Disposition Without Administration - Small Estates - Personal Only

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

1. Small Estate Affidavit -Some States, but not Florida, allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2. Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Florida Summary:

Under Florida statute, where as estate is valued at less than $75,000, or the decedent has been dead for more than two years, any beneficiary of the estate may file a petition for summary administration of the estate. Upon approval by the court of the petition, the court may order the immediate distribution of the assets of the estate. Please see the statutes below for details.

Florida Requirements:

Florida requirements are set forth in the statutes below.

735.201 Summary administration; nature of proceedings.

Summary administration may be had in the administration of either a resident or nonresident decedent's estate, when it appears:

(1) In a testate estate, that the decedent's will does not direct administration as required by chapter 733.

(2) That the value of the entire estate subject to administration in this state, less the value of property exempt from the claims of creditors, does not exceed $75,000 or that the decedent has been dead for more than 2 years.

1735.202 May be administered in the same manner as other estates.

The estate may be administered in the same manner as the administration of any other estate, or it may be administered as provided in this part.

735.203 Petition for summary administration.

(1) A petition for summary administration may be filed by any beneficiary or person nominated as personal representative in the decedent's will offered for probate. The petition must be signed and verified by the surviving spouse, if any, and any beneficiaries except that the joinder in a petition for summary administration is not required of a beneficiary who will receive a full distributive share under the proposed distribution. However, formal notice of the petition must be served on a beneficiary not joining in the petition.

(2) If a person named in subsection (1) has died, is incapacitated, or is a minor, or has conveyed or transferred all interest in the property of the estate, then, as to that person, the petition must be signed and verified by:

(a) The personal representative, if any, of a deceased person or, if none, the surviving spouse, if any, and the beneficiaries;

(b) The guardian of an incapacitated person or a minor; or

(c) The grantee or transferee of any of them shall be authorized to sign and verify the petition instead of the beneficiary or surviving spouse.

(3) If each trustee of a trust that is a beneficiary of the estate of the deceased person is also a petitioner, formal notice of the petition for summary administration shall be served on each qualified beneficiary of the trust as defined in s. 736.0103 unless joinder in, or consent to, the petition is obtained from each qualified beneficiary of the trust.

735.2055 Filing of petition.

The petition for summary administration may be filed at any stage of the administration of an estate if it appears that at the time of filing the estate would qualify.

735.206 Summary administration distribution.

(1) Upon the filing of the petition for summary administration, the will, if any, shall be proved in accordance with chapter 733 and be admitted to probate.

(2) Prior to entry of the order of summary administration, the petitioner shall make a diligent search and reasonable inquiry for any known or reasonably ascertainable creditors, serve a copy of the petition on those creditors, and make provision for payment for those creditors to the extent that assets are available.

(3) The court may enter an order of summary administration allowing immediate distribution of the assets to the persons entitled to them.

(4) The order of summary administration and distribution so entered shall have the following effect:

(a) Those to whom specified parts of the decedent's estate, including exempt property, are assigned by the order shall be entitled to receive and collect the parts and to have the parts transferred to them. They may maintain actions to enforce the right.

(b) Debtors of the decedent, those holding property of the decedent, and those with whom securities or other property of the decedent are registered are authorized and empowered to comply with the order by paying, delivering, or transferring to those specified in the order the parts of the decedent's estate assigned to them by the order, and the persons so paying, delivering, or transferring shall not be accountable to anyone else for the property.

(c) After the entry of the order, bona fide purchasers for value from those to whom property of the decedent may be assigned by the order shall take the property free of all claims of creditors of the decedent and all rights of the surviving spouse and all other beneficiaries.

(d) Property of the decedent that is not exempt from claims of creditors and that remains in the hands of those to whom it may be assigned by the order shall continue to be liable for claims against the decedent until barred as provided in the code. Any known or reasonably ascertainable creditor who did not receive notice and for whom provision for payment was not made may enforce the claim and, if the creditor prevails, shall be awarded reasonable attorney's fees as an element of costs against those who joined in the petition.

