Florida Assignment Agreement Forbearance

Description

How to fill out Florida Assignment To Living Trust?

Steering through the administrative processes of official documents and formats can be difficult, particularly if one is not engaged in that professionally.

Even locating the appropriate template for a Florida Assignment Agreement Forbearance will consume a lot of time, as it must be valid and precise to the last detail.

Nonetheless, you will need to spend significantly less time searching for an appropriate template if it originates from a trustworthy source.

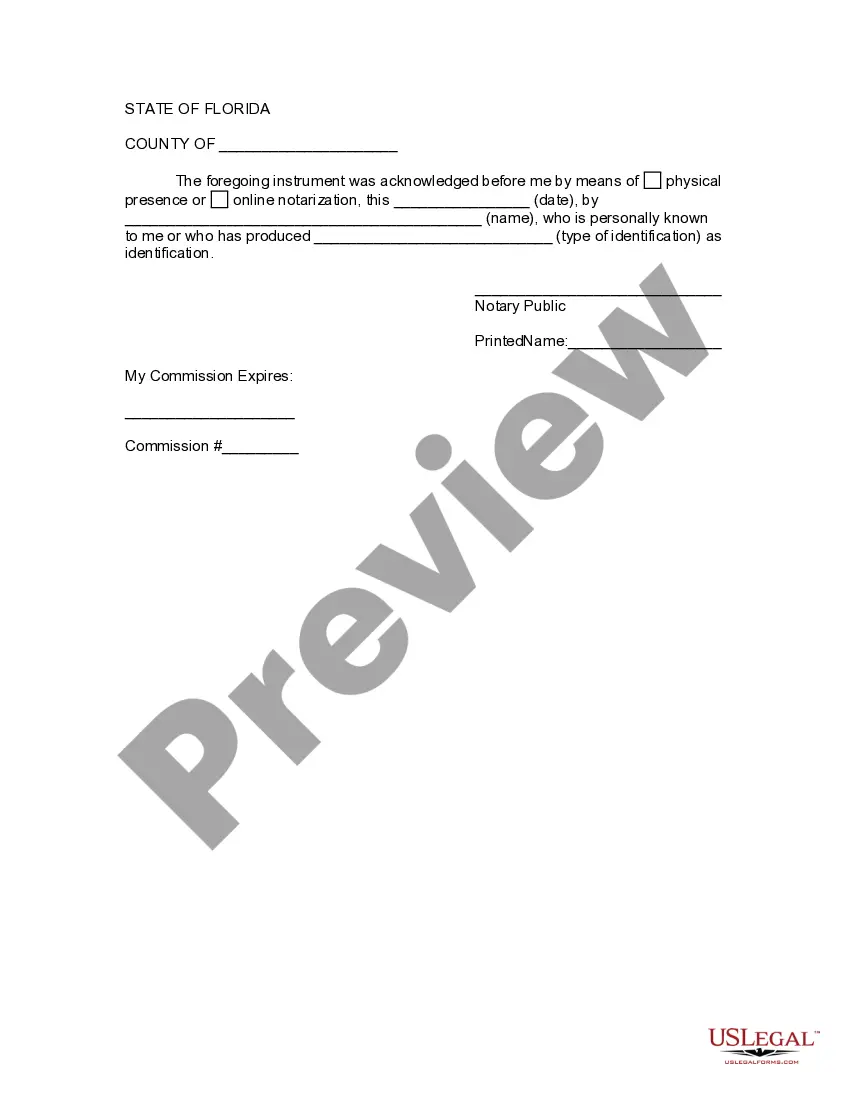

Acquire the correct document in a few straightforward steps: Enter the document's title in the search bar. Select the appropriate Florida Assignment Agreement Forbearance from the results. Review the details of the template or view its preview. If the template meets your criteria, click Buy Now. Continue to select your subscription plan. Use your email to create a secure password for your US Legal Forms account. Choose a credit card or PayPal payment method. Download the template file onto your device in your preferred format. US Legal Forms will save you time and effort in confirming whether the form you found online meets your requirements. Establish an account and gain unlimited access to all the documents you need.

- US Legal Forms is a service that streamlines the task of finding the right documents online.

- US Legal Forms serves as a single destination to acquire the latest document samples, verify their applicability, and download them for completion.

- This is a repository containing over 85,000 templates applicable across various domains.

- When searching for a Florida Assignment Agreement Forbearance, you won't have to doubt its authenticity since all forms are validated.

- Having an account with US Legal Forms will guarantee you can access all necessary samples effortlessly.

- You can store them in your history or add them to the My documents section.

- You can access your saved forms from any device by selecting Log In on the library website.

- If you haven't created an account yet, you can still search for the template you require.

Form popularity

FAQ

A forbearance agreement is made between a mortgage lender and a borrower that has gone delinquent on the repayment terms. In this agreement, the lender agrees not to foreclose on the mortgage, while the delinquent borrower agrees to a revised mortgage plan that will bring them current on the owed payments.

In a forbearance agreement, the loan owner ("lender") agrees to reduce or suspend your payments for a set amount of time. With a repayment plan, the lender temporarily increases your monthly payment by adding part of the overdue amount to your current payments so that you can get caught up on the loan.

Most types of forbearance are not automaticyou need to submit a request to your student loan servicer, often using a form. Also, for some types of forbearance, you must provide your student loan servicer with documentation to show that you meet the eligibility requirements for the forbearance you are requesting.

The documentation the lender requires varies by lender, but it may include a financial statement, proof of income, tax returns, bank statements, and a hardship statement.

A forbearance agreement is a contract, so you should include standard contract terms such as: (1) time is of the essence clause; (2) choice of law provision; (3) no delay or omission by bank shall constitute a waiver; (4) no oral modification clause; (5) parol evidence clause; (6) notice provisions and addresses of all