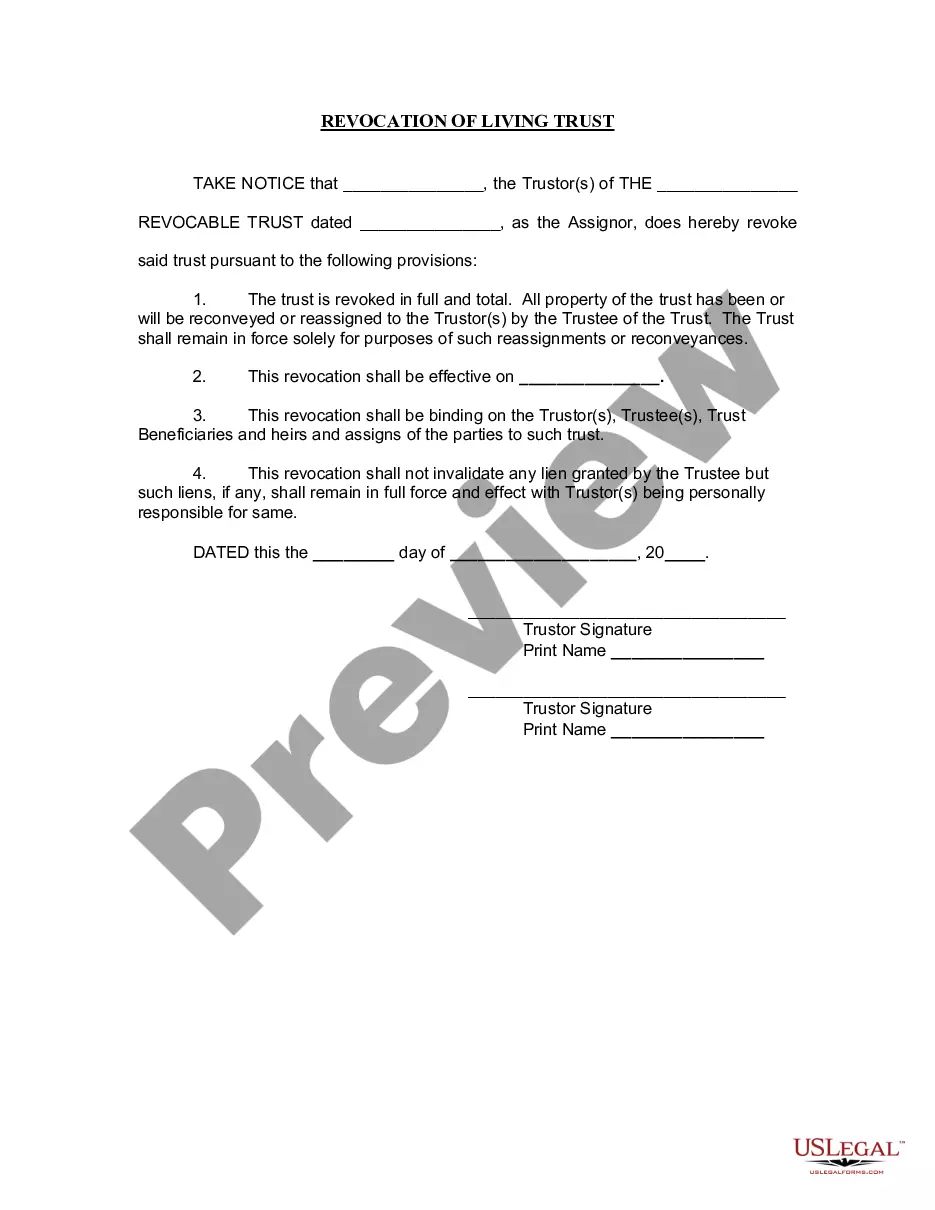

Trust Revocable Agreement For House

Description

How to fill out Florida Living Trust For Husband And Wife With No Children?

The Trust Revocable Agreement For House you see on this page is a multi-usable legal template drafted by professional lawyers in accordance with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, easiest and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Trust Revocable Agreement For House will take you just a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or check the form description to confirm it satisfies your requirements. If it does not, use the search bar to find the right one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Select the format you want for your Trust Revocable Agreement For House (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your papers one more time. Make use of the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Most trusts are named after the Trust Creators and also include the date the trust was created. Examples are ?John and Jane Smith Revocable Trust dated 1/1/20?; or ?Smith Family Trust dated 1/1/20?; or ?John W. Smith and Jane A. Smith Revocable Family Trust dated 1/1/20?.

However, revocable living trusts can be expensive, don't have direct tax benefits, and don't protect against creditors. Carefully weigh these pros and cons against your situation before deciding to set up a revocable living trust. A financial advisor can help you create an estate plan for your family's needs and goals.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.