Satisfaction, Release or Cancellation of Mortgage by Individual

Assignments Generally: Lenders,

or holders of mortgages or deeds of trust, often assign mortgages or deeds

of trust to other lenders, or third parties. When this is done the

assignee (person who received the assignment) steps into the place of the

original lender or assignor. To effectuate an assignment, the general

rules is that the assignment must be in proper written format and recorded

to provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Florida Law

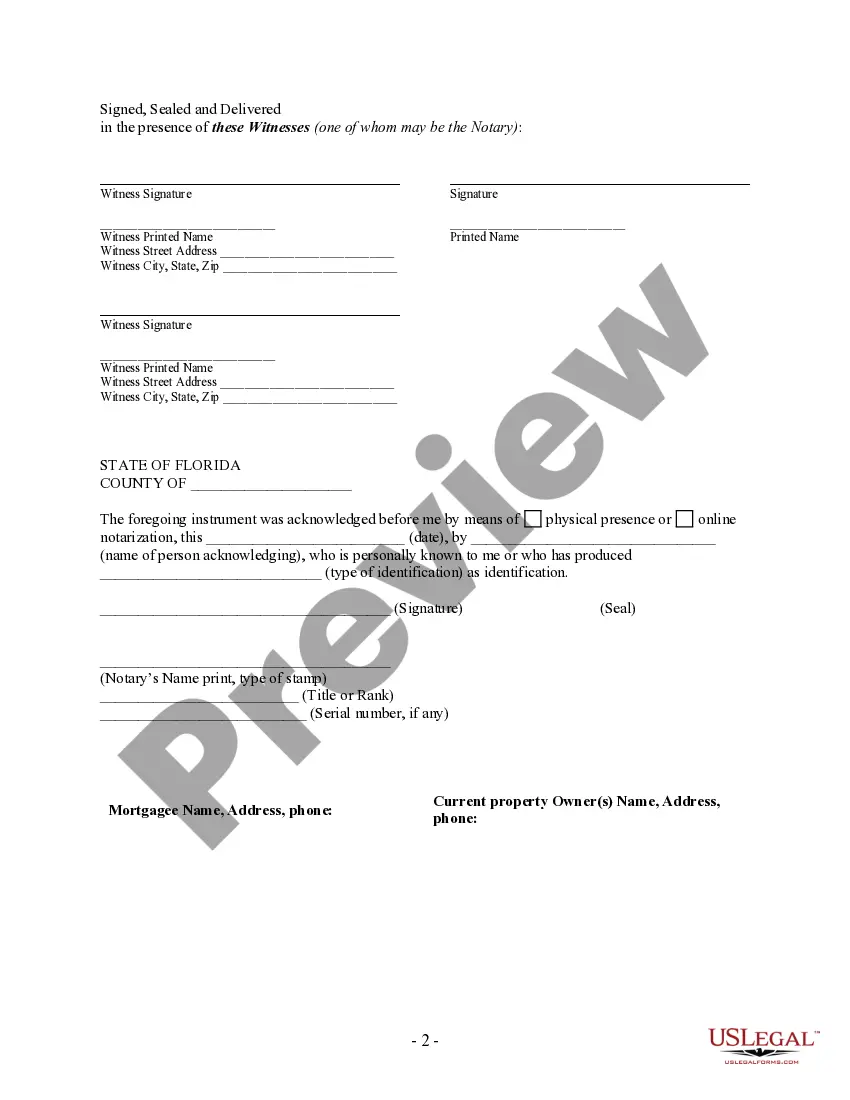

Execution of Assignment or Satisfaction: Must

be signed by the mortgagee.

Assignment: No assignment of a mortgage

upon real property or of any interest therein, shall be good or effectual

in law or equity, against creditors or subsequent purchasers, for a valuable

consideration, and without notice, unless the assignment is contained in

a document which, in its title, indicates an assignment of mortgage and

is recorded according to law.

Demand to Satisfy: Upon full payoff of

the mortgage, the mortgagor may demand of the mortgagee that satisfaction

be recorded. The mortgagee then has 60 days to comply, or face liability.

Recording Satisfaction: Within 60 days

of the date of receipt of the full payment of the mortgage, lien, or judgment,

the person required to acknowledge satisfaction of the mortgage, lien,

or judgment shall send or cause to be sent the recorded satisfaction to

the person who has made the full payment.

