This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Automobile Promissory Note With Chattel Mortgage

Description

How to fill out Georgia Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Red tape necessitates exactness and correctness.

If you don't routinely handle paperwork like the Automobile Promissory Note With Chattel Mortgage, it may lead to certain confusions.

Choosing the appropriate template from the outset will guarantee that your paperwork submission proceeds without issues and avert any hassles of re-sending a document or repeating the same task from the beginning.

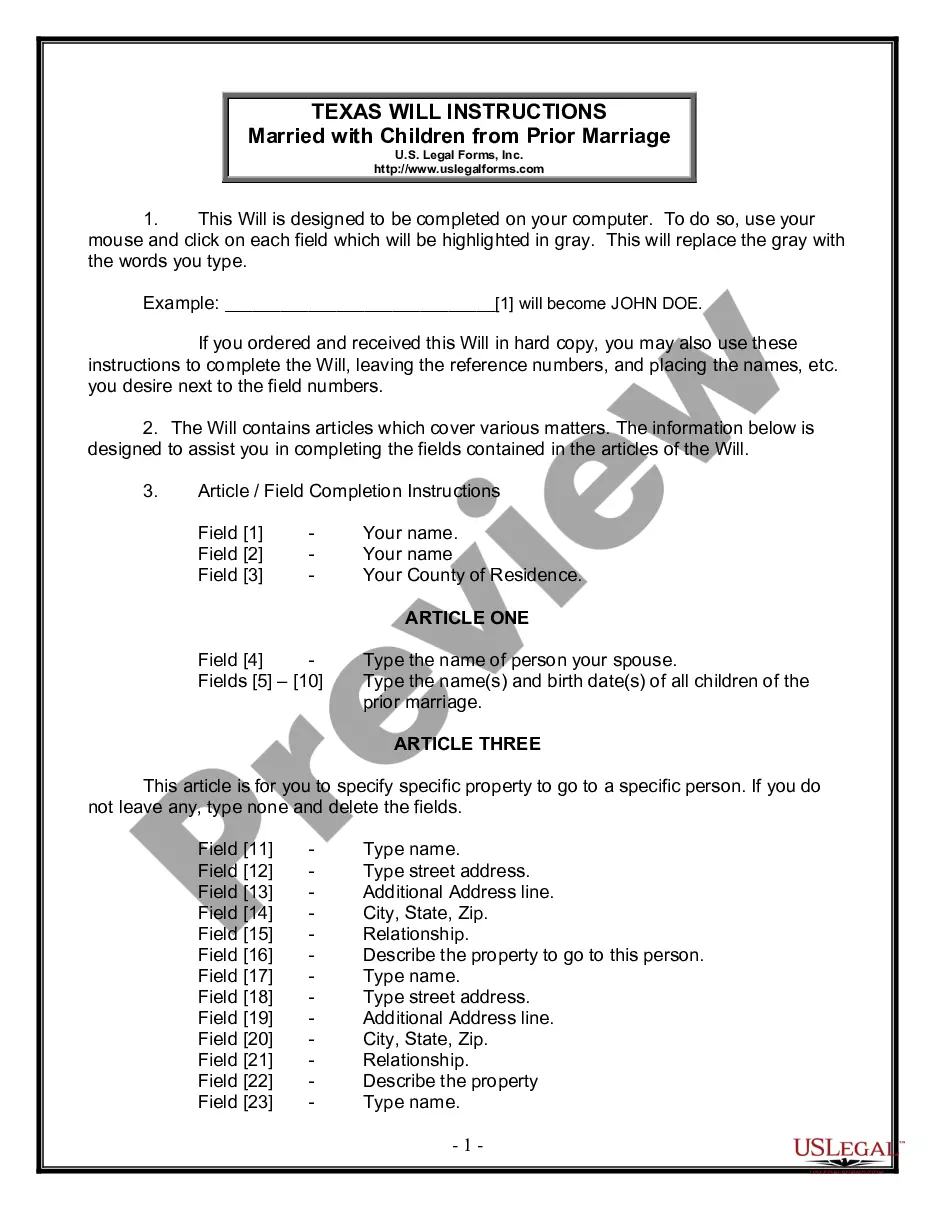

If you are not a subscribed member, finding the necessary template may require a few extra steps: Locate the sample using the search bar. Ensure the Automobile Promissory Note With Chattel Mortgage you’ve discovered is applicable for your state or region. Open the preview or read the description that includes details on the sample's use. If the result meets your needs, click the Buy Now button. Choose the appropriate option from the available pricing plans. Log In to your account or create a new account. Complete the purchase using a credit card or PayPal. Receive the form in your preferred format. Locating the correct and current samples for your paperwork can take just a few minutes with an account on US Legal Forms. Eliminate bureaucratic uncertainties and simplify your work with forms.

