Llc Holding

Description

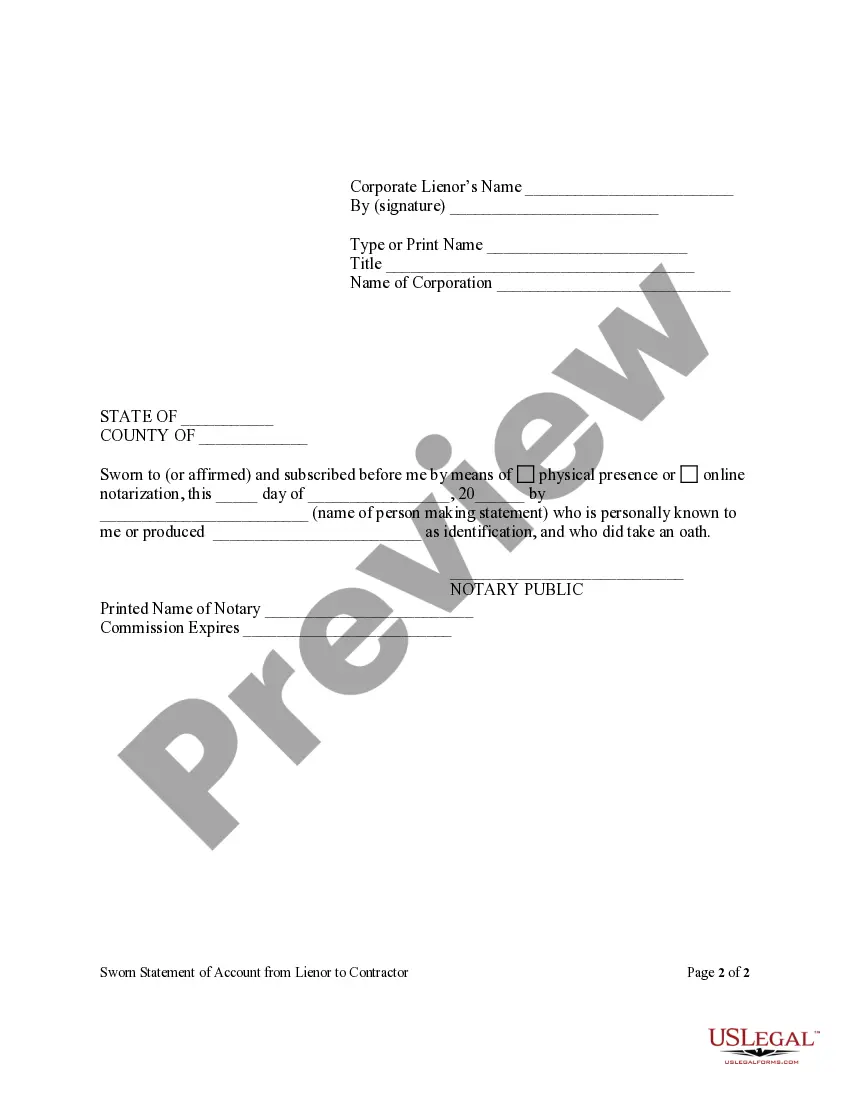

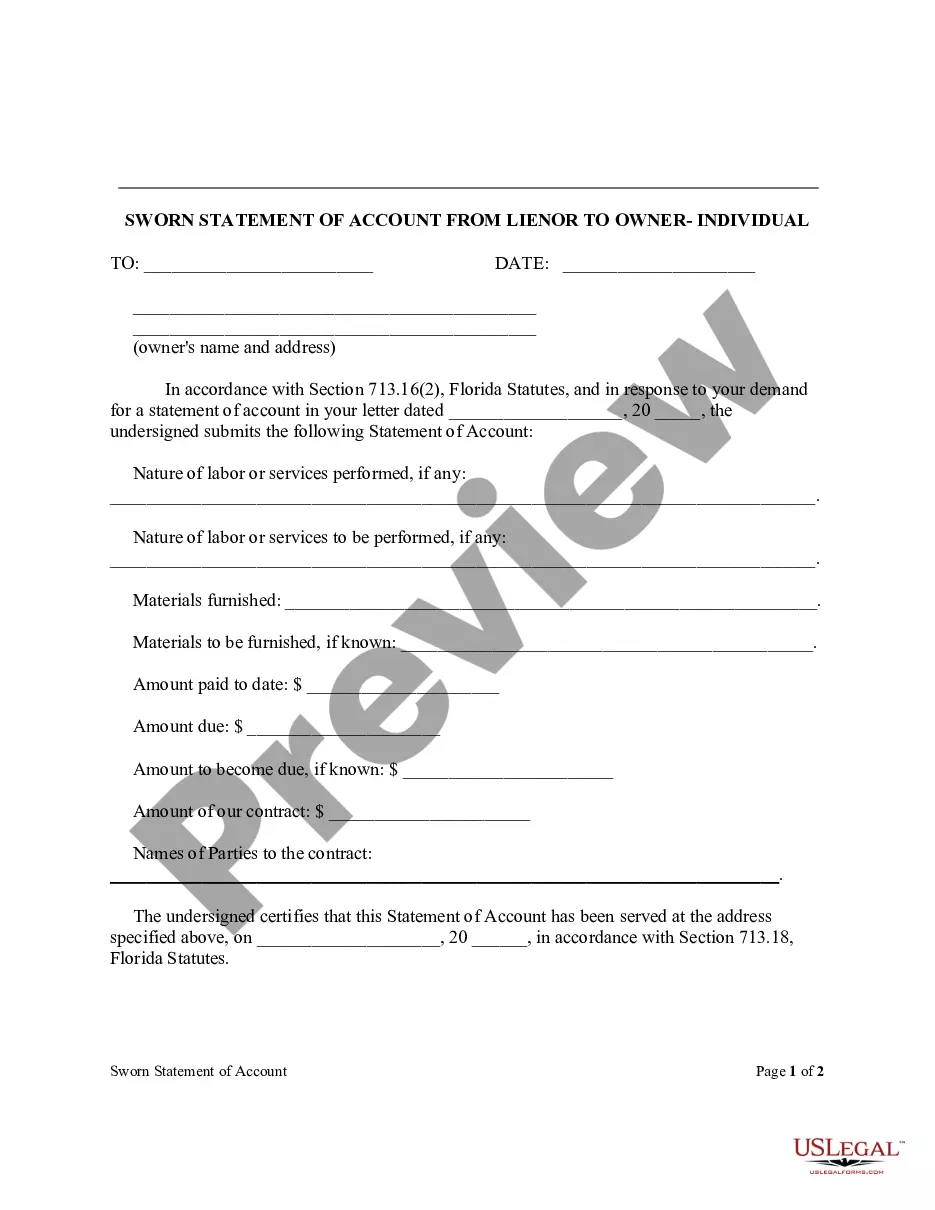

How to fill out Florida Sworn Statement Of Account From Lienor To Contractor - Corporation?

- Log in to your account if you're a returning user and ensure your subscription is active. If it's expired, renew it according to your plan.

