Joint Owner Right Of Survivorship

Description

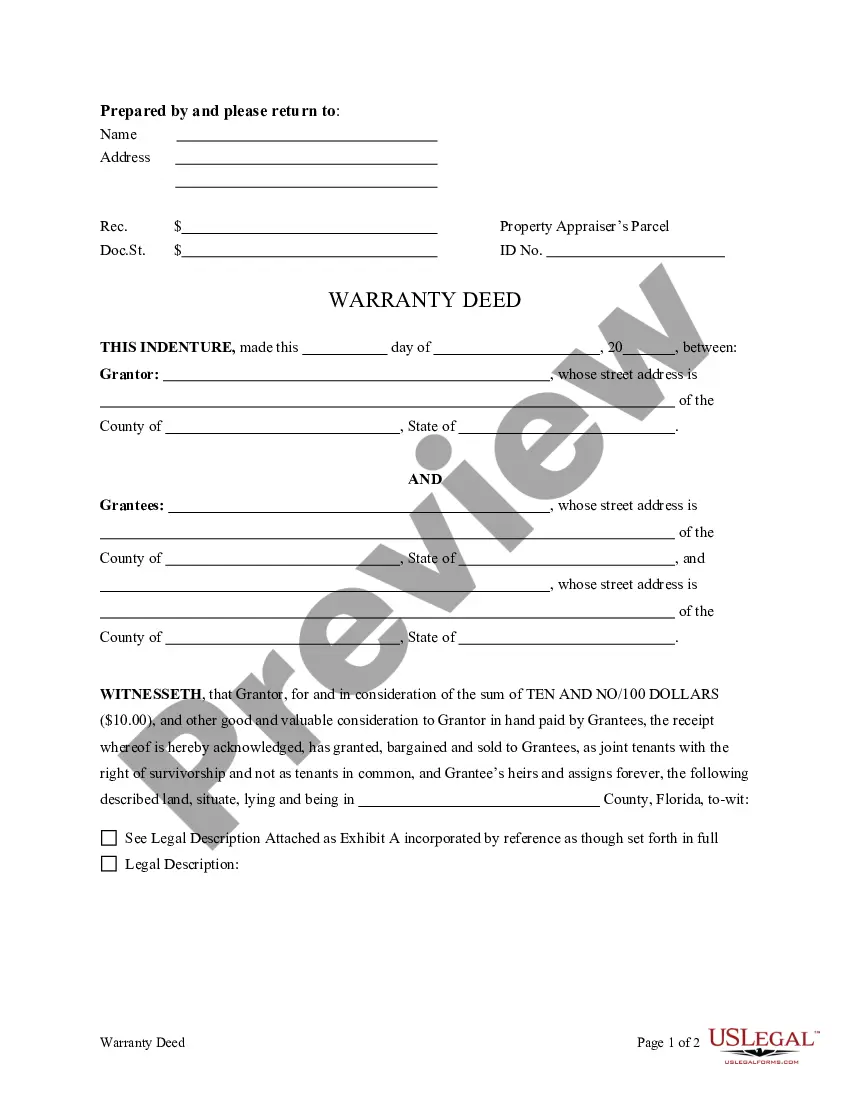

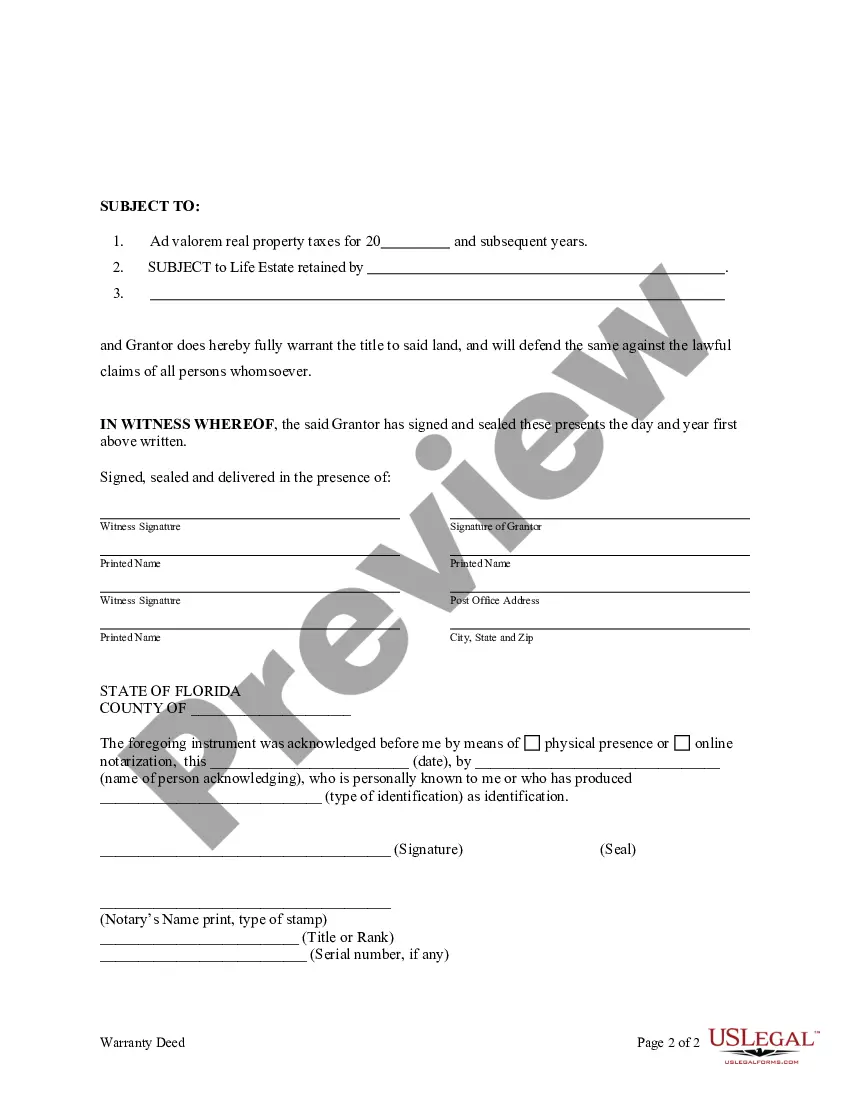

How to fill out Florida Warranty Deed From Individual To Two Individuals As Joint Tenants With Right Of Survivorship With Retained Life Estate?

Whether for business purposes or for individual affairs, everybody has to handle legal situations sooner or later in their life. Filling out legal documents requires careful attention, beginning from selecting the appropriate form sample. For instance, when you pick a wrong version of the Joint Owner Right Of Survivorship, it will be rejected once you send it. It is therefore crucial to get a reliable source of legal documents like US Legal Forms.

If you need to obtain a Joint Owner Right Of Survivorship sample, stick to these easy steps:

- Find the template you need by using the search field or catalog navigation.

- Check out the form’s description to make sure it matches your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong form, get back to the search function to locate the Joint Owner Right Of Survivorship sample you require.

- Get the file if it meets your requirements.

- If you already have a US Legal Forms profile, just click Log in to gain access to previously saved templates in My Forms.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the profile registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Pick the file format you want and download the Joint Owner Right Of Survivorship.

- Once it is downloaded, you are able to fill out the form by using editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time searching for the right template across the internet. Utilize the library’s simple navigation to find the appropriate template for any situation.

Form popularity

FAQ

A joint tenant with the right of survivorship is a legal ownership structure involving two or more parties for an account or another asset. Each tenant has an equal right to the account's assets and is afforded survivorship rights if the other account holder(s) dies.

For example, if two people, Mark and Amanda, own a property together and Mark dies, then Amanda will become to sole owner of the property even if this is not detailed in the will because the two of them purchased the property together.

Joint Tenancy This means that the property is equally shared among all the co-owners. Also, it works on the concept of survivorship which means that in case a co-owner dies, his rights will be automatically transferred to the surviving tenant.

A joint owner or co-owner means that both owners have the same access to the account. As an owner of the account, both co-owners can deposit, withdraw, or close the account. You most likely want to reserve this for someone with whom you already have a financial relationship, such as a family member.

As noted above, a joint owned property may be held in legal forms, such as joint tenancy. This is when two or more people have equal rights and obligations to the property they rent or own together until one partner passes away. At this time, the owner's interest passes to the survivors without probate.