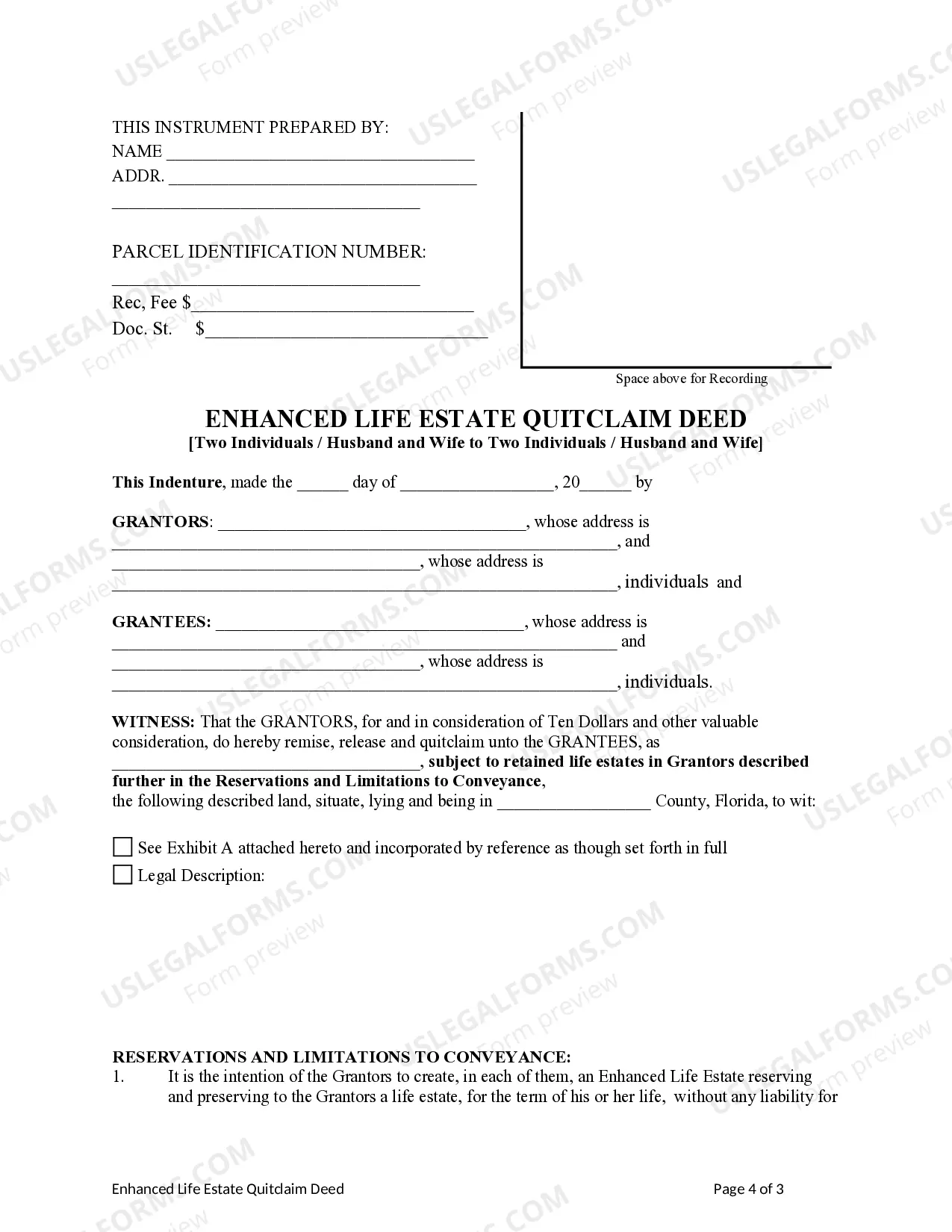

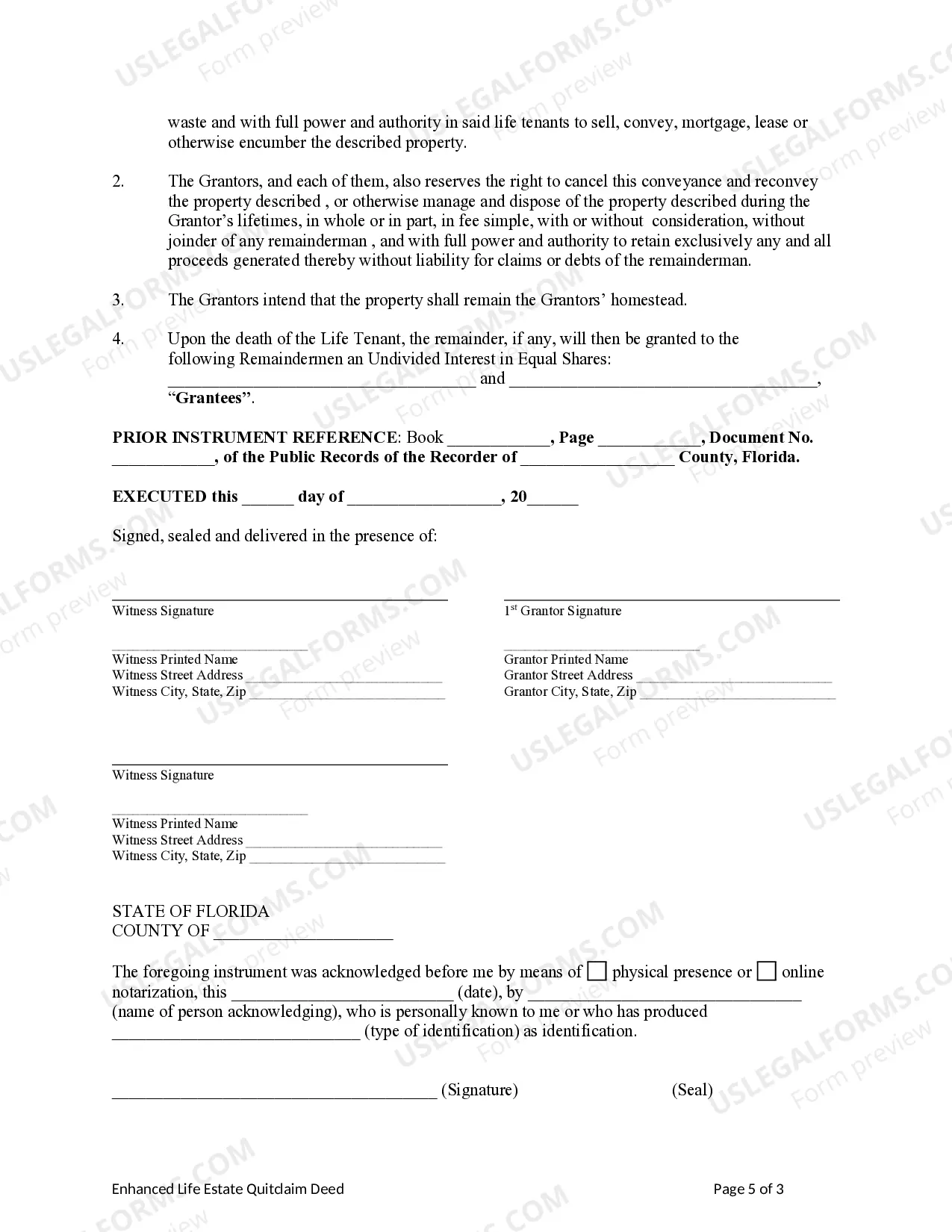

This form is an Enhanced Life Estate Deed where the Grantors are two individuals or husband and wife and the Grantees are two individuals or husband and wife. Grantors convey the property to Grantees subject to a retained enhanced life estate. Further, the Grantors retains for life the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Enhanced Life Estate Deed Form

Description

How to fill out Enhanced Life Estate Deed Form?

There’s no longer a need to spend countless hours searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our site provides over 85,000 templates for various business and personal legal situations compiled by state and area of use. All forms are properly crafted and validated, ensuring you receive an updated Enhanced Life Estate Deed Form.

