An assignment is the transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, chattel, or other thing assigned. An assignment is distinguished from a grant in that an assignment is usually limited to the transfer of intangible rights, including contractual rights, choses in action, and rights in or connected with property, rather than, as in the case of a grant, the property itself. Some contracts restrict the right of assignment, so the terms of the contract must be read to determine if assignment is prohibited. For example, a landlord may permit a lease to be assigned, usually along with an assumption agreement, whereby the new tenant becomes responsible for payments and other duties of the original lessee.

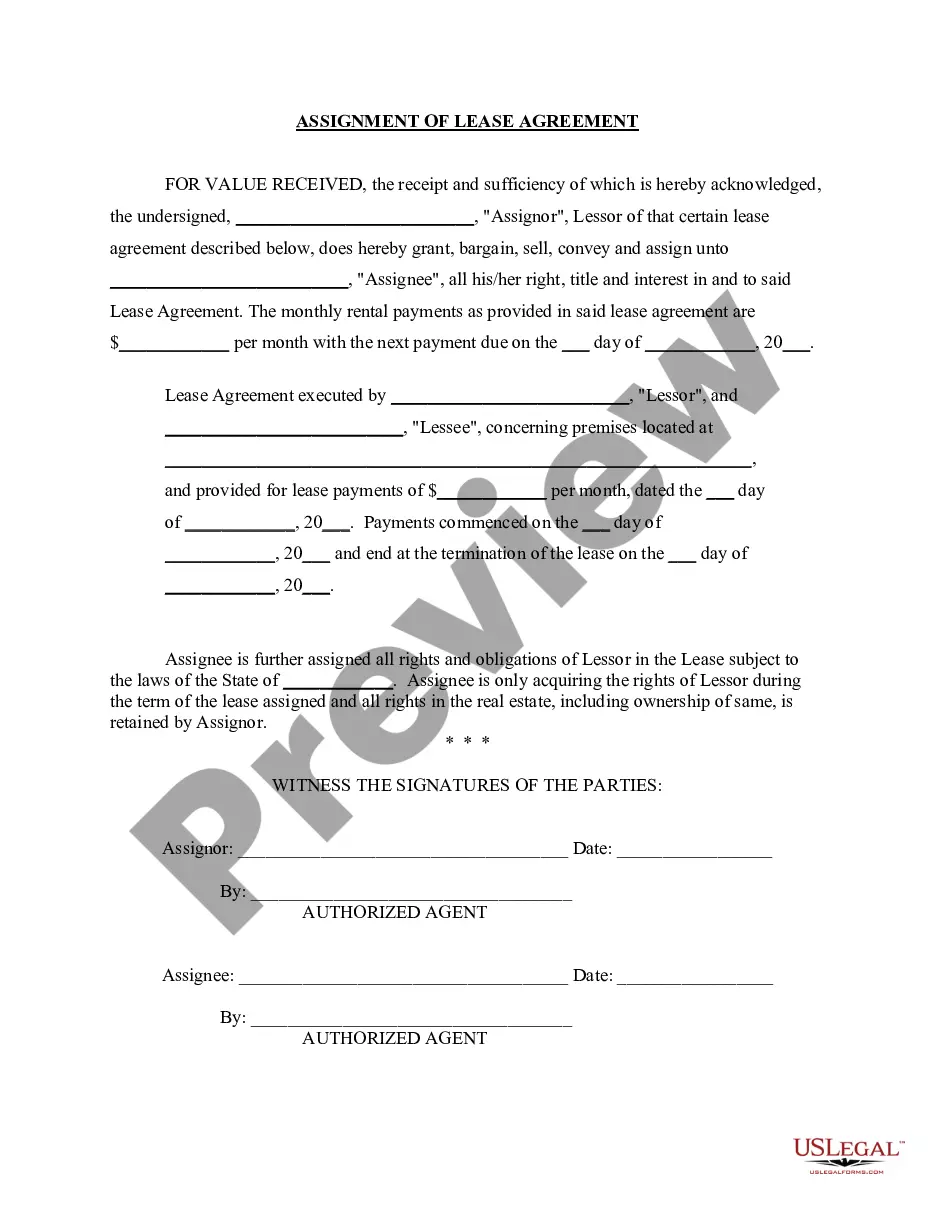

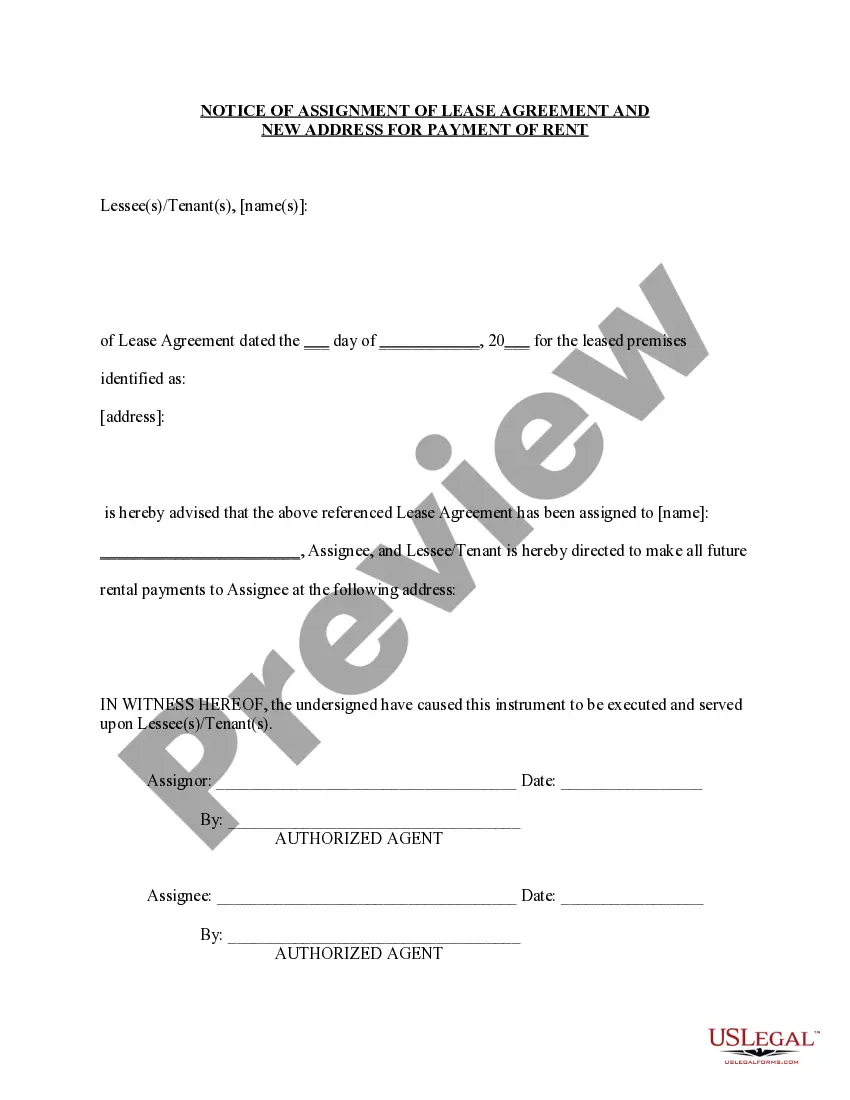

Assignment of Lease Florida without Lease Agreement In the state of Florida, an assignment of lease refers to the legal transfer of lease rights and obligations from one party to another when a lease agreement is in place. However, there are instances where parties may need to proceed with an assignment of lease without a lease agreement. This unique scenario comes with certain considerations and implications. In this detailed description, we will explore the concept of assignment of lease in Florida without a lease agreement and cover any potential variations that may exist. What is an Assignment of Lease? An assignment of lease is a legal agreement that allows a tenant (assignor) to transfer their lease rights and responsibilities to another individual or business entity (assignee). The assignee then becomes responsible for fulfilling the terms of the lease, including rent payment, maintenance obligations, and compliance with lease conditions. This process typically requires the consent of the landlord. Assignment of Lease Florida without Lease Agreement: Though it is common practice to have a lease agreement in place before pursuing an assignment of lease, Florida recognizes situations where an assignment