Florida Double Llc Withdrawal

Description

Form popularity

FAQ

Yes, you can remove yourself from an LLC in Florida, but the process involves specific steps. Typically, this action requires approving amendments to the operating agreement and notifying state authorities. If you're considering Florida double LLC withdrawal, understanding your rights and options is vital. Consulting platforms like US Legal Forms can provide valuable resources to ensure a smooth transition.

A double LLC in Florida refers to the establishment of two separate LLCs, often for different business ventures or asset protection purposes. This structure allows individuals to compartmentalize risks associated with each entity, which can lead to better liability management. If you're exploring Florida double LLC withdrawal, it's essential to grasp how this structure impacts your overall strategy and obligations.

While forming an LLC in Florida offers flexibility and protection, there are drawbacks to consider. One major concern is the potential for self-employment taxes, which might affect your overall profit. Additionally, maintaining compliance with state regulations can require time and effort, including regular filings and fees. Understanding these factors is crucial, especially if you're contemplating Florida double LLC withdrawal.

In Florida, an LLC can have multiple Doing Business As (DBA) names. This flexibility allows you to operate different business ventures under one legal entity. However, each DBA must be registered with the Florida Division of Corporations. By managing DBAs effectively, you can streamline your operations and enhance your marketing strategies while simplifying the Florida double LLC withdrawal process.

Yes, in Florida, you can operate multiple Doing Business As (DBA) names under one LLC. This flexibility allows you to diversify your business offerings without forming multiple legal entities. Understanding how to manage this is essential, especially when considering a Florida double LLC withdrawal. ZenBusiness can help you file for additional DBAs efficiently, keeping your business organized.

