Enhanced Estate Five With The Best

Description

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Quitclaim - Individual To Five Individuals?

- If you're an existing user, log into your account to access your forms. Ensure your subscription is active; renew if necessary according to your plan.

- For first-time users, start by previewing the desired form. Confirm that it meets local jurisdiction requirements.

- If you need a different template, utilize the Search tab to find the right one. Select the appropriate document to proceed.

- Click on the Buy Now button and choose a subscription plan that aligns with your needs. Create an account to unlock library access.

- Complete your purchase using a credit card or PayPal.

- Download the form and save it on your device. Access your documents anytime from the My Forms section of your profile.

Concluding your legal documentation doesn't have to be stressful. With US Legal Forms, you can confidently navigate the process while ensuring that your documents are precise and legally sound.

Take the next step towards hassle-free legal compliance by exploring US Legal Forms today!

Form popularity

FAQ

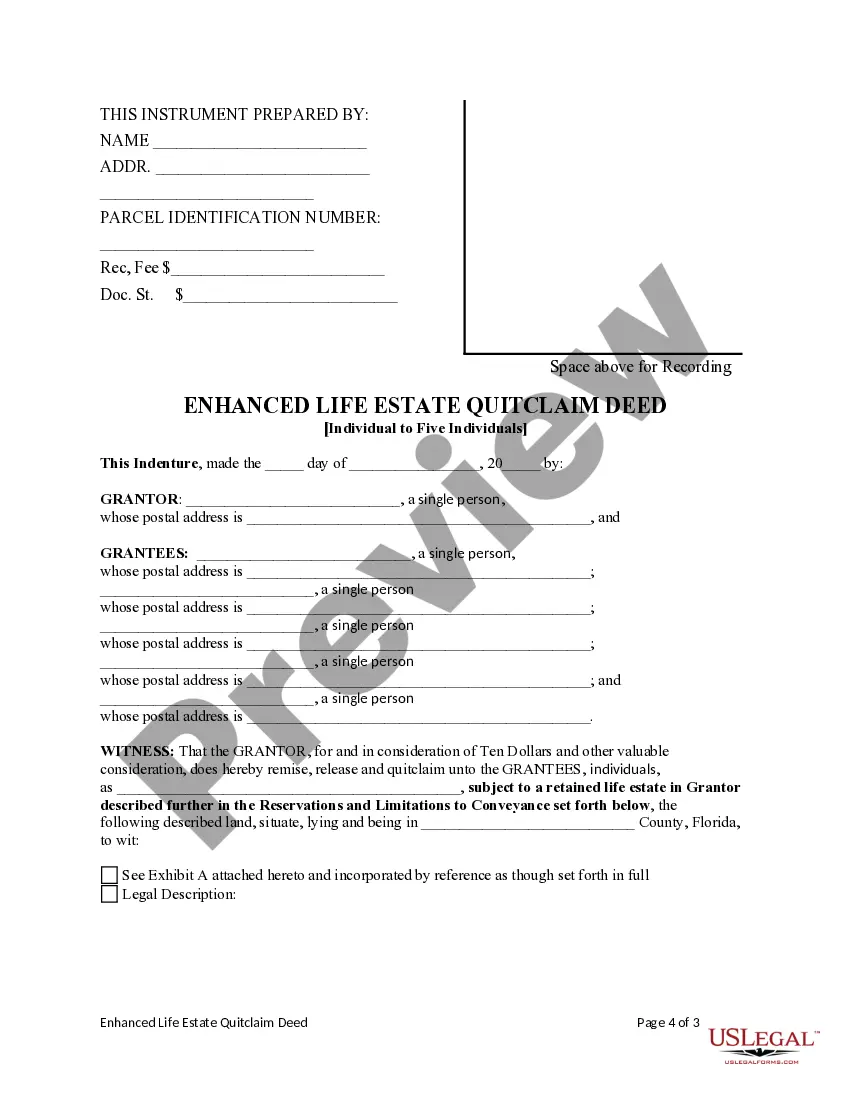

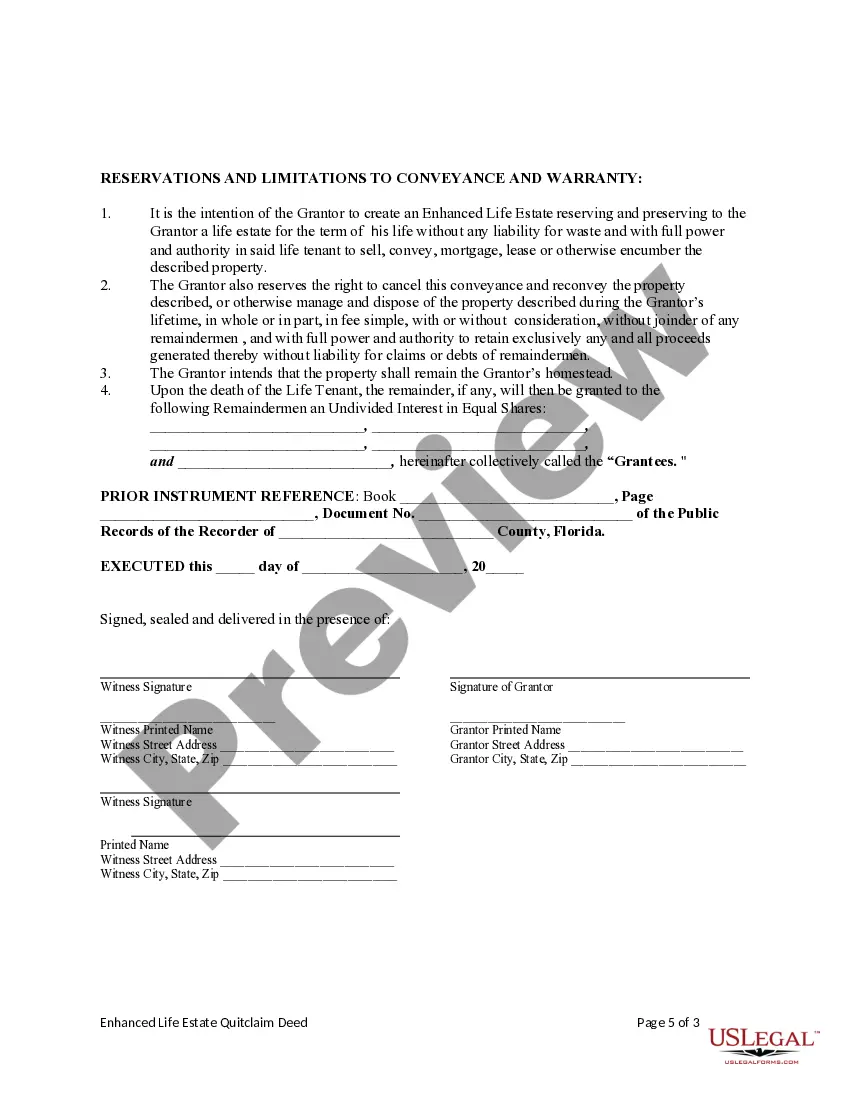

The primary difference lies in control and flexibility. A life estate deed restricts your options after you create the deed, while an enhanced life estate deed allows you to make changes during your lifetime. Choosing the enhanced estate five with the best means you can enjoy greater benefits and smoother transitions of your property.

In Florida, the enhanced life estate deed allows you to retain the right to live in and manage the property while designating beneficiaries upon your death. This deed simplifies the transfer process, avoiding probate and providing more control over your assets. With the enhanced estate five with the best, you secure a straightforward means of asset management.

The two general types of life estates are traditional life estates and enhanced life estates. Traditional life estates grant rights only during your lifetime, whereas enhanced life estates allow you greater flexibility. Understanding these differences helps you choose the enhanced estate five with the best for your needs.

A life estate allows you to use and benefit from the property for your lifetime, while an enhanced life estate includes added benefits. With an enhanced life estate, you maintain more control over property changes and avoid probate when you pass. Therefore, it reflects a smart choice for those seeking the enhanced estate five with the best.

