Affidavit Of No Estate Tax Due Withholding Tax

Description

How to fill out Affidavit Of No Florida Estate Tax Due?

Getting a go-to place to access the most current and appropriate legal samples is half the struggle of handling bureaucracy. Choosing the right legal papers calls for precision and attention to detail, which is the reason it is important to take samples of Affidavit Of No Estate Tax Due Withholding Tax only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the details about the document’s use and relevance for the situation and in your state or region.

Take the following steps to complete your Affidavit Of No Estate Tax Due Withholding Tax:

- Use the catalog navigation or search field to find your sample.

- Open the form’s description to check if it fits the requirements of your state and area.

- Open the form preview, if there is one, to ensure the form is the one you are interested in.

- Resume the search and find the right template if the Affidavit Of No Estate Tax Due Withholding Tax does not match your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Pick the pricing plan that fits your needs.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by choosing a transaction method (credit card or PayPal).

- Pick the document format for downloading Affidavit Of No Estate Tax Due Withholding Tax.

- When you have the form on your gadget, you may alter it using the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal paperwork. Explore the comprehensive US Legal Forms library to find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

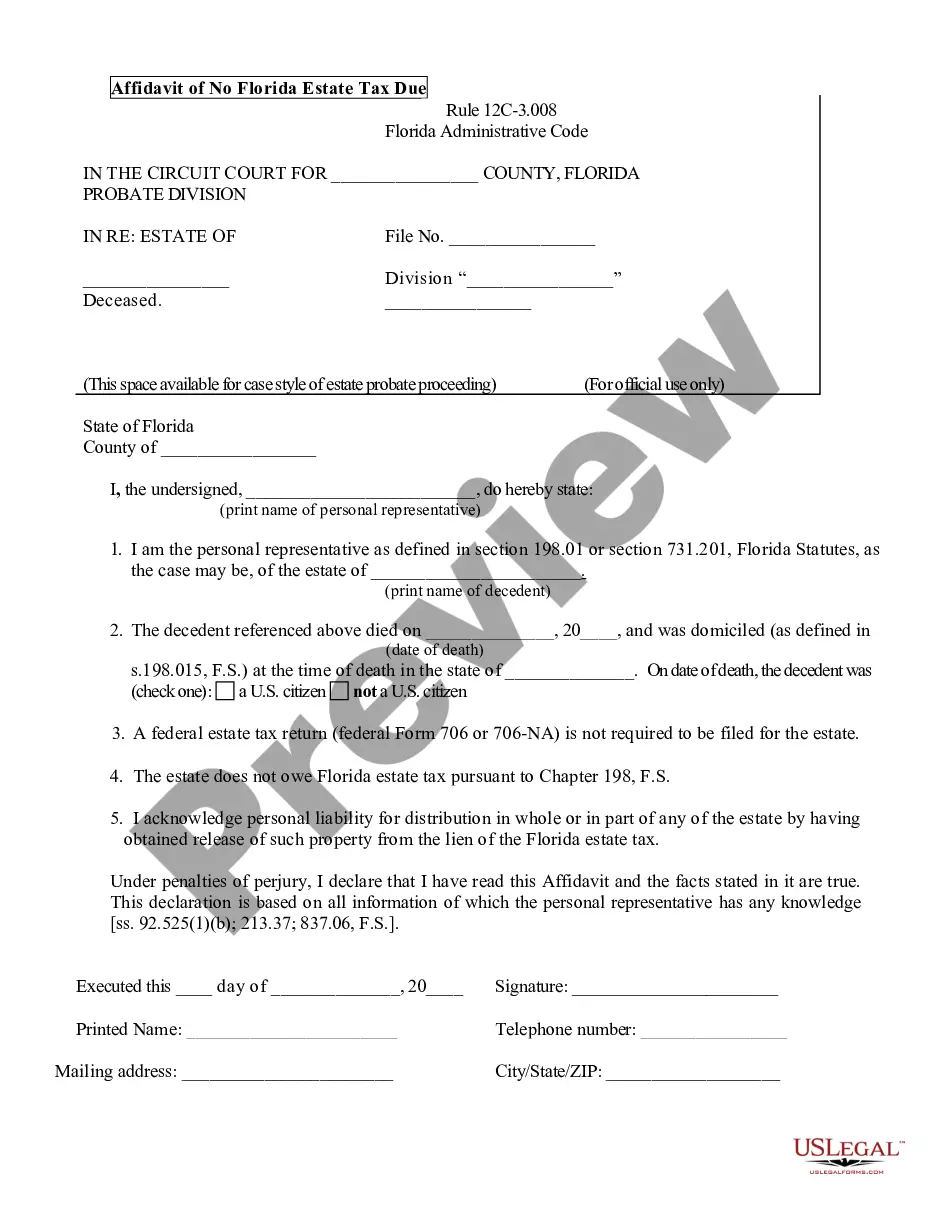

For estates of decedents who do not owe Florida tax and that are not required to file a federal estate tax return (federal Form 706 or 706NA), the personal representative may need to complete an Affidavit of No Florida Estate Tax Due (Florida form DR-312) to remove Florida's automatic estate tax lien.

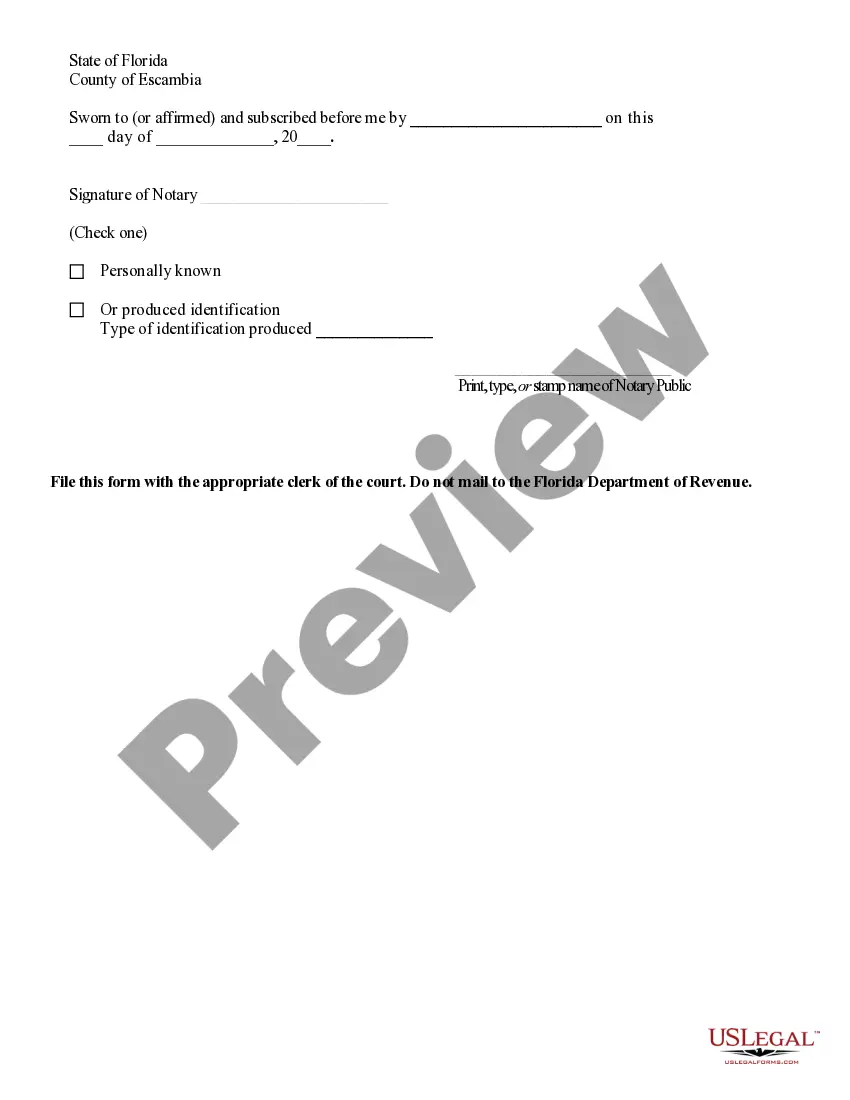

PURPOSE AND EFFECT: The purpose of the proposed amendments to Rule 12C-3.008, F.A.C., is to: (1) require, pursuant to Section 198.32(2), F.S., that Form DR-312 (Affidavit of No Florida Estate Tax Due), be executed by the personal representative of a nontaxable estate and be sworn to before a notary; (2) remove the ...

Where to File Form DR-312 Form DR-312 must be recorded directly with the clerk of the circuit court in the county or counties where the decedent owned property. Do not send this form to the Florida Department of Revenue.