Payment Bond For Construction

Description

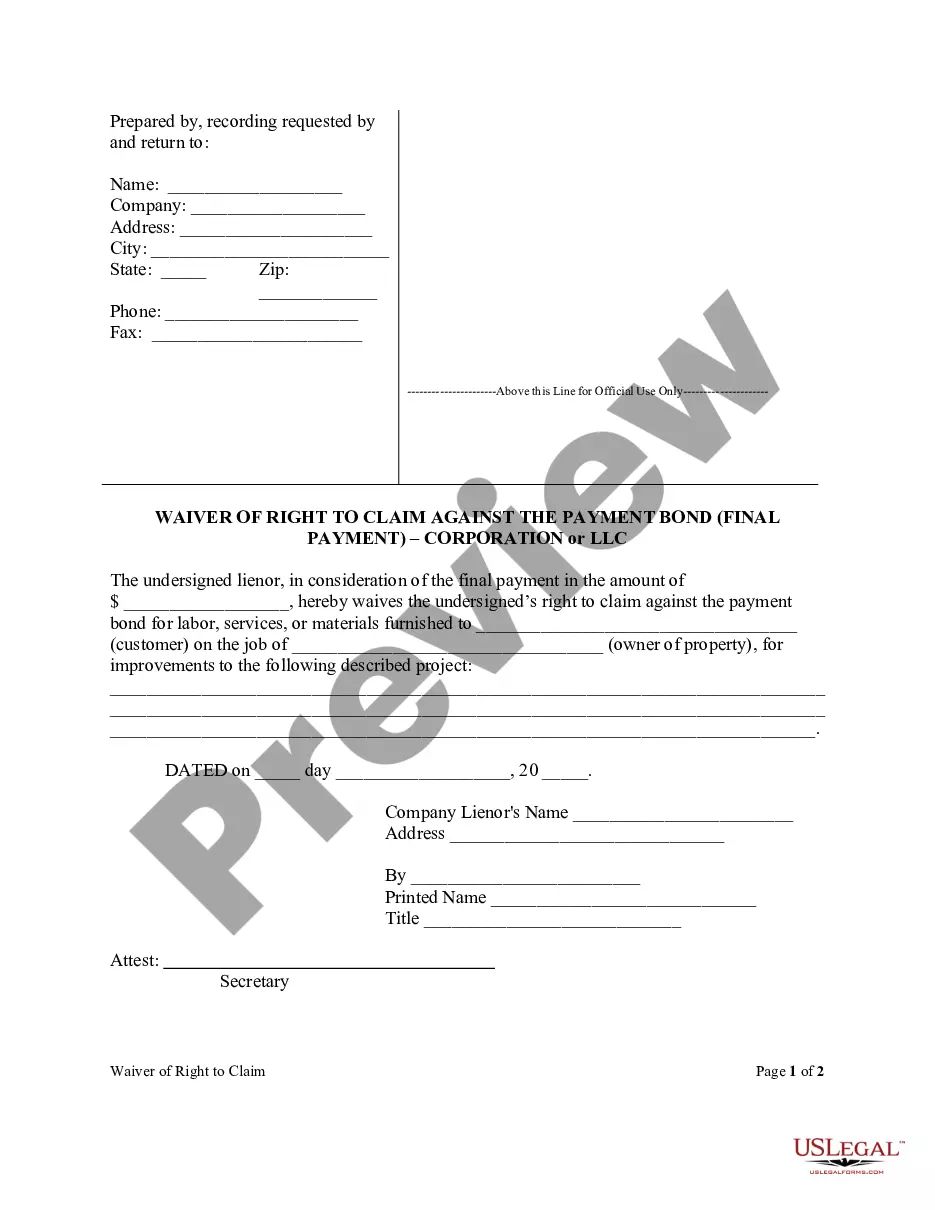

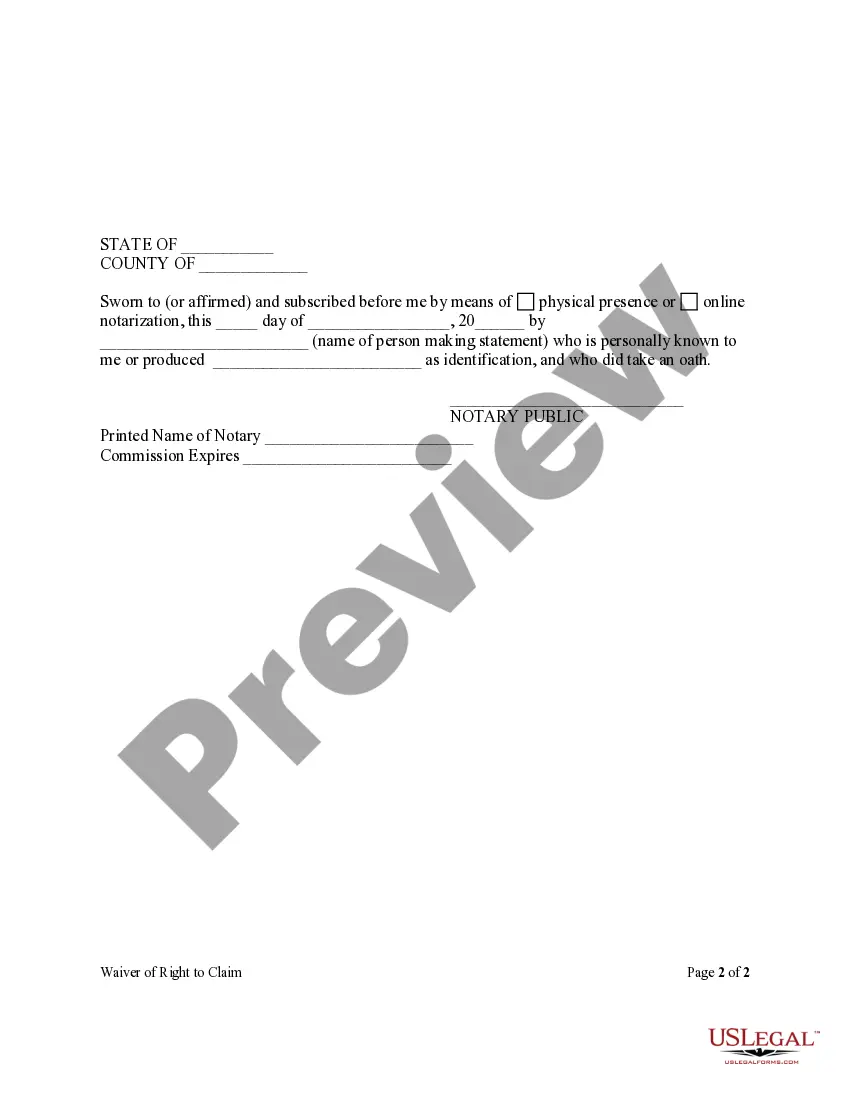

How to fill out Payment Bond For Construction?

The Payment Bond For Construction you see on this page is a multi-usable legal template drafted by professional lawyers in accordance with federal and state laws. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Payment Bond For Construction will take you just a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or check the form description to confirm it suits your needs. If it does not, utilize the search bar to find the right one. Click Buy Now when you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Pick the format you want for your Payment Bond For Construction (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers again. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

To get a construction bond, you first need to identify the specific type of bond required for your project, such as a payment bond or performance bond. Then, gather documentation that demonstrates your financial stability and project details. Contact a surety bond professional or a platform like uslegalforms to help you through the application process. They can simplify the steps, providing the guidance you need to secure the right bonds for your construction project.

To get a payment bond for construction, start by determining the amount you need based on the total value of your project. Next, gather necessary documentation such as project details, your credit history, and any relevant licenses. Reach out to a surety bond company or a broker who can help you navigate the application process, ensuring you meet all requirements. They will guide you through each step, making it easier to obtain your bond.