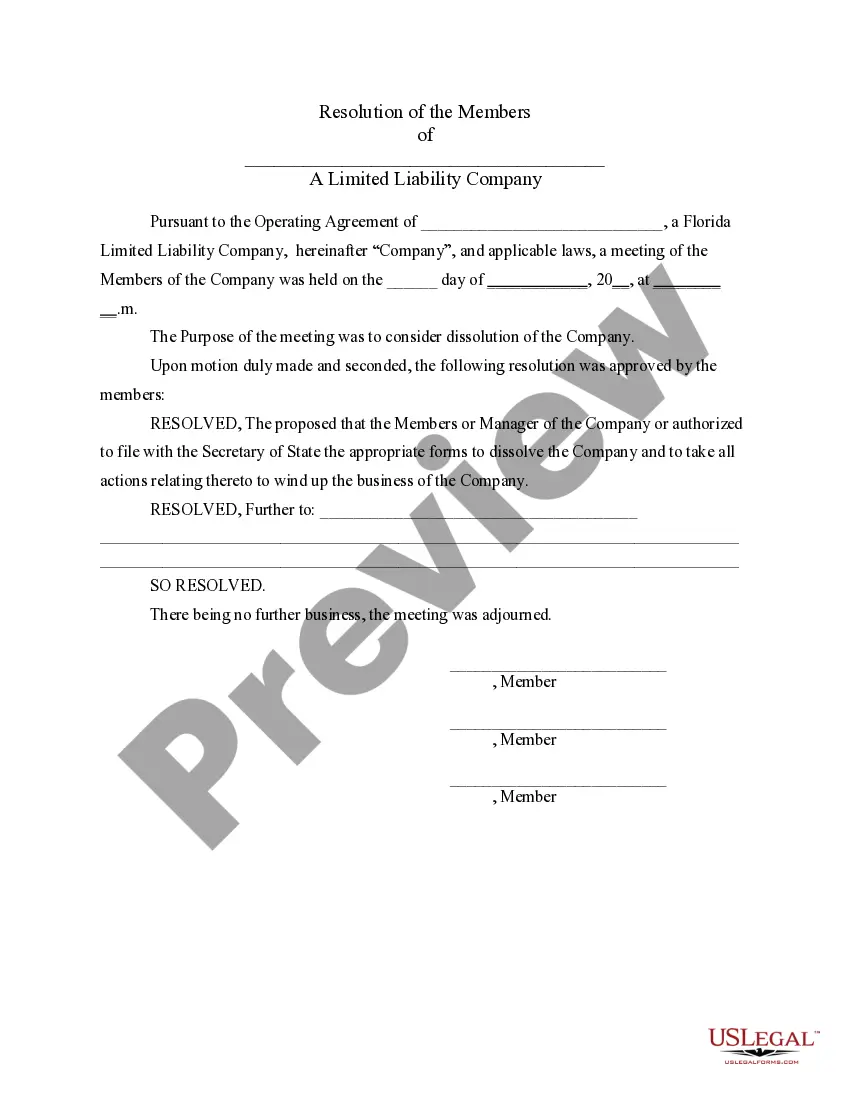

To shut down a business in Florida, you must formally dissolve your LLC by filing the necessary paperwork with the state. This includes addressing debts and obligations your business may have. If your business involves a Florida double LLC withdrawal, ensure you comply with all legal requirements to close your operations securely. Using platforms like ZenBusiness can streamline this process for you.