(e) The recipients of the decedent's property under the order of summary administration shall be personally liable for a pro rata share of all lawful claims against the estate of the decedent, but only to the extent of the value of the estate of the decedent actually received by each recipient, exclusive of the property exempt from claims of creditors under the constitution and statutes of Florida.

(f) After 2 years from the death of the decedent, neither the decedent's estate nor those to whom it may be assigned shall be liable for any claim against the decedent, unless proceedings have been taken for the enforcement of the claim.

(g) Any heir or devisee of the decedent who was lawfully entitled to share in the estate but who was not included in the order of summary administration and distribution may enforce all rights in appropriate proceedings against those who procured the order and, if successful, shall be awarded reasonable attorney's fees as an element of costs.

735.2063 Notice to creditors.

(1) Any person who has obtained an order of summary administration may publish a notice to creditors according to the relevant requirements of s. 733.2121, notifying all persons having claims or demands against the estate of the decedent that an order of summary administration has been entered by the court. The notice shall specify the total value of the estate and the names and addresses of those to whom it has been assigned by the order.

(2) If proof of publication of the notice is filed with the court, all claims and demands of creditors against the estate of the decedent who are not known or are not reasonably ascertainable shall be forever barred unless the claims and demands are filed with the court within 3 months after the first publication of the notice.

