Florida Tenant Out For Security Deposit

Description

Form popularity

FAQ

The new security deposit law in Florida greatly impacts how landlords and tenants approach security deposits. Under this law, landlords now have specific guidelines regarding the collection, holding, and return of security deposits, which benefits Florida tenants out for security deposit claims. Tenants should be aware of their rights and the timelines set for the return of their deposits after moving out. Utilizing resources like US Legal Forms can help you navigate these new regulations confidently.

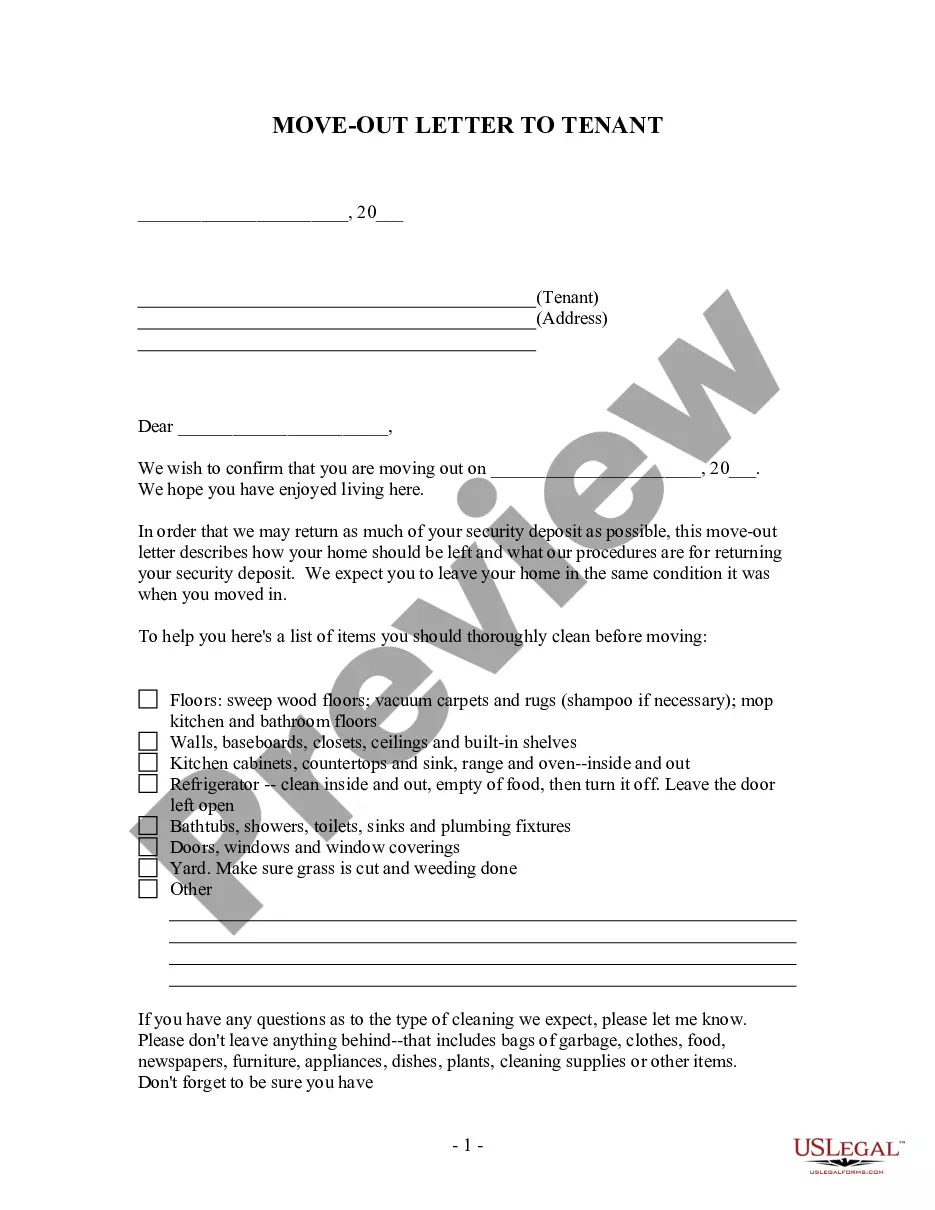

When writing a demand letter for your security deposit, start by including your address and the landlord's contact information. Clearly state the amount owed and provide the facts around your tenancy, including the lease dates and any compliance with move-out requirements. For more formal templates, consider using the uslegalforms platform, which can help streamline the process as you navigate being a Florida tenant out for security deposit.

To ensure a smooth security deposit return, the landlord must first conduct a walkthrough to assess any potential damages. After that, they need to send the deposit back along with an itemized list of any deductions, if necessary. For landlords looking for structured guidance, the uslegalforms platform offers templates to help you prepare the required documents.

Yes, Florida law does require landlords to provide receipts for a security deposit. This documentation is crucial as it protects both the tenant and landlord by giving proof of the transaction. So, when dealing with your security deposit as a Florida tenant, insist on keeping a record of all receipts.

In Florida, a landlord can ask for a maximum security deposit equivalent to two months' rent for an unfurnished property. For a furnished property, this amount can increase to three months' rent. It is essential for tenants to know their rights to avoid overcharges when you are a Florida tenant out for security deposit.

After you move out, a Florida landlord has 15 days to return your security deposit if they do not plan to make any deductions. If deductions are needed, they must send you an itemized list within 30 days, allowing you to understand the reasons for the withholding. Therefore, it’s crucial to stay informed as a Florida tenant out for security deposit.

In Florida, landlords can collect a security deposit but must adhere to specific rules. When you are a Florida tenant out for security deposit, the law mandates that the deposit must be kept in a separate account. Additionally, landlords must provide written notice about where the deposit is held and the tenant's rights regarding its return.

To dispute security deposit charges in Florida, begin by reviewing your lease and the reasons for the charges. You can communicate directly with your landlord, presenting any evidence that supports your case. If necessary, you may escalate the issue by filing a dispute resolution request or pursuing legal action, especially in cases involving the Florida tenant out for security deposit.

To impose a claim on a security deposit in Florida, you must first notify the tenant in writing. This notice must specify the reasons for withholding the deposit and should be sent within 30 days after the tenant vacates the property. Using a platform like uslegalforms can help streamline this process, ensuring you follow the appropriate legal steps regarding the Florida tenant out for security deposit.

If a landlord does not return a security deposit in Florida, they may be subject to penalties under state law. Tenants can file a claim in court to recover the deposit along with any applicable damages. Thus, knowing your rights as a Florida tenant out for security deposit is crucial in these situations.