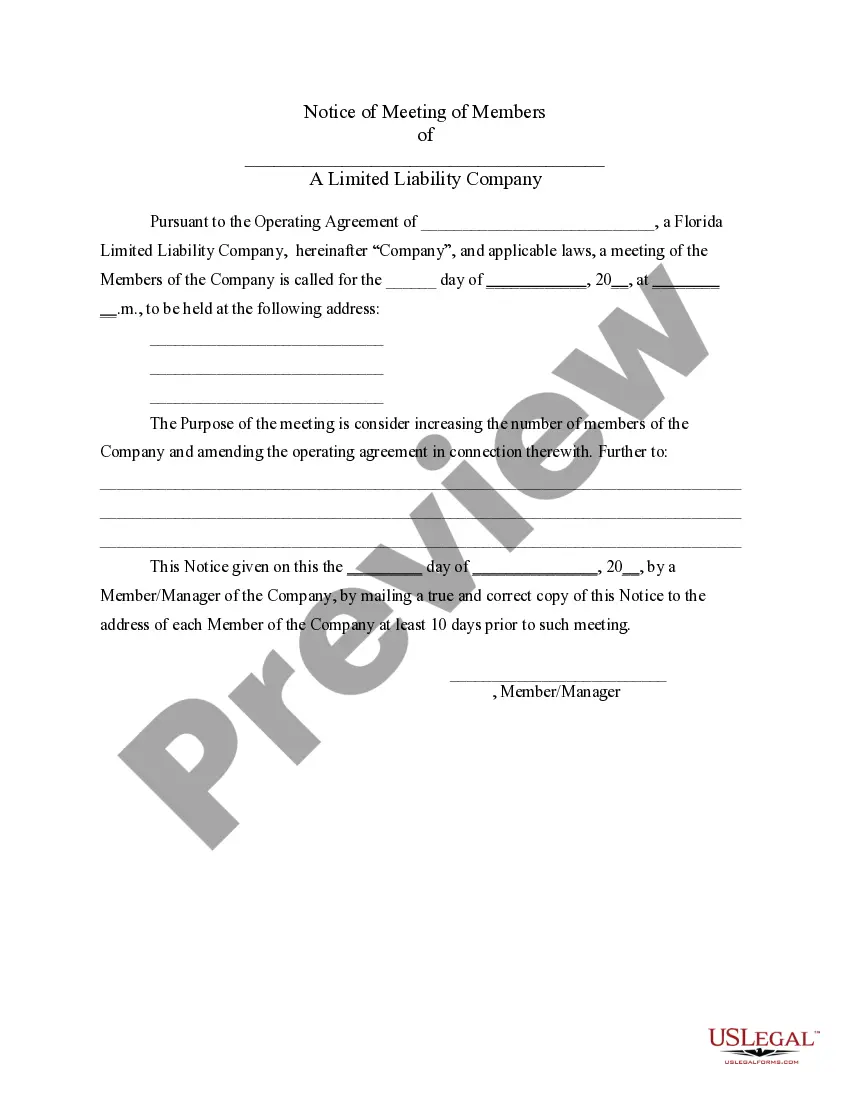

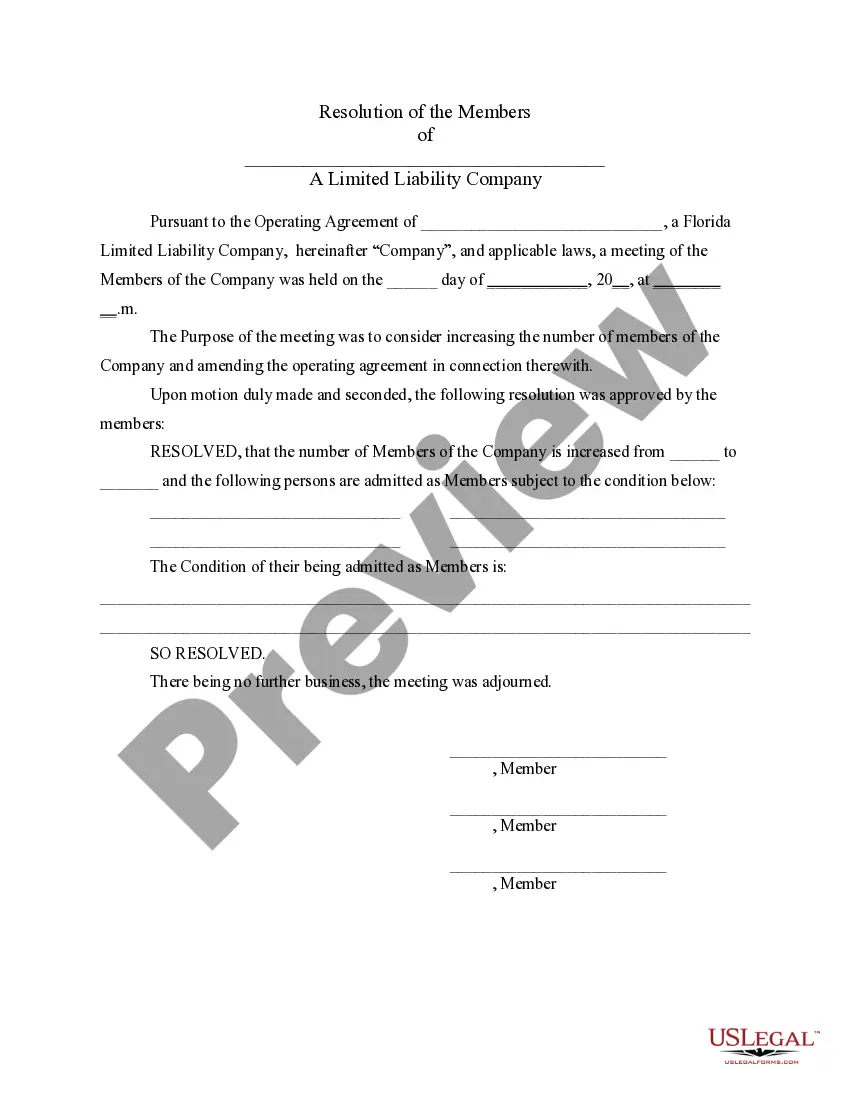

Removing someone from an LLC in Florida requires a careful approach, often following the guidelines in your operating agreement. Documentation must be processed according to state rules. If you are navigating a Florida double LLC withdrawal, resources from US Legal Forms can provide the assistance you need.

To remove yourself from an LLC in Florida, you will need to follow the withdrawal process outlined in your operating agreement. This may involve drafting an amendment and submitting it to the state if ownership percentages change. This step is particularly relevant if you're considering a Florida double LLC withdrawal.

To remove a registered agent from your LLC in Florida, you must submit a Statement of Change of Registered Agent to the Florida Division of Corporations. It’s important to select a reliable new agent in advance, especially during processes like Florida double LLC withdrawal.

Yes, one partner can dissolve an LLC in Florida if the operating agreement allows for it. Typically, this requires notifying other members and filing specific documents with the state. Understanding the dissolution process is vital, particularly in cases of Florida double LLC withdrawal.