Trustee For A Charity

Description

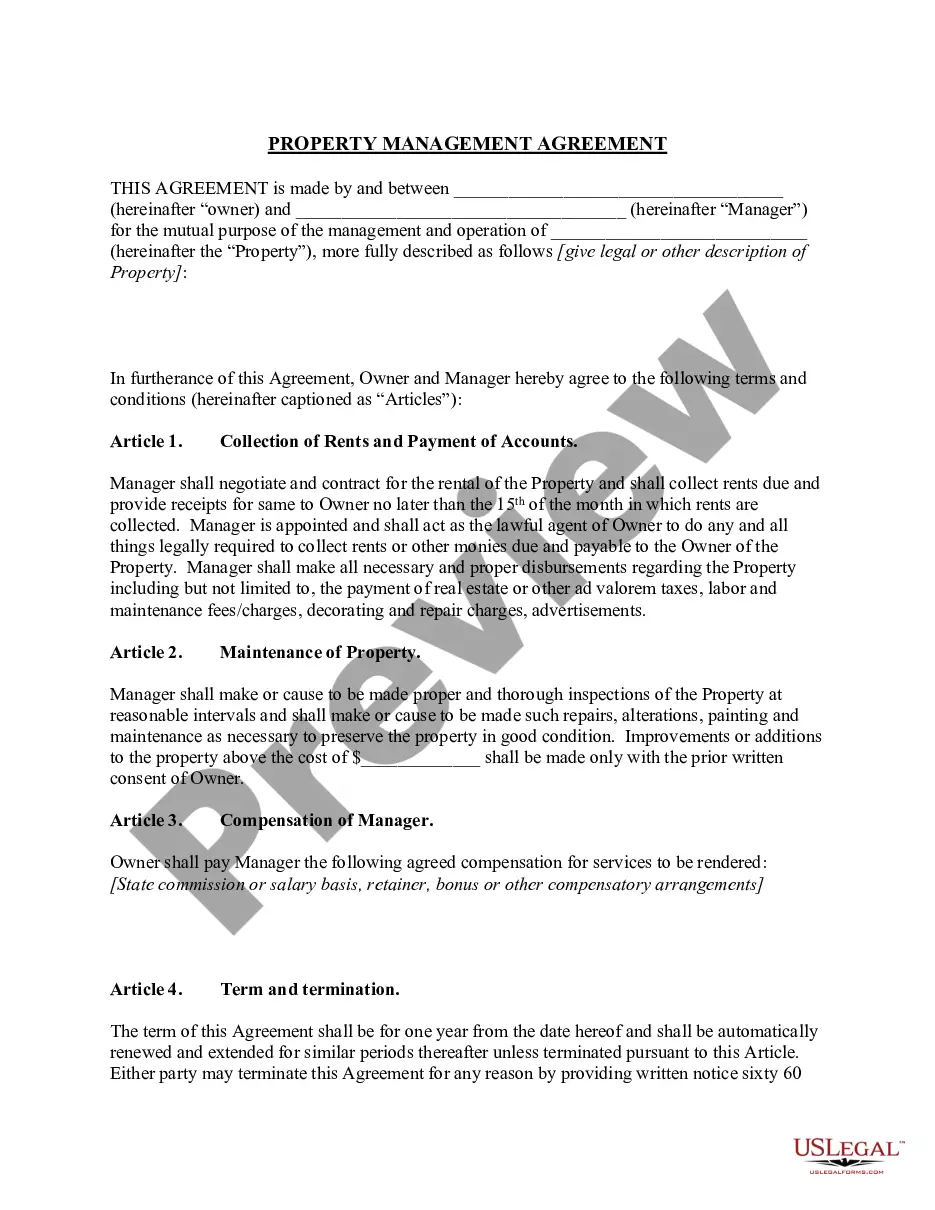

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

- If you are an existing user, log in to your account and download your form by clicking the Download button. Ensure your subscription is active, or renew it as needed.

- For new users, start by checking the Preview mode and reading the form description to verify that it fits your requirements and complies with your jurisdiction's regulations.

- If the form doesn’t meet your specific needs, use the Search feature to explore additional templates until you find the right one.

- Once you have identified the correct document, click the Buy Now button, select your preferred subscription plan, and create an account to access extensive resources.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download the document and save it to your device. You can always access it later in the My Forms section of your profile.

Using US Legal Forms simplifies the often complex nature of legal documentation. Their extensive library ensures you're equipped with everything needed to finalize your role confidently as a charity trustee.

Don't hesitate to harness this powerful tool for your legal needs. Start your journey today by visiting US Legal Forms and explore how easy legal form management can be!

Form popularity

FAQ

Finding a trustee for your charity can begin with reaching out to your professional network or community organizations. Look for individuals who align with your charity’s mission and possess relevant skills or experiences. You can also use platforms like USLegalForms, which provides resources and templates to facilitate the recruitment and selection process. Selecting the right trustee is crucial, as they will significantly impact your charity's success.

Most charities are required to have at least three trustees to maintain governance standards. This minimum allows for essential checks and balances, enhancing the charity's operational integrity. It's important to have enough trustees to foster discussions and address various perspectives within the organization. Before establishing your charity, consider reviewing state regulations, as requirements may differ.

The role of a charity trustee encompasses overseeing the organization’s operations, ensuring compliance with laws, and safeguarding the charity's assets. They are responsible for forming strategic plans, managing finances, and acting in the best interest of the charity. Essentially, charity trustees hold the organization accountable to its mission and the community it serves. In this capacity, they serve as vital advocates for the charity's cause.

The minimum number of trustees often depends on both state regulations and the organization's bylaws. Generally, two or three trustees are required to form a legal board, ensuring adequate governance and compliance. This structure not only helps in making collective decisions but also protects the interests of the charity. Be sure to consult legal guidelines specific to your jurisdiction for precise requirements.

In most jurisdictions, the minimum number of trustees for a charitable trust is typically two. This requirement helps in addressing potential conflicts and ensuring diverse oversight. However, having more than two can improve the governance structure significantly. Always check your state’s laws, as they can vary regarding the formation of charitable trusts.

A nonprofit organization usually requires at least three trustees to comply with legal obligations and effectively govern. This core group helps establish a foundation for accountability and transparency. Ensuring diverse expertise among these trustees can greatly enhance strategic planning and operational success. Having sufficient trustees also reassures donors and stakeholders about the nonprofit's credibility.

The ideal number of trustees for a charity typically ranges from three to seven. This number allows for a diverse range of perspectives while ensuring effective decision-making. More trustees can lead to complexities, while too few may limit input and oversight. Ultimately, having a balanced team is essential for a successful charity board.

Yes, a non-profit organization can act as a trustee for a charity. This capability allows them to manage charitable assets and ensure they are distributed according to the charity's goals. It can lead to enhanced fundraising, transparency, and accountability. For efficient management, platforms like US Legal Forms can provide you with the tools and forms needed for compliance.

The primary distinction lies in their roles within the organization. A nonprofit board of directors focuses on the operational and strategic direction of the nonprofit, while a board of trustees handles the oversight of assets, ensuring they are used in alignment with the charity's mission. These roles are complementary; however, they require different skill sets and responsibilities. Understanding this difference is vital for effective governance of the charity.

The IRS form most commonly associated with a charitable trust is Form 5227. This form is specifically used to report certain information about charitable trusts and their operations. Completing this form is crucial for compliance and tax reporting. For more guidance, consider accessing resources from US Legal Forms to simplify the process.