Florida Real Estate Closing Statement Sample With Seller Concessions

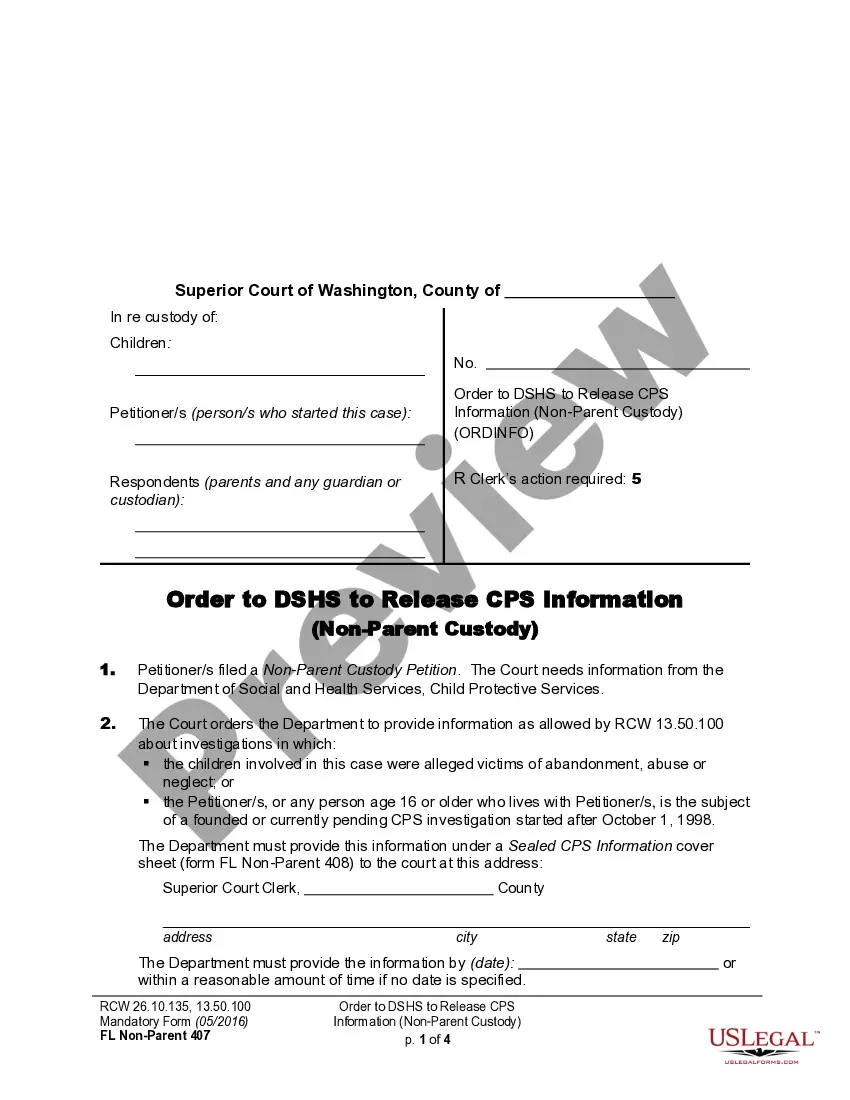

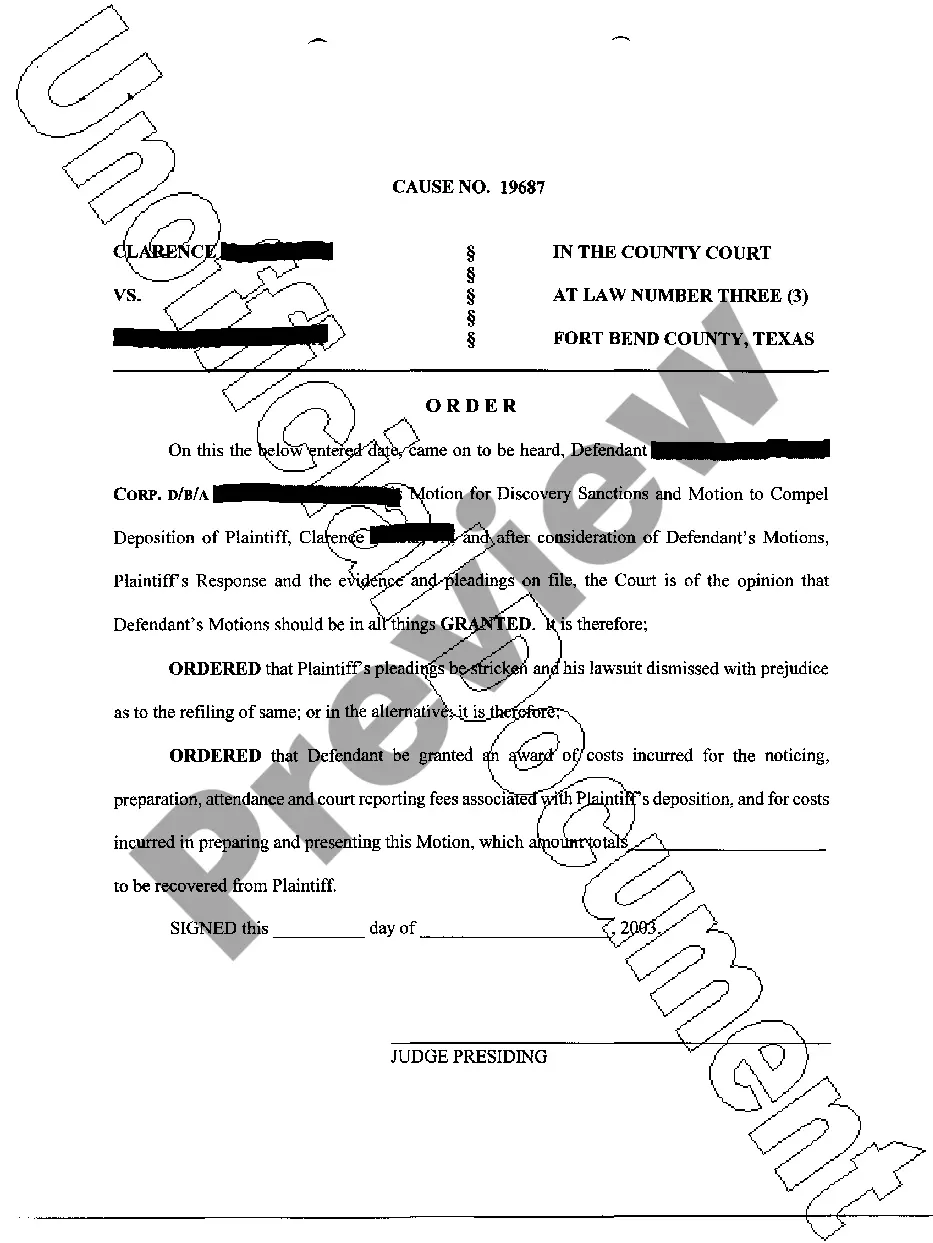

Description

How to fill out Florida Closing Statement?

Gaining access to legal document samples that adhere to federal and state regulations is crucial, and the internet provides numerous options to select from.

However, what is the use of spending time searching for the appropriate Florida Real Estate Closing Statement Sample With Seller Concessions online when the US Legal Forms digital library already houses such templates in a centralized location.

US Legal Forms is the premier online legal repository with over 85,000 editable templates created by legal professionals for any business and personal need.

Examine the template using the Preview feature or through the text description to verify it satisfies your needs.

- They are user-friendly to navigate with all documents categorized by state and intended use.

- Our experts keep up with legislative updates, ensuring that your form is always refreshed and compliant when procuring a Florida Real Estate Closing Statement Sample With Seller Concessions from our platform.

- Obtaining a Florida Real Estate Closing Statement Sample With Seller Concessions is quick and straightforward for both existing and new users.

- If you already have an account with a valid subscription, sign in and download the document sample you need in your desired format.

- If you are a newcomer to our site, follow the steps below.

Form popularity

FAQ

In general, a personal loan contract is just as legally binding between friends or family as it would be with a bank. However, a contract between friends or family might be simpler or have fewer terms.

You may be able to get a personal loan without income verification if you pledge collateral, use a co-signer or have an excellent credit score. June 6, 2023, at p.m. Some people who need money fast to pay for unexpected expenses or large purchases turn to personal loans.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Some of the easiest loans to get approved for include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with essentially no approval requirements typically charge the highest interest rates and loan fees.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.