Quitclaim Deed To Revocable Trust Form With Bank

Description

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

Legal document management might be mind-boggling, even for the most experienced experts. When you are looking for a Quitclaim Deed To Revocable Trust Form With Bank and don’t get the time to devote trying to find the right and up-to-date version, the processes may be demanding. A strong online form library might be a gamechanger for anybody who wants to deal with these situations effectively. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any demands you may have, from personal to organization paperwork, all in one spot.

- Use advanced tools to complete and control your Quitclaim Deed To Revocable Trust Form With Bank

- Gain access to a useful resource base of articles, instructions and handbooks and materials connected to your situation and requirements

Save time and effort trying to find the paperwork you will need, and utilize US Legal Forms’ advanced search and Preview feature to get Quitclaim Deed To Revocable Trust Form With Bank and get it. For those who have a subscription, log in in your US Legal Forms profile, search for the form, and get it. Review your My Forms tab to find out the paperwork you previously saved as well as control your folders as you can see fit.

If it is the first time with US Legal Forms, register an account and obtain unlimited usage of all advantages of the platform. Here are the steps to take after downloading the form you want:

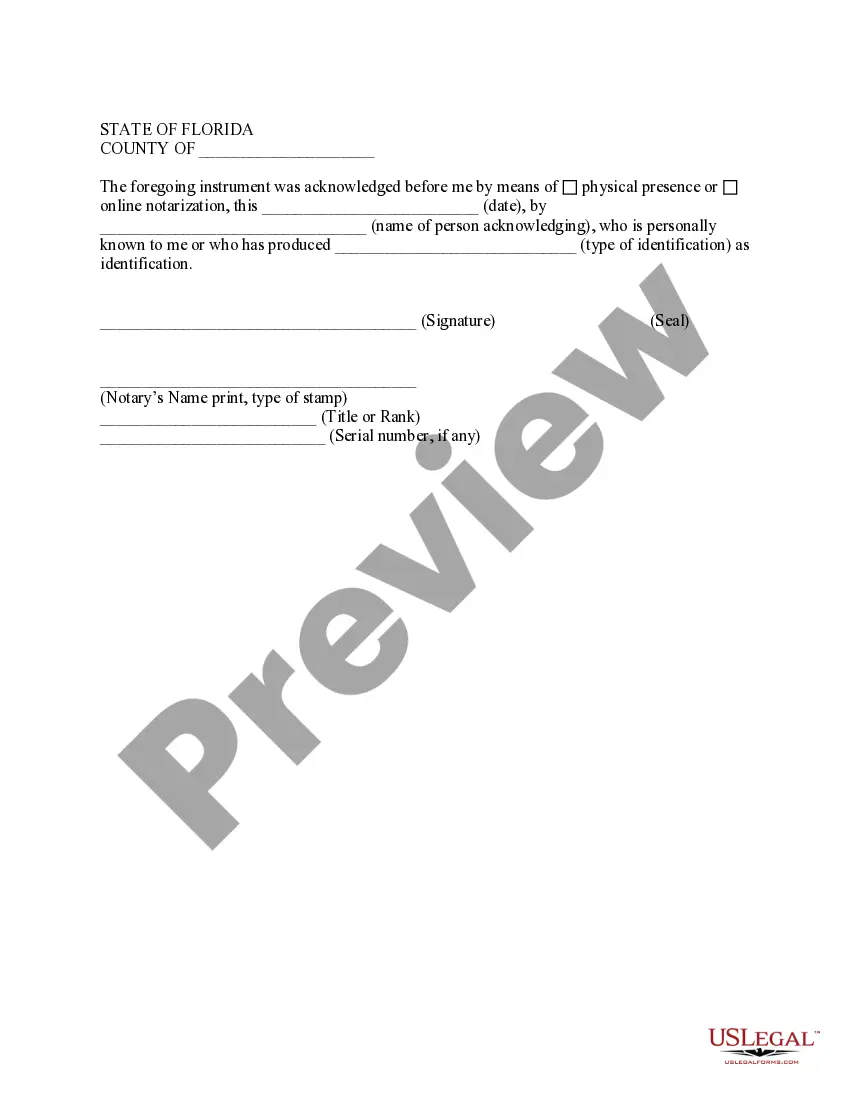

- Verify it is the right form by previewing it and looking at its description.

- Be sure that the sample is acknowledged in your state or county.

- Choose Buy Now when you are ready.

- Select a monthly subscription plan.

- Find the format you want, and Download, complete, eSign, print and send out your document.

Enjoy the US Legal Forms online library, backed with 25 years of expertise and trustworthiness. Transform your everyday document administration into a easy and intuitive process today.

Form popularity

FAQ

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Not all bank accounts are suitable for a Living Trust. If you need regular access to an account, you may want to keep it in your name rather than the name of your Trust. Or, you may have a low-value account that won't benefit from being put in a Trust.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Meet with your personal banker where your account is held. Tell your banker you would like to transfer a bank account into a trust. Remove any existing bank account beneficiaries. Present an official copy of the trust to your banker.

A grantor may place a mortgaged home in a living trust by signing a warranty or quitclaim deed from the current owners to the trust. In this case, the deed would name the living trust as grantee and would be and recorded just like any other property transfer.