Employee To File Taxes

Description

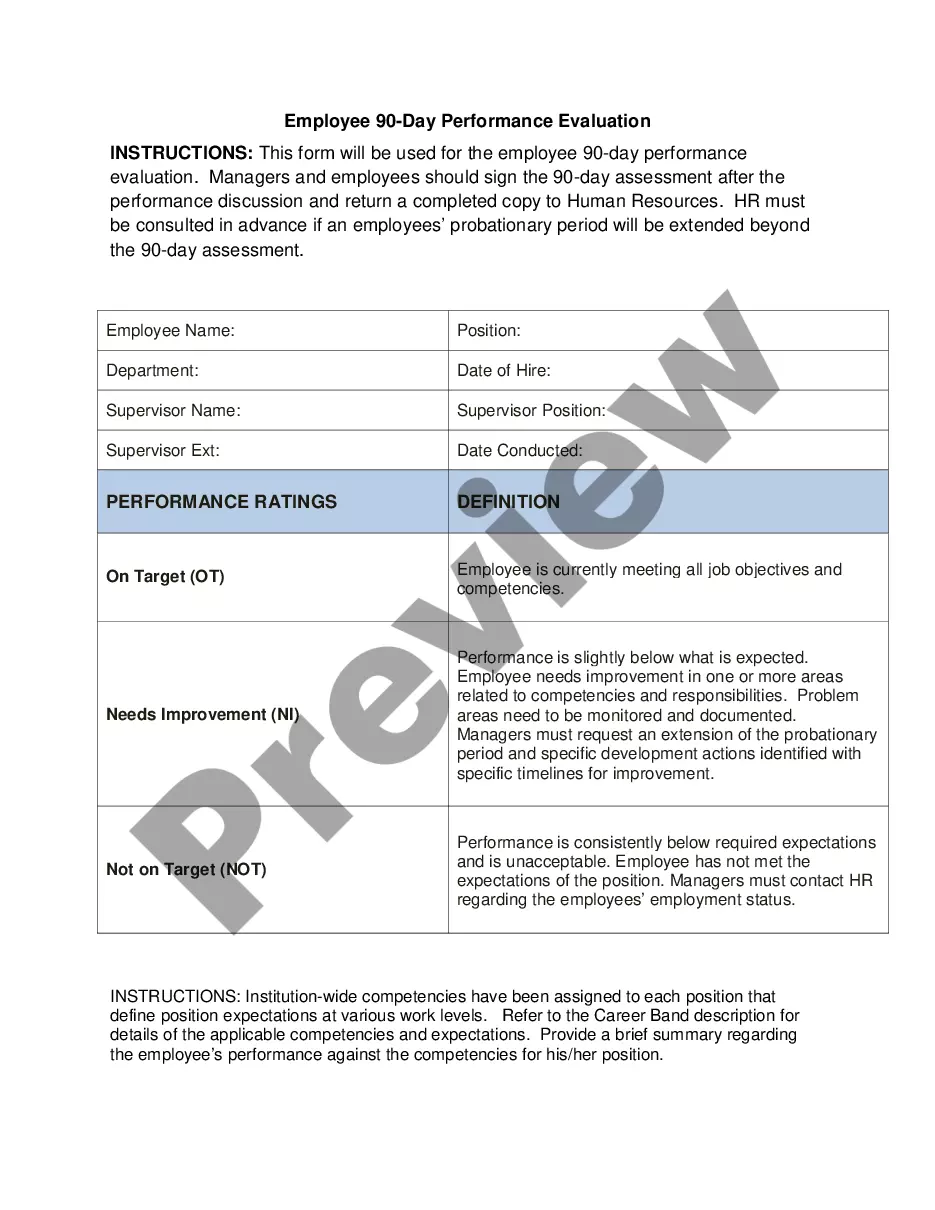

How to fill out Florida Employment Employee Personnel File Package?

It’s no secret that you can’t become a legal professional overnight, nor can you learn how to quickly draft Employee To File Taxes without having a specialized background. Creating legal forms is a long process requiring a particular education and skills. So why not leave the creation of the Employee To File Taxes to the professionals?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court paperwork to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and get the document you require in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Employee To File Taxes is what you’re looking for.

- Start your search over if you need a different form.

- Set up a free account and select a subscription option to buy the template.

- Choose Buy now. Once the transaction is complete, you can download the Employee To File Taxes, complete it, print it, and send or send it by post to the necessary people or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

How to fill out Form W-2 Box A: Employee's Social Security number. ... Box B: Employer Identification Number (EIN) ... Box C: Employer's name, address, and ZIP code. ... Box D: ... Boxes E and F: Employee's name, address, and ZIP code. ... Box 1: Wages, tips, other compensation. ... Box 2: Federal income tax withheld. ... Box 3: Social Security wages.

How to Fill Out a W-2 Tax Form? - YouTube YouTube Start of suggested clip End of suggested clip Box one shows gross wages tips. And any other compensation received by an employee. While box 2MoreBox one shows gross wages tips. And any other compensation received by an employee. While box 2 shows the total amount of federal income tax withheld from employee wages for the year.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

4 form, formally titled "Employee's Withholding Certificate," is an IRS tax document that employees fill out and submit to their employers. Employers use the information provided on a W4 to calculate how much tax to withhold from an employee's paycheck throughout the year.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).