The ladybird deed may limit your control over your property while you're alive. You can revoke it, but it's essential to consider potential tax implications and impacts on Medicaid eligibility. Additionally, heirs might have to navigate probate if any issues arise, which can complicate the transfer of property under the enhanced estate five with the best.

A ladybird deed can supersede a will concerning the property it covers. When you designate beneficiaries in a ladybird deed, they automatically inherit the property upon your death, regardless of what your will states. This can lead to conflicts if proper planning isn't done, so it's essential to align your estate planning documents to ensure a smooth distribution of your assets.

While the Lady Bird deed can streamline property transfer, it has its challenges. One major concern is its limited applicability; it may not meet the needs of everyone, especially those with complex estates. Furthermore, if not drafted properly, it could lead to unintended consequences for your heirs, making it crucial to work with experts who understand enhanced estate five with the best.

An enhanced life estate deed allows you to retain the right to live in your property while designating heirs who will receive it after your death. For instance, you may create an enhanced estate five with the best by naming your children as beneficiaries, ensuring they inherit the property without going through probate. This approach often simplifies the transfer process and maintains family ownership.

Medicaid may pursue recovery against your estate after your passing, but having a ladybird deed can provide some protection. Since the property ownership transfers directly to your heirs upon death, it may not be considered part of your estate for Medicaid recovery. However, it's important to consult with legal professionals to ensure you fully understand your options and protect your assets.

Choosing between a trust and a ladybird deed depends on individual needs. A trust offers robust protection for your assets and detailed management options, which makes it a smart choice for those with significant assets. On the other hand, an enhanced estate five with the best provides simplicity and immediate ownership transfer, which can be advantageous depending on your situation.