Claim Against Bond Form Sa

Description

How to fill out Claim Against Bond Form Sa?

There’s no longer any justification to spend hours searching for legal documents to adhere to your local state laws.

US Legal Forms has compiled all of them in one location and enhanced their availability.

Our platform offers over 85k templates for various business and personal legal matters organized by state and area of application.

Using the search field above, find another template if the current one doesn’t meet your needs. Click Buy Now next to the template title once you find the correct one. Select the most appropriate subscription plan and create an account or sign in. Make a payment for your subscription using a card or PayPal to proceed. Choose the file format for your Claim Against Bond Form Sa and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to work with an online editor. Preparing official documents under federal and state regulations is fast and simple with our platform. Experience US Legal Forms today to maintain your documentation in order!

- All forms are expertly created and authenticated for accuracy, so you can trust in acquiring a current Claim Against Bond Form Sa.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever necessary by accessing the My documents tab in your profile.

- If you've never utilized our service previously, the process will require some additional steps to complete.

- Here's how new users can access the Claim Against Bond Form Sa in our collection.

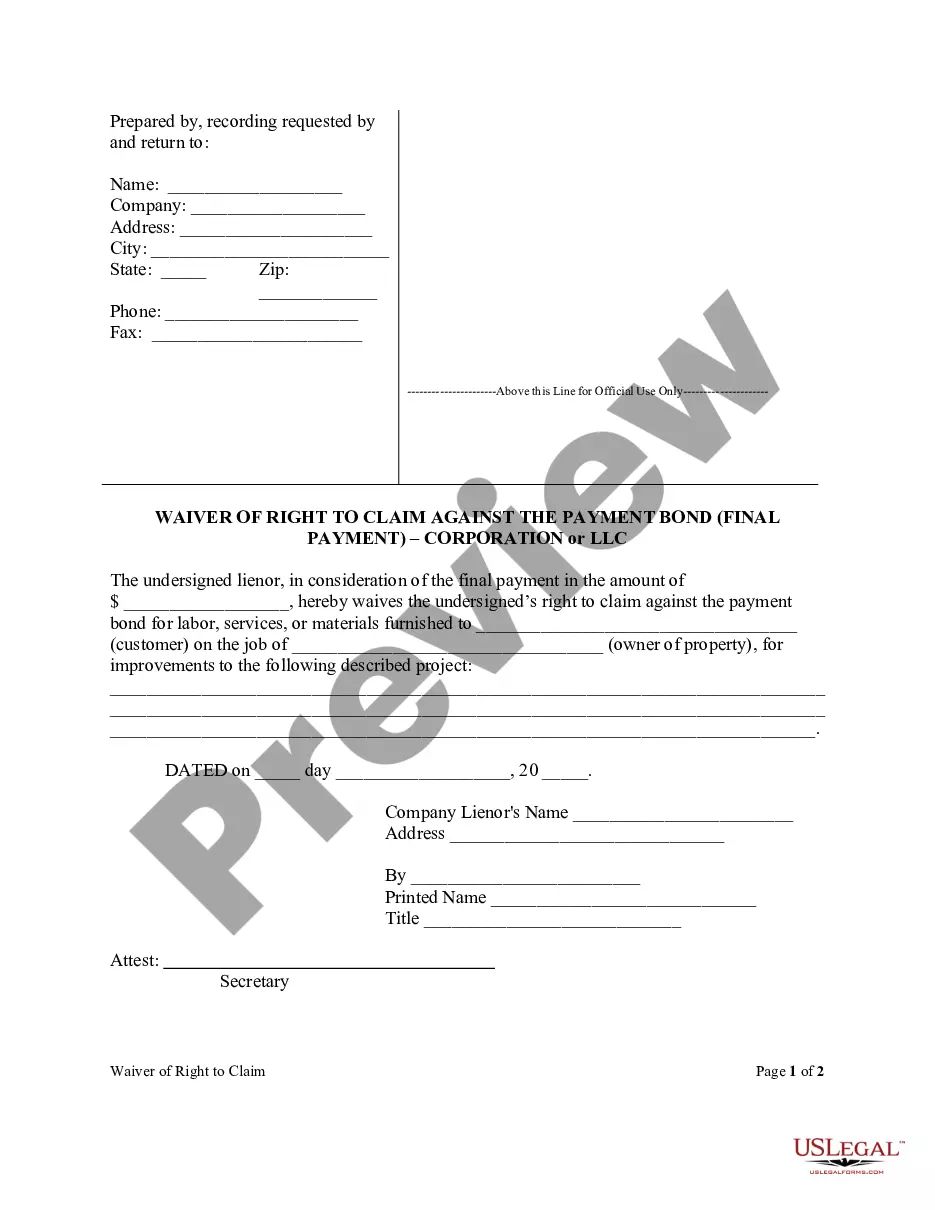

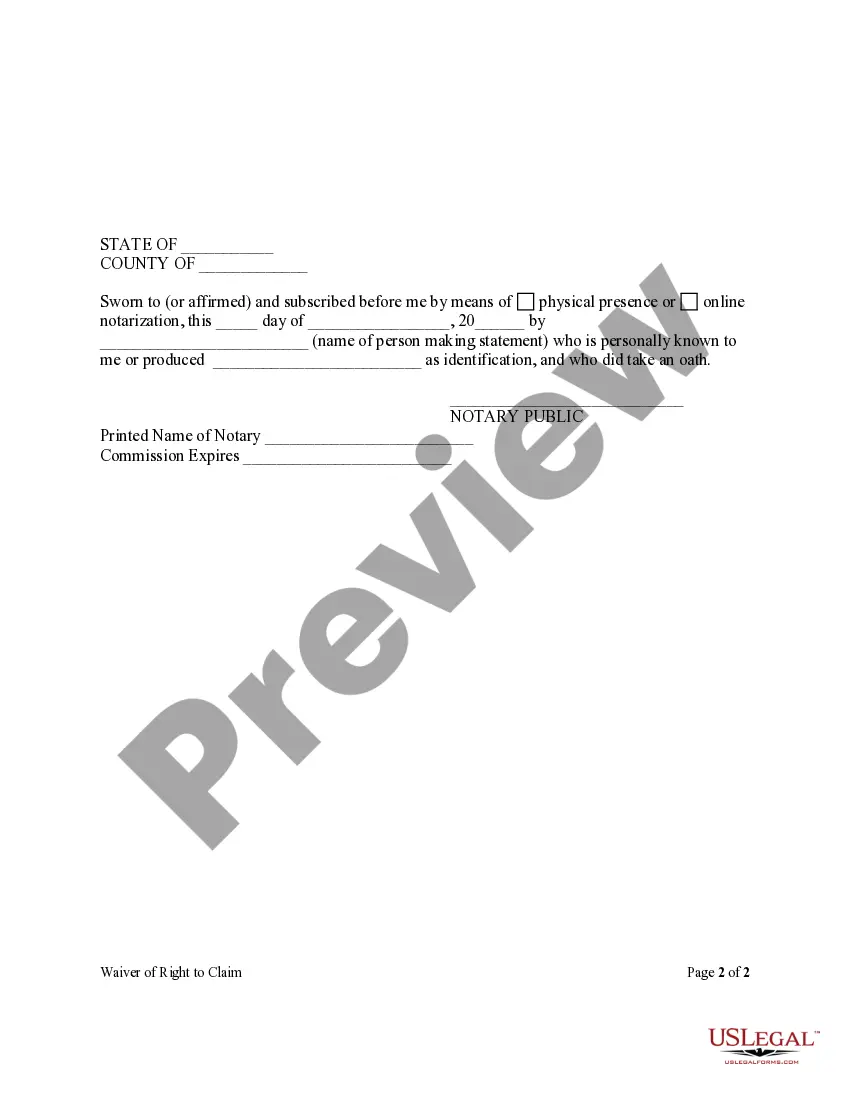

- Review the page content carefully to confirm it contains the sample you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

You can claim bonds when you believe that the bond principal has failed to fulfill the obligations outlined in the bond agreement. This typically occurs in cases of non-performance or default by the party responsible for the bond. To initiate this process, you will need to complete the Claim against bond form sa, which ensures that you provide all necessary information for your claim. Using this form streamlines the process and helps protect your rights as a claimant.

To make a surety bond claim, begin by reviewing your bond agreement for specific claim procedures, and prepare the claim against bond form sa. Next, compile all required evidence, such as contracts or photographs, to support your claim. Submit the claim to the surety company while adhering to their guidelines to ensure timely processing. For a more straightforward experience, consider using the resources available on US Legal Forms.

Filing a claim on a surety bond starts with collecting all relevant documentation, including the claim against bond form sa. Reach out to the surety company that issued the bond, as they typically provide instructions for filing claims. Complete the claim form accurately and include all supporting evidence. You can simplify this process by utilizing platforms like US Legal Forms, which offer easy-to-use templates.

