Name Change Form For Irs

Description

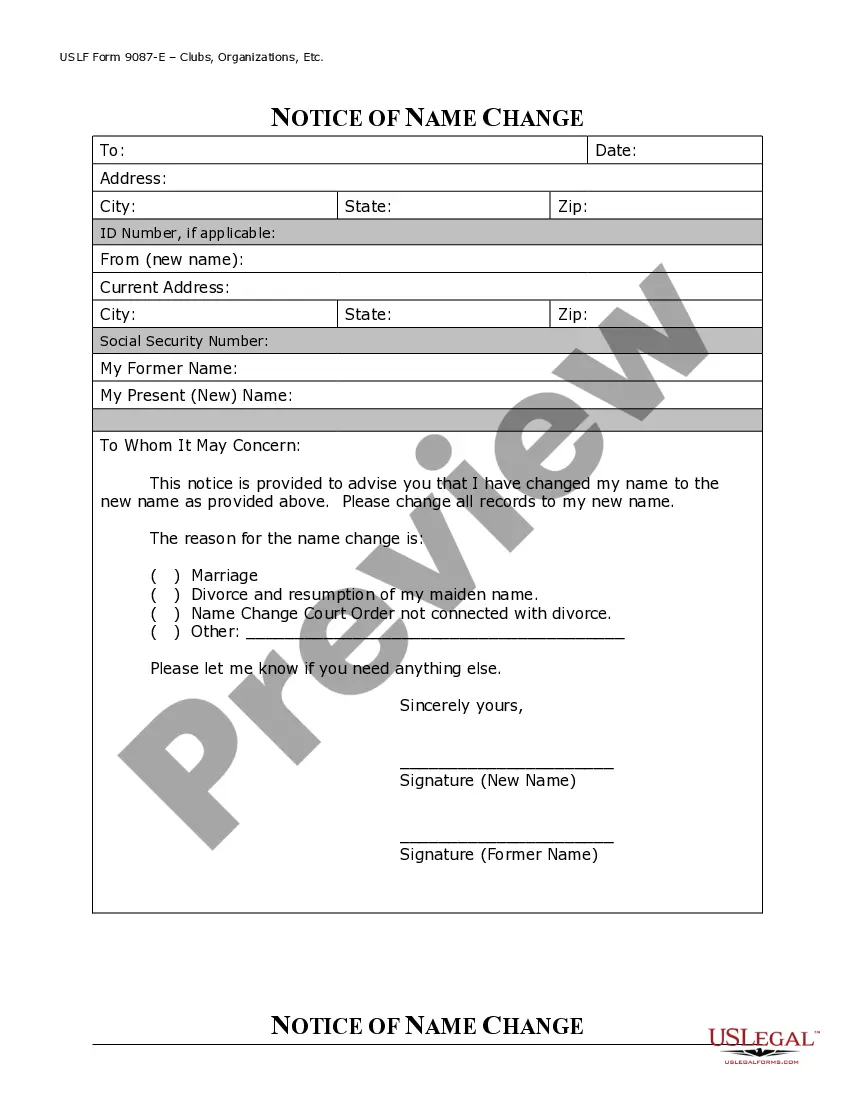

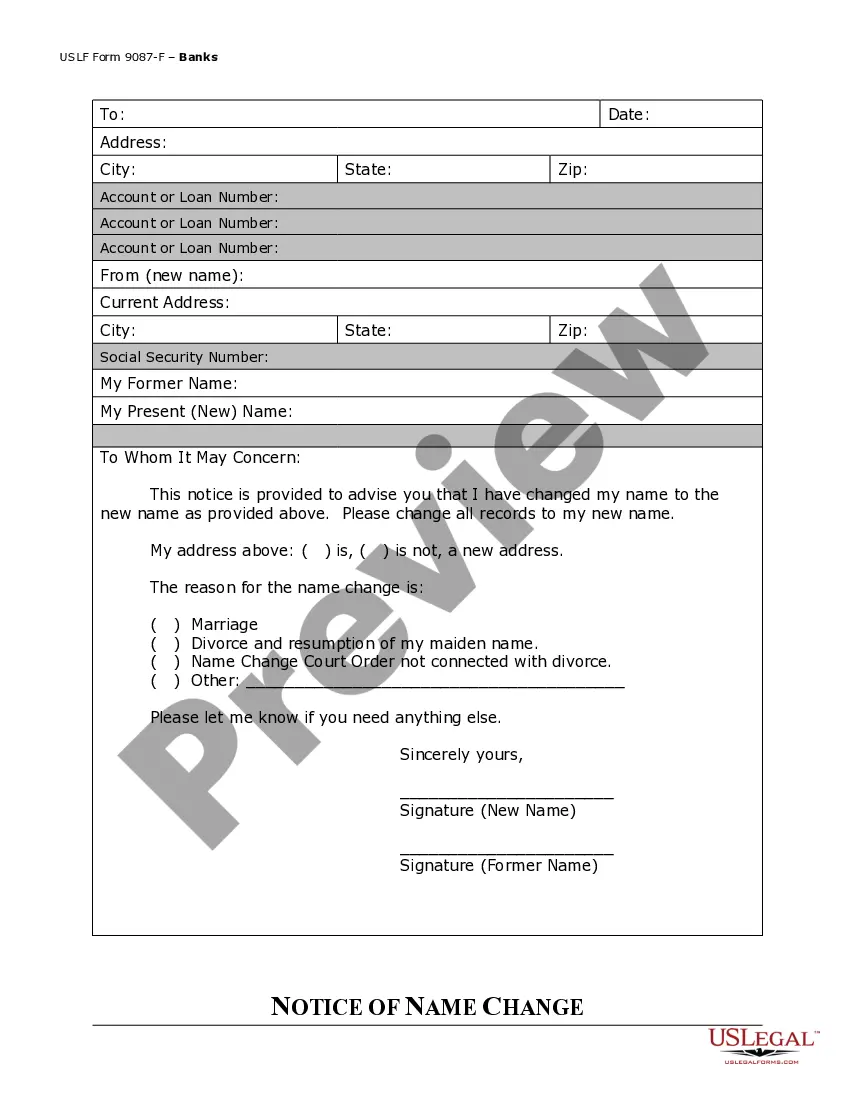

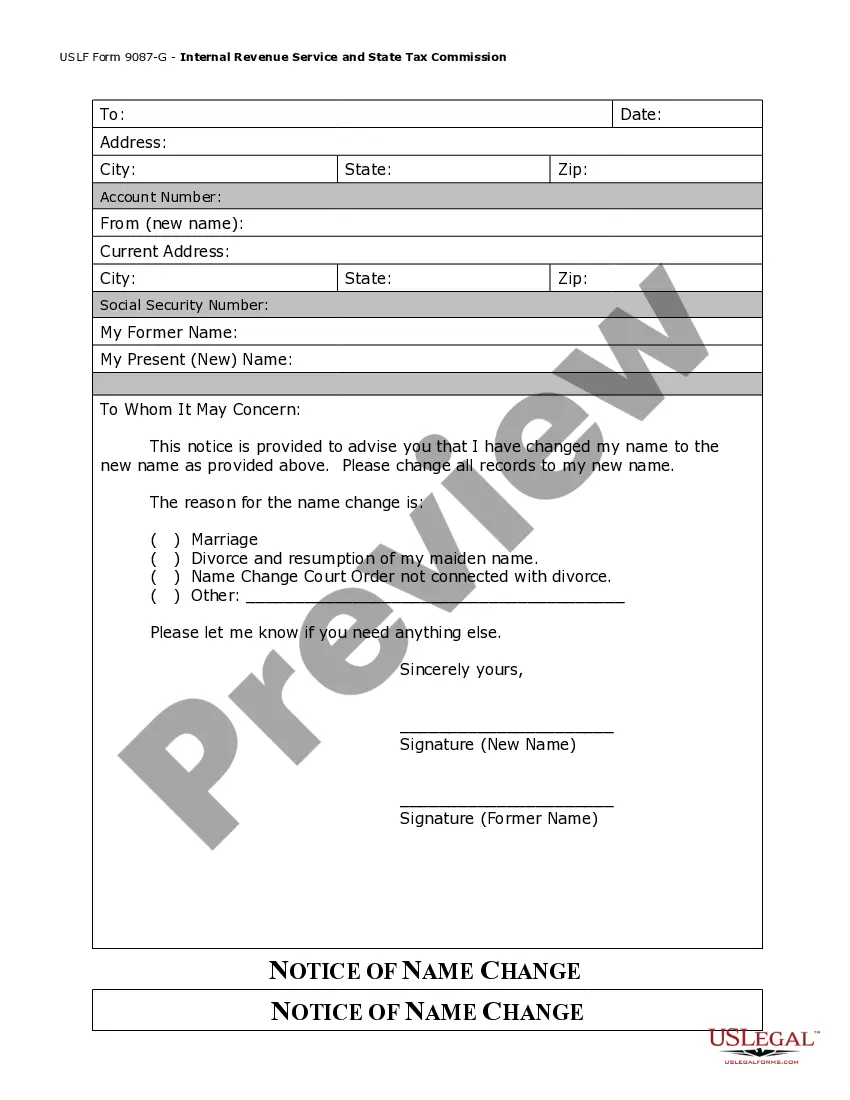

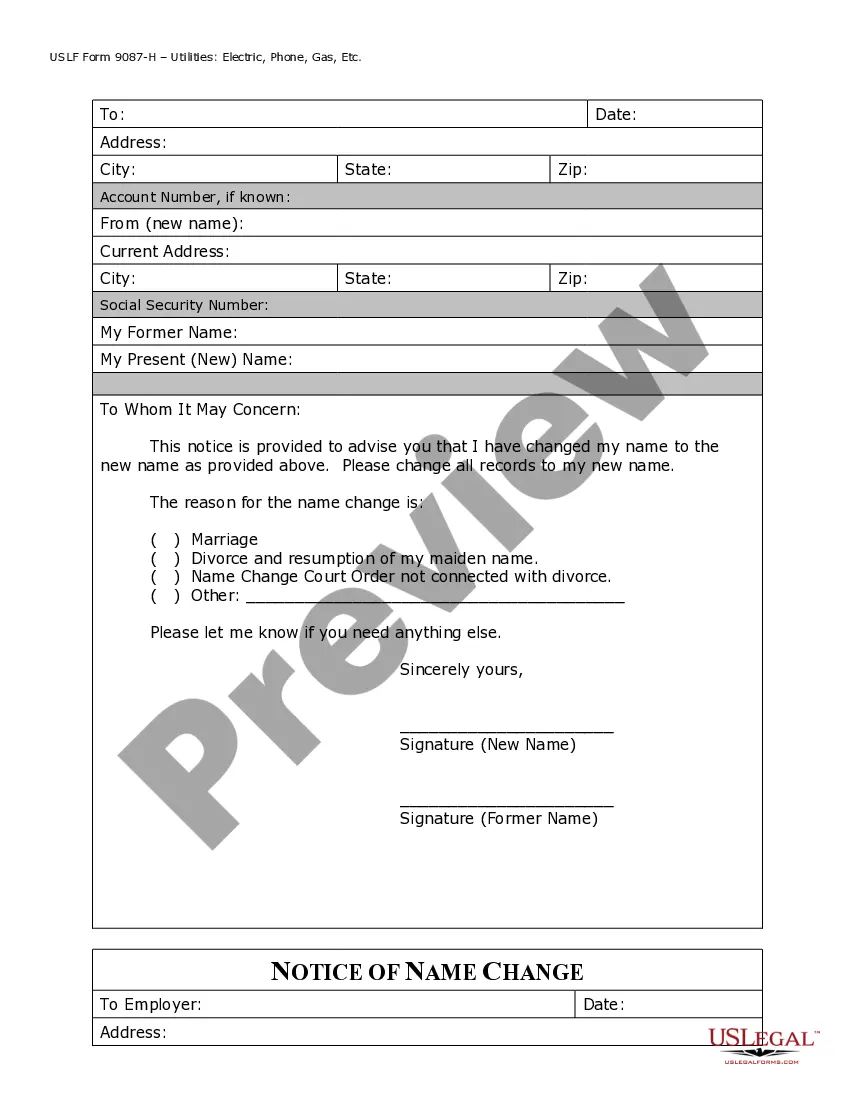

How to fill out Florida Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- Log in to your US Legal Forms account if you're already a user, and ensure your subscription is active. Click the Download button to get your name change form.

- For first-time users, browse the preview modes and form descriptions to find the correct name change form that aligns with your jurisdiction.

- If the desired form isn't available, utilize the search feature to locate the proper template that meets your needs.

- Select the form by clicking on the Buy Now button and choose a suitable subscription plan to gain full access.

- Complete the payment using credit card or PayPal for your selected subscription plan.

- Finally, download the form to your device, and access it anytime via the My Forms section of your profile.

Following these steps ensures that your name change process with the IRS is efficient and legally compliant. US Legal Forms stands out with its extensive collection of over 85,000 customizable legal templates, more than most competitors.

Embrace the ease of legal compliance today. Start your journey with US Legal Forms and make the name change process seamless!

