Attorney Powers Power With Liabilities

Description

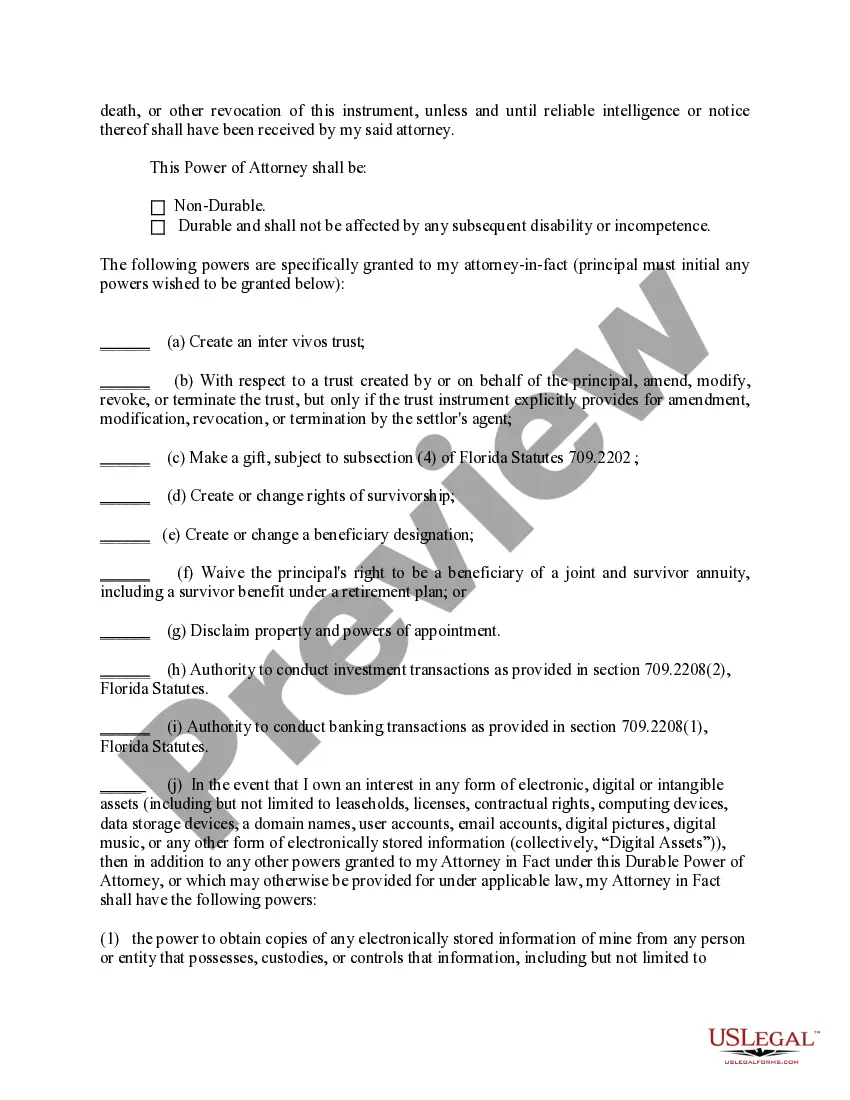

How to fill out Florida Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Whether for commercial objectives or personal matters, everyone must deal with legal issues at some stage in their life.

Filling out legal paperwork requires meticulous care, starting with selecting the appropriate form template.

