Firpta Affidavit Form Florida For Minor Child

Description

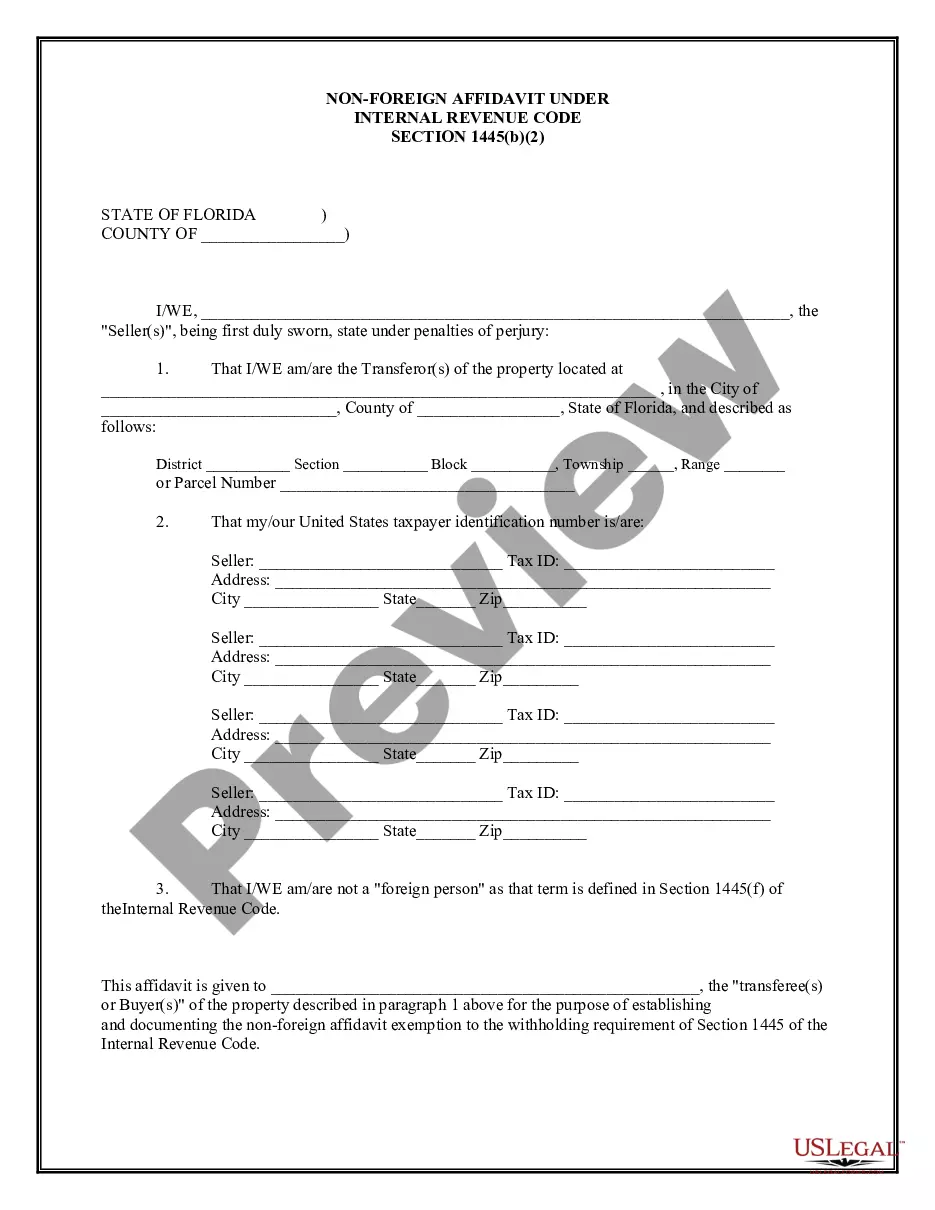

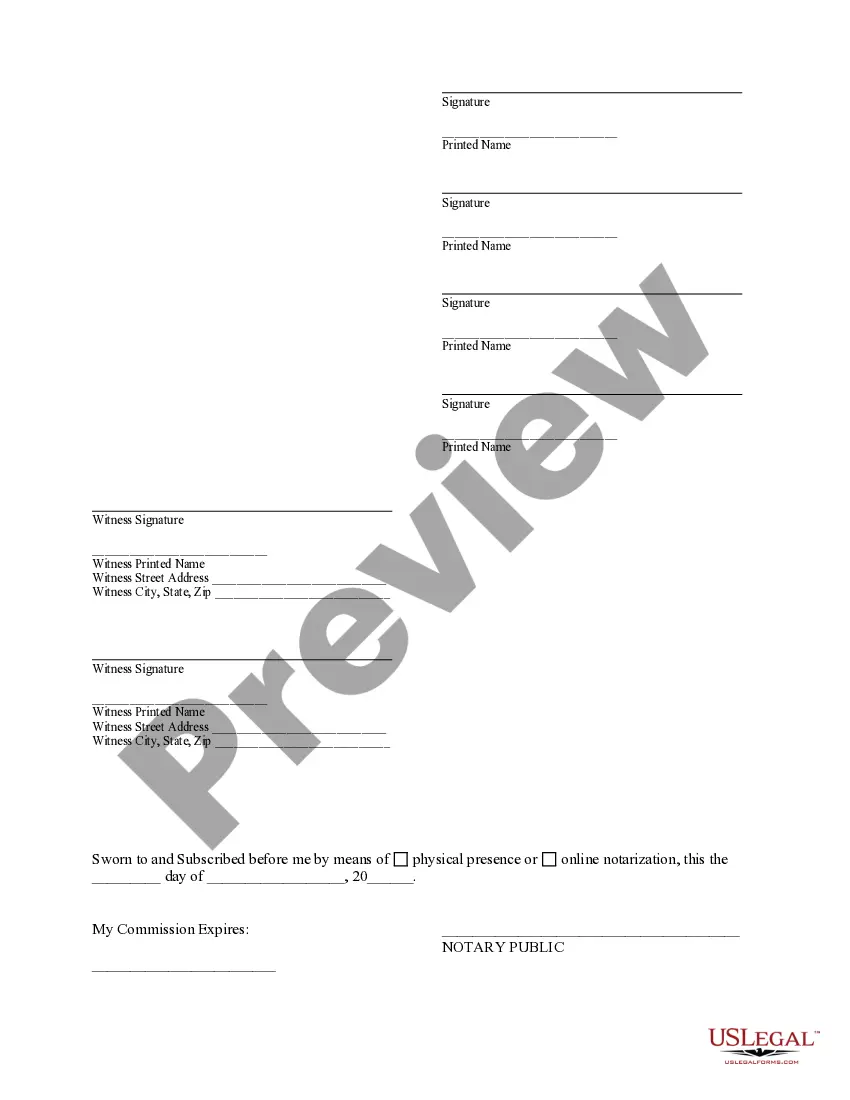

How to fill out Florida Non-Foreign Affidavit Under IRC 1445?

It’s no secret that you can’t become a legal expert overnight, nor can you learn how to quickly draft Firpta Affidavit Form Florida For Minor Child without the need of a specialized background. Putting together legal documents is a long process requiring a particular education and skills. So why not leave the preparation of the Firpta Affidavit Form Florida For Minor Child to the specialists?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court documents to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our website and get the form you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Firpta Affidavit Form Florida For Minor Child is what you’re searching for.

- Begin your search over if you need any other template.

- Register for a free account and choose a subscription plan to buy the form.

- Choose Buy now. Once the transaction is through, you can get the Firpta Affidavit Form Florida For Minor Child, complete it, print it, and send or send it by post to the designated people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Internal Revenue Code (?IRC?) §1445 provides that a transferee (Buyer) of a U.S. real property interest must withhold tax if the transferor (Seller) is a ?foreign person.? In order to avoid withholding, IRC §1445 (b) requires that the Seller (a) provides an affidavit to the Buyer with the Seller's taxpayer ...

No withholding is required provided that the sale price is $300,000 or less and the buyer (including family members) intends to use the property as a personal residence for at least 50% of the time it is in use for a period of 24 months after closing.

For example, FIRPTA law does not apply if you are buying a residence for $300,000 or less or the property is not a U.S. real property interest. To learn more about FIRPTA, including whether the law applies to your purchase, visit .irs.gov and type FIRPTA into the search field.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.