Form popularity

FAQ

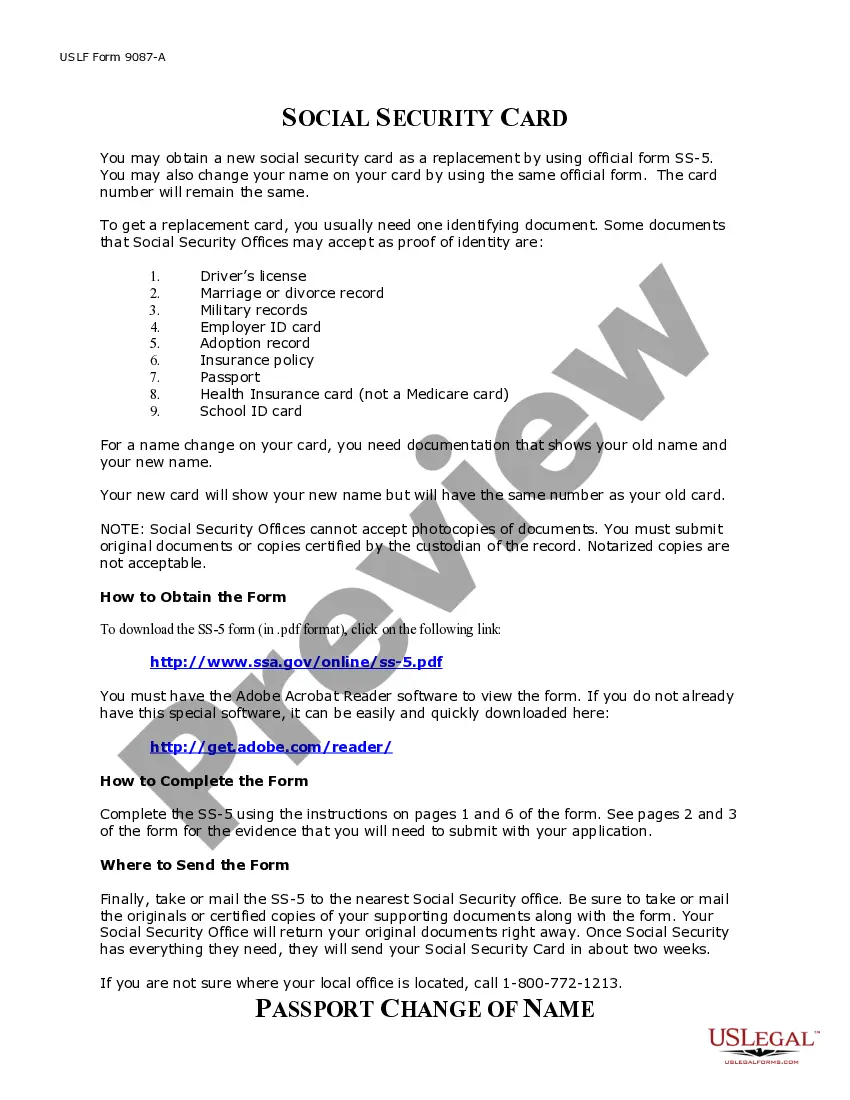

Some IRS forms cannot be filed electronically, including Form 8822, which is the name change form for the IRS. Other forms that fall into this category typically involve specific situations and filings. It is crucial to refer to the IRS website to check the full list of forms that cannot be submitted online.

Submitting a change of address online is currently not an option for the IRS. The IRS requires taxpayers to submit the change of address using Form 8822 through the mail. Ensuring your address is updated is vital, so do not hesitate to send in this form promptly.

No, you cannot electronically file Form 8822. This name change form for the IRS needs to be mailed physically to the appropriate address after completion. Utilizing the proper channels ensures that your name change is recorded without delays.

Most IRS forms cannot be submitted electronically, including Form 8822. While taxpayers can file many common tax forms online, specific forms still require mailing. Therefore, ensure you follow the correct submission methods indicated in the IRS guidelines.

Currently, you cannot electronically file Form 8822 online. This form must be printed and mailed to the IRS. Always check the IRS website for any updates on electronic filing options for the name change form for the IRS.

You can send your IRS name change letter, or Form 8822, to the address specified in the form instructions. Generally, the destination address depends on your state of residence. Checking the IRS website can provide you with the most accurate and updated mailing information.

To let the IRS know you changed your name, you should complete Form 8822. Once filled out, you can submit this form to inform the IRS of your name change officially. Remember to provide accurate information, as discrepancies can lead to issues with your tax records.

Yes, there is a name change form for the IRS, specifically Form 8822. This form allows you to notify the IRS of any changes to your name. Completing this form ensures that your tax records match your current legal name, which is important for accurate record-keeping and tax processing.

To notify the IRS of a business change of ownership, you should file Form 8822-B. This form ensures that the IRS is aware of any changes in the responsible party for your business. It is important to keep your business records current to avoid complications with tax filings. Utilizing an appropriate name change form for IRS can facilitate timely updates.

To change your trust address, you will need to file Form 8822, which is the Name change form for IRS. This form allows you to update the IRS with the new address of your trust. Completing this form ensures that the IRS maintains accurate records regarding your trust. If you are handling various documents for your trust, using uslegalforms platform can streamline this process for you.