Affidavit Of No Estate Tax Due With Be Notarized

Description

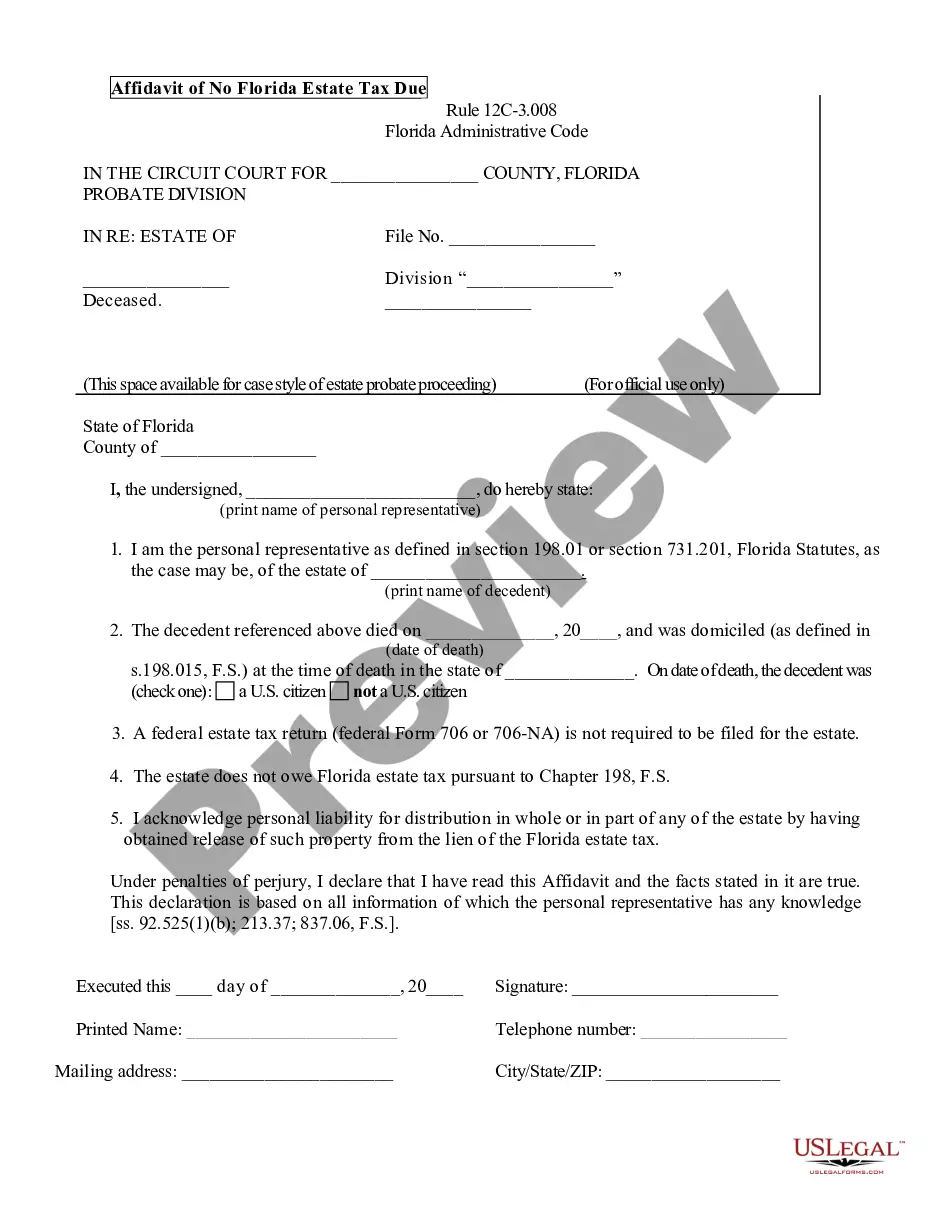

How to fill out Affidavit Of No Florida Estate Tax Due?

Managing legal paperwork can be overwhelming, even for seasoned professionals.

When searching for an Affidavit of No Estate Tax Due With Notarization and lacking the time to seek out the correct and current version, the tasks can be challenging.

US Legal Forms meets all your requirements, from personal to business documents, in one location.

Leverage innovative tools to fill out and manage your Affidavit of No Estate Tax Due With Notarization.

Here are the steps to follow after locating the form you need: Confirm the form is correct by previewing and reviewing its details, ensure it is valid in your state or county, click Buy Now when ready, choose a monthly subscription plan, select the format you require, and Download, complete, eSign, print, and submit your document. Enjoy the US Legal Forms online library, backed by 25 years of experience and reliability. Streamline your routine document management into a simple and user-friendly process today.

- Benefit from a comprehensive resource center filled with articles, tutorials, and guides tailored to your needs.

- Save time and energy in locating the documents you require, and use US Legal Forms’ advanced search and Preview feature to obtain the Affidavit of No Estate Tax Due With Notarization.

- If you have a subscription, Log Into your US Legal Forms account, search for the form, and acquire it.

- Visit the My documents tab to review the files you've previously saved and manage your folders as desired.

- If this is your first time using US Legal Forms, create an account for unlimited access to all the library's benefits.

- Utilize an advanced web form library that can revolutionize the way you handle these matters efficiently.

- US Legal Forms is a leader in online legal forms, offering over 85,000 state-specific legal documents at your convenience.

- Access legal and business forms that are specific to your state or county.

Form popularity

FAQ

Yes, generally anyone can fill out a small estate affidavit, provided they meet specific eligibility criteria established by state law. This affidavit helps in claiming assets without going through probate. However, understanding the process is essential to avoid mistakes, so consulting a legal expert or using resources like US Legal Forms can facilitate the accurate completion of your affidavit of no estate tax due that will be notarized.

