Trust Revocable Agreement With Japan

Description

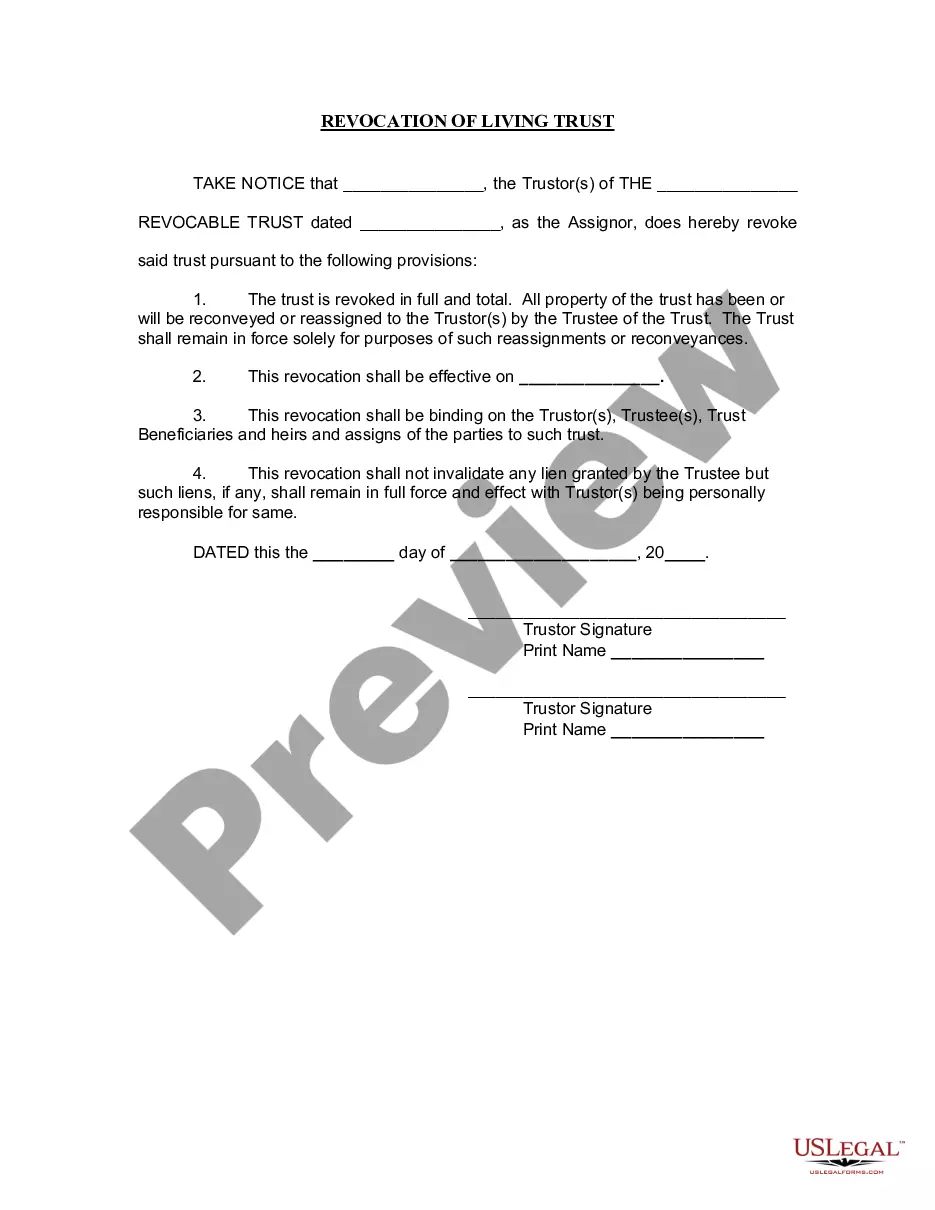

How to fill out Florida Living Trust For Husband And Wife With No Children?

Handling legal paperwork and operations could be a time-consuming addition to your day. Trust Revocable Agreement With Japan and forms like it usually require you to search for them and understand the way to complete them correctly. As a result, whether you are taking care of economic, legal, or individual matters, using a thorough and hassle-free web catalogue of forms close at hand will greatly assist.

US Legal Forms is the best web platform of legal templates, boasting over 85,000 state-specific forms and a variety of resources to help you complete your paperwork effortlessly. Explore the catalogue of pertinent documents open to you with just one click.

US Legal Forms gives you state- and county-specific forms available at any time for downloading. Protect your papers managing operations with a top-notch support that lets you make any form in minutes without additional or hidden charges. Simply log in in your account, find Trust Revocable Agreement With Japan and acquire it right away within the My Forms tab. You may also gain access to formerly downloaded forms.

Would it be your first time making use of US Legal Forms? Sign up and set up your account in a few minutes and you will have access to the form catalogue and Trust Revocable Agreement With Japan. Then, follow the steps listed below to complete your form:

- Be sure you have the right form using the Review feature and reading the form information.

- Choose Buy Now once all set, and choose the subscription plan that suits you.

- Press Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of experience helping users handle their legal paperwork. Find the form you want right now and improve any operation without breaking a sweat.

Form popularity

FAQ

Interest income earned by the trust is deductible if distributed to a foreign beneficiary but because the beneficiary is a nonresident alien, he will not be subject to U.S. income tax on the distribution. Therefore, the income is not subject to withholding tax (see Rev. Rul.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

Trusts in Japan. Despite its civil law tradition, Japanese law allows the creation of trusts as an estate- planning device. Whether trusts created under for- eign laws have effect with regard to Japanese assets, however, is less clear. Japanese statutes don't directly address this issue.

Yes, once the trust grantor becomes incapacitated or dies, his revocable trust is now irrevocable, meaning that generally the terms of the trust cannot be changed or revoked going forward. This is also true of trusts established by the grantor with the intention that they be irrevocable from the start.

Trusts, including trusts established abroad, are recognised and permitted in Japan both for legal and tax purposes.