Completing formal paperwork under federal and state laws is quick and straightforward with our platform. Give US Legal Forms a try now to keep your documents organized!

- If you are acquainted with our platform and already have an account, please verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever needed by accessing the My documents tab in your profile.

- If you are new to our platform, the process will require a few more steps to finalize.

- Here’s how newcomers can acquire the Enhanced Life Estate Deed Form from our library.

- Examine the page content carefully to confirm it includes the sample you need.

- To assist with this, use the form description and preview options if available.

- Utilize the Search field above to look for another template if the current one does not meet your requirements.

- Click Buy Now next to the template title when you identify the correct one.

- Choose the most appropriate pricing plan and register for an account or Log In.

- Make payment for your subscription using a credit card or through PayPal to continue.

- Select the file format for your Enhanced Life Estate Deed Form and download it to your device.

- Print your form to fill it out manually or upload the sample if you prefer to complete it in an online editor.

Form popularity

FAQ

Yes, a person holding a life estate in Florida can sell the property, but their ability to do so may depend on the type of life estate. In a conventional life estate, the owner typically requires consent from remainder beneficiaries, limiting their options. However, if they utilize an enhanced life estate deed form, they have the freedom to sell the property without needing permission, allowing for seamless management of their assets.

An enhanced life estate deed form offers several advantages, including the ability to avoid probate. The property passes directly to the named beneficiaries, streamlining the transfer process. Additionally, this type of deed allows the original owner to retain full use and control of the property during their lifetime, providing peace of mind and flexibility regarding their estate planning.

The main difference lies in the rights transferred and retained. A traditional life estate deed restricts the owner’s ability to change the ownership without the consent of the remainder beneficiaries. Conversely, with an enhanced life estate deed form, the owner maintains greater control over the property, enabling them to manage and transfer it without restrictions, while still ensuring it will pass directly to beneficiaries upon their death.

In Florida, there are primarily two types of life estates: conventional life estates and enhanced life estates. A conventional life estate allows the owner the right to use the property during their lifetime, but it often limits their ability to sell or transfer it without consent from remainder beneficiaries. On the other hand, an enhanced life estate deed form provides more flexibility, allowing the owner to sell, mortgage, or lease the property while still retaining certain rights.

In Canada, the property in a life estate is owned by the life tenant, who has the right to use the property during their lifetime. Upon the death of the life tenant, ownership transfers to the remainderman, as specified in the enhanced life estate deed form. This arrangement ensures that the property passes directly to the intended beneficiaries without going through probate, providing clarity and peace of mind. Utilizing an effective legal platform, such as uslegalforms, can assist you in creating the appropriate documents for this process.

To navigate around a life estate, you can consider creating an enhanced life estate deed form. This type of deed allows property owners to transfer their property while retaining the right to live in it until their death. In such cases, the property automatically transfers to the designated beneficiaries upon the owner's passing, thus bypassing probate. By utilizing this approach, you ensure a smoother transition of ownership while achieving your estate planning goals.

An enhanced life estate deed in Texas is a legal document that allows property owners to retain the right to use and benefit from their property during their lifetime. Upon death, the property automatically passes to the designated beneficiaries without going through probate. Utilizing an enhanced life estate deed form can significantly speed up the distribution process and ensure your wishes are honored.

Yes, you can sell a house that has a ladybird deed in Texas. Since you retain control over the property as the owner, you have the ability to sell, lease, or mortgage the property without restrictions. This form of deed gives you the oversight to manage your asset according to your needs while still providing for a smooth transfer of ownership after your passing.

The main difference between a life estate and an enhanced life estate in Florida lies in the control over the property. A traditional life estate restricts your ability to sell or mortgage the property without the beneficiaries' consent, while an enhanced life estate allows you to maintain full control over your property during your lifetime. This flexibility makes the enhanced life estate deed a preferred option for many.

An enhanced life estate deed in Florida allows property owners to retain the right to live in and control their property while designating beneficiaries to receive it upon their death. This deed simplifies the inheritance process by avoiding probate, ensuring that your loved ones receive the property quickly and efficiently. It’s a powerful estate planning tool that provides peace of mind.