Mortgage Deed Sample With Replacement

Description

How to fill out Florida Mortgage Deed From Individual?

Getting a go-to place to take the most recent and appropriate legal templates is half the struggle of handling bureaucracy. Finding the right legal files demands accuracy and attention to detail, which is why it is vital to take samples of Mortgage Deed Sample With Replacement only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and see all the details concerning the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to complete your Mortgage Deed Sample With Replacement:

- Make use of the catalog navigation or search field to locate your template.

- View the form’s description to see if it fits the requirements of your state and region.

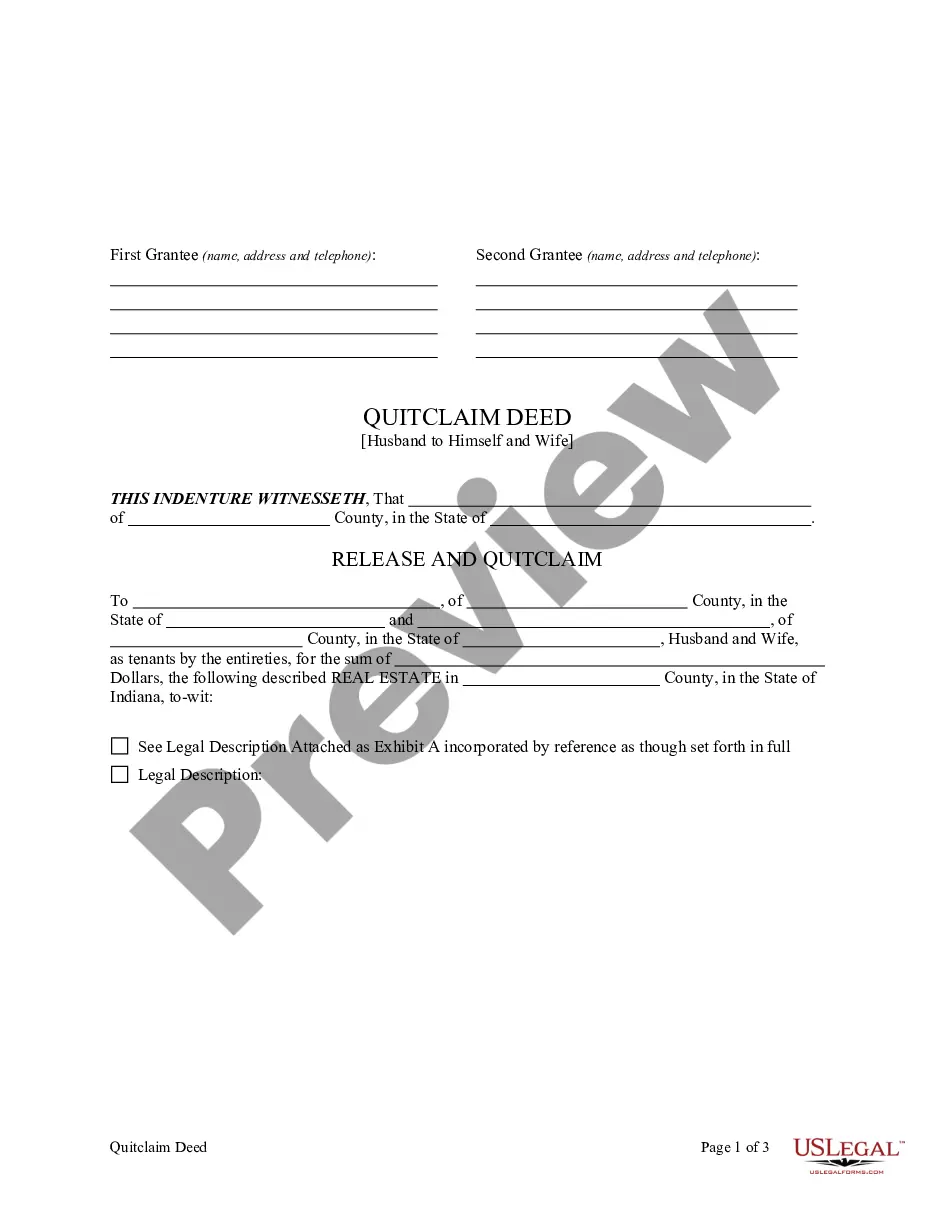

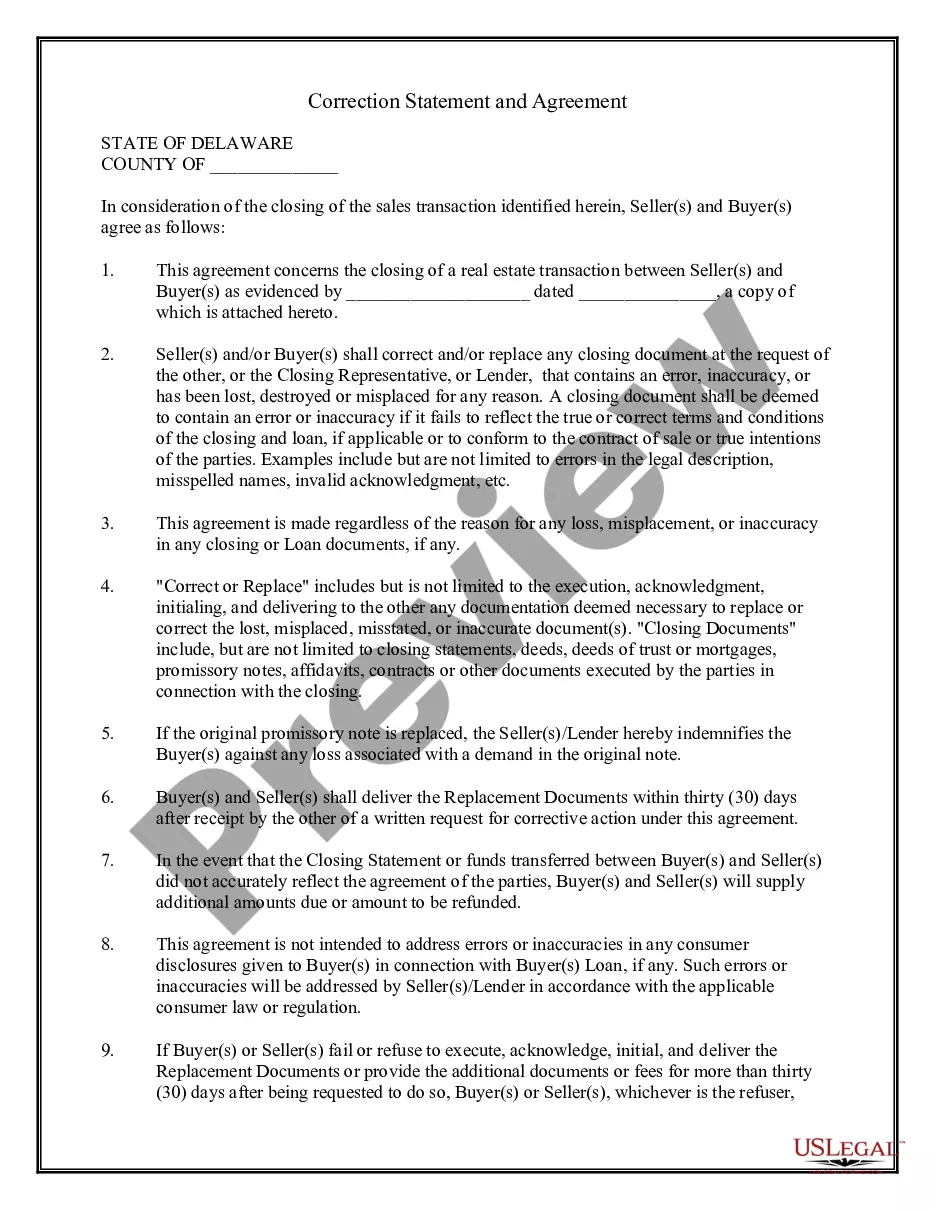

- View the form preview, if available, to make sure the form is the one you are interested in.

- Get back to the search and locate the correct document if the Mortgage Deed Sample With Replacement does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Pick the pricing plan that fits your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (bank card or PayPal).

- Pick the document format for downloading Mortgage Deed Sample With Replacement.

- When you have the form on your gadget, you can alter it using the editor or print it and complete it manually.

Eliminate the headache that accompanies your legal paperwork. Discover the extensive US Legal Forms library to find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

The ?SUBSTITUTION OF TRUSTEE AND DEED OF FULL RECONVEYANCE? is the document that is used to ?RECONVEY WITHOUT WARRANTY, TO THE PERSON OR PERSONS LEGALLY ENTITLED THERETO, ALL the estate, title and interest now held by said trustee under said Deed of trust.? This is the preferred document used to reconvey a loan.

As an example, say Sally decides to purchase a house, and in doing so, she needs to take out a mortgage of $300,000 from the bank. The new property acts as collateral under the deed of trust. Once Sally has fully paid off her mortgage, the trustee must then complete a ?Request for Reconveyance.?

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

The deed of reconveyance will typically include: The name and address of the homeowner/mortgage borrower. The name of the lender/trustee. A description of the property and parcel number based on the original deed.

How to Write a Mortgage Deed Step 1 ? Fill In the Effective Date. ... Step 2 ? Enter Borrower and Lender Details. ... Step 3 ? Write Loan Information. ... Step 4 ? Fill In Property Details. ... Step 5 ? Identify Assigned Rents. ... Step 6 ? Enter Acceleration Upon Default. ... Step 7 ? Choose the Power of Sale Option.