Deed Limited Partnership With Significant Control

Description

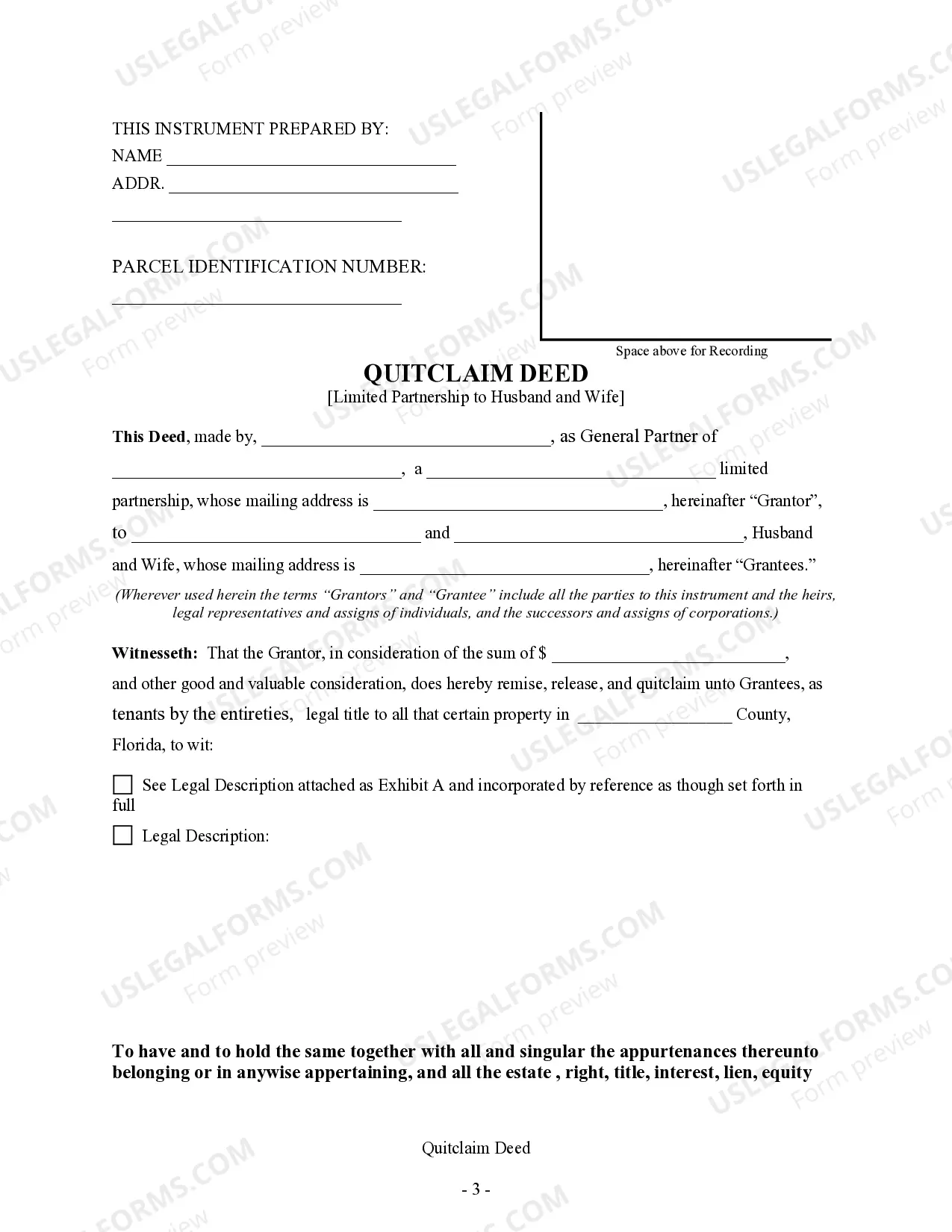

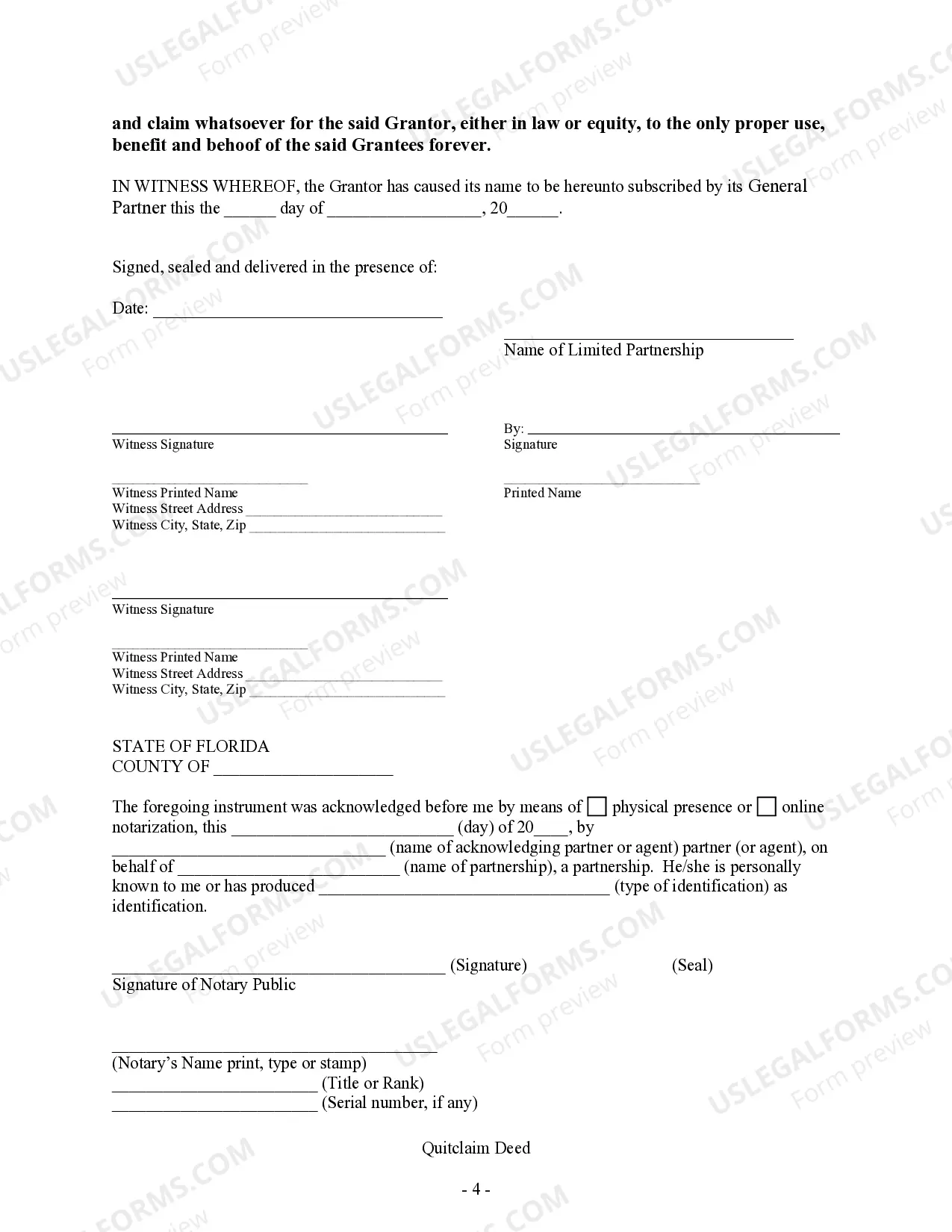

How to fill out Florida Quitclaim Deed From A Limited Partnership To A Husband And Wife?

Bureaucracy necessitates exactness and meticulousness.

If you do not engage with completing documentation like Deed Limited Partnership With Significant Control on a daily basis, it may result in some misconceptions.

Choosing the correct sample from the outset will guarantee that your document submission will proceed smoothly and avert any troubles of re-submitting a file or repeating the same task from the beginning.

