Legal Termination Of Employment

Description

How to fill out Florida Employment Or Job Termination Package?

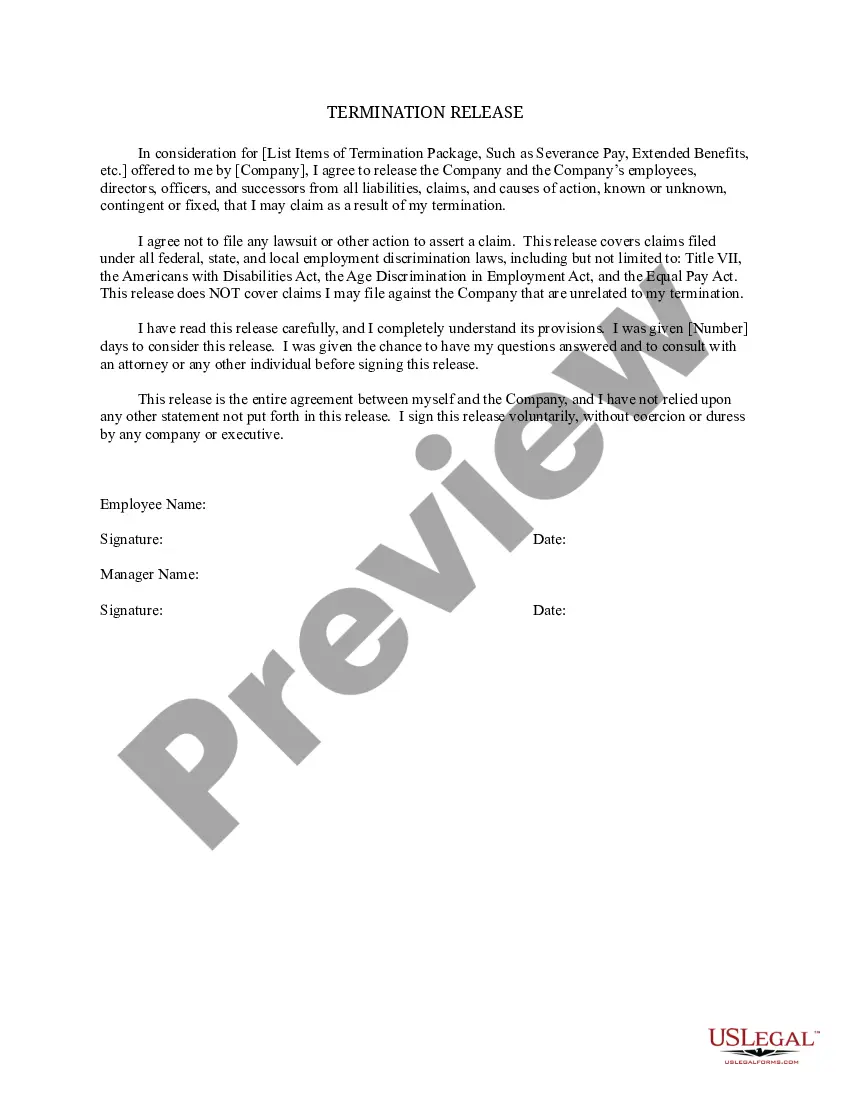

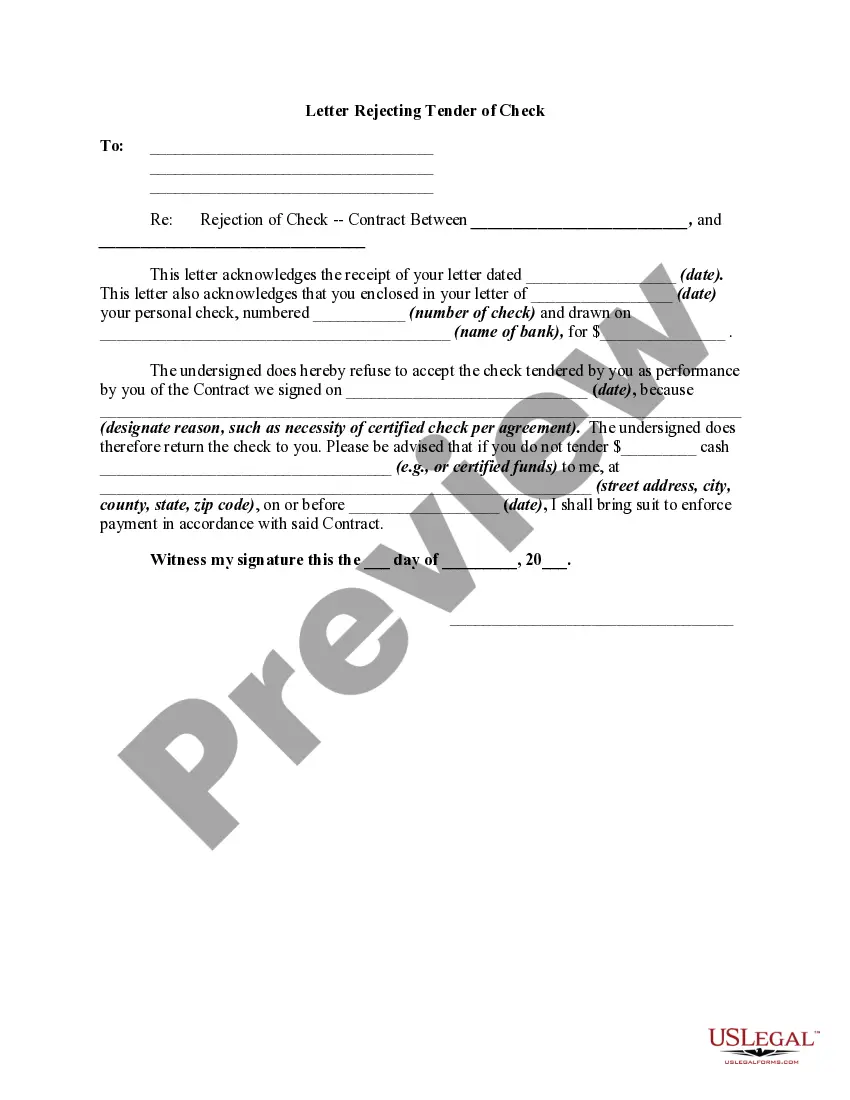

The official conclusion of employment you see on this page is a versatile legal template crafted by expert attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal experts with more than 85,000 validated, state-specific forms for any business and personal situation.

Select the format you prefer for your official conclusion of employment (PDF, DOCX, RTF) and store the sample on your device. Fill out and sign the document. Print the template to complete it manually. Alternatively, employ an online comprehensive PDF editor to swiftly and accurately fill out and sign your form with a legally-binding electronic signature. Re-download your paperwork anytime needed by accessing the My documents tab in your profile to retrieve any previously saved forms. Register for US Legal Forms to have authenticated legal templates for all of life's occasions available to you.

- Search for the document you require and examine it.

- Browse through the sample you looked for and preview it or review the form description to ensure it meets your needs. If it doesn't, utilize the search feature to locate the correct one. Click Buy Now once you have located the template you seek.

- Register and Log In.

- Choose the pricing plan that fits your needs and create an account. Use PayPal or a credit card to complete the payment quickly. If you already possess an account, Log In and review your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

To file and pay the income tax withheld, the S corporation must complete Form WTP-10003 ?Oklahoma Nonresident Distributed Income Withholding Tax Annual Return?. The S corporation will file Form WTP-10003 on or before the due date (including extensions) of the S corporation's income tax return.

