Attorney Powers Power With Bank Accounts

Description

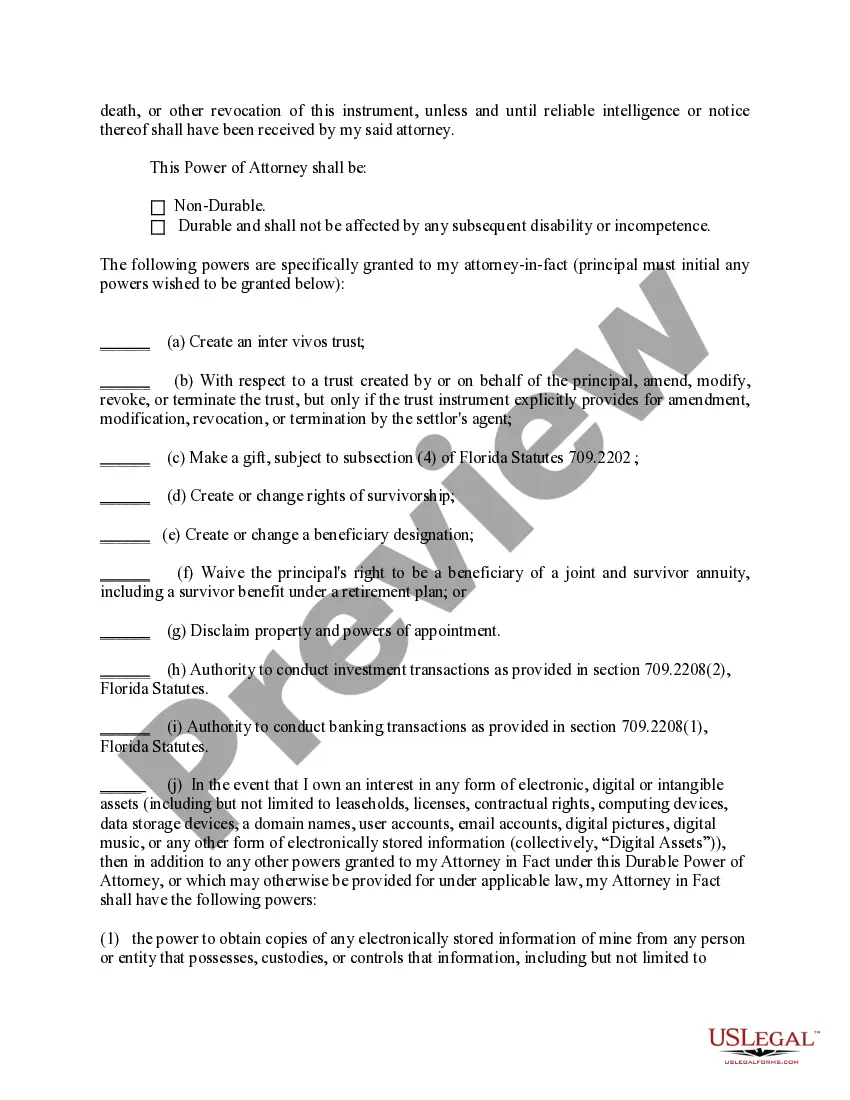

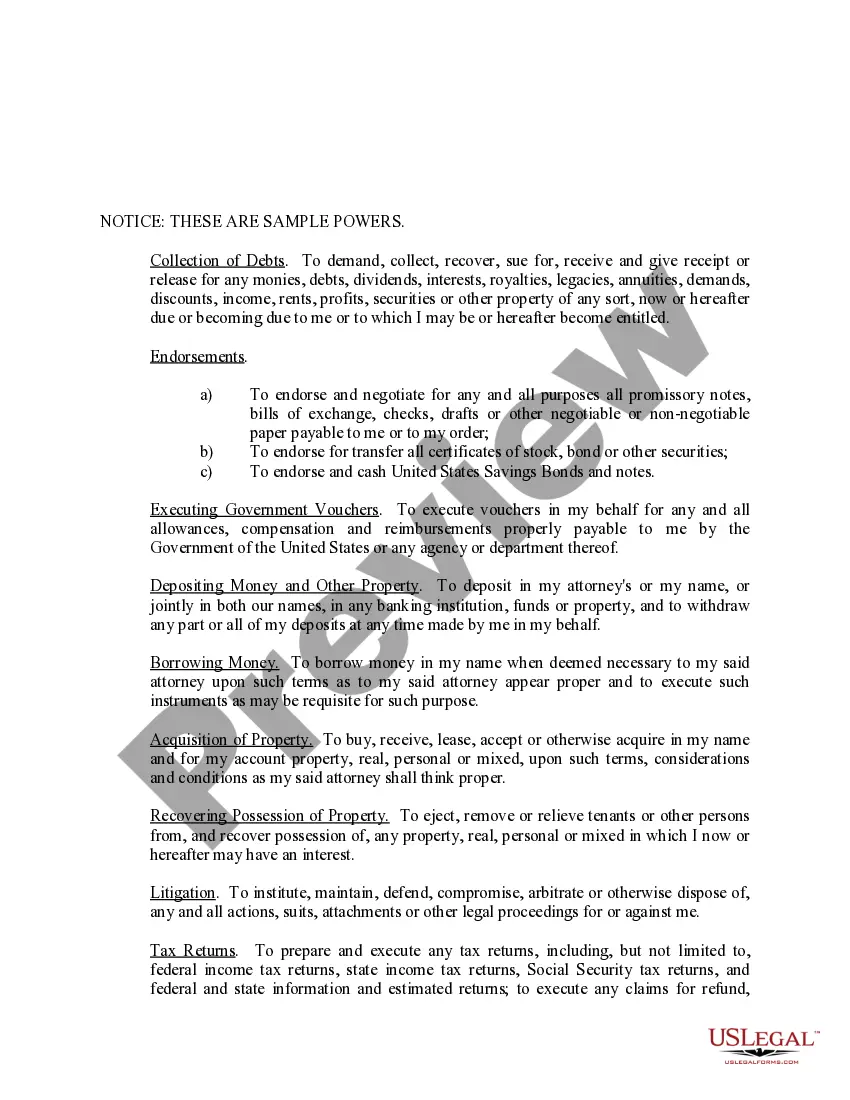

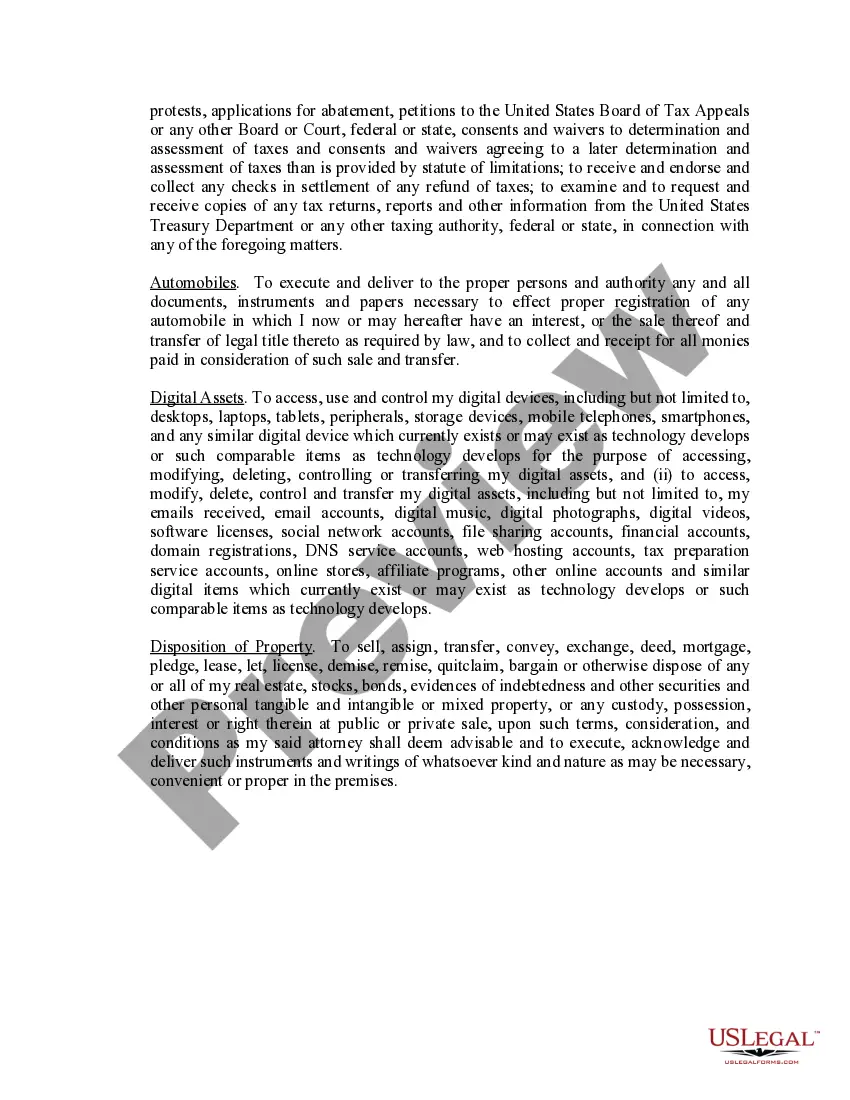

How to fill out Florida Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Creating legal documents from the ground up can frequently be overwhelming.