The bond process in construction begins with the contractor applying for a payment bond for construction through a surety company. The surety evaluates the contractor's financial stability and project details before issuing the bond. Once secured, the bond remains in effect until all financial obligations are met, thereby ensuring all parties involved are compensated as promised.

Yes, a payment bond for construction is often synonymous with a labor and material bond. Both serve the same purpose, which is to guarantee that all workers and suppliers receive timely payment for their contributions. Therefore, if you're seeking security for your construction projects, understanding these terms can greatly benefit your planning.

?State statute is 30 days, but for us, we wait 90.? Auctions can take place 60 days after an account is past due, ing to Ohio law.

In Michigan, after falling behind by 60 days, the owner of the facility can start preparing to sell your stuff through an auction.

How do I find out if a business is registered in Michigan? You can use the business entity search managed by the Michigan Department of Licensing and Regulatory Affairs. Search by business name, ID number or an individual's name to find out if a business is registered in Michigan.

Living in a storage unit is prohibited by various local and federal housing laws. Storage facilities must evict any person they find living on the premises in order to comply with the law and most insurance policies. To put it plainly, living in a storage unit is illegal.

Find storage auctions near you, fast There are currently 40890 active auctions throughout Michigan, based on your filters - no matter where you live, you can always find an auction near you. With StorageTreasures, you can bid and win on Michigan self storage units with ease.

In the event that occupant fails to pay rent for a period of 30 days, the owner can begin proceedings to sell the contents. The owner must provide notice to the occupant of the default.