- Acquire the correct template for your documentation from US Legal Forms.

- US Legal Forms is the largest online collection of forms boasting over 85 thousand templates for various sectors.

- You can access the latest and most applicable version of the Automobile Promissory Note With Chattel Mortgage by simply searching it on the site.

- Search, save, and store templates in your profile or verify the description to ensure you have the accurate one at your disposal.

- With an account on US Legal Forms, you can conveniently gather, keep in one place, and browse through the templates you've saved with just a few clicks.

- When on the site, click the Log In button to authenticate.

- Then, navigate to the My documents page, where your forms are organized.

Form popularity

FAQ

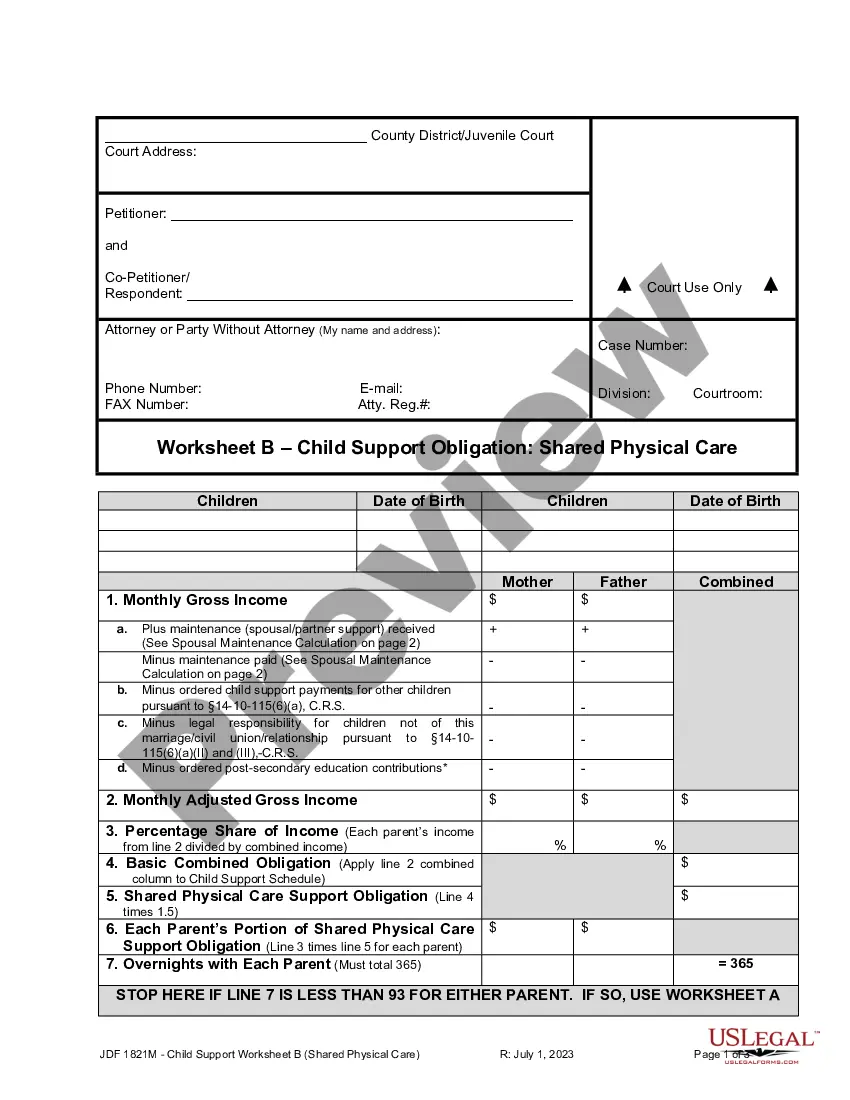

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

