Quitclaim Deed To Revocable Trust Form With Decimals

Description

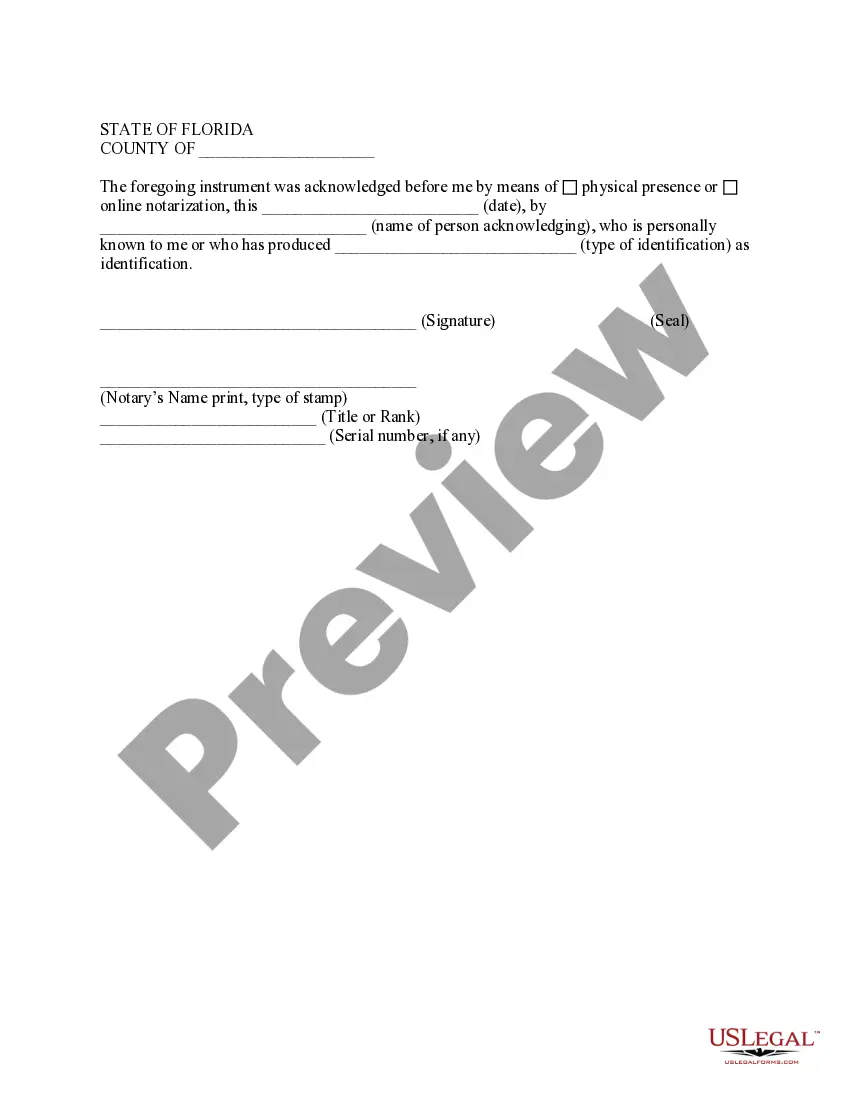

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

Legal management can be mind-boggling, even for the most skilled professionals. When you are searching for a Quitclaim Deed To Revocable Trust Form With Decimals and do not get the time to commit looking for the right and updated version, the operations may be stress filled. A robust web form catalogue could be a gamechanger for everyone who wants to deal with these situations effectively. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms covers any demands you might have, from personal to organization documents, in one place.

- Utilize advanced resources to finish and control your Quitclaim Deed To Revocable Trust Form With Decimals

- Access a useful resource base of articles, instructions and handbooks and resources related to your situation and needs

Help save time and effort looking for the documents you need, and use US Legal Forms’ advanced search and Review tool to find Quitclaim Deed To Revocable Trust Form With Decimals and download it. In case you have a membership, log in in your US Legal Forms account, search for the form, and download it. Review your My Forms tab to see the documents you previously saved as well as control your folders as you can see fit.

Should it be your first time with US Legal Forms, create an account and acquire limitless use of all benefits of the platform. Listed below are the steps for taking after getting the form you want:

- Verify this is the proper form by previewing it and reading its information.

- Be sure that the sample is approved in your state or county.

- Select Buy Now when you are all set.

- Choose a subscription plan.

- Pick the file format you want, and Download, complete, eSign, print and send out your document.

Benefit from the US Legal Forms web catalogue, backed with 25 years of expertise and stability. Change your everyday document managing in a easy and intuitive process today.

Form popularity

FAQ

A revocable trust does not pay taxes. For federal and California income tax purposes, the assets in the trust are treated as belonging to you.

The main disadvantage of a revocable living trust is that it does not protect you from creditors or lawsuits. Because you have control of everything in your trust and have access to the assets, you can still be sued for liability.

Due to this, quitclaim deeds typically are not used in situations where the property involved has an outstanding mortgage. After all, it would be difficult for many grantors to pay off a mortgage without proceeds from the sale of the property.

?John Smith and Jane Smith Revocable Living Trust Dated November 21, 2022?. There are no legal requirements when it comes to naming a trust. Those examples above are the most common way estate planning attorneys draft them.

A quit claim deed in a divorce or legal separation gives one party the sole ownership of the property. This allows that party to sell or mortgage the property without the approval or consent of the other party.