PART II DISPOSITION OF PERSONAL PROPERTY WITHOUT ADMINISTRATION

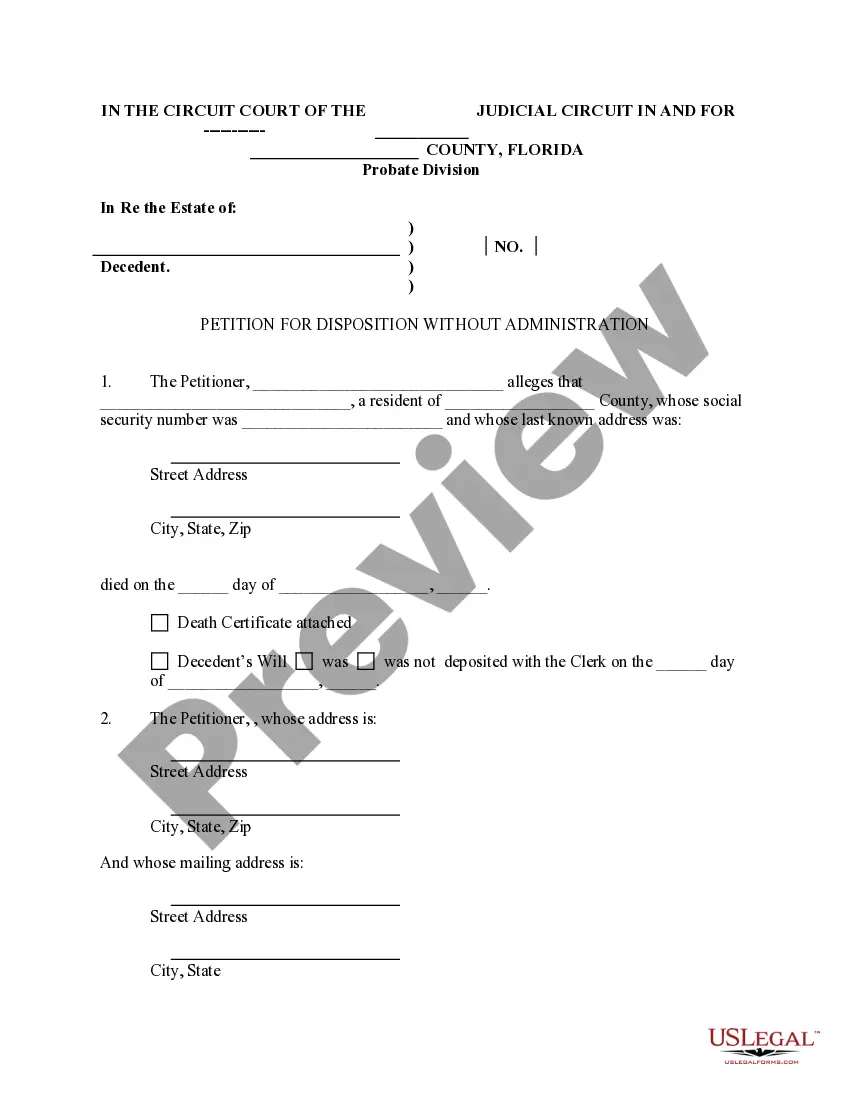

735.301 Disposition without administration.

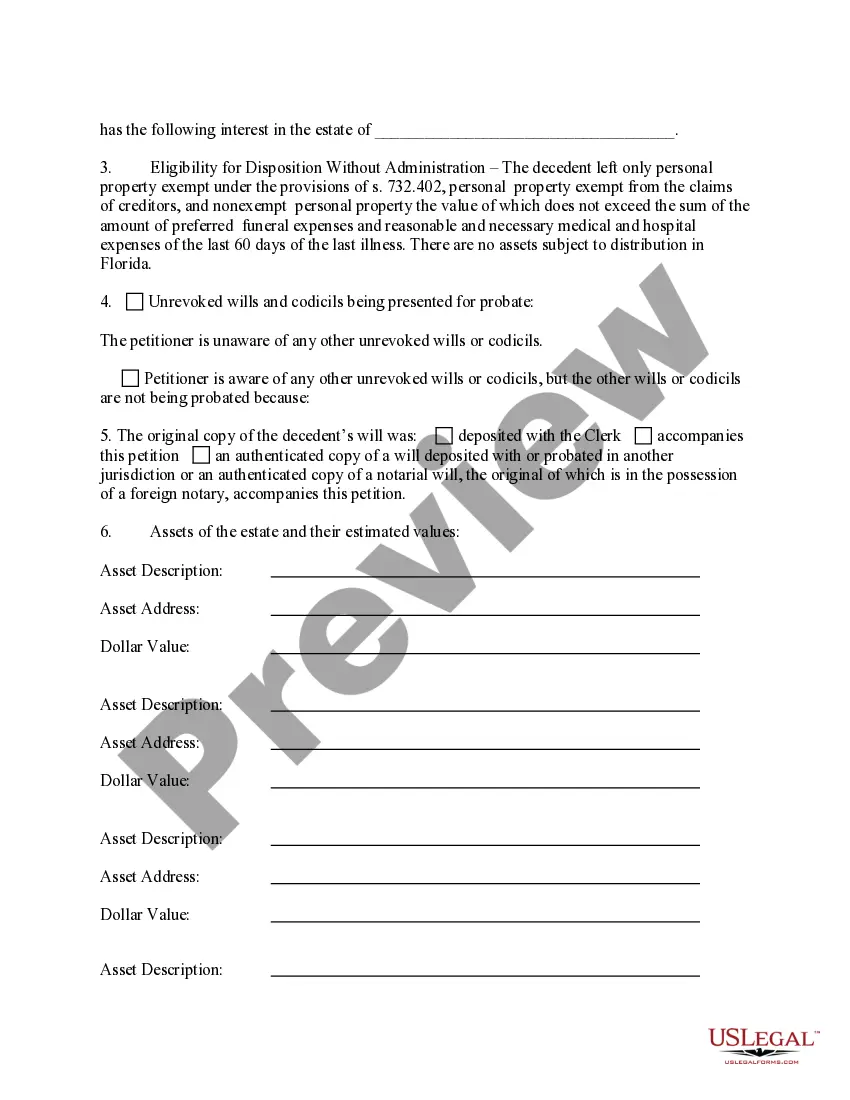

(1) No administration shall be required or formal proceedings instituted upon the estate of a decedent leaving only personal property exempt under the provisions of s. 732.402, personal property exempt from the claims of creditors under the Constitution of Florida, and nonexempt personal property the value of which does not exceed the sum of the amount of preferred funeral expenses and reasonable and necessary medical and hospital expenses of the last 60 days of the last illness.