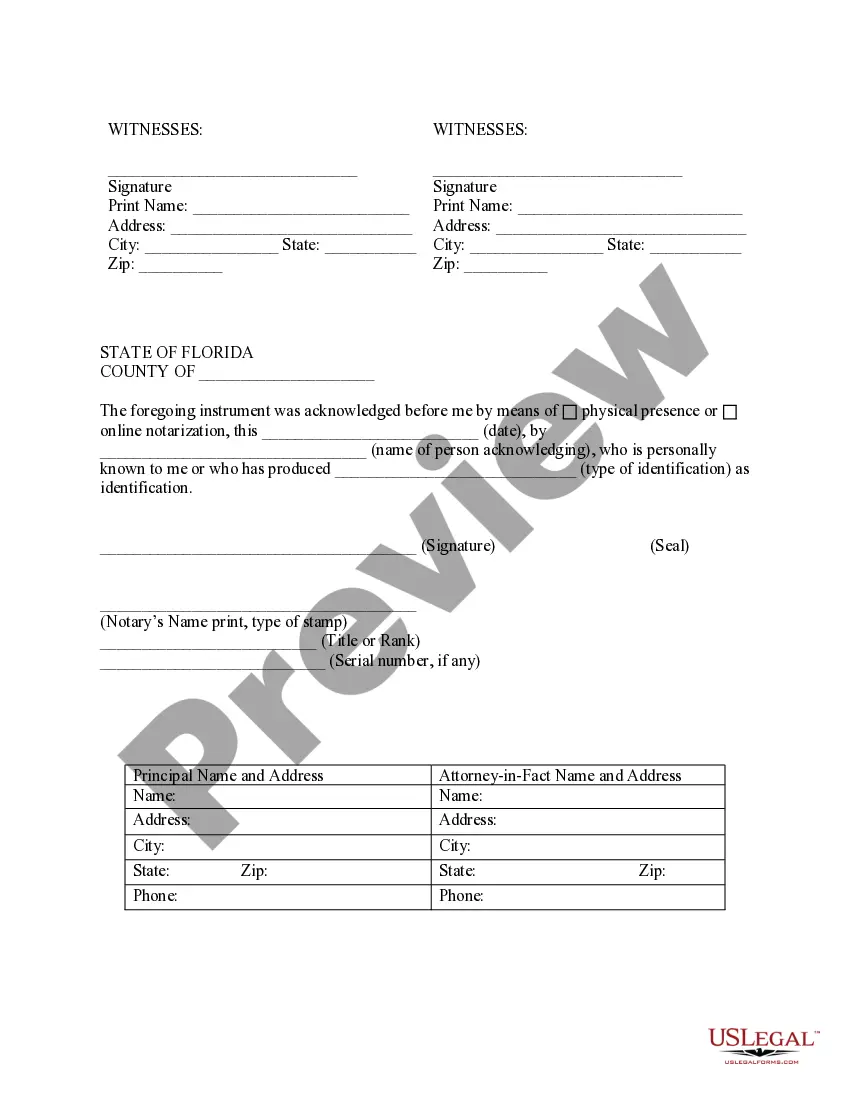

Fill out the profile registration form, select your payment method: you can use a credit card or a PayPal account, choose the document format you desire, and download the Attorney Powers Power With Liabilities. Once it is saved, you can either fill out the form using editing software or print it and complete it by hand. With a vast catalog from US Legal Forms available, you won’t have to waste time searching for the suitable sample online. Utilize the library's easy navigation to find the right form for any circumstance.

- For example, if you choose an incorrect version of an Attorney Powers Power With Liabilities, it will be rejected upon submission.

- Therefore, it is crucial to have a trustworthy source of legal documents like US Legal Forms.

- If you need to obtain a sample of Attorney Powers Power With Liabilities, adhere to these straightforward steps.

- Locate the form you are seeking by using the search box or catalog navigation.

- Review the description of the form to confirm it corresponds to your circumstances, state, and locality.

- Click on the form preview to examine it.

- If it is the wrong document, return to the search feature to identify the Attorney Powers Power With Liabilities sample you need.

- Obtain the file if it fulfills your specifications.

- If you already have a US Legal Forms account, just click Log in to access documents you have saved in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

