Power Of Attorney Form For Bank Account

Description

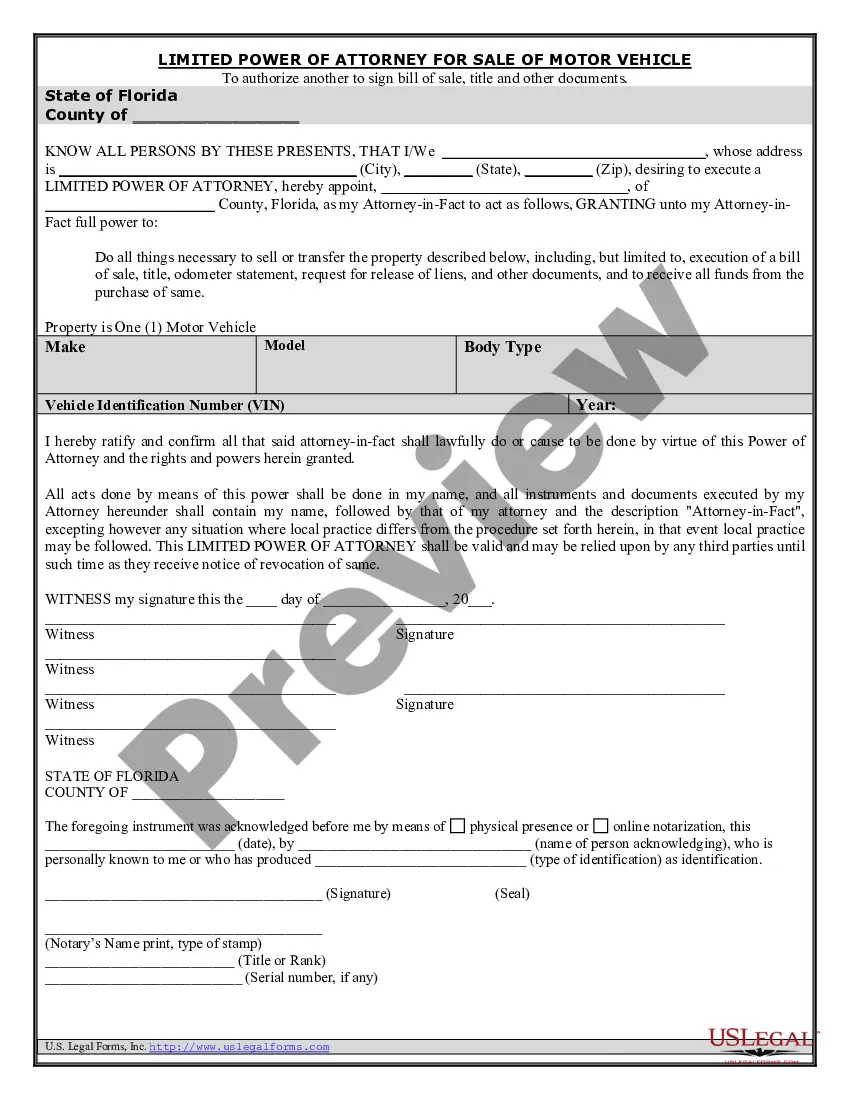

How to fill out Florida Power Of Attorney For Sale Of Motor Vehicle?

- Log into your US Legal Forms account if you are a returning user. Click the Download button for the power of attorney form you need, ensuring your subscription is active.

- If you're new to our service, start by checking the Preview mode and form description to verify you’ve selected the correct document for your needs.

- Should you need a different template, utilize the Search tab located above to find the appropriate form that aligns with your local legal requirements.

- Next, proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to create an account to access the legal library.

- Finalize your transaction by entering your payment details via credit card or PayPal to complete your subscription.

- Once purchased, download the power of attorney form to your device. You can also access it later in the My Forms section of your profile.

By using US Legal Forms, you benefit from a robust collection of legal options and the ability to modify documents easily. This resource not only saves time but also ensures you create precise and legally sound paperwork with the guidance of premium experts.

Start managing your legal documentation effortlessly today! Visit US Legal Forms to explore our extensive library and secure your power of attorney form for your bank account.

Form popularity

FAQ

Yes, you can write your own Power of Attorney letter, but it is important to follow specific guidelines to ensure its validity. A Power of Attorney form for bank accounts must specify the authority you wish to grant, including managing bank transactions. While you may draft this document on your own, using a template can help ensure that you include all necessary details and legal phrases. To simplify the process, consider using a reliable platform like US Legal Forms, which offers easy-to-use templates.

Generally, a power of attorney form for bank account does not give the agent the authority to add themselves as a co-owner of a checking account. The designated person can access the account and perform transactions, but they do not possess ownership rights unless you explicitly grant that through a different legal process. It's essential to clarify any limitations outlined in the power of attorney document you create. By using our platform, you can easily customize your power of attorney form to reflect your specific needs.

A power of attorney form for bank account allows you to designate someone to manage your financial affairs on your behalf. This person can handle tasks like depositing and withdrawing funds, paying bills, and making day-to-day banking decisions. When you complete and submit this power of attorney form, your bank will recognize the designated individual as your representative. Thus, having a reliable power of attorney ensures that your financial matters are addressed even when you cannot do so.

In Tennessee, a power of attorney form for a bank account must meet specific legal criteria to be valid. The principal must be of sound mind when signing, and the document must clearly outline the powers granted. Additionally, it's advisable to have the POA notarized for banking transactions. Always verify current laws, as they can change, and consider using platforms like US Legal Forms for up-to-date templates.

Yes, a power of attorney can be added to a checking account to allow another person to access and manage the account. This arrangement gives your agent the authority to perform transactions, such as deposits, withdrawals, and payments. However, it's important to inform your bank and provide them with the necessary power of attorney form for the account. Be sure to confirm any specific conditions your bank may have.

To write a power of attorney letter for a bank account, start by clearly stating your intent and detailing the powers you wish to grant. Include your and your agent's full names, addresses, and the specific account information. It's crucial to follow your state’s legal requirements and to ensure the document is signed and notarized if necessary. US Legal Forms offers templates that can help simplify this process.

A power of attorney form for a bank account allows you to grant someone else authority to manage your financial affairs. This arrangement can include paying bills, managing investments, and accessing funds. Banks will typically require the POA document to be presented, and they may have specific requirements or restrictions regarding its use. It's essential to check with your bank for any additional forms or procedures.

The approval time for a power of attorney form for a bank account can vary between banks. Generally, you can expect a turnaround of a few days to a couple of weeks. This process involves the bank verifying the document and ensuring it meets their requirements. To expedite the process, ensure that your power of attorney form is completed correctly.

You can grant someone permission to access your bank account through a power of attorney. This specially crafted power of attorney form for bank accounts enables you to specify the rights and limitations of access. It's essential to communicate your intentions clearly and ensure the document adheres to legal standards.

Yes, a power of attorney can apply specifically to bank accounts, allowing someone to manage your finances on your behalf. It is important to use a legally compliant power of attorney form for bank accounts to ensure that your wishes are clearly stated and acknowledged. This arrangement gives you peace of mind, knowing your financial matters are in trusted hands.