Living Trust Form Sample For Married

Description

How to fill out Florida Assignment To Living Trust?

- If you have an existing account with US Legal Forms, log in and access your dashboard. Check your subscription status before proceeding.

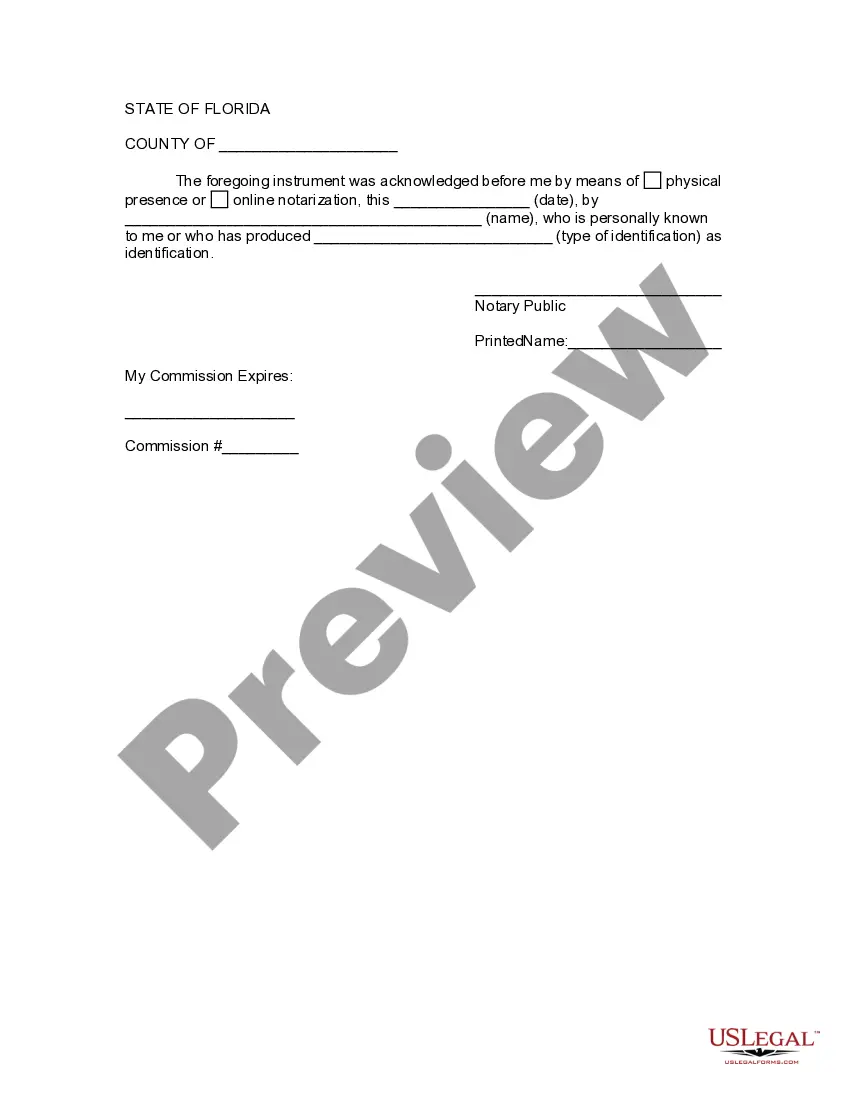

- Explore the Preview mode to review the living trust form sample tailored for married couples. Confirm it meets your local jurisdiction’s requirements.

- If adjustments are needed, utilize the Search function to find a more suitable template.

- Select the form and click on the Buy Now button. Choose a subscription plan that fits your needs and create an account if you're a new user.

- Complete your purchase by entering your payment information through your preferred method, either credit card or PayPal.

- Once your transaction is confirmed, download the template to your device from the My Forms section within your profile.

With US Legal Forms, you have access to a vast collection of over 85,000 legal forms, ensuring you find exactly what you need without hassle.

Start your journey towards efficient estate planning today by visiting US Legal Forms and downloading your living trust form now!

Form popularity

FAQ

To create a living trust template, begin by researching existing samples specifically designed for married couples. Use a living trust form sample for married individuals as a foundation for your template. Make sure you incorporate any legal requirements unique to your state. Finally, ensure that your template is comprehensive, covering all aspects of trust management and distribution.

Setting up a trust template involves selecting a reliable resource that provides a living trust form sample for married individuals. Once you find a suitable template, you can customize it to fit your needs. Be sure to include necessary details, such as beneficiaries and asset distribution. After finalizing the template, review it carefully, and consult an attorney if you have any legal questions.

To create a living trust by yourself, start by choosing the assets you want to include in the trust. Next, you will need to draft a living trust form sample for married couples, detailing how you want your assets distributed. It's crucial to sign the document and have it notarized to ensure its validity. Additionally, transferring your chosen assets into the trust is essential for it to work as intended.

The best trust for a married couple typically depends on individual circumstances, but many experts suggest a revocable living trust as a strong option. A living trust form sample for married couples can provide flexibility, allowing spouses to amend the trust as their lives change. Additionally, this trust helps avoid probate, ensuring a smoother transfer of assets. It's advisable to consult a legal professional to tailor the trust to your specific needs and goals.

Suze Orman often recommends a revocable living trust as a flexible option, particularly when reviewing a living trust form sample for married couples. This type of trust allows both partners to maintain control over their assets while providing a clear path for distribution after death. It also offers privacy, as assets in a revocable living trust do not go through probate. This can save time and reduce stress for loved ones during a difficult time.

When considering a living trust form sample for married couples, a joint trust can simplify management and allow for straightforward distribution of assets. Joint trusts often streamline the estate planning process, making it easier for the surviving spouse to access resources. However, separate trusts offer greater control and privacy, which some couples prefer. Ultimately, it’s essential to weigh the benefits of each option based on your unique financial situation.

Whether husband and wife should have separate trusts depends on their financial situation and goals. Separate trusts can offer distinct benefits, such as protecting individual assets or addressing specific needs. However, using a living trust form sample for married couples allows them to combine their assets while still achieving their individual objectives in a cohesive manner.

The best type of trust for a married couple is usually a joint revocable living trust. This option allows both spouses to manage and use their assets together while also providing a clear plan for distribution upon death. A living trust form sample for married couples can help outline these arrangements and simplify future transitions.

Married couples often benefit from revocable living trusts. This type of trust provides flexibility and control over assets during their lifetime while avoiding probate after death. Utilizing a living trust form sample for married couples can help ensure that both partners' wishes are met and protect their combined assets.

Suze Orman emphasizes the importance of trusts as an essential tool for financial planning. She often highlights that a properly structured trust can protect assets and simplify the transfer of wealth between generations. For married couples, using a living trust form sample can be an effective way to achieve their financial goals and secure their family's future.