Subcontractors For Construction Projects

Description

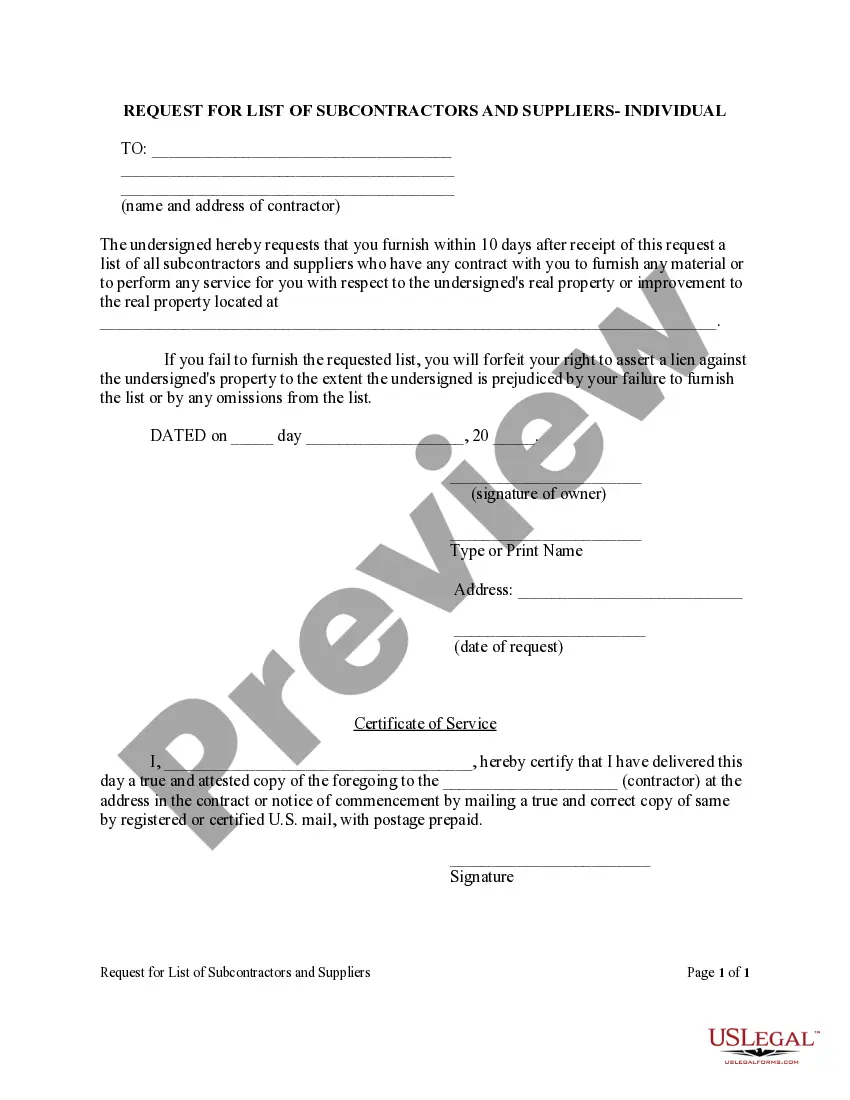

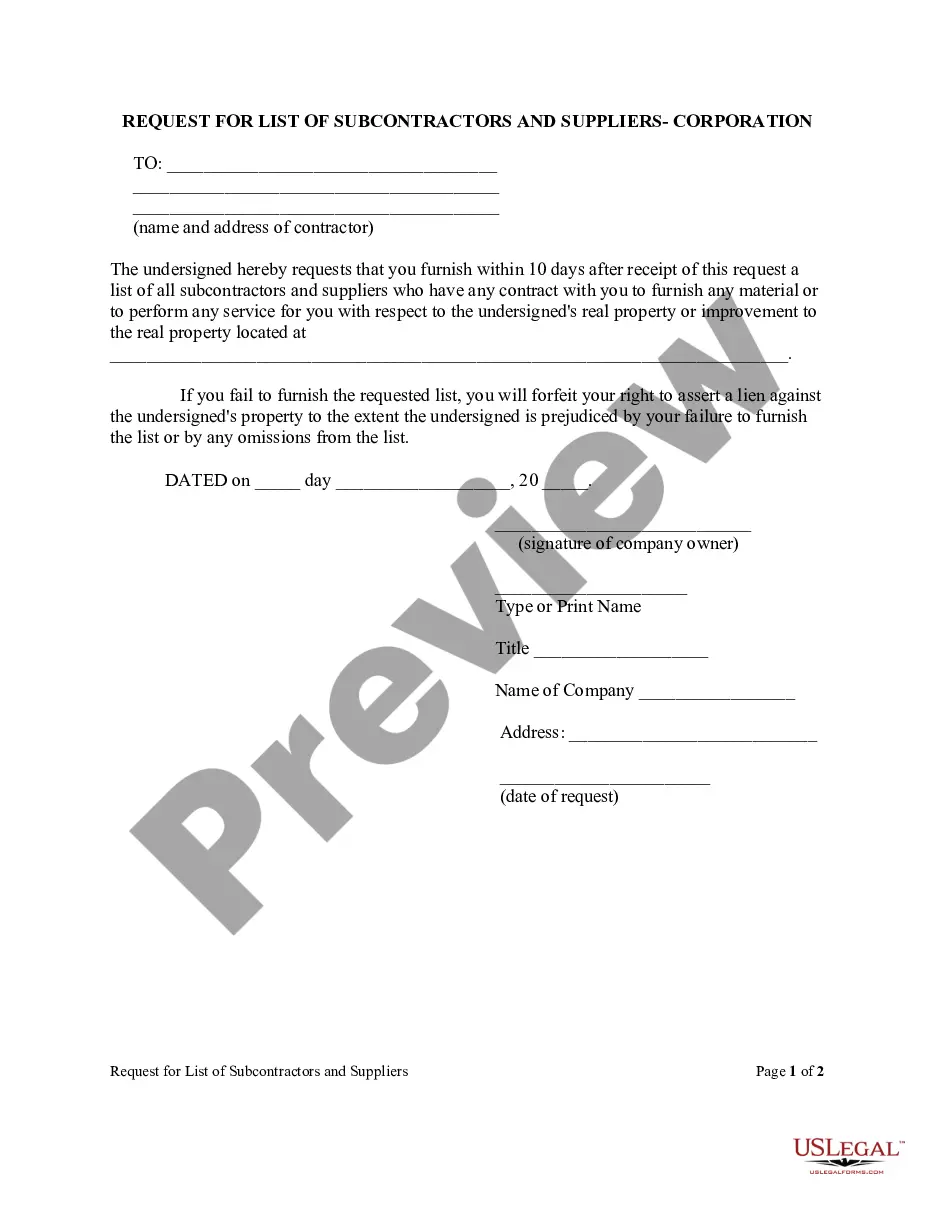

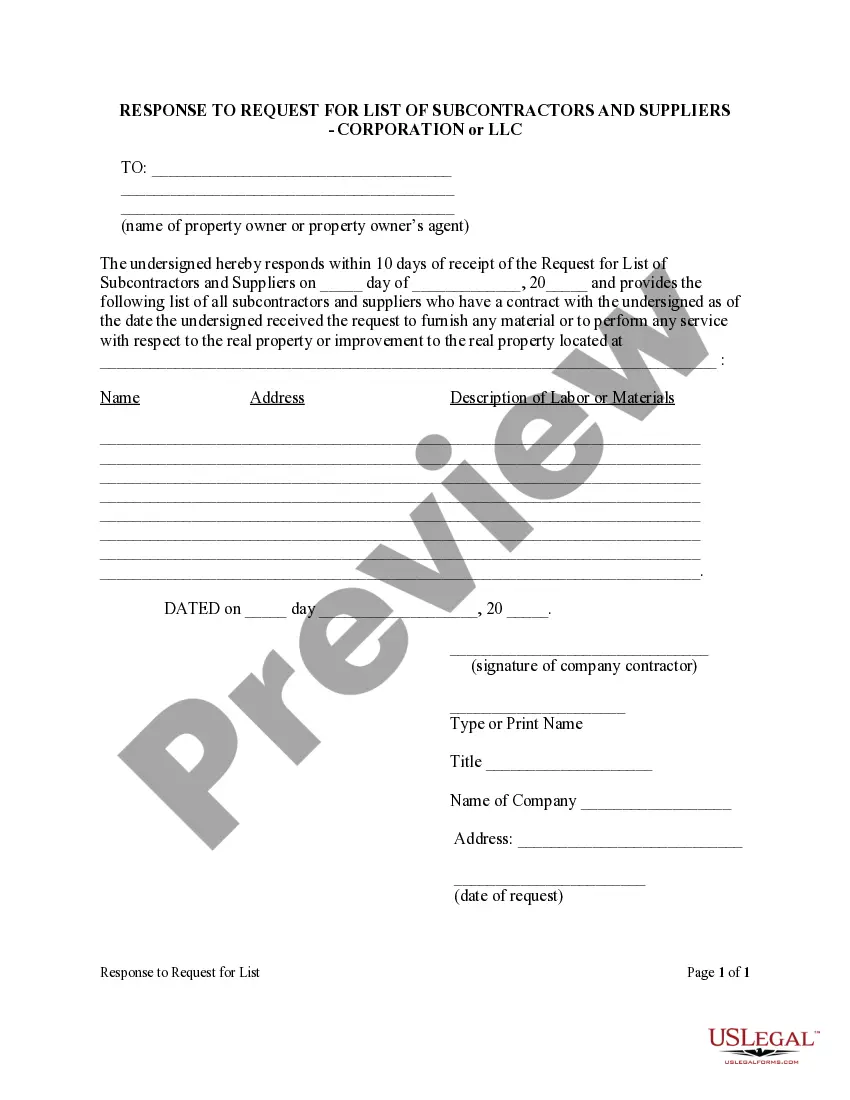

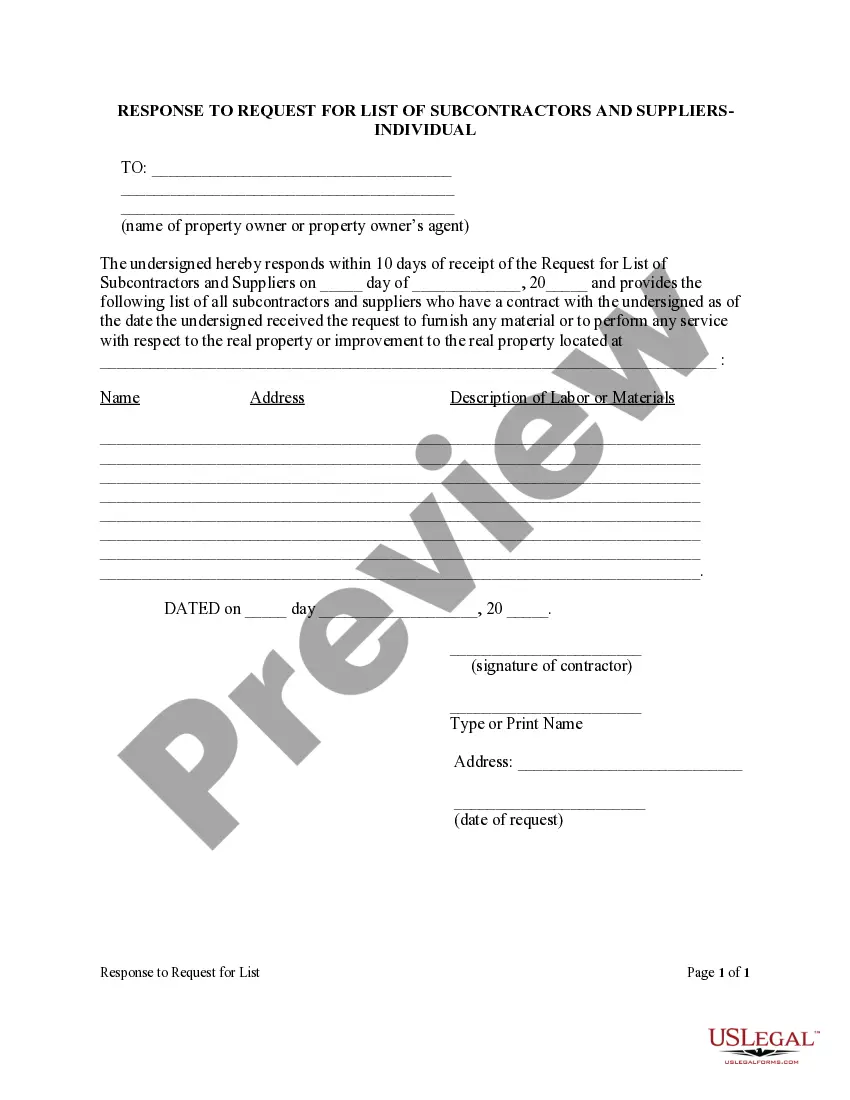

How to fill out Florida Response To Request For List Of Subcontractors And Suppliers - Individual?

- Log in to your account if you're a returning user. Ensure your subscription is active; if not, renew it as per your payment plan.

- If you're a new user, start by checking the Preview mode and form description to find the exact template that suits your specific needs.

- If you don’t find what you need, use the Search tab to look for a different template that aligns with local jurisdiction requirements.

- Once you locate the appropriate document, click the Buy Now button and select your desired subscription plan. Creating an account is essential to utilize the extensive library.

- Complete your purchase using your credit card or PayPal to access your chosen forms.

- Finally, download your form to your device and access it later through the My Forms menu in your profile.

With US Legal Forms, you benefit from a vast library boasting over 85,000 editable legal forms, tailored for various legal needs, including those for subcontractors in the construction industry.