Yes, you can write your own affidavit of heirship, but it is crucial to make sure it meets all legal requirements. The affidavit should clearly outline the heirs and their relation to the deceased. Furthermore, remember that this document must be notarized for it to be considered valid. Using a service like US Legal Forms can simplify this process, ensuring your affidavit of no estate tax due will be notarized and compliant with your state's regulations.

An estate tax clearance letter is an official document issued by the tax authority, confirming that a deceased person's estate has satisfied all tax obligations. This letter is essential for settling the estate and distributing assets according to the will or state law. In some circumstances, beneficiaries might need an Affidavit of no estate tax due with be notarized to accompany the letter. Knowing how to obtain these documents is crucial, and USLegalForms can provide guidance.

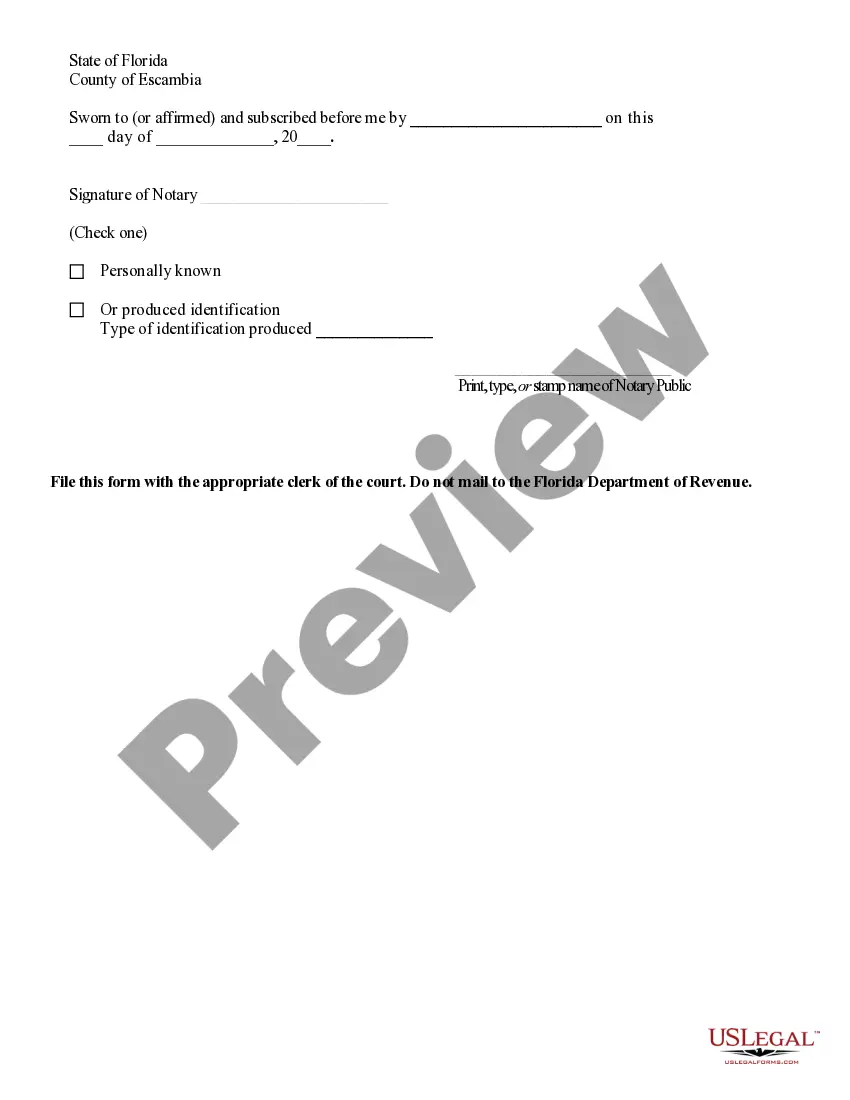

In Florida, an affidavit must contain specific information, including the affiant's name, the circumstances requiring the affidavit, and the signature of a notary public. The affidavit serves as a sworn statement confirming certain facts, such as the absence of estate taxes. When submitting an Affidavit of no estate tax due with be notarized, ensure you meet all legal requirements to avoid potential issues. USLegalForms offers resources to simplify this process.

If you don't file taxes for a deceased person with no estate, you may face legal penalties or complications. The IRS expects a final tax return even if there are no taxes owed. In certain cases, you may need to obtain an Affidavit of no estate tax due with be notarized to confirm no taxes are due. It is best to consult with a tax professional to navigate these requirements.

To file an estate tax return, you typically need the decedent's financial documents, such as tax returns, bank statements, and property deeds. You will also need the death certificate and any documentation showing debts or liabilities. Gathering these documents helps ensure accuracy and completeness in the filing process. An Affidavit of no estate tax due with be notarized may be necessary if no tax is owed.

An affidavit of no Florida estate tax due is a legal document that confirms an estate does not owe any estate taxes in Florida. This affidavit simplifies the estate settlement process, saving time and reducing complications for the heirs. It is important to have this affidavit of no estate tax due with be notarized to ensure its acceptance by financial institutions and courts. You can find resources and templates on uslegalforms to guide you through this process.

A letter 627 estate tax closing letter serves as official confirmation from the IRS that no estate tax is owed. This letter is crucial for the estate's executor, as it allows them to manage the estate's distribution without the burden of pending tax issues. If you are preparing an affidavit of no estate tax due with be notarized, obtaining this letter can provide necessary assurance and support for your documentation process.

Filling a small estate affidavit involves gathering essential information about the deceased's assets and debts. Start by identifying the total value of the estate, ensuring it meets your state's requirements for small estates. You will also need to list beneficiaries and include their signatures. Remember, for the affidavit of no estate tax due with be notarized, a notary public must witness the document to ensure it is valid.