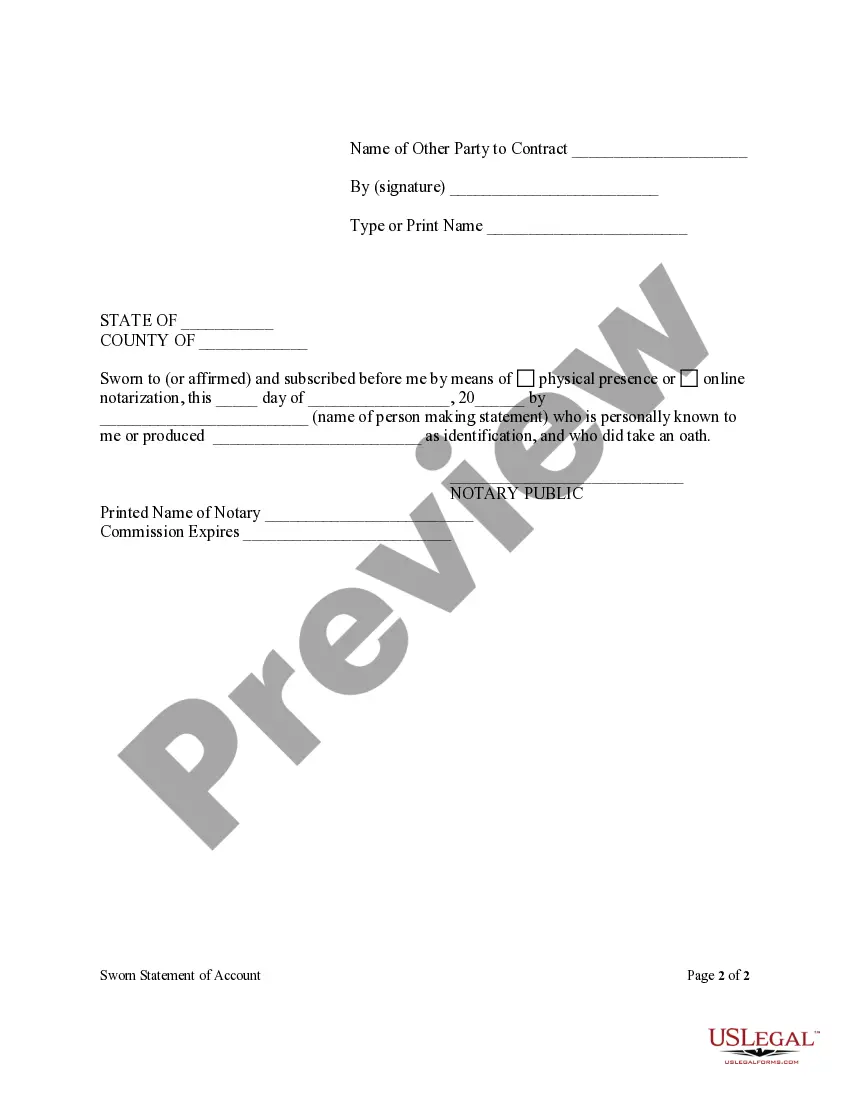

Sworn To And Subscribed Before Me By Means Of Physical Presence

Description

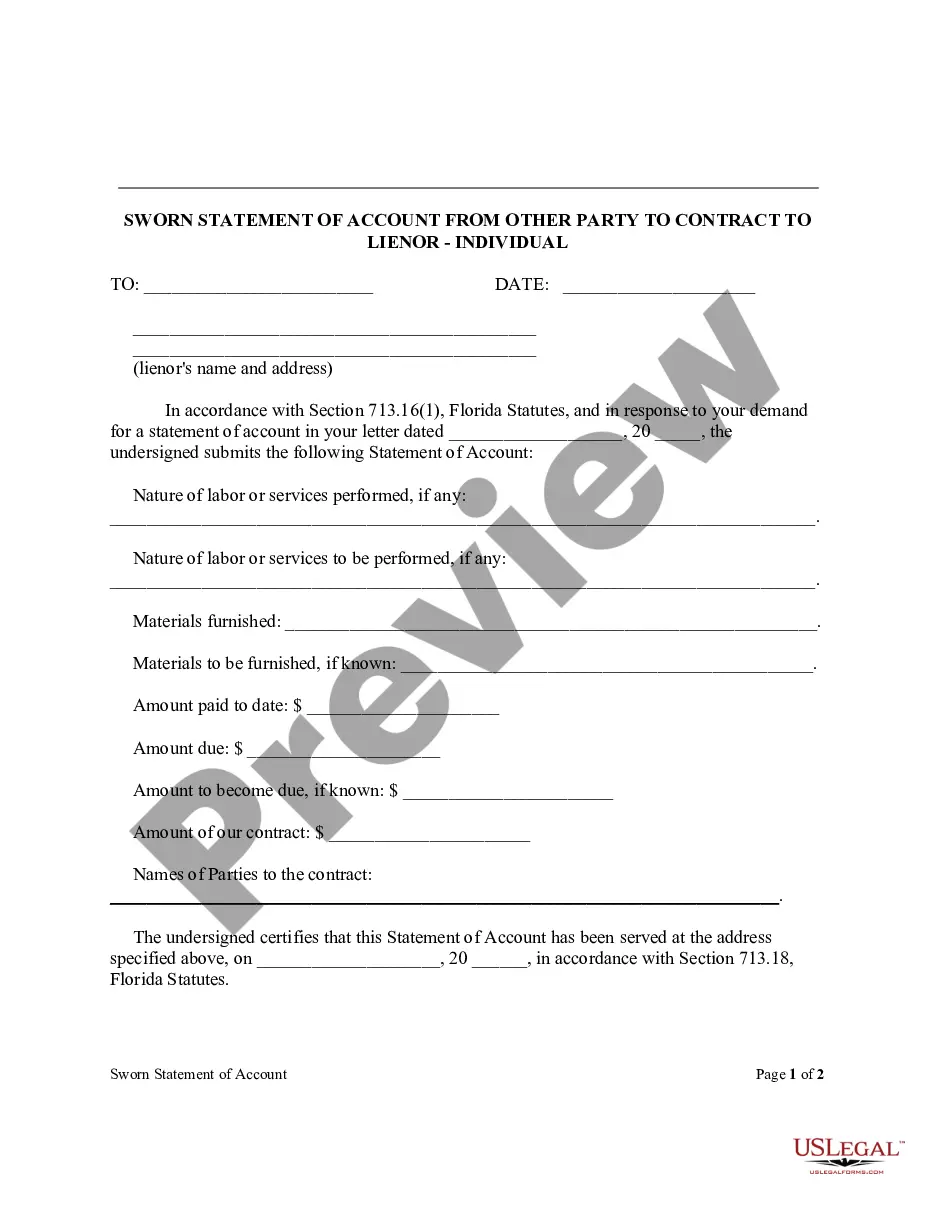

How to fill out Florida Sworn Statement Of Account From Other Party To Contract To Lienor - Individual?

The Sworn To And Subscribed Before Me By Means Of Physical Presence you observe on this page is a reusable formal template created by professional attorneys in accordance with federal and local regulations and statutes.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts access to more than 85,000 validated, state-specific forms for any business and personal scenario. It’s the fastest, easiest, and most dependable way to obtain the documents you require, as the service ensures bank-standard data security and anti-malware safeguards.

Complete and sign the document. Print out the template to finalize it manually. Alternatively, utilize an online multifunctional PDF editor to quickly and accurately fill out and sign your form with a valid signature.

- Seek the document you require and examine it.

- Browse through the sample you searched for and preview it or assess the form description to confirm it meets your needs. If it does not, utilize the search feature to find the appropriate one. Click Buy Now once you have identified the template you need.

- Register and sign in.

- Choose the pricing plan that best fits your needs and create an account. Use PayPal or a credit card to make an immediate payment. If you already have an account, Log In and review your subscription to continue.

- Obtain the fillable template.

- Select the format you prefer for your Sworn To And Subscribed Before Me By Means Of Physical Presence (PDF, DOCX, RTF) and download the sample onto your device.

Form popularity

FAQ

After 'Subscribed and sworn to before me,' the notary will usually include their signature, seal, and the date of the notarization. This information indicates that the notary has performed their duties adequately. Including additional details such as the location of the notarization adds to the legitimacy of the document. Utilizing such practices ensures compliance and reinforces the formal nature of the document.