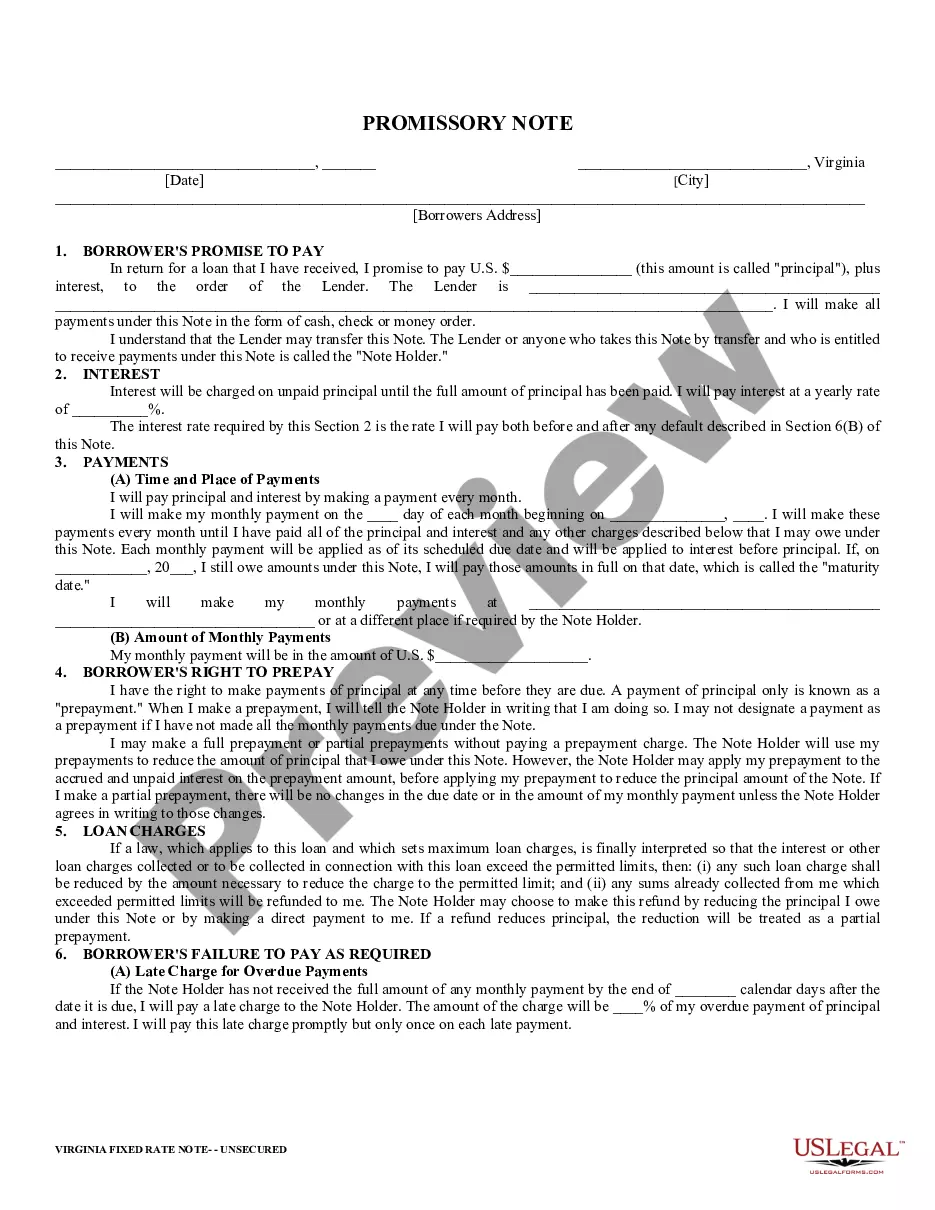

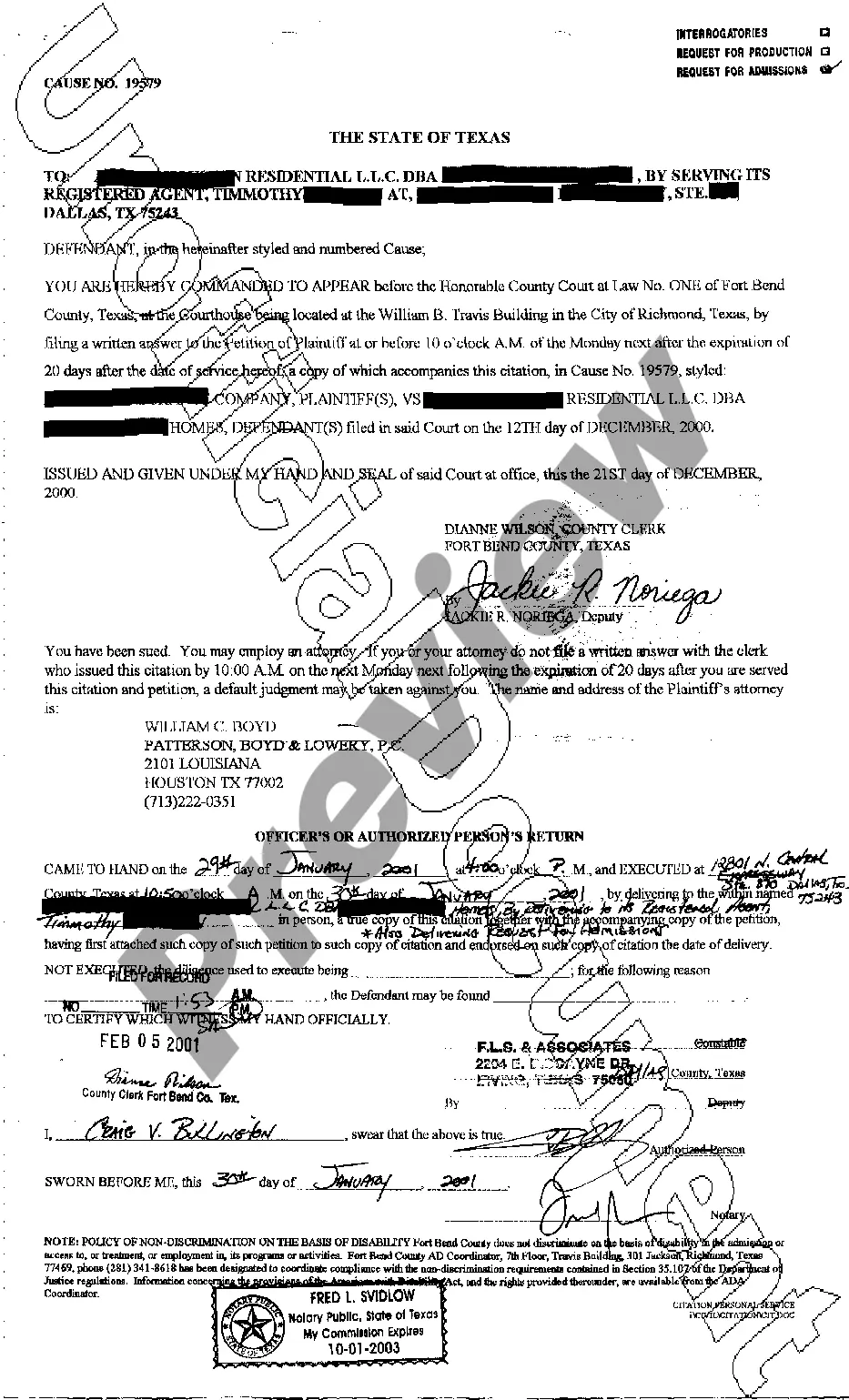

- For first-time users, start by browsing the Preview mode and checking the form descriptions to find the right document that meets your local jurisdiction requirements.

- Should you need to explore more options, utilize the Search tab to find alternate templates that suit your specific needs.

- Once you find a suitable document, click the Buy Now button. Choose your preferred subscription plan and create an account for access to the comprehensive library.

- Proceed with your purchase by entering your credit card details or using your PayPal account.

- Finally, download your form to your device, allowing you to complete it at your convenience and access it anytime from the My Forms menu in your profile.

US Legal Forms not only simplifies the process of obtaining legal documents but also guarantees that you have access to the most extensive collection of forms on the market.

Don't miss out on the opportunity to enhance your LLC holdings. Start using US Legal Forms today for precise, legally sound documents crafted with expertise.

Form popularity

FAQ

Putting your LLC on pause is possible, often referred to as inactive status. You may need to file a form with your state to indicate that your business will not operate for a certain period. Each state has its own rules for this process, so it’s crucial to follow the guidelines. The US Legal Forms platform can assist you by providing the necessary forms and detailed directions to help you manage the status of your LLC holding effectively.

Making your LLC inactive involves filing specific paperwork with your state’s Secretary of State. Typically, you will need to submit a form stating that your LLC will no longer conduct business. It's essential to ensure you comply with state regulations, as each state has its own requirements. The US Legal Forms platform offers templates and instructions to help you navigate this process smoothly.

Yes, you can turn an LLC into a holding company. To do this, you simply need to ensure your LLC holds the ownership of other companies or assets. This process often involves updating your operating agreement to reflect the new purpose. Using the US Legal Forms platform can simplify this transition, providing you with the necessary documents and guidance for establishing your LLC holding.