OK 512S Information All corporations having an election in effect under Subchapter S of the Internal Revenue Code (IRC) engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file a return on Form 512-S.

You can change your filing date by filing Form 200-F (Request to Change Franchise Tax Filing Period) by mail or online using OkTAP, Oklahoma's online filing system, by July 1st. After you have filed the request to change your filing period, you will not need to file this form again.

If a federal consolidated return is filed, an Oklahoma consolidated return may be required or permitted under certain circumstances. ( Instructions, Form 512, Oklahoma Corporation Income Tax Return) The election to file a separate return or a consolidated return is made with the timely filing of the return.

Schedule B of the OK 512 is for computation of Oklahoma taxable income of a unitary enterprise. To indicate a Unitary enterprise: Go to the Oklahoma > General worksheet. In section 2 - Options.

A Form 500-B must be completed for each nonresident member to whom the pass-through entity has made an Oklahoma taxable distribution and paid withholding to Oklahoma. Form 500-B should not report withhold- ing paid by sources other than the pass-through entity.

Every corporation organized under the laws of this state or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue or creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies ...

File as Oklahoma married filing separate. The Oklahoma resident, filing a joint federal return with a nonresident civilian spouse, may file an Oklahoma return as married filing separate. The resident will file on Form 511 using the married filing separate rates and reporting only his/her income and deductions.