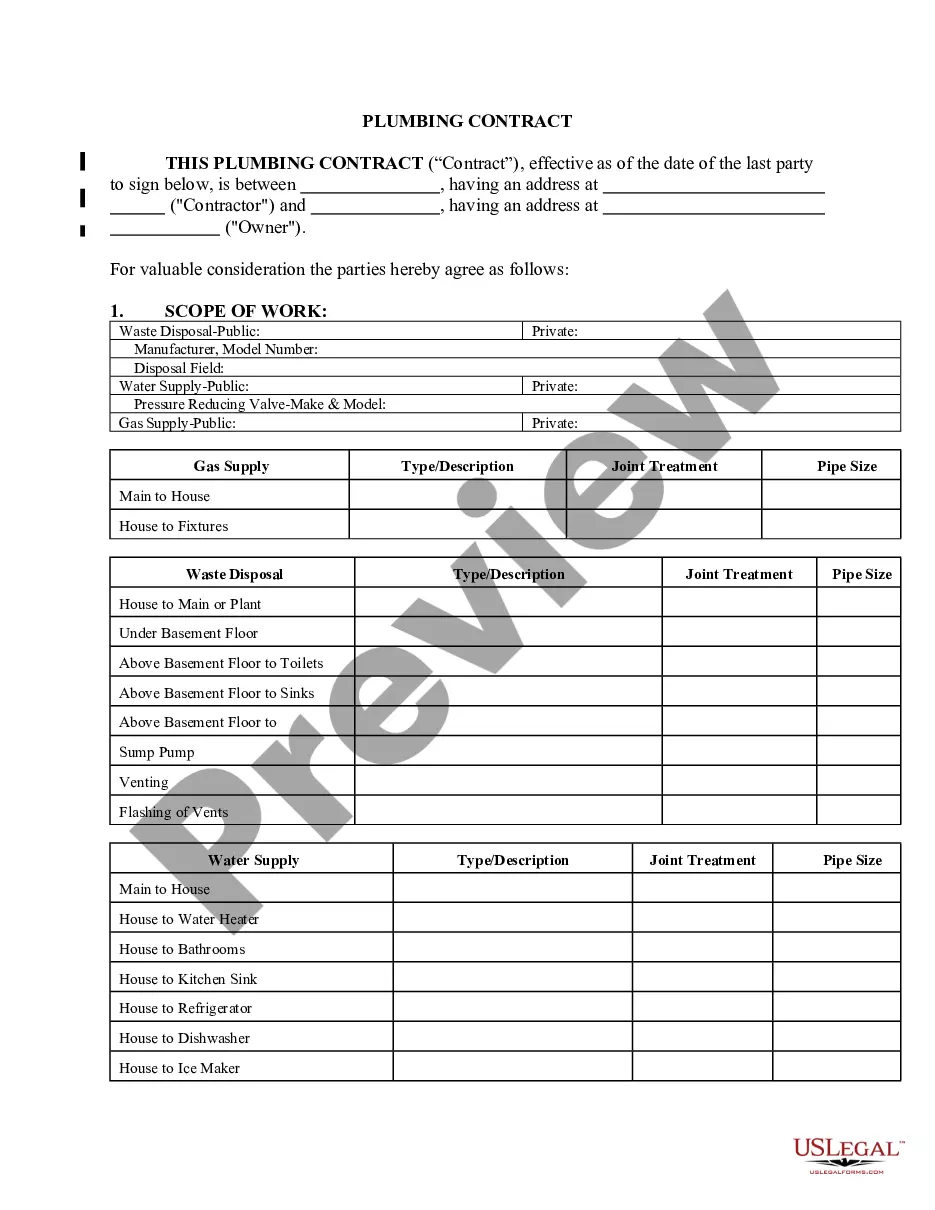

A chattel mortgage is a loan for a manufactured home or other movable piece of personal property, such as machinery or a vehicle.

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...

The bookkeeping behind the Chattel Mortgage purchase:Deposit Paid (Current Asset) no tax code.Motor Vehicles at Cost (Non-Current Asset) apply capital expense including GST tax code.Chattel Mortgage (Motor Vehicle) (Non-Current Liability) no tax code.Chattel Mortgage Interest Charges (Expense) no tax code.More items...?

A chattel mortgage is used to purchase movable personal property, other than real estate, which serves as collateral for the loan until it's repaid. Farm equipment, livestock, farm assets, and mobile and manufactured homes are a few examples of property you could purchase with a chattel loan.