Quitclaim Deed To Revocable Trust Form With Beneficiaries

Description

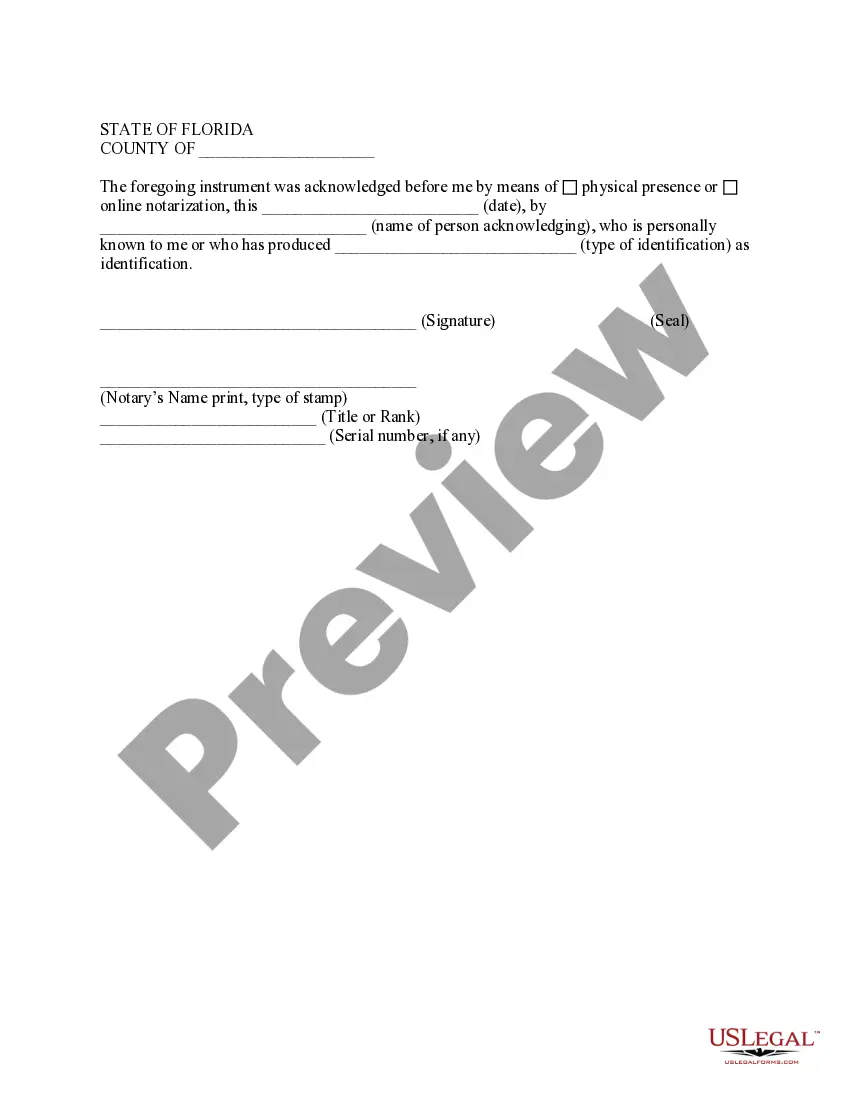

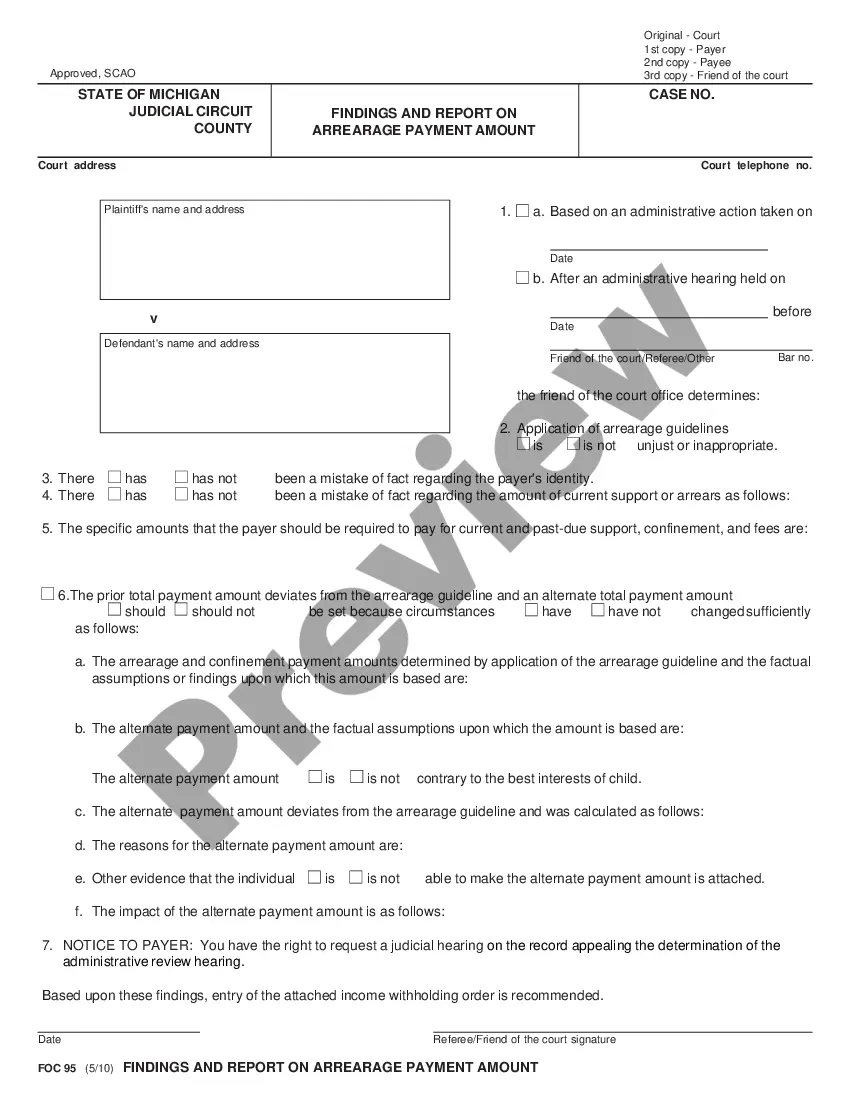

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

Obtaining legal templates that meet the federal and local laws is a matter of necessity, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the right Quitclaim Deed To Revocable Trust Form With Beneficiaries sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life situation. They are simple to browse with all files grouped by state and purpose of use. Our professionals keep up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Quitclaim Deed To Revocable Trust Form With Beneficiaries from our website.

Obtaining a Quitclaim Deed To Revocable Trust Form With Beneficiaries is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the steps below:

- Examine the template utilizing the Preview option or through the text description to make certain it fits your needs.

- Look for another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Quitclaim Deed To Revocable Trust Form With Beneficiaries and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

There are three parties, all of which have to be legal entities **, in a Deed of Trust drawn up ing to California's laws: The ?Trustor? is the person who borrowed the money (the Payor of the Note) The ?Beneficiary? is the person who is lending the money (the Payee of the Note)

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Due to this, quitclaim deeds typically are not used in situations where the property involved has an outstanding mortgage. After all, it would be difficult for many grantors to pay off a mortgage without proceeds from the sale of the property.

Transfers to an irrevocable trust are generally subject to gift tax. This means that even though assets transferred to an irrevocable trust will not be subject to estate tax, they will generally be subject to gift tax.