To file a complaint against a dealership surety bond, first gather all necessary documents, including your evidence and the claim against bond form sa. Then, contact the appropriate state agency that oversees surety bonds in your area, or visit their website for detailed instructions. Ensure you submit your claim within the required time frame to avoid delays. Using a user-friendly platform like US Legal Forms can help streamline this process.

An example of a bond claim could involve a subcontractor not fulfilling their contracted responsibilities, leading the primary contractor to file a claim on their performance bond. Such claims are essential for protecting the interests of those involved in construction projects. By using the Claim against bond form sa, you can ensure that your claim is well-prepared and your rights are safeguarded.

To make a claim against a performance bond, start by reviewing the terms of the bond and gathering supporting evidence of the contractor's failure. Then, prepare a written claim to submit to the surety company, including all relevant documentation. Utilizing the Claim against bond form sa ensures you cover all necessary details while facilitating the claim process.

Bond claims are requests made to recover funds or compensation from a bond provider when a bond principal fails to meet obligations. These claims serve as a safety net for parties who rely on the performance or conduct of a bonded individual or entity. Understanding how to file a claim using the Claim against bond form sa can streamline the process for claimants.

To put a claim on a surety bond, begin by reviewing the bond agreement to understand the specific requirements. Next, collect relevant documentation, including contracts and proof of loss. Finally, submit your claim to the surety company, leveraging the Claim against bond form sa to ensure you provide all necessary information for a successful claim.

A real example of a bond is a performance bond that guarantees a contractor will complete a project as per the contractual terms. If the contractor fails to meet their obligations, the bond can be claimed to compensate the project owner for any losses incurred. Utilizing the Claim against bond form sa can aid in filing such claims efficiently.

A bid bond claim occurs when a contractor submits a proposal for a project but fails to sign the contract after winning the bid. In this situation, the project owner can make a claim on the bid bond to recover any financial losses. This protective measure supports integrity in the bidding process, and it's wise to reference the Claim against bond form sa when initiating your claim.