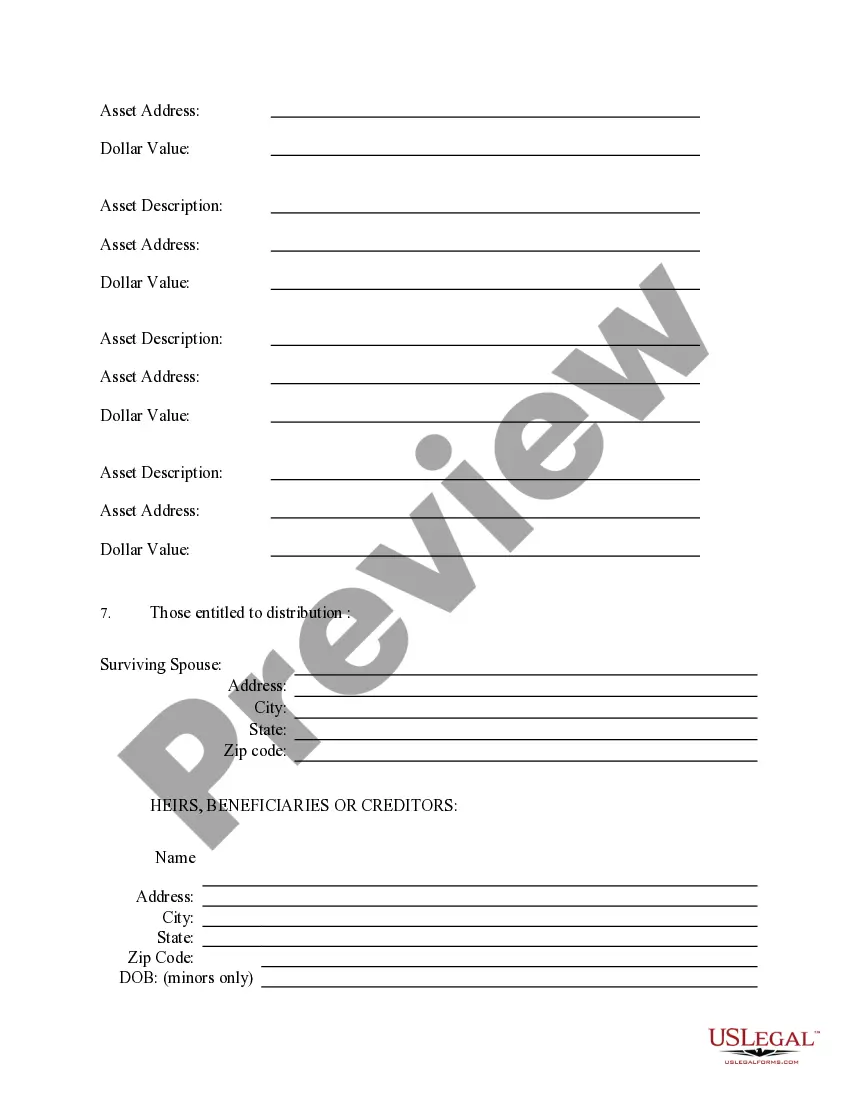

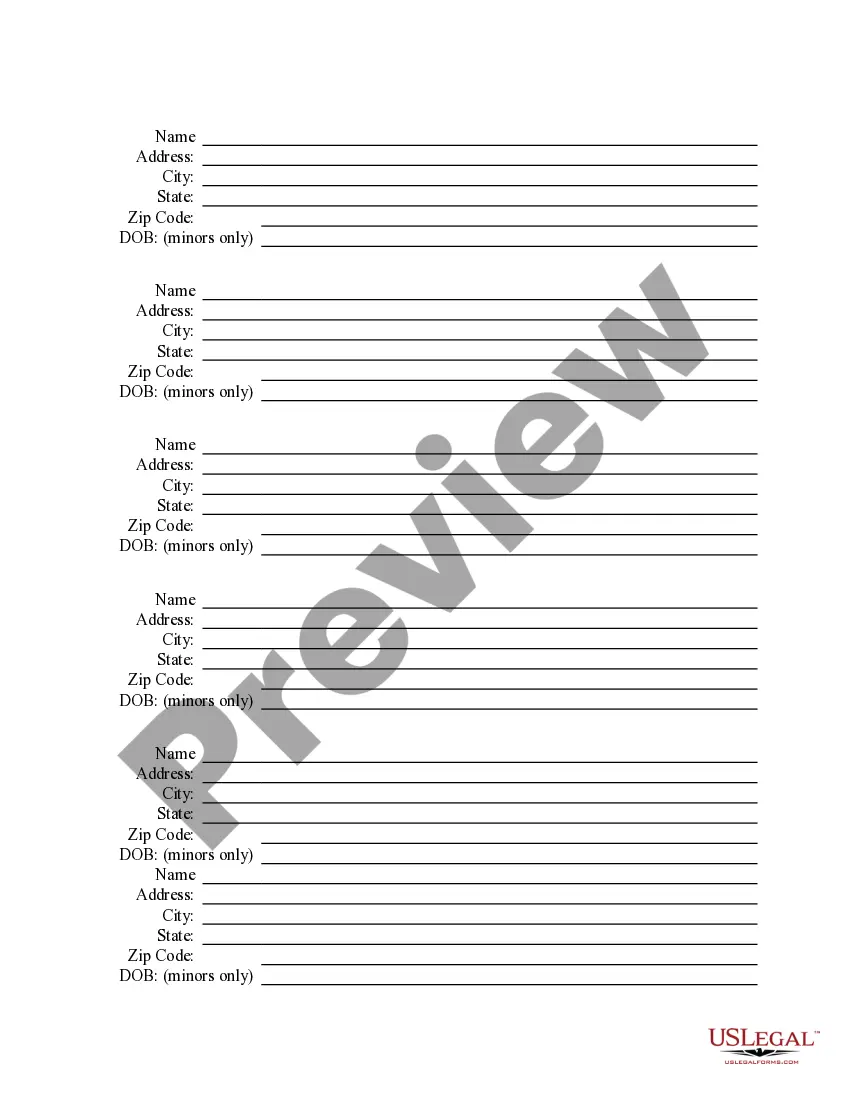

(2) Upon informal application by affidavit, letter, or otherwise by any interested party, and if the court is satisfied that subsection (1) is applicable, the court, by letter or other writing under the seal of the court, may authorize the payment, transfer, or disposition of the personal property, tangible or intangible, belonging to the decedent to those persons entitled.

(3) Any person, firm, or corporation paying, delivering, or transferring property under the authorization shall be forever discharged from liability thereon.

735.302 Income tax refunds in certain cases.

(1) In any case when the United States Treasury Department determines that an overpayment of federal income tax exists and the person in whose favor the overpayment is determined is dead at the time the overpayment of tax is to be refunded, and irrespective of whether the decedent had filed a joint and several or separate income tax return, the amount of the overpayment, if not in excess of $2,500, may be refunded as follows:

(a) Directly to the surviving spouse on his or her verified application; or

(b) If there is no surviving spouse, to one of the decedent's children who is designated in a verified application purporting to be executed by all of the decedent's children over the age of 14 years.

In either event, the application must show that the decedent was not indebted, that provision has been made for the payment of the decedent's debts, or that the entire estate is exempt from the claims of creditors under the constitution and statutes of the state, and that no administration of the estate, including summary administration, has been initiated and that none is planned, to the knowledge of the applicant.

(2) If a refund is made to the surviving spouse or designated child pursuant to the application, the refund shall operate as a complete discharge to the United States from liability from any action, claim, or demand by any beneficiary of the decedent or other person. This section shall be construed as establishing the ownership or rights of the payee in the refund.