Name your Oregon LLC. You'll need to choose a name to include in your articles before you can register your LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

????????Steps for Setting up Shop Do your research. ... Create a business plan. ... Select your business name and structure. ... Register your business. ... Learn your tax obligations. ... Check what licenses, permits or certifications you need. ... Learn about ?other requirements. ... Meet ongoing registration requirements.

Oregon doesn't require your LLC to have an operating agreement. However, having an operating agreement allows you to open a business bank account, override default laws, and better protect your limited liability.

Obtain Funding From State Agencies The first place you should look for funding is from state agencies. Oregon offers a number of programs that can help you finance your business. For example, the Oregon Innovation Partnership provides grants to businesses that are working on innovative projects.

The reality is that all businesses require some type of investment. But if you don't have money at the moment or have minimal financial funds at your disposal, don't worry. You may still pursue your venture, as long as you come up with a solid game plan and plan for hurdles you might come across along the way.

Starting a business in Oregon FAQ Corporations must file Articles of Incorporation. Both filings cost $100. You also pay $100 to register your business entity name with the Oregon Business Registry and an additional $50 if you want to register a DBA (called an assumed business name in Oregon).

How to start a business with no money: 10 ways to make it happen in 2023 Keep your day job. Make a realistic business plan and budget. Set goals. Determine if you can operate totally online or at home. Make a savings plan. Ask for help. Apply for loans and grants. Get into crowdfunding.

Starting an LLC costs $100 in Oregon. This is the state filing fee for a document called the Oregon Articles of Organization. The Articles of Organization are filed with the Oregon Secretary of State. And once approved, this is what creates your LLC.