Don't let legal documentation overwhelm you—start today by visiting US Legal Forms and streamline your subcontracting processes.

Form popularity

FAQ

Subcontractors for construction projects typically fill out Form 1040 Schedule C to report their business income and expenses. If their income exceeds a certain threshold, they may also need to complete Schedule SE for self-employment tax. Always check for the latest IRS guidelines to ensure you are using the correct forms for your situation.

If you receive both a 1099 for subcontractor work and a W-2 from employment, you must report income from both sources on your tax return. In this case, use Form 1040 to combine your earnings. It's essential to maintain accurate documentation for each income type, as each may have different tax implications.

The process of subcontracting in construction begins with identifying your project's needs and then selecting qualified subcontractors. After evaluating their credentials, negotiate a contract that specifies the work scope, schedule, and payment terms. Clear communication and written agreements help ensure that both parties understand their responsibilities and deliverables.

To hire subcontractors for construction projects, you need a written subcontractor agreement detailing the work scope, payment terms, and deadlines. Additionally, obtain a W-9 form from the subcontractor for tax purposes. Keeping all documentation organized will help you comply with tax requirements and protect your business.

Yes, construction subcontractors typically receive a 1099 form if they earn $600 or more from a single contractor in a year. This form helps subcontractors report their income to the IRS accurately. Make sure you provide your subcontractors with a 1099 at the end of the tax year for their records.

A subcontractor must report all income to the IRS, regardless of the amount earned. However, subcontractors for construction projects may not owe any federal income tax if their earnings fall below the standard deduction threshold. It's crucial to consult a tax professional to understand specific obligations based on your personal situation and income.

Contractors are responsible for overall project management and coordination, while subcontractors focus on specialized tasks assigned to them. Contractors hire subcontractors for construction projects to leverage their expertise and streamline the workflow. Understanding this difference is crucial for anyone involved in construction to foster effective collaboration.

The role of a subcontractor in construction involves executing specific tasks that contribute to a project's overall success. They collaborate with the primary contractor, adhere to timelines, and ensure that their work complies with industry standards. By utilizing subcontractors for construction projects, contractors can efficiently manage resources while enhancing project quality.

A subcontractor in construction is a professional hired by a primary contractor to perform specific tasks related to a project. Their expertise allows them to focus on particular aspects of construction, such as plumbing, electrical work, or roofing. Engaging subcontractors for construction projects often leads to higher quality results due to their specialized skills.

Yes, there is a key difference between independent contractors and subcontractors. Independent contractors manage their own projects, while subcontractors for construction projects work under the direction of a primary contractor. This distinction helps clarify responsibilities and roles within a construction environment.