A holding company can be a good idea if it aligns with your strategic objectives. By using an LLC holding, you can protect assets, reduce risk, and simplify management. It can provide flexibility when expanding your business portfolio or managing various investments. Always assess your unique circumstances and consult experts to ensure this structure fits your goals.

Deciding whether to establish a holding company for your LLC involves careful consideration of your business operations. A holding company can provide asset protection and enhance management efficiency. If you plan to own multiple businesses or investments, this structure may offer significant advantages. Consulting with a professional can yield personalized insights tailored to your specific needs.

LLC holding refers to a limited liability company that holds ownership interests in other companies or assets. This structure allows for liability protection while managing various business ventures. Essentially, an LLC holding acts as an umbrella organization that streamlines ownership and helps in asset management. If you're looking to consolidate your business interests, an LLC holding might be a suitable option.

Whether it is worth having a holding company depends on your business strategy and goals. An LLC holding can help you centralize management and protect assets more effectively. However, you should also assess the costs and administrative duties involved. Evaluating your long-term plans will help you decide if an LLC holding aligns with your business needs.

A disadvantage of an LLC holding is that it may involve significant regulatory requirements and compliance costs. Additionally, the income generated by subsidiaries can be taxed at different levels, which might lower overall profitability. Some individuals may also perceive holding companies as complex structures, potentially causing confusion. If you're considering forming an LLC holding, weigh the benefits against potential drawbacks carefully.

Yes, a holding LLC generally requires an EIN to function effectively. This number facilitates tax filings and financial transactions, essential for maintaining the separation between personal and business obligations. An EIN also proves valuable when engaging in business banking and securing business credit. Therefore, if you are establishing a holding LLC, obtaining an EIN should be a priority.

Yes, a holding company can be structured as a single member LLC. This setup allows you, as the sole owner, to retain complete control while still enjoying the benefits of limited liability. A single member LLC offers simplicity in management and filing taxes. For those interested in creating a holding LLC, this can be an efficient and advantageous option.