Estate Planning Questionnaire And Worksheets With Answer Key

Description

How to fill out Florida Estate Planning Questionnaire And Worksheets?

When you are required to finalize Estate Planning Questionnaire And Worksheets With Answer Key that adheres to your local state laws and statutes, there can be many alternatives to select from.

There's no necessity to scrutinize every document to ensure it satisfies all the legal requirements if you are a US Legal Forms subscriber.

It is a reliable resource that can assist you in acquiring a reusable and current template on any subject.

Browse the suggested page and verify it for alignment with your needs.

- US Legal Forms is the most extensive online directory with a collection of over 85k ready-to-utilize documents for business and personal legal matters.

- All templates are verified to comply with each state's guidelines.

- Consequently, when downloading Estate Planning Questionnaire And Worksheets With Answer Key from our site, you can be assured that you possess a legitimate and current document.

- Retrieving the necessary sample from our platform is remarkably simple.

- If you already have an account, merely Log In to the system, confirm your subscription is active, and save the chosen file.

- In the future, you can navigate to the My documents tab in your profile and maintain access to the Estate Planning Questionnaire And Worksheets With Answer Key at any time.

- If this is your first encounter with our library, kindly follow the instructions below.

Form popularity

FAQ

One significant mistake parents often make when setting up a trust fund is failing to communicate their intentions to the beneficiaries. Without clear guidance, beneficiaries may misunderstand the purpose and terms of the trust, leading to potential conflicts. Using an estate planning questionnaire and worksheets with answer key can help clarify your wishes and prevent these misunderstandings, ensuring a smoother transition when needed.