may occur even without a formal lease agreement. It is important to note that the absence of a lease agreement may make the assignment process more complex and potentially raise legal concerns. While the assignment of a lease without a lease agreement is not expressly defined in Florida law, it may occur in the following circumstances: 1. Verbal Agreements: In some cases, a tenant may have entered into a lease agreement orally or through an informal arrangement. If the landlord acknowledges and recognizes these verbal terms, an assignment of lease can still take place with proper consent and documentation. 2. Lease Abandonment: If a tenant vacates a property without formally terminating their lease agreement or providing notice to the landlord, the landlord may consider this as an abandonment of the lease. In such cases, the landlord may have the discretion to assign the lease to a new tenant without the need for a formal lease agreement. 3. Sublease Agreements: While not synonymous with a lease assignment, a sublease agreement can sometimes be established without a formal lease agreement. In a sublease scenario, the original tenant becomes the sublessor, and the new tenant becomes the sublessee, assuming partial responsibility for rent payment and lease obligations. However, the sublessor retains primary responsibility for fulfilling the terms of the original lease agreement with the landlord. It is crucial to consult with legal professionals familiar with Florida real estate and lease laws to ensure compliance and protection of one's rights in situations involving assignment of lease without a lease agreement. In conclusion, Assignment of Lease Florida without a lease agreement refers to the transfer of lease rights and responsibilities in situations where a formal lease agreement may be absent. This can occur in cases of verbal agreements, lease abandonment, or sublease arrangements. It is vital to seek legal advice and documentation to ensure the validity and protection of all parties involved.