If you are not a subscribed user, finding the needed sample would require a few extra steps: Locate the template using the search bar. Ensure the Deed Limited Partnership With Significant Control you have found is applicable for your state or county. Check the preview or peruse the description that includes the details on the use of the template. When the result corresponds with your query, click the Buy Now button. Select the suitable option among the suggested pricing plans. Log In to your account or sign up for a new one. Finalize the purchase using a credit card or PayPal account. Acquire the form in the format of your preference. Securing the right and current samples for your documentation is a matter of a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your paperwork.

- You can always procure the appropriate sample for your documentation in US Legal Forms.

- US Legal Forms is the largest online forms directory that houses over 85 thousand samples for a variety of fields.

- You can discover the latest and most pertinent version of the Deed Limited Partnership With Significant Control by merely searching for it on the platform.

- Find, store, and save templates in your account or refer to the description to confirm you have the accurate one available.

- With an account at US Legal Forms, it is feasible to obtain, store in one place, and browse the templates you save to access them in a few clicks.

- When on the website, click the Log In button to authenticate.

- Then, navigate to the My documents page, where the catalog of your forms is maintained.

- Examine the description of the forms and save the ones you need at any given time.

Form popularity

FAQ

Identifying a person with significant control involves reviewing the ownership and control structures of the entity. In a deed limited partnership with significant control, look for individuals who hold a major stake, have decision-making authority, or can influence the direction of the partnership. You can also use official documents and records to investigate these relationships clearly. By utilizing resources like US Legal Forms, you can access templates and guidance to assist you in this identification process.

A person with significant control is typically an individual or an entity that holds substantial influence over a business's operations and decisions. In the context of a deed limited partnership with significant control, this may include partners who have the authority to make key business choices, or who hold a specific percentage of ownership. Recognizing such individuals is crucial for compliance and transparency within the partnership structure. Understanding this concept can help you navigate your legal responsibilities effectively.

In a deed limited partnership with significant control, limited partners can have varying degrees of influence, depending on the partnership agreement. While they typically do not manage day-to-day operations, provisions can be made to grant them specific rights, such as voting on major decisions. This structure allows you to balance control and liability effectively. Ultimately, each partnership can tailor the level of control to meet its unique needs.

Yes, Limited Liability Partnerships (LLPs) can indeed have Persons with Significant Control. In an LLP, the individuals involved may hold significant influence or decision-making power that qualifies them as PSCs. This designation is important when establishing a deed limited partnership with significant control, as it affects transparency and compliance within the partnership structure. If you need assistance navigating this topic, uslegalforms offers resources and templates tailored to your needs.

A PSC, or Person with Significant Control, refers to an individual who has substantial control over a company, typically the power to make decisions. On the other hand, an RLE, or Relevant Legal Entity, represents a legal entity that holds position or influence within a structure. Understanding these terms is crucial for anyone considering a deed limited partnership with significant control, as it directly impacts ownership and governance structures. For comprehensive guidance, uslegalforms can help clarify these nuances.

Significant control beneficial ownership refers to the real individuals who ultimately own or control a partnership, even if their names are not officially registered. This concept aims to uncover the true owners behind the scenes for greater transparency. It's important for partnerships to identify beneficial owners to comply with legal requirements.

Having significant control means possessing the authority to influence decisions within a partnership, typically through ownership of over 25% of shares or votes. This control signifies responsibility and accountability in governance matters. Understanding this concept is crucial for anyone involved in a deed limited partnership with significant control.

Partners in a limited partnership are required to keep a PSC register to ensure transparency and compliance with legal standards. This register must list individuals who hold significant control over the partnership. Keeping this document updated protects the partnership and assures stakeholders about control structures.

To add a person with significant control in your deed limited partnership, you must follow your partnership agreement’s procedure, typically requiring approval from existing partners. Once agreed upon, you should update the PSC register to document the new individual's control. This addition maintains compliance and properly reflects changes in authority.

A director manages the day-to-day operations of a company, while a person with significant control, or PSC, has a larger stake that influences the direction of the partnership. A PSC may not be involved in daily management but can impact important decisions. Identifying these roles clarifies the structure of a deed limited partnership with significant control.