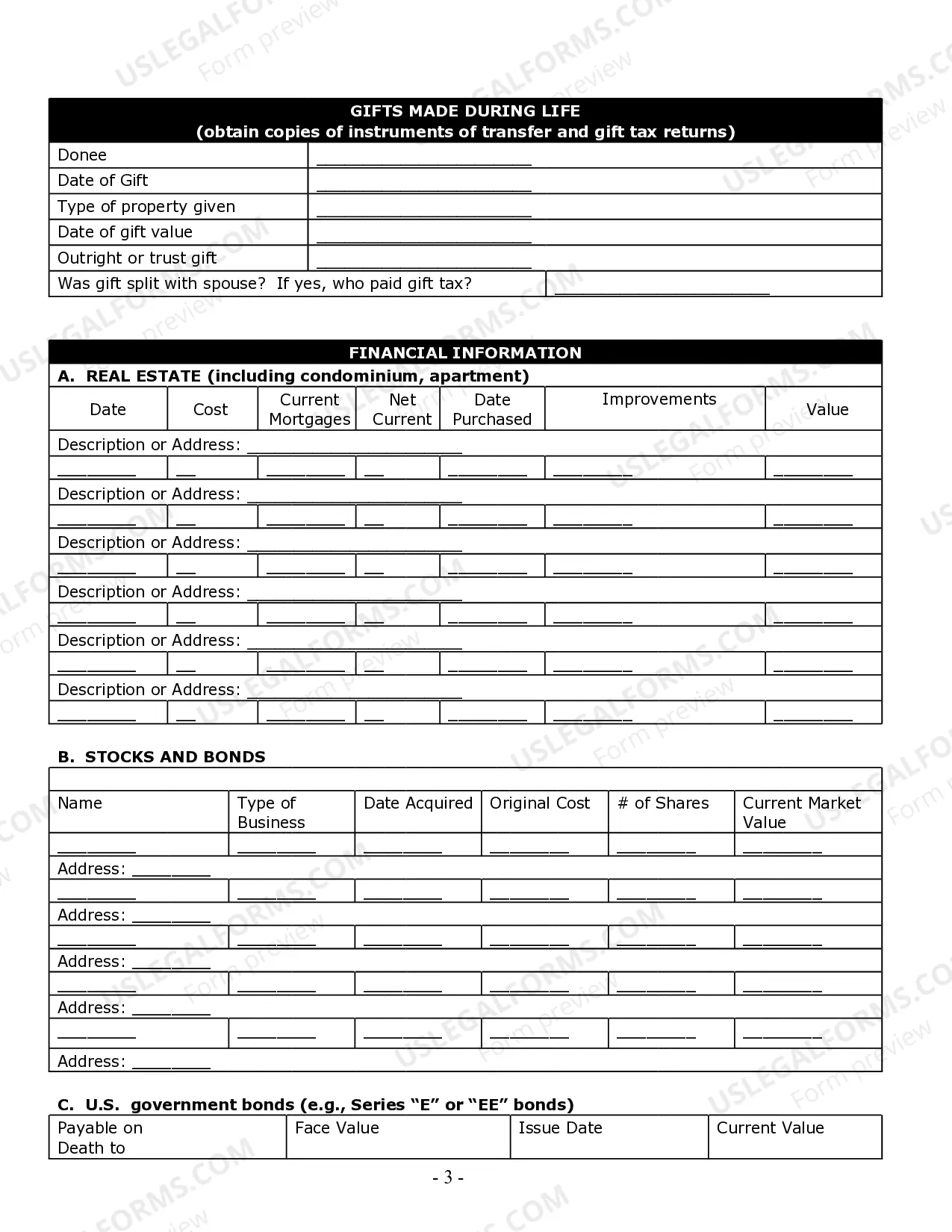

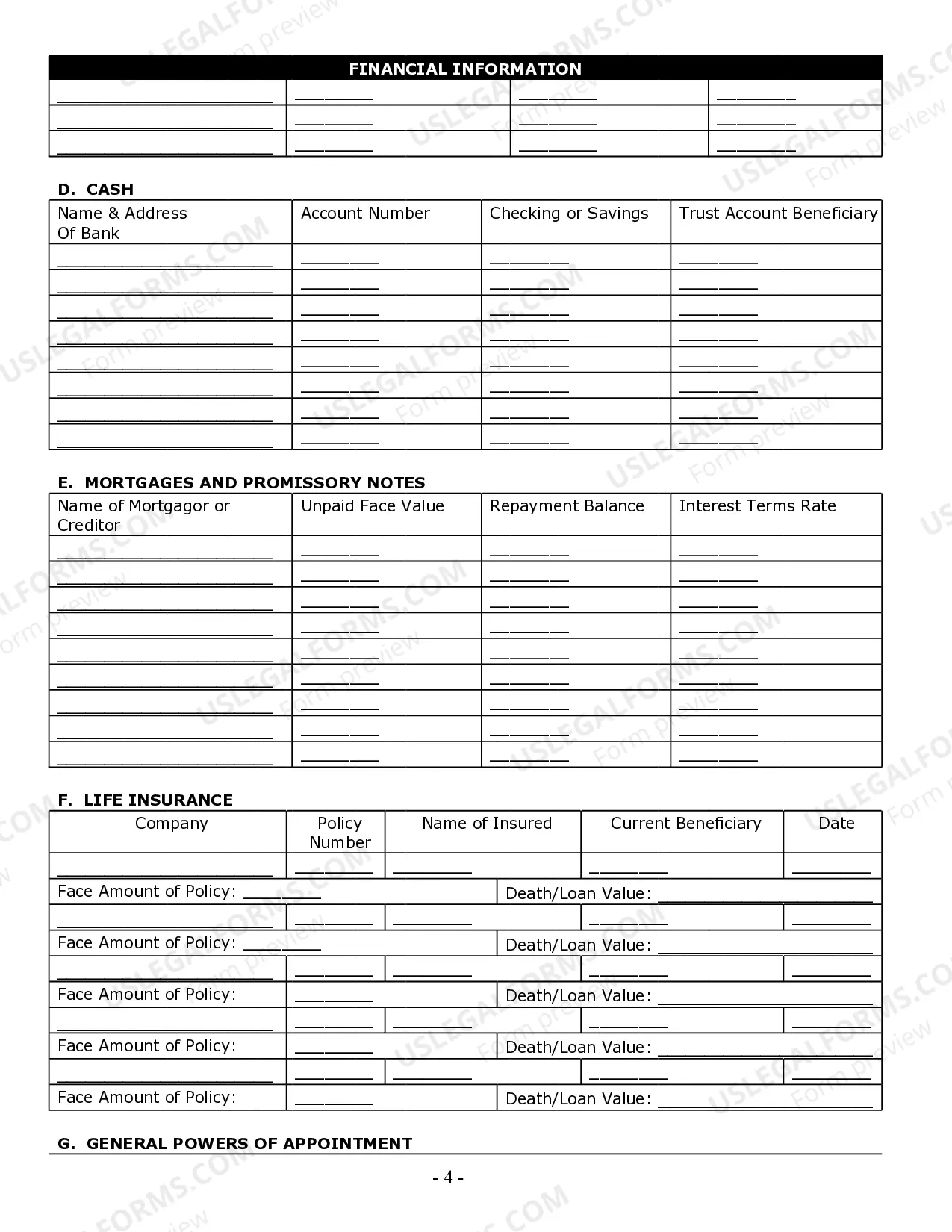

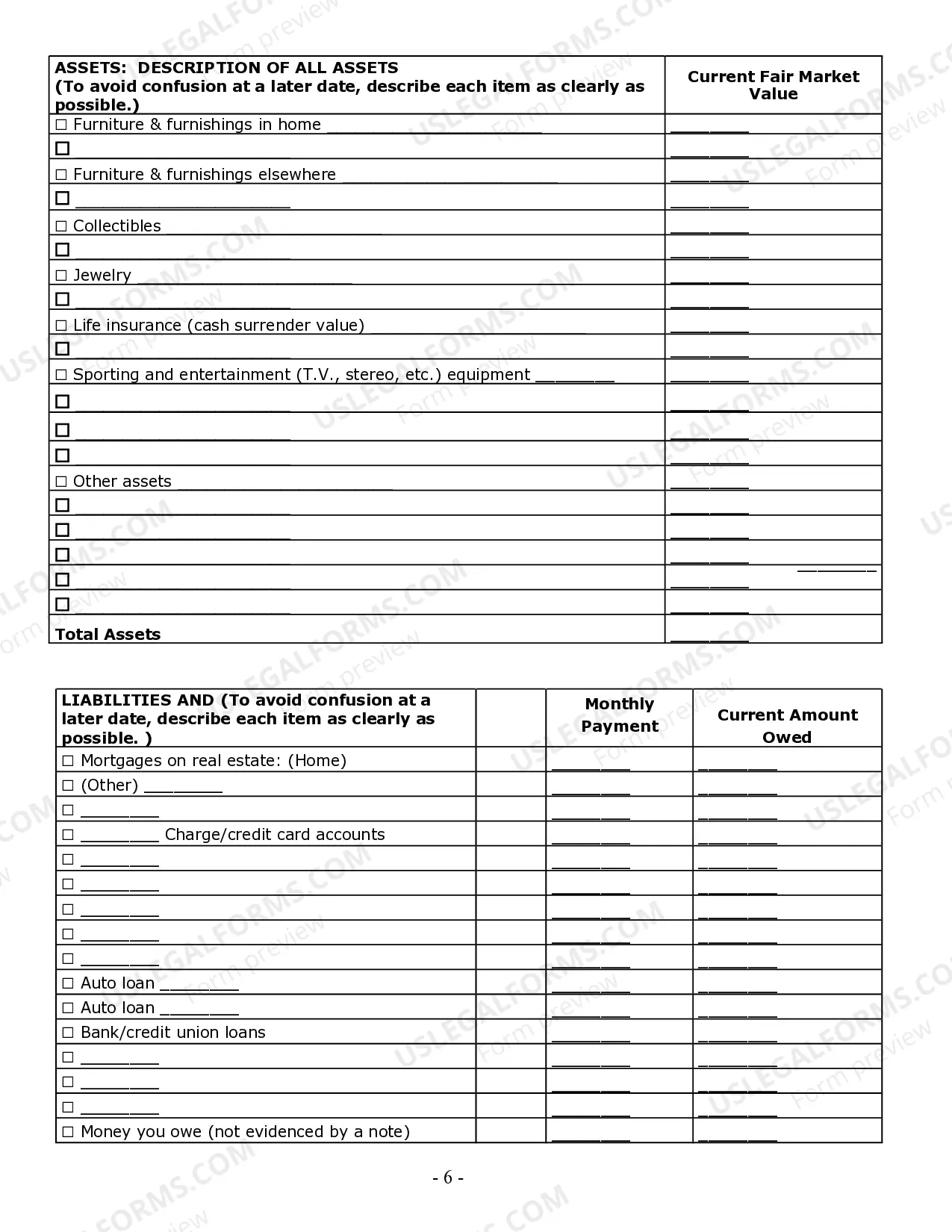

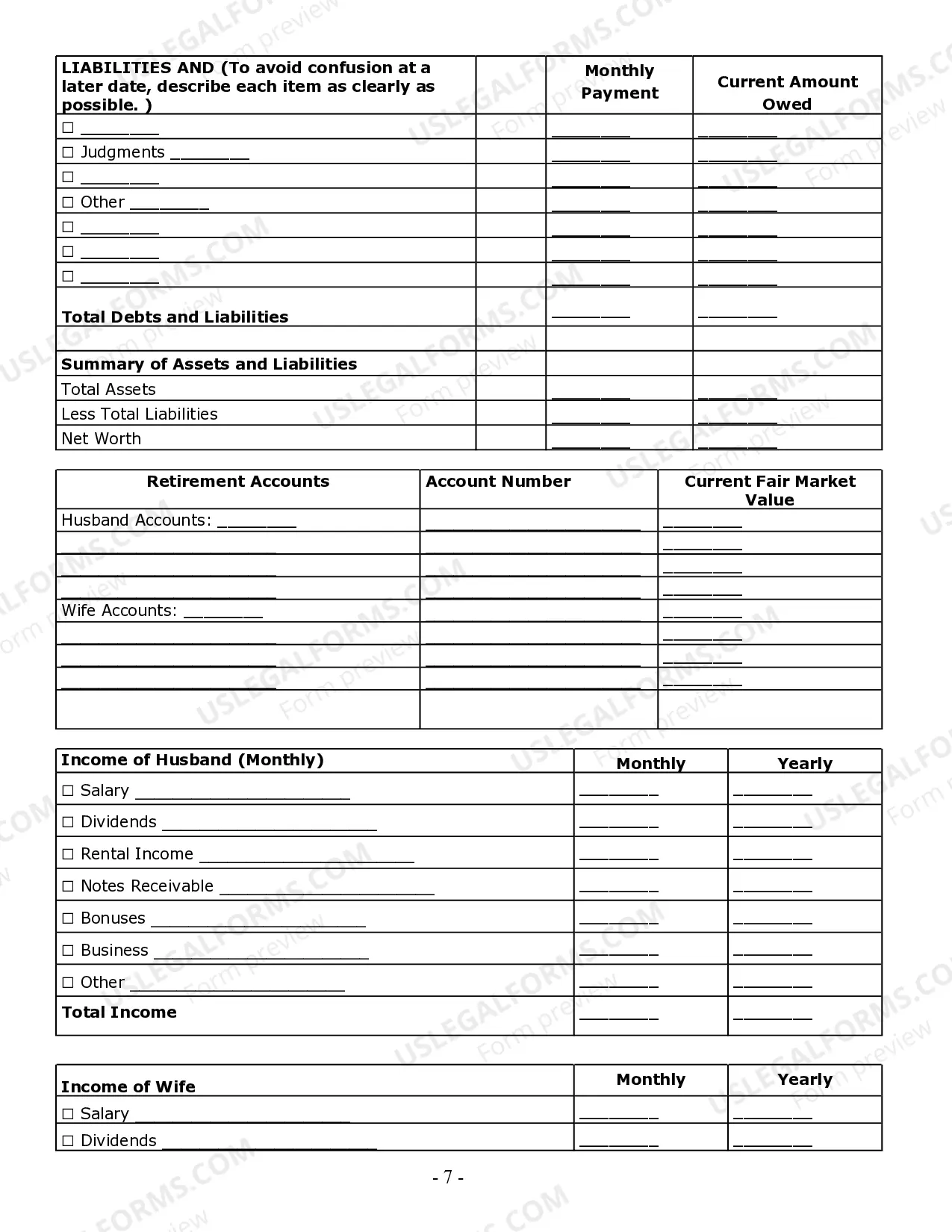

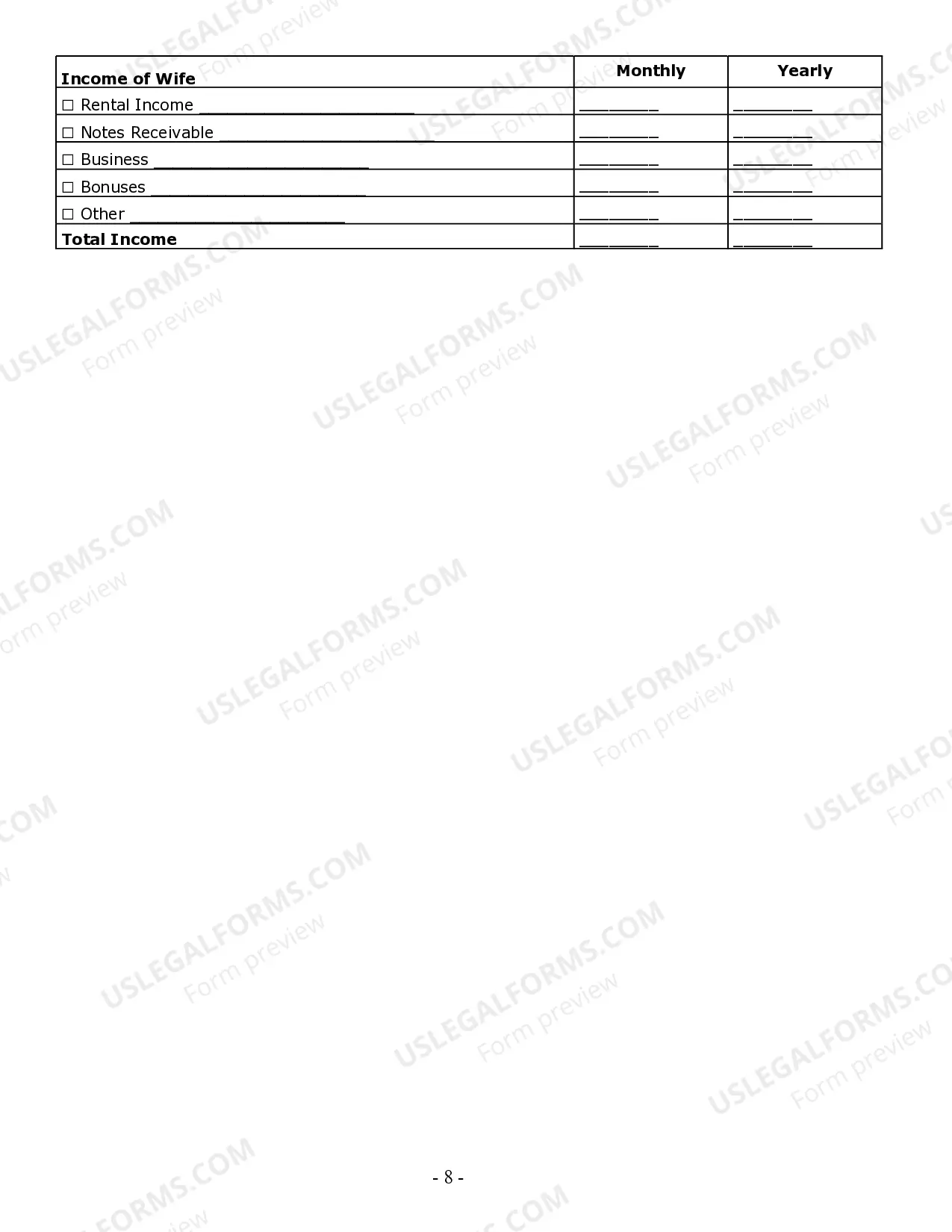

Organizing documents for estate planning involves collecting all necessary legal and financial paperwork, such as wills, trusts, and insurance policies. You should categorize these documents based on type and importance, making sure they are easily accessible. An estate planning questionnaire and worksheets with answer key can guide you through this process by prompting you to gather and organize relevant information effectively.

The 5 by 5 rule is a guideline in estate planning that indicates how gifts from a trust can be made without incurring gift tax. This rule allows the beneficiary to receive distributions of up to $5,000 or 5% of the trust's assets each year, whichever is greater. When using an estate planning questionnaire and worksheets with answer key, understanding this rule can help you strategize your gifts effectively.

AARP indeed offers estate planning services tailored to support members in navigating this critical aspect of financial management. These services can range from access to expert advice to resources that simplify paperwork. By using estate planning questionnaire and worksheets with answer key, you will find these services simplify complex decisions and enhance your peace of mind.

Yes, AARP offers various estate planning services that aim to educate and assist members in creating strategic plans. They provide resources including guides and webinars to help individuals navigate the complexities of estate planning. Utilizing estate planning questionnaire and worksheets with answer key can facilitate the process, ensuring you have a clear roadmap for your estate.