Marginal Satisfaction: Not allowed.

Penalty: In the case of a civil action

arising out of the failure of the mortgagee to properly record, within

30 days of demand, a satisfied mortgage, the prevailing party shall be

entitled to attorney's fees and costs, and shall be guilty of a misdemeanor

of the second degree.

Acknowledgment: An assignment or satisfaction

must contain a proper Florida acknowledgment, or other acknowledgment approved

by statute.

Florida Statutes

701.01 Assignment.--Any mortgagee may assign and transfer

any mortgage made to her or him, and the person to whom any mortgage may

be assigned or transferred may also assign and transfer it, and that person

or her or his assigns or subsequent assignees may lawfully have, take and

pursue the same means and remedies which the mortgagee may lawfully have,

take or pursue for the foreclosure of a mortgage and for the recovery of

the money secured thereby.

701.02 Assignment not effectual against creditors unless recorded

and indicated in title of document.--

(1) No assignment of a mortgage

upon real property or of any interest therein, shall be good or effectual

in law or equity, against creditors or subsequent purchasers, for a valuable

consideration, and without notice, unless the assignment is contained in

a document which, in its title, indicates an assignment of mortgage and

is recorded according to law.

(2) The

provisions of this section shall also extend to assignments of mortgages

resulting from transfers of all or any part or parts of the debt, note

or notes secured by mortgage, and none of same shall be effectual in law

or in equity against creditors or subsequent purchasers for a valuable

consideration without notice, unless a duly executed assignment be recorded

according to law.

(3) Any assignment of a mortgage, duly executed

and recorded according to law, purporting to assign the principal of the

mortgage debt or the unpaid balance of such principal, shall, as against

subsequent purchasers and creditors for value and without notice, be held

and deemed to assign any and all accrued and unpaid interest secured by

such mortgage, unless such interest shall be specifically and affirmatively

reserved in such assignment by the assignor, and no reservation of such

interest or any part thereof shall be implied.

701.04 Cancellation of mortgages, liens, and judgments.--

(1) Within 14 days after receipt of the written request of a mortgagor,

the holder of a mortgage shall deliver to the mortgagor at a place designated

in the written request an estoppel letter setting forth the unpaid principal

balance, interest due, and the per diem rate. Whenever the amount

of money due on any mortgage, lien, or judgment shall be fully paid to

the person or party entitled to the payment thereof, the mortgagee, creditor,

or assignee, or the attorney of record in the case of a judgment, to whom

such payment shall have been made, shall execute in writing an instrument

acknowledging satisfaction of said mortgage, lien, or judgment and

have the same acknowledged, or proven, and duly entered of record in the

book provided by law for such purposes in the proper county. Within

60 days of the date of receipt of the full payment of the mortgage, lien,

or judgment, the person required to acknowledge satisfaction of the mortgage,

lien, or judgment shall send or cause to be sent the recorded satisfaction

to the person who has made the full payment. In the case of a civil

action arising out of the provisions of this section, the prevailing party

shall be entitled to attorney's fees and costs.

(2) Whenever a writ

of execution has been issued, docketed, and indexed with a sheriff and

the judgment upon which it was issued has been fully paid, it shall be

the responsibility of the party receiving payment to request, in writing,

addressed to the sheriff, return of the writ of execution as fully satisfied.

701.05 Failing or refusing to satisfy lien; punishment for.--Any

person entitled to and receiving the payment of the amount of money due

upon any mortgage, lien, or judgment, who shall fail for 30 days after

written demand made by the person paying the same, to cancel and satisfy

of record, as provided by law, any such mortgage, lien or judgment so paid,

shall be guilty of a misdemeanor of the second degree, punishable as provided

in s. 775.082 or s. 775.083.

701.06 Certain cancellations and satisfactions of mortgages

validated.--All cancellations or satisfactions of mortgages made prior

to the enactment of chapter 4138, Acts of 1893, by the mortgagee or assignee

of record of such mortgage entering same on the margin of the record of

such mortgage in the presence of the custodian of such record and attested

by the said custodian and signed by said mortgagee or assignee of record

of such mortgage, shall be valid and effectual for every purpose as if

the same had been done subsequent to the enactment of chapter 4138, Acts

of 1893.