Form popularity

FAQ

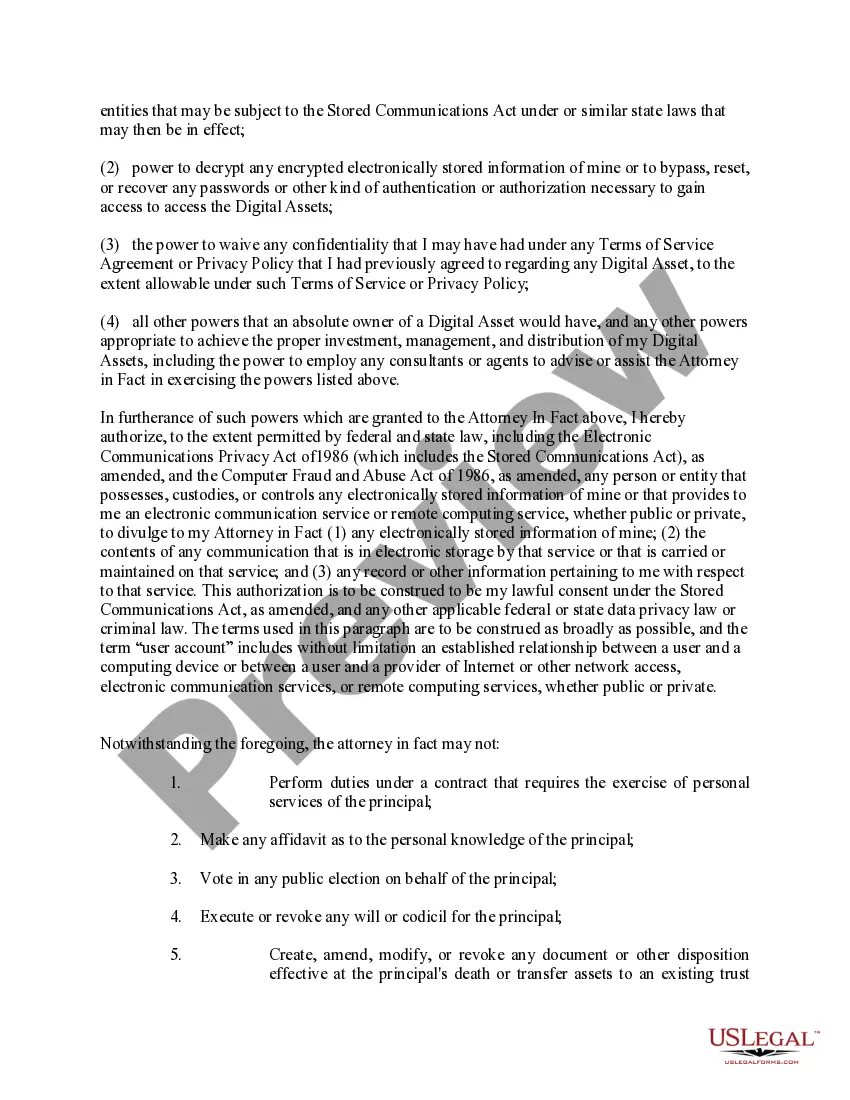

Red flags for power of attorney include lack of transparency, excessive control over finances, and unexplained changes in estate plans. When you observe these behaviors, they may indicate misuse of the attorney powers power with liabilities. Being attentive to these signs protects both you and the individual you represent. For more detailed information and resources, consider consulting UsLegalForms to ensure the implementation of proper practices.

Yes, a power of attorney can be held liable for mismanagement of the entrusted responsibilities. When you hold attorney powers power with liabilities, you must act with care, loyalty, and transparency. If you fail to meet these standards, you could face consequences, including financial restitution or legal action. It's advisable to thoroughly understand your obligations to minimize risks associated with potential liabilities.

You may be liable if you mishandle the powers granted under your role as a power of attorney. With attorney powers power with liabilities, it is essential to act responsibly and transparently. This means making decisions that align with the interests of the person you represent, avoiding conflicts of interest, and keeping accurate records. Engaging with a legal professional or UsLegalForms can provide clarity on these responsibilities.

Liabilities in the context of power of attorney refer to the responsibilities and potential financial obligations that come with managing another person's affairs. When you hold attorney powers power with liabilities, you must act in the best interest of the person you represent. Any mismanagement or failure to adhere to this duty could lead to accountability for any related losses or damages. Understanding these liabilities ensures you proceed with caution and knowledge.

Having power of attorney (POA) does not typically make you responsible for your parents' debt. Your authority under attorney powers power with liabilities allows you to manage their financial affairs but does not transfer their financial obligations to you. It’s crucial to clarify that unless you co-signed on any debt or became a guarantor, their debts remain their own. For tailored guidance, consider visiting UsLegalForms to understand your role and liabilities better.

Filling out a financial power of attorney form requires careful consideration of the authority you wish to grant. Begin by clearly stating the principal's information, followed by detailed descriptions of the powers granted to the agent. It’s crucial to ensure all sections are completed without ambiguity. Utilizing USLegalForms can streamline this process, ensuring compliance and clarity as you navigate attorney powers power with liabilities.

In Virginia, a power of attorney is valid if it meets specific requirements outlined by state law. The document must be signed by the principal and notarized or signed in the presence of two witnesses. It's essential to ensure that the powers granted are clear to avoid any confusion. You can find user-friendly templates on USLegalForms to simplify the process of creating a valid POA.

As a power of attorney, you bear significant responsibilities that come with certain liabilities. You must act in the best interest of the principal and cannot use the authority granted for personal gain. Failing to uphold these duties could lead to legal consequences. Understanding your role helps navigate the complexities of attorney powers power with liabilities.

Yes, a power of attorney can indeed come with liabilities. When an individual grants attorney powers, the appointed agent has a responsibility to act in the best interest of the principal. If the agent makes poor decisions or mismanages the principal's assets, they may face legal liability. Understanding attorney powers power with liabilities is essential to ensure you choose a trustworthy agent.