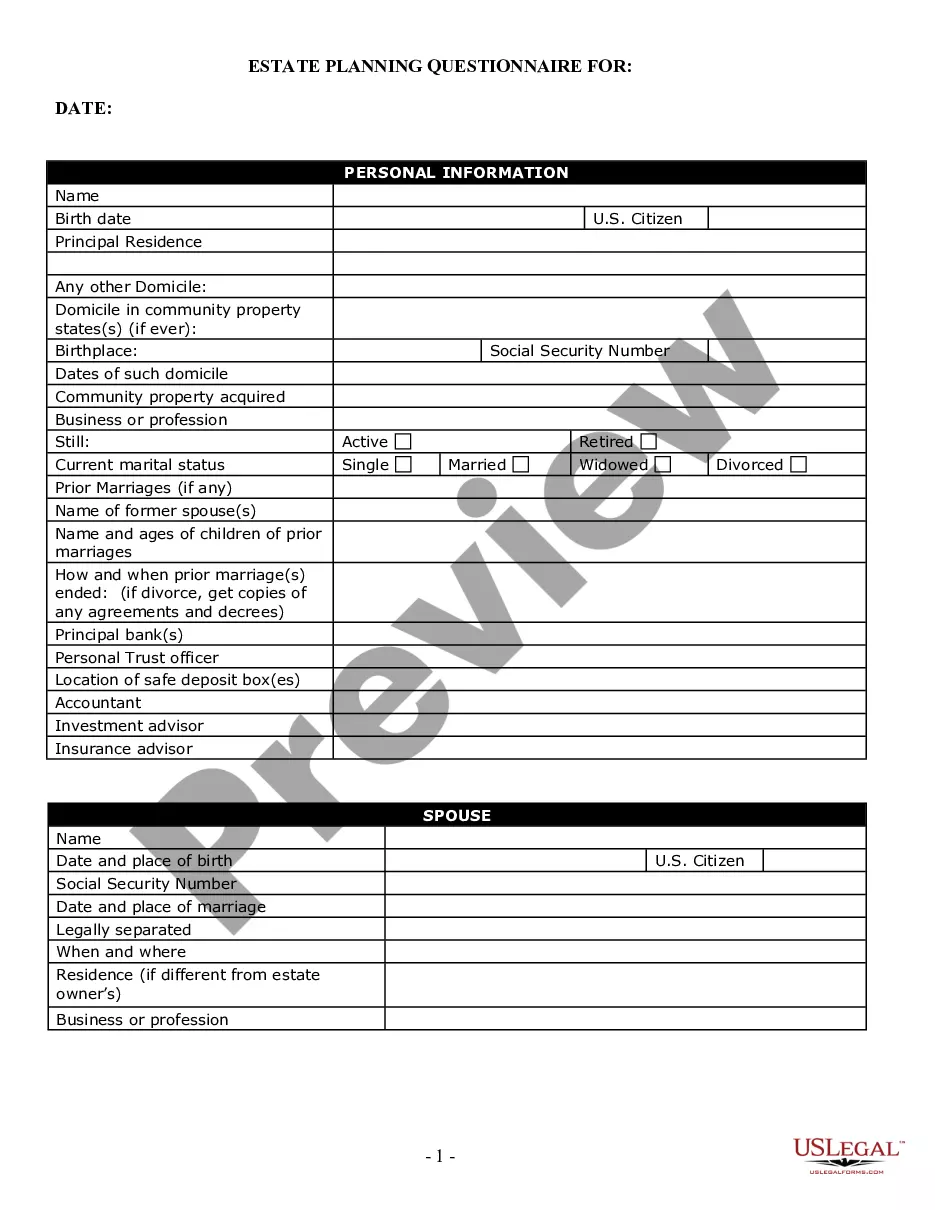

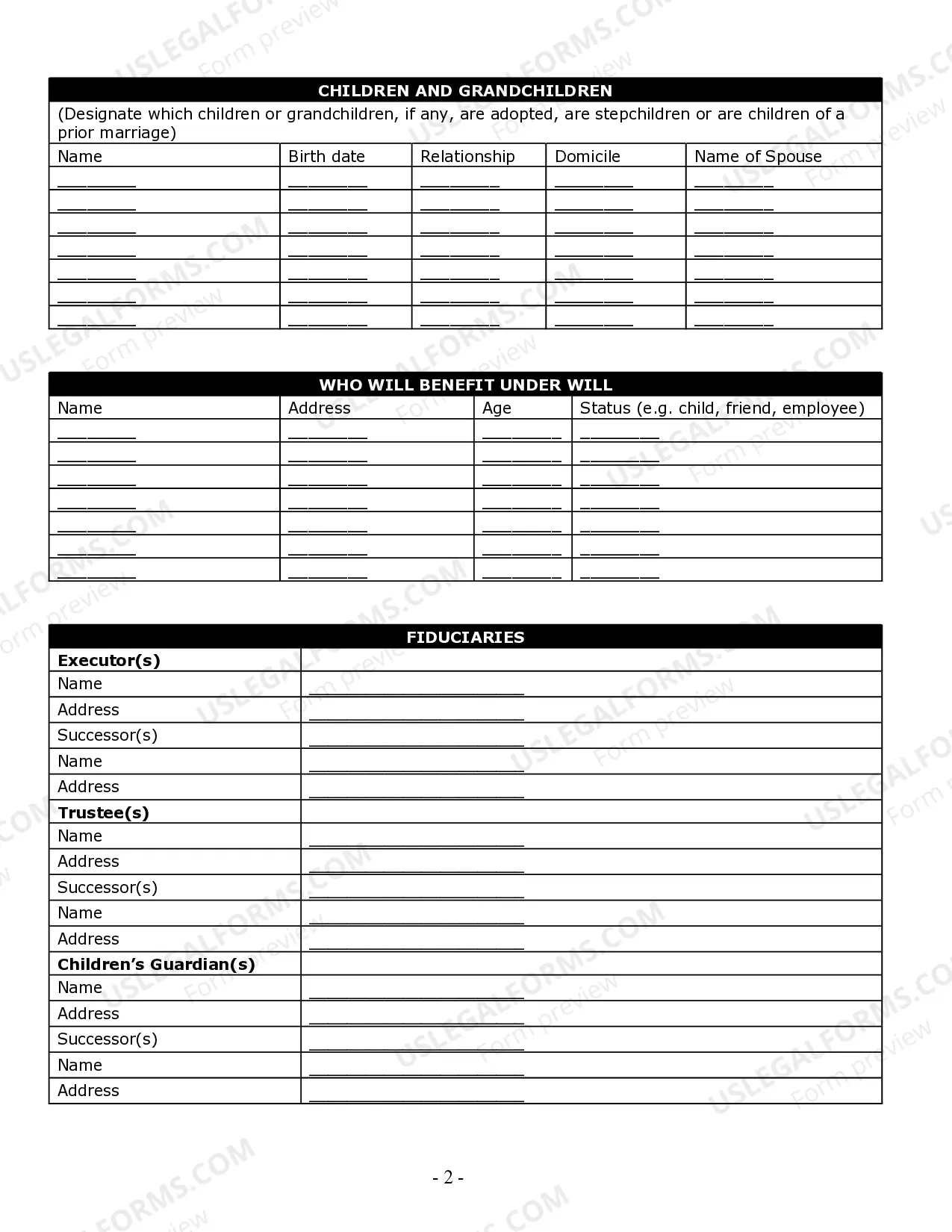

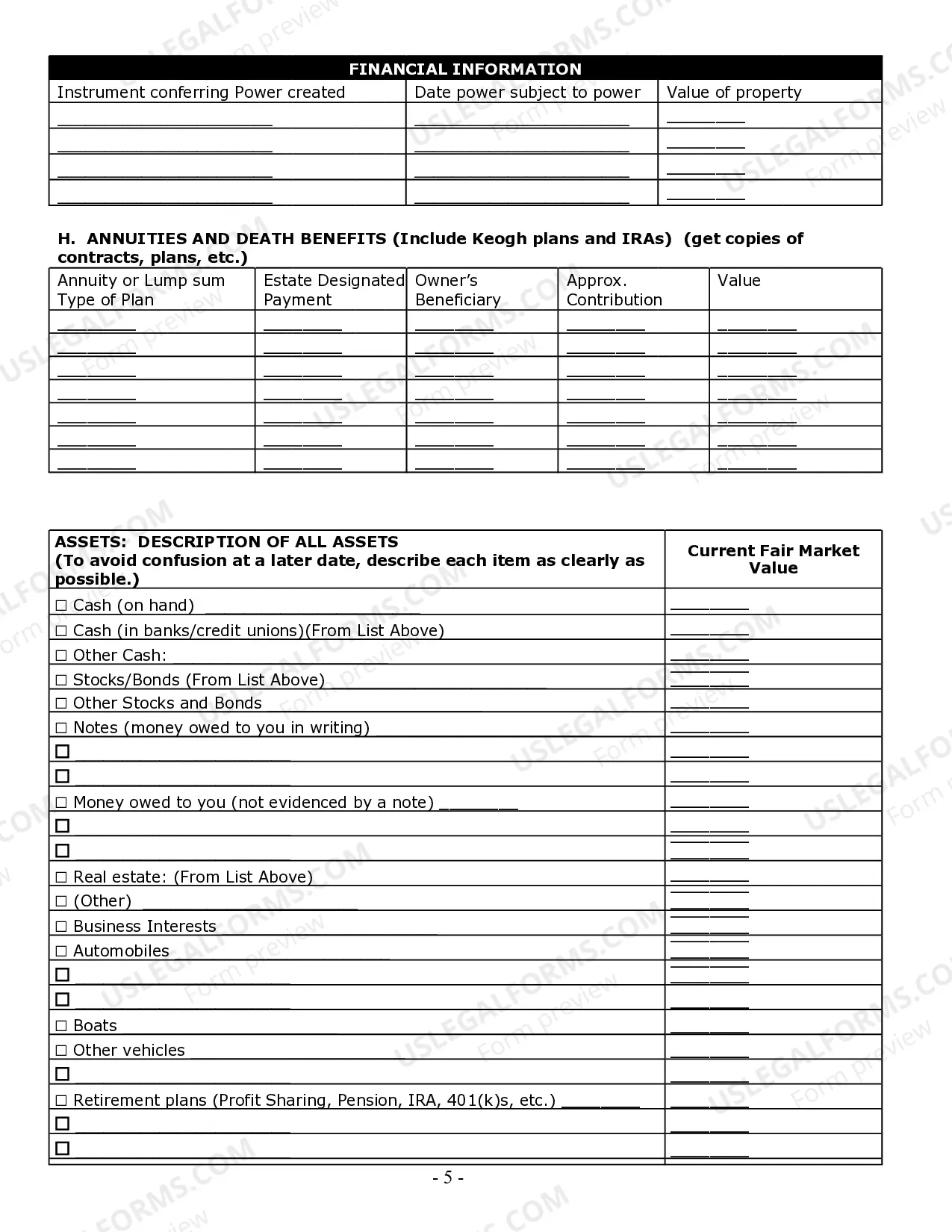

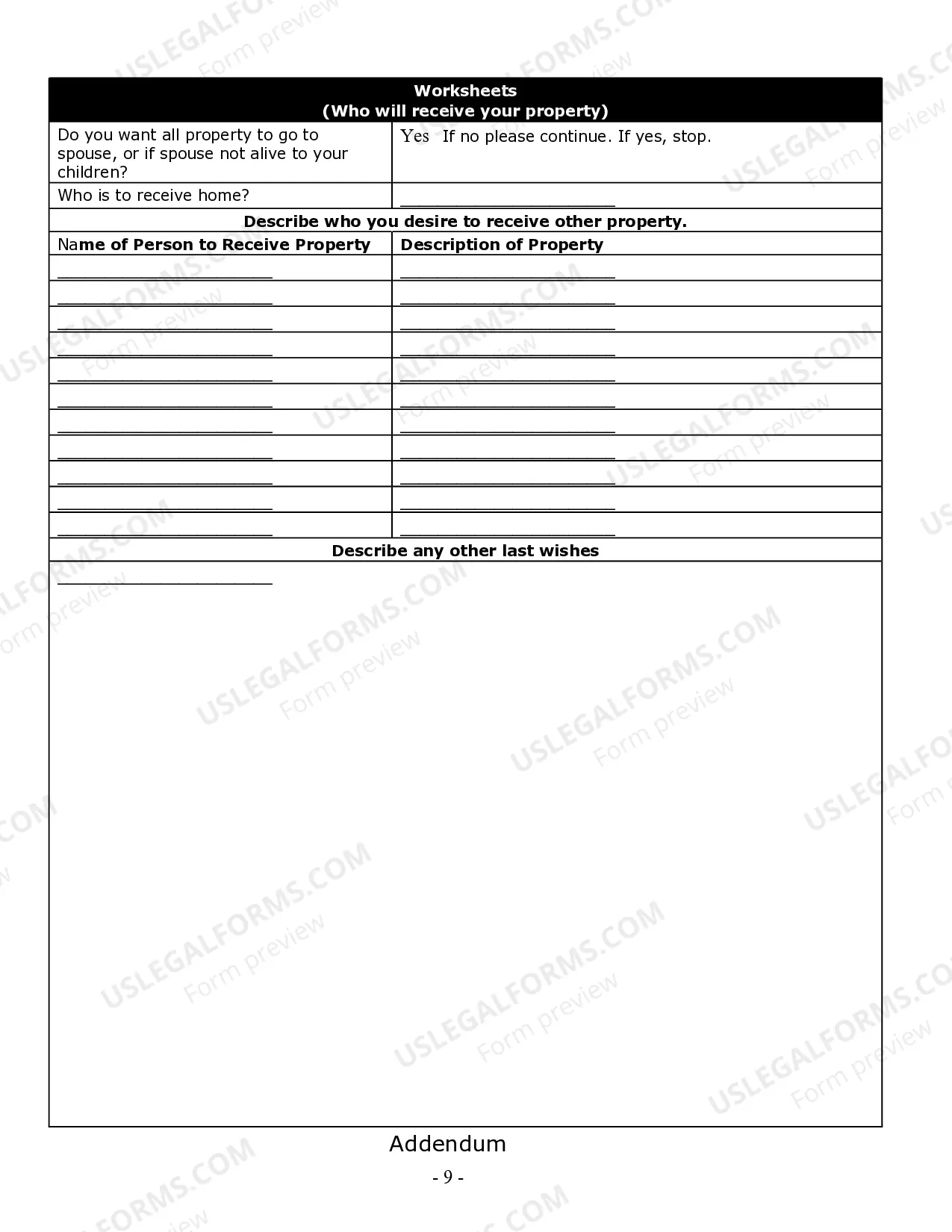

To fill out an estate planning questionnaire, start by gathering your personal and financial information, including assets, liabilities, and beneficiaries. Take your time to review each question, as accuracy is crucial for effective planning. You can use estate planning questionnaire and worksheets with answer key available on platforms like uslegalforms to ensure you cover all necessary details comprehensively.

AARP provides a variety of services related to aging and retirement, including financial planning, health resources, and legal assistance. Specifically, for estate planning, AARP offers access to workshops and resources that help individuals understand the process. Their estate planning questionnaire and worksheets with answer key are valuable tools that guide members through essential documents and decisions.

The 5 by 5 rule in estate planning allows a client to withdraw up to $5,000 per year from a trust without triggering gift taxes. This provides flexibility in accessing funds while ensuring tax efficiency. It's essential to consider this rule when designing your estate planning questionnaire and worksheets with answer key, as it can influence your financial strategy.

Using the estate planning questionnaire and worksheets with answer key provides clarity and organization in your planning process. These tools simplify the gathering of necessary information, making it easier to articulate your wishes. Additionally, they help minimize confusion and ensure all important elements are addressed. Utilizing USLegalForms' resources can streamline your planning, providing peace of mind knowing you have a comprehensive plan.

The estate planning process typically involves seven essential steps. First, gather your financial information and identify your goals. Next, prepare an estate planning questionnaire and worksheets with answer key to guide you through preferences. Then, create a will, set up trusts if needed, and consider designating beneficiaries. Finally, review and update your plans regularly to reflect any life changes, ensuring your estate plan remains relevant.