Florida Affidavit Property For Partial Exemption

Description

How to fill out Florida Affidavit Property For Partial Exemption?

Precisely formulated official documentation is one of the essential assurances for preventing issues and legal disputes, but acquiring it without an attorney's assistance may require time.

Whether you need to swiftly locate a current Florida Affidavit Property For Partial Exemption or any other forms for job, family, or commercial events, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected document. Additionally, you can retrieve the Florida Affidavit Property For Partial Exemption at any time since all the documents ever obtained on the platform remain accessible within the My documents section of your profile. Conserve time and resources on preparing official documentation. Experience US Legal Forms today!

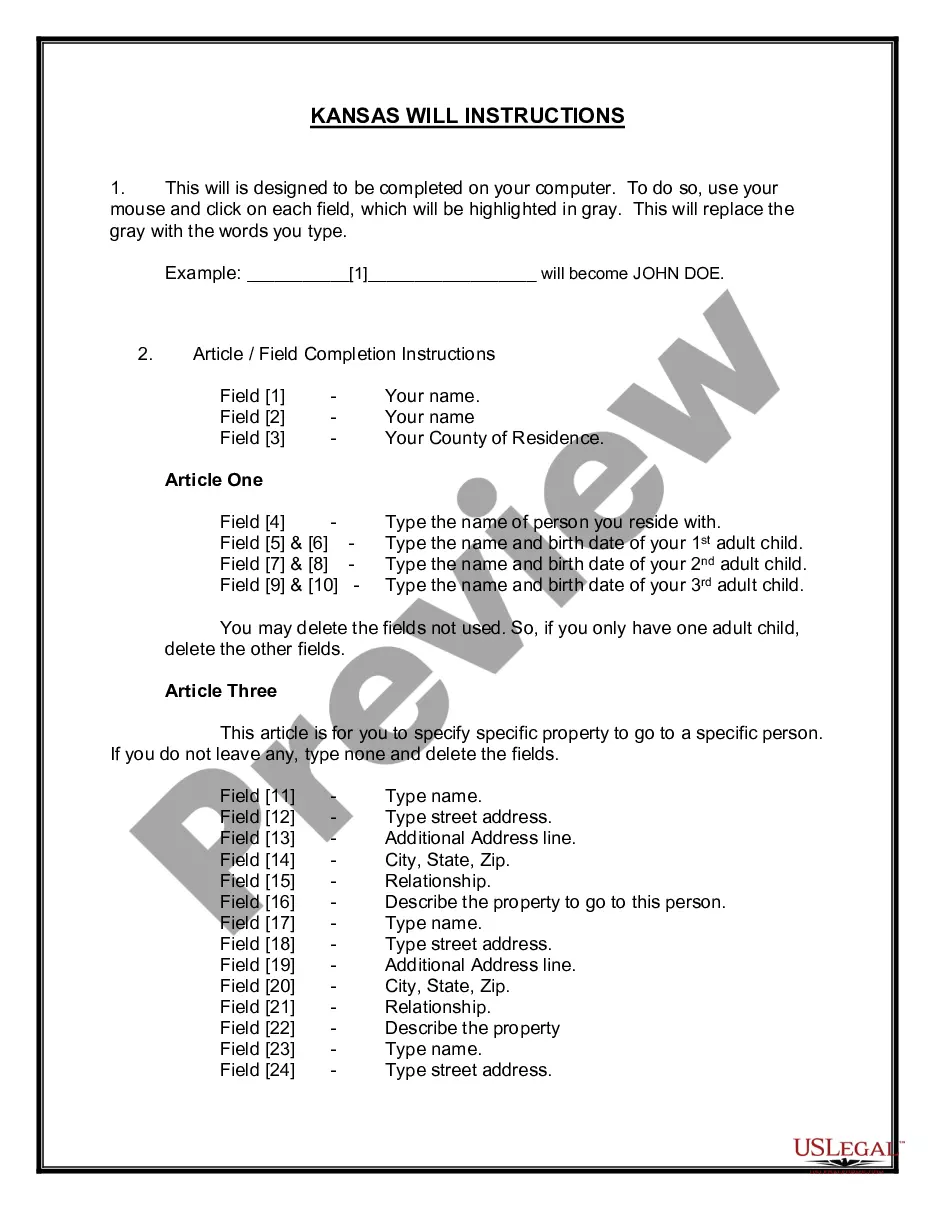

- Ensure that the document is appropriate for your situation and location by reviewing the description and preview.

- Search for another template (if necessary) using the Search bar in the page header.

- Click Buy Now when you find the relevant template.

- Select the pricing option, Log Into your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (through a credit card or PayPal).

- Select PDF or DOCX file format for your Florida Affidavit Property For Partial Exemption.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

Where to File Form DR-312 Form DR-312 must be recorded directly with the clerk of the circuit court in the county or counties where the decedent owned property. Do not send this form to the Florida Department of Revenue.

The 10 US States That Do Not Accept Out of State Resale Certificates: Alabama. California. Florida.

Provide information about all owners of the property in the spaces provided. Indicate the dates of occupancy, driver's license numbers, Florida voter registration numbers, dates of birth and employment information. Write your signature and the date on the appropriate line. If you have a co-applicant, he must also sign.

May be filed with the clerk of the circuit court to remove any Florida estate tax lien on the decedent's real property. This affidavit is admissible as evidence that no Florida estate tax is due by the estate.

Form DR-312 should be filed with the clerk of the court and duly recorded in the public records of the county or counties where the decedent owned property. If you have any questions, or need assistance, call Taxpayer Services at 850-488-6800, Monday through Friday, excluding holidays.