Certain instances may require extensive research and substantial financial expenditure.

If you’re seeking a simpler and more cost-effective method to prepare Attorney Powers Power With Bank Accounts or any other documents without unnecessary complications, US Legal Forms is readily available for you.

Our online repository of over 85,000 contemporary legal forms encompasses nearly every facet of your financial, legal, and personal matters.

Before proceeding directly to downloading Attorney Powers Power With Bank Accounts, consider these suggestions: Verify the form preview and descriptions to ensure you’ve located the correct form. Confirm that the selected form complies with the laws and regulations of your state and county. Choose the most appropriate subscription plan to access the Attorney Powers Power With Bank Accounts. Download the document, then complete, certify, and print it. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us today and make document preparation straightforward and efficient!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously prepared by our legal experts.

- Utilize our platform whenever you require dependable services to effortlessly find and download the Attorney Powers Power With Bank Accounts.

- If you're already familiar with our site and have set up an account in the past, simply Log In to your account, find the template, and download it or access it again later in the My documents section.

- Don’t have an account? No problem. Setting one up is quick and easy, allowing you to browse the catalog.

Form popularity

FAQ

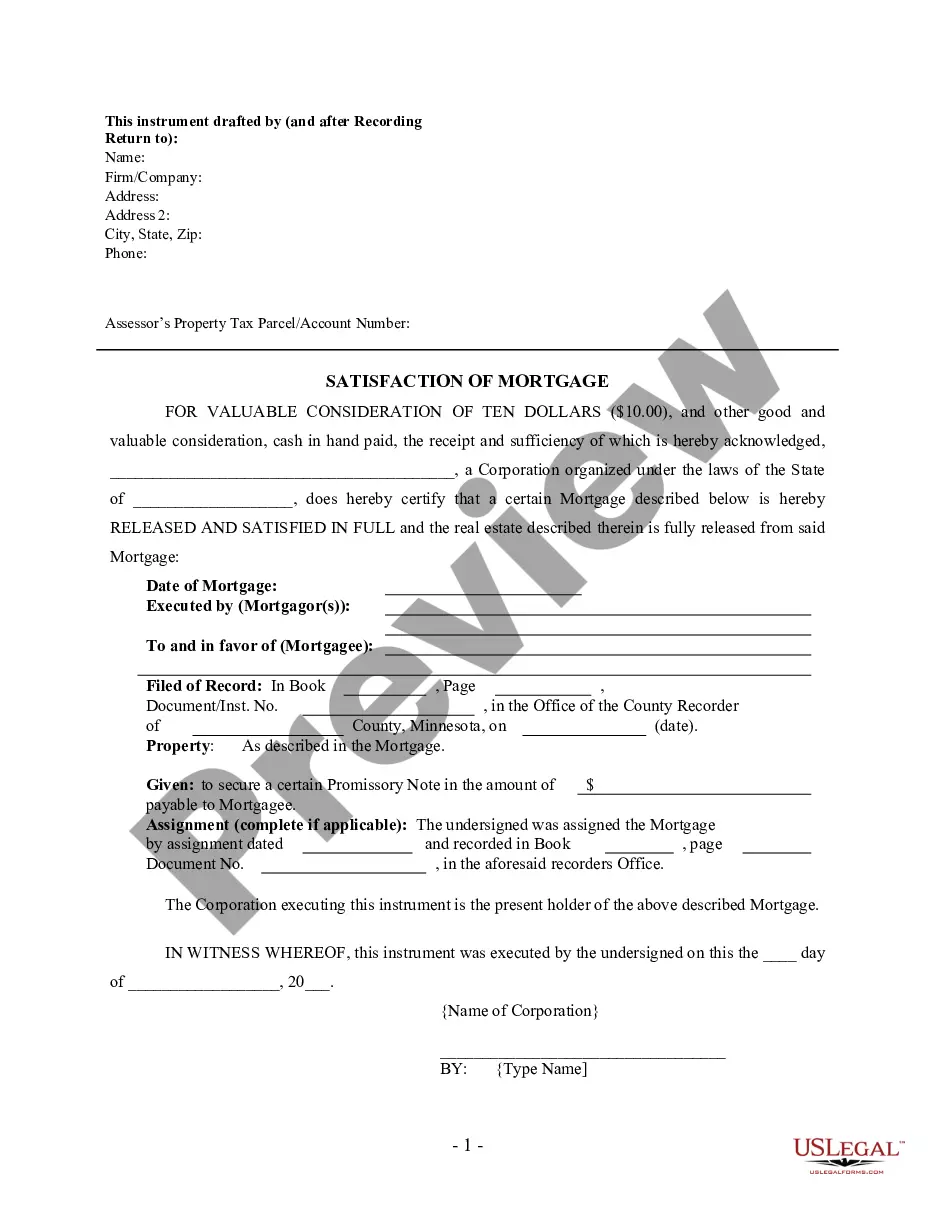

To protect your elderly parents' bank accounts, consider setting up a power of attorney. This allows you or a trusted family member to manage their finances without compromising their independence. Additionally, you can use platforms like US Legal Forms to create a legally binding POA that aligns with your state’s requirements, ensuring their financial safety and security.

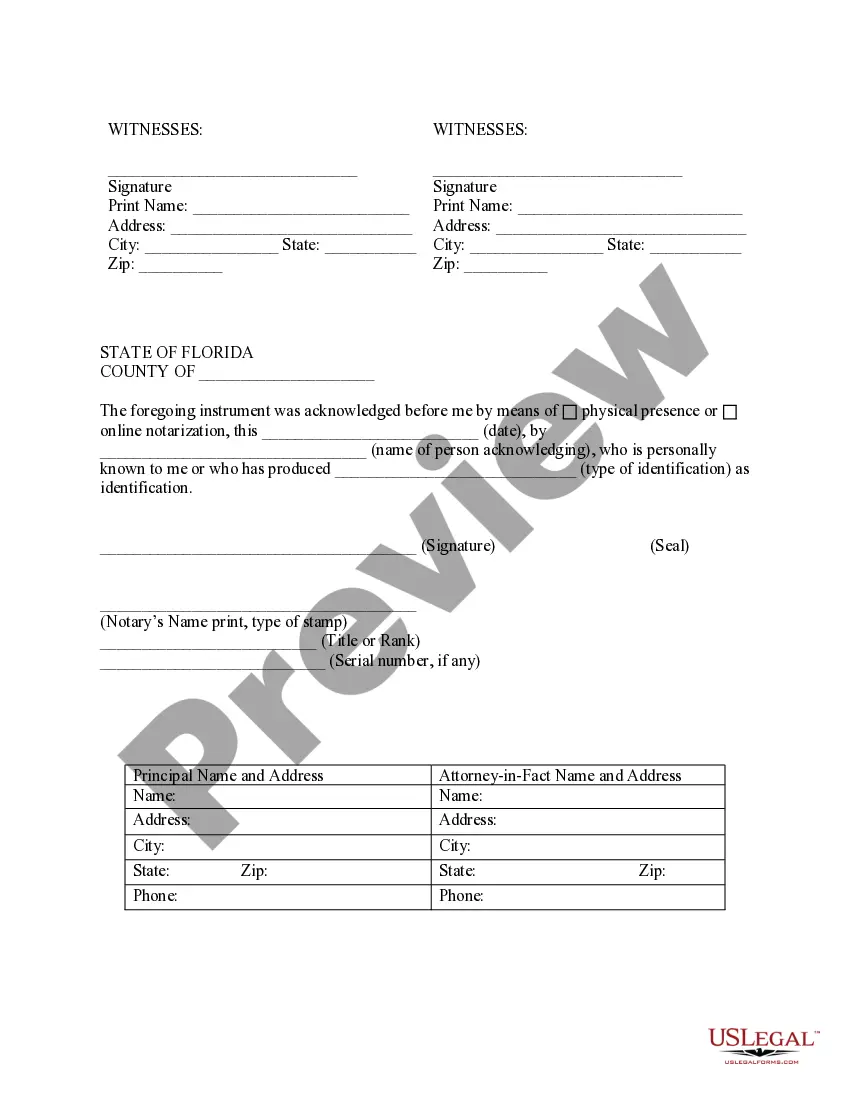

There are instances where a bank may refuse to honor a power of attorney. This can occur if the bank doubts the validity of the document or if it doesn't comply with their internal policies. To avoid such issues, ensure the POA is specific and appropriately executed, as well as consider addressing your concerns with your bank beforehand.

Choosing between a power of attorney and a joint bank account depends on your needs and situation. A POA allows you to selectively grant attorney powers power with bank accounts without transferring ownership. In contrast, a joint account gives a co-owner equal access. Assessing your goals will help you make the best decision for managing finances securely.

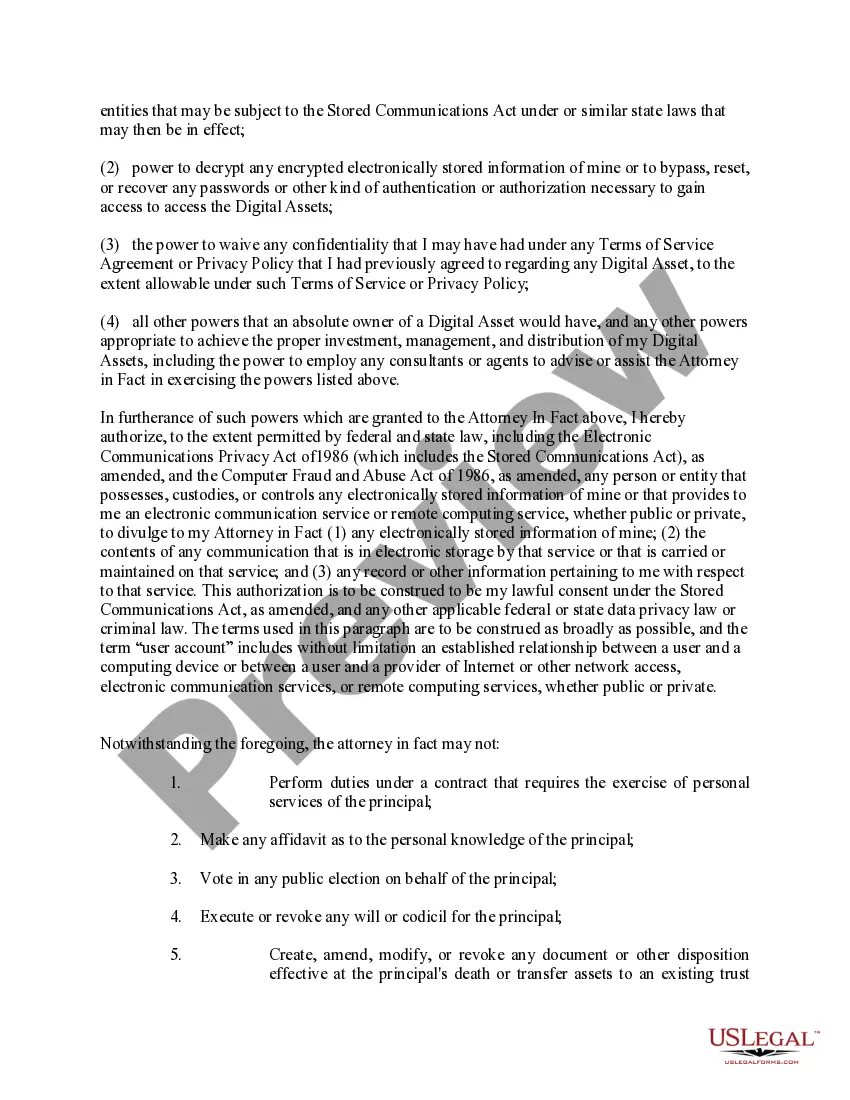

Typically, a power of attorney can conduct various transactions on your bank account, such as making deposits, withdrawing funds, and managing payments. They can also access account information and communicate with the bank on your behalf. It is important to specify the extent of these powers in the POA document to avoid any confusion.

A power of attorney grants another person the authority to manage your bank accounts on your behalf. This means they can make transactions, access funds, and make financial decisions according to your wishes. Attorney powers power with bank accounts is effective when you want someone you trust to handle your financial matters, especially in situations where you may become unable to do so.

A bank may deny a power of attorney (POA) for several reasons. Commonly, the bank might question the legitimacy of the document or whether it complies with state laws. Additionally, if they suspect the duration of the POA has expired, they could refuse to honor it. Ensuring you have a properly drafted POA is crucial for addressing these potential issues.

A Power of Attorney (POA) can add themselves to a bank account, but it must align with the terms set forth in the POA agreement. The attorney powers power with bank accounts grants the POA authority to manage finances, which includes accessing and handling bank accounts. However, banks may require specific documentation to ensure that the POA is valid and properly executed. To avoid confusion, it is advisable to consult with a legal professional and verify the requirements of your specific banking institution.