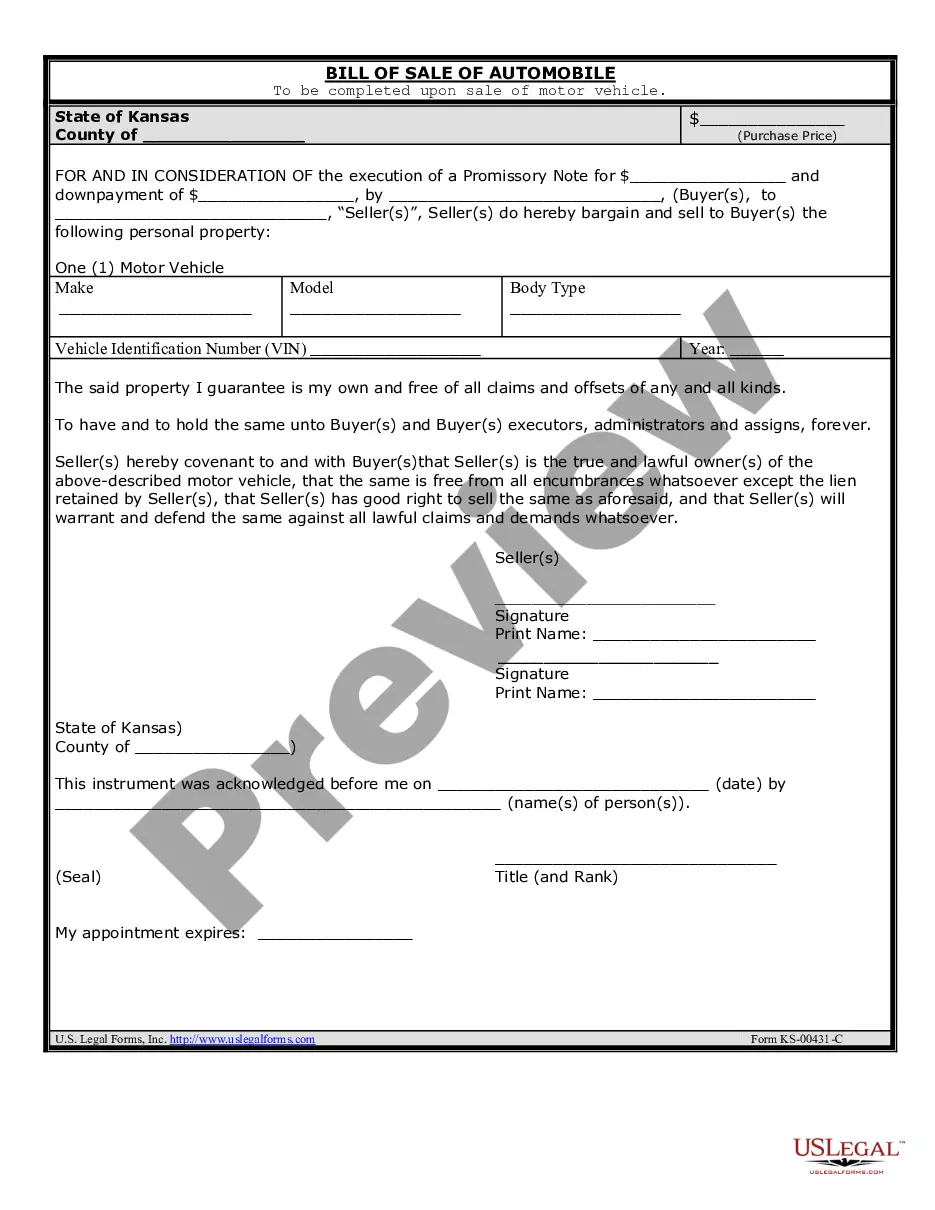

To transfer stock shares to a trust, you first need to establish the trust. After that, you can complete a stock transfer form provided by your brokerage. Make sure to indicate the name of the trust and the trustee on the form. Utilizing a trust deed for shares simplifies the process and helps manage your assets effectively.

To put shares in a trust, you begin by drafting a trust deed for shares that details the management structure and responsibilities. Next, you must complete the transfer forms required by the company that issued the shares. Working with uslegalforms can simplify this process by providing templates and legal guidance tailored to your needs.

An example of a trust deed for shares might outline the specific shares being transferred, the trusted individual or entity, and the rules governing the management of those shares. It serves as a legally binding document that details all necessary provisions for both the grantor and the beneficiaries. To create a trust deed, you might consider using a platform like uslegalforms for guidance.

Holding shares in a trust can provide numerous benefits, such as asset protection and structured distribution. A trust deed for shares ensures that your investment is safeguarded for future beneficiaries. Moreover, it can potentially reduce tax liabilities depending on your financial situation.

Yes, shares can be transferred to a trust under the right conditions. You will need to complete the necessary paperwork, including the trust deed for shares, to ensure a smooth transfer. Consulting with a legal expert may also help clarify the requirements for your specific situation.

To move shares to a trust, you usually need to execute a transfer of shares form, along with creating a trust deed for shares. This involves specifying the trust's details and following any pertinent company procedures. It may also help to consult with a legal professional or use services like uslegalforms to guide you through the process.

Yes, you can put shares in a trust using a trust deed for shares. This legal document outlines how the shares will be managed and the rights of the beneficiaries involved. By placing shares in a trust, you can ensure that the assets are protected and distributed according to your wishes.

Indeed, shares can be held by a trust, and this is facilitated through a trust deed for shares. When shares are assigned to a trust, they become part of the trust's assets, managed by a trustee who acts in the best interest of the beneficiaries. This arrangement can offer advantages such as reducing estate taxes and providing a clear plan for asset distribution.

The primary purpose of a trust deed is to establish a legal arrangement for managing assets, like shares, for the benefit of designated beneficiaries. It provides a framework for how the trust will operate, including the roles of trustees and beneficiaries. A well-structured trust deed for shares can help secure your financial legacy and facilitate the